GLOBAL LEMON HARD TEA MARKET SIZE (2024 - 2030)

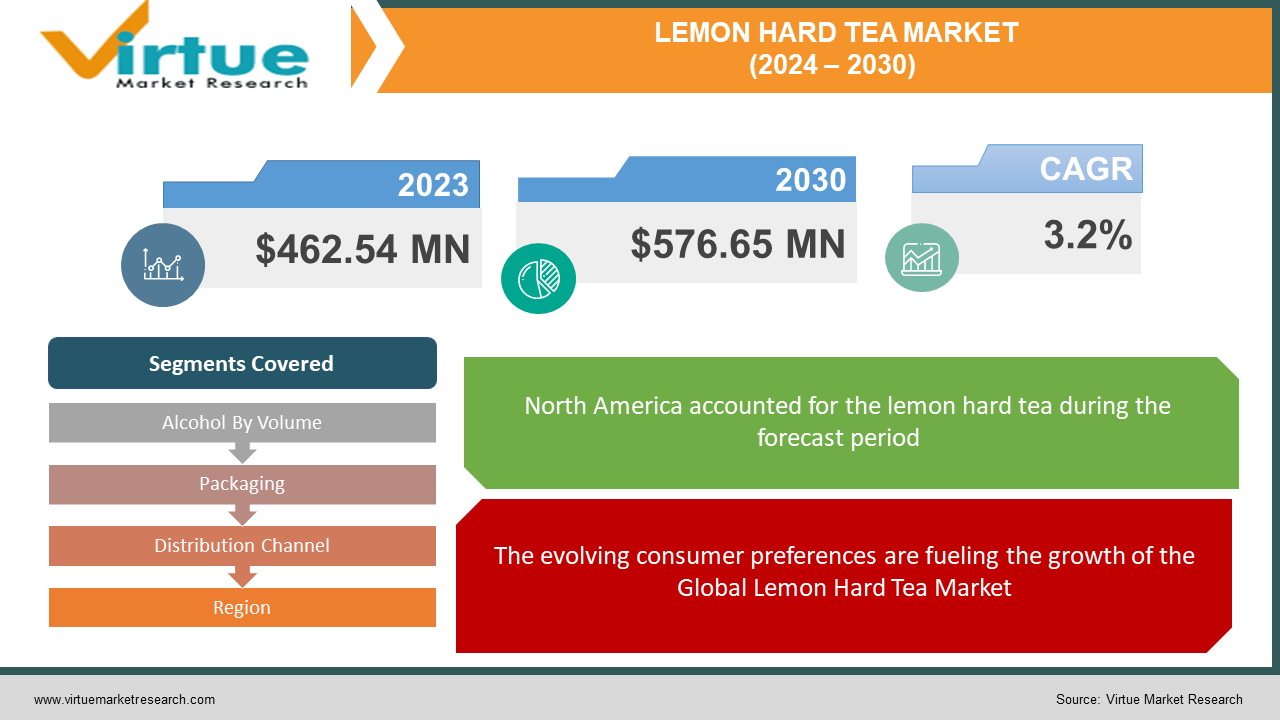

In 2023, The Lemon Hard Tea Market was valued at $ 462.54 Million, and is projected to reach a market size of $ 576.65 Million by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 3.2%.

In the "hard" beverage industry, the hard tea category is rapidly emerging as a disruptive force, paralleling the remarkable growth of hard seltzers. The desire for experimental and unique drinks among consumers has propelled the growth of tea-based alcoholic beverages. Synergy Flavours, a global flavors manufacturer, highlights that hard tea is following a trajectory similar to that of hard seltzers, which originated in the US and are now gaining traction in Europe. Nonetheless, the European market is still relatively new to hard teas, and consumer reactions may differ across countries. Hard teas offer an extensive selection of flavor profiles to suit varying consumer tastes, aligning with the flavors generally found in ready-to-drink (RTD) teas.

The alcohol content of hard teas generally ranges from 5% ABV (Alcohol By Volume), aligning with industry standards, but there is also a trend toward lower ABV options. The rise of hard teas is propelled by health-conscious consumers and a perception that tea can enhance mood. Classic tea pairings and traditional flavors remain popular, although experimentation with flavor profiles is observed. The competitive market includes brands such as Tios Drinks, Jiant, Boardroom Spirits, and Masq, offering innovative and better-for-you options in the hard tea category.

Global Lemon Hard Tea Market Drivers:

The evolving consumer preferences are fueling the growth of the Global Lemon Hard Tea Market.

Alcohol is a popular beverage consumed worldwide, and consumer attitudes towards its consumption are evolving positively owing to the captivating flavors and perceived benefits it offers. This augmenting demand for alcohol has led to the introduction of novel beverages like hard tea, which are infused with alcohol. Hard tea is available in two distinct types: low alcohol and high alcohol. Low-alcohol hard tea is generally infused with beer, while high-alcohol hard tea is infused with rum or whiskey, catering to the preferences of consumers. These diverse options provide consumers with choices based on their desired alcohol content. Therefore, this factor propels the demand for lemon hard tea beverages.

The growing popularity of lemon-flavored hard tea beverages is another factor contributing to the growth of the Global Lemon Hard Tea Market.

The augmenting demand for hard teas is propelled by the extensive selection of flavors accessible in both offline and online distribution channels. Lemon-flavored hard teas are gaining traction owing to the rising focus on immune-boosting food and beverages. In light of the pandemic, consumers are prioritizing holistic health, and citrus flavors are well-received as they align with healthier alcoholic beverage choices. Additionally, citrus flavors complement alcoholic drinks, creating a refreshing beverage that appeals to a large audience. Lemon-flavored beverages are also rising in popularity owing to the escalating demand for margaritas, mojitos, and RTD cocktails. Companies are even exploring other tea varieties like green, white, and oolong infused with lemonade. Therefore, this factor also propels the demand for lemon hard tea beverages.

Global Lemon Hard Tea Market Challenges:

The Global Lemon Hard Tea Market is encountering challenges, primarily in terms of iron deficiency risks. Tannins, naturally occurring compounds in tea, are copious and can meddle with the absorption of iron in the body. When consumed alongside certain meals, tannins can bind to iron, which makes it harder for the body to absorb this vital nutrient through digestion. Iron deficiency is a global problem, and excessive tea consumption can exacerbate the issue, especially for individuals already low in iron. Tea tannins have a sturdier impact on reducing iron absorption from plant-based diets contrasted to animal-based foods. Thus, these challenges inhibit the growth of the Global Lemon Hard Tea Market.

Global Lemon Hard Tea Market Opportunities:

Market expansion strategies present a lucrative opportunity in the Global Lemon Hard Tea Market. The demand for lemon-flavored hard tea beverages is augmenting owing to their advantages, including refreshing flavor, citrus health benefits, low alcohol content, and digestive aid. Businesses specializing in the production of lemon hard tea beverages can attain considerable benefits from this opportunity by broadening their product offerings to emerging markets, encompassing China, India, Brazil, and Mexico. By pursuing this expansion, companies can broaden their customer base and drive a notable increase in their overall revenue.

COVID-19 Impact on the Global Lemon Hard Tea Market:

The Global Lemon Hard Tea Market has been considerably influenced by the COVID-19 outbreak. As a result of rigorous lockdowns, travel restrictions, and social distancing measures, the demand for lemon hard tea waned. Delays in the expedient manufacturing and distribution of goods and services have also been caused by the pandemic's influence on the market's supply chain. Numerous individuals encountered financial uncertainty, causing a decline in spending on non-essential items. The pandemic shifted consumer preferences towards health-focused options like lower-alcohol or alcohol-free beverages. These factors negatively impacted the market's growth. Despite these challenges, the market is likely to rebound alongside the global recovery from the pandemic.

Global Lemon Hard Tea Market Recent Developments:

- In April 2023, Lipton introduced Hard Iced Tea, a new non-carbonated beverage with a 5% ABV, to coincide with National Tea Day. It comes in four flavors influenced by renowned Lipton tea variants: Lemon, Peach, Half & Half, and Strawberry, and is made with real brewed Lipton tea, natural fruit flavors, and a quality malt base. This refreshing addition aspires to strike a delightful balance of sweetness for tea enthusiasts to rejoice.

- In April 2023, Molson Coors and Coca-Cola partnered to launch Peace Hard Tea, a new beverage hitting the market in September 2023. With a 5% ABV content, it offers three flavors: Freedom of Peach, Really Really Razzy, and More Peace More Lemon. This collaboration strives to provide consumers with a refreshing and flavorsome choice in the domain of hard tea.

- In February 2023, Barrio Logan's ReBru Spirits launched Longball, a refreshing alcoholic beverage blending lemon and iced tea flavors. The beverage is now accessible at bars, restaurants, and retail outlets in San Diego County through Scout Distribution.

GLOBAL LEMON HARD TEA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.3% |

|

Segments Covered |

By Alcohol By Volume (ABV) (%), Packaging, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Locust Cider & Brewing Co. (United States), New Amsterdam Vodka (United States), Mike's Hard Lemonade Co. (United States), Loverboy Inc. (United States), Anheuser-Busch InBev (Belgium), Great Lakes Brewing Company (United States), Brock Street Brewing Company (Canada), AriZona Beverages Company (United States), Twisted Tea Brewing Company (United States), Lipton (United States) |

Global Lemon Hard Tea Market Segmentation:

Global Lemon Hard Tea Market Segmentation: By Alcohol By Volume (ABV) (%)

-

2.0% - 5.0% ABV

- Over 5.1% ABV

In 2022, the 2.0% - 5.0% ABV segment held the highest market share. The growth can be ascribed to the augmenting demand for low-alcohol beverages. There is a growing trend among health-conscious individuals to opt for beverages with an ABV below 5%. Amongst this trend, millennials are the primary consumers of low-alcohol beverages as they prioritize a holistic approach to drinking. Consumers in the market are also mindful of clean labels, carbohydrate content, and sugar levels in alcoholic drinks. The availability of hard teas in major retailers such as Costco, Walmart, and Tesco further boosts their sales, particularly those with an ABV of 4%-5%.

Global Lemon Hard Tea Market Segmentation: By Packaging

-

Bottle

-

Cans

In 2022, the cans segment held the highest market share. The growth can be ascribed to the growing popularity of aluminum cans owing to their lighter weight, reducing carbon emissions, and requiring less secondary packaging. When it comes to keeping hard tea fresh, aluminum cans have a slight advantage over bottles in preventing oxidation. The tight seal created by can lids prevents oxygen from reaching the beer, while bottle crowns allow for some oxygen seepage over time. Light can also affect hard tea quality, with aluminum cans providing better protection by blocking out all light, unlike glass bottles that are only partially opaque.

Global Lemon Hard Tea Market Segmentation: By Distribution Channel

-

Convenience Stores

-

Supermarkets/Hypermarkets

-

E-commerce

-

Others

In 2022, the supermarkets/hypermarkets segment held the highest market share. The growth can be ascribed to the wider reach and accessibility of supermarkets/hypermarkets, allowing for a larger consumer base. These locations are evolving into the go-to, one-stop store for daily necessities because of the abundance of goods offered at substantial savings. Given the availability of an array of goods and discounts on them, the need for supermarkets/hypermarkets has gone up, delivering consumers with a one-of-a-kind shopping experience. Consumers often prefer to purchase beverages like lemon-flavored hard teas in bulk, which is easier to do at supermarkets/hypermarkets.

Global Lemon Hard Tea Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The region of North America dominated the Global Lemon Hard Tea Market in the year 2022. North America is home to several prominent market players, encompassing Locust Cider & Brewing Co., New Amsterdam Vodka, Mike's Hard Lemonade Co., Brock Street Brewing Company, and Great Lakes Brewing Company. Furthermore, the region has witnessed the emergence of multiple new hard tea brands during the pandemic. Manufacturers in North America are placing a growing emphasis on producing beverages with lower alcohol content. This ongoing trend of reducing alcohol consumption is projected to boost the sales of hard teas in North America.

The region of Europe is anticipated to expand at the quickest rate over the forecast period 2023 - 2030 owing to the augmented consumer awareness of alcohol, the rising popularity of low-alcohol beverages, and the strong presence of key market players, including Anheuser-Busch InBev, AKRAS Flavours GmbH, and Carlsberg A/S.

Global Lemon Hard Tea Market Key Players:

-

Locust Cider & Brewing Co. (United States)

-

New Amsterdam Vodka (United States)

-

Mike's Hard Lemonade Co. (United States)

-

Loverboy Inc. (United States)

-

Anheuser-Busch InBev (Belgium)

-

Great Lakes Brewing Company (United States)

-

Brock Street Brewing Company (Canada)

-

AriZona Beverages Company (United States)

-

Twisted Tea Brewing Company (United States)

-

Lipton (United States)

Chapter 1. GLOBAL LEMON HARD TEA MARKET- Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. GLOBAL LEMON HARD TEA MARKET- Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. GLOBAL LEMON HARD TEA MARKET- Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. GLOBAL LEMON HARD TEA MARKET- Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. GLOBAL LEMON HARD TEA MARKET- Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. GLOBAL LEMON HARD TEA MARKET- By Alcohol By Volume (ABV) (%)

6.1 2.0% - 5.0% ABV

6.2 Over 5.1% ABV

Chapter 7. GLOBAL LEMON HARD TEA MARKET- By Packaging

7.1 Bottle

7.2 Cans

Chapter 8. GLOBAL LEMON HARD TEA MARKET- By Distribution Channel

8.1 Convenience Stores

8.2 Supermarkets/Hypermarkets

8.3 E-commerce

8.4 Others

Chapter 9. GLOBAL LEMON HARD TEA MARKET– By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Latin America

9.5 The Middle East

9.6 Africa

Chapter 10. GLOBAL LEMON HARD TEA MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1 Locust Cider & Brewing Co. (United States)

10.2 New Amsterdam Vodka (United States)

10.3 Mike's Hard Lemonade Co. (United States)

10.4 Loverboy Inc. (United States)

10.5 Anheuser-Busch InBev (Belgium)

10.6 Great Lakes Brewing Company (United States)

10.7 Brock Street Brewing Company (Canada)

10.8 AriZona Beverages Company (United States)

10.9 Twisted Tea Brewing Company (United States)

10.10 Lipton (United States)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Lemon Hard Tea Market is estimated to be worth USD 707.36 Million in 2022 and is projected to reach a value of USD 917.16 Million by 2030, growing at a CAGR of 3.3% during the forecast period 2023-2030.

The Global Lemon Hard Tea Market Drivers are the Evolving Consumer Preferences and the Growing Popularity of Lemon-Flavored Hard Tea Beverages.

Based on the Alcohol By Volume (ABV) (%), the Global Lemon Hard Tea Market is segmented into 2.0% - 5.0% ABV and Over 5.1% ABV.

The United States and Canada are the most dominating countries in the region of North America for the Global Lemon Hard Tea Market.

Locust Cider & Brewing Co., New Amsterdam Vodka, and Mike's Hard Lemonade Co. are the leading players in the Global Lemon Hard Tea Market.