Global Intumescent Coatings Market Size (2023 – 2030)

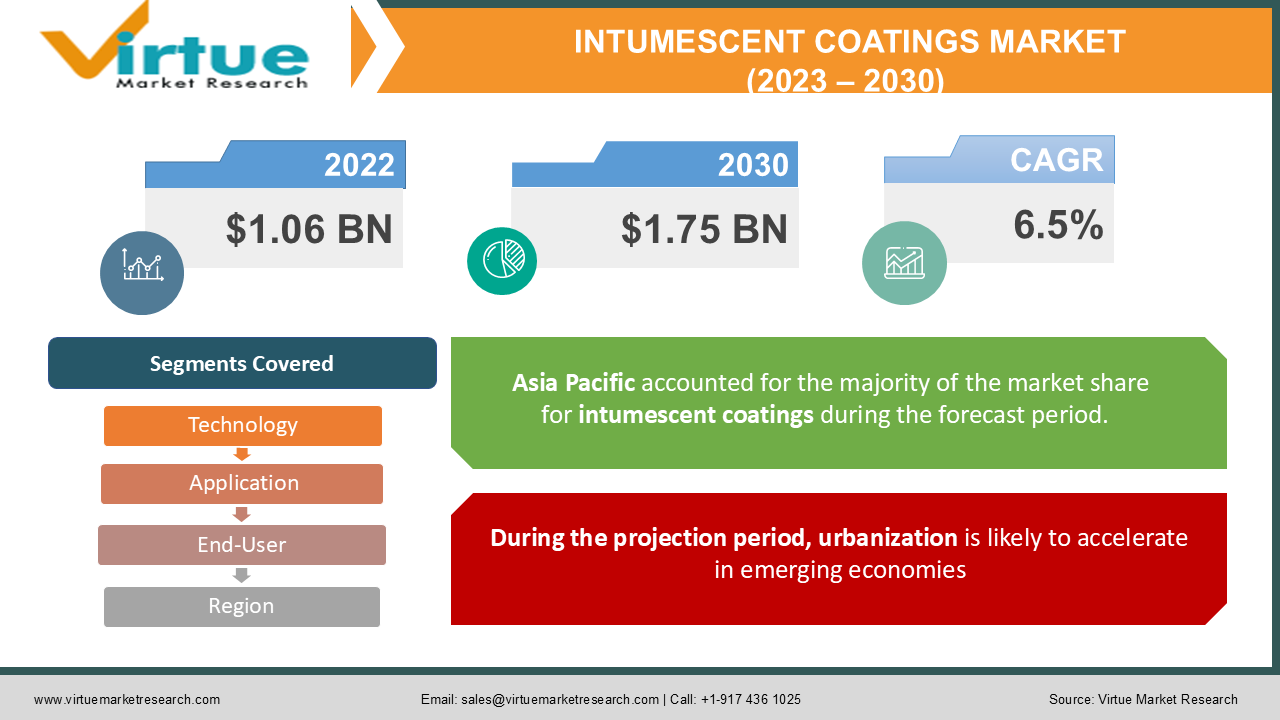

According to our research report, the global intumescent coatings market in 2022 was valued at $1.06 billion, and is projected to reach a market size of $1.75 billion by 2030. The market is projected to grow with a CAGR of 6.5% per annum during the period of analysis.

Industry Overview

High product demand in the oil and gas industry due to rigorous regulations, along with an increase in exploration operations globally, is expected to drive market expansion. Furthermore, demand from the construction sector is likely to drive market expansion throughout the projection period. In the oil and gas sector, intumescent coatings are used to give fire protection to onshore and offshore steel structures at temperatures of 1,100°C and above. They are also used to protect structural steel against moisture and chemical exposure, which causes brittleness in the steel. These coatings offer protection from pool and jet fires. Increasing energy consumption is predicted to fuel the oil and gas industry, driving demand for intumescent coating over the forecast period.

As the traditional oil and gas resources industry matures, rising demand for energy, shale gas, tight gas, and coal bed methane (CBM) is likely to be a key driving force for the expansion of the intumescent coatings market. Increased worldwide investments in oil and gas drilling equipment and platform maintenance and repair are also expected to fuel demand for intumescent coatings. Furthermore, increased investment in shale gas development in the United States is expected to drive product demand during the next seven years.

The introduction of improved thin-film, light-weight intumescent coatings is likely to boost demand even further. Increased awareness regarding residential fireproofing is expected to drive market growth throughout the forecast period. Additionally, increased demand for cellulosic intumescent coatings to safeguard the structural integrity of reinforced steel in buildings is likely to drive market expansion during the forecast period.

Impact of Covid-19 on the Industry

The pandemic of COVID-19 had a detrimental influence on the market. The market, on the other hand, has reached pre-pandemic levels and is predicted to increase gradually during the projection period. The nationwide lockdowns imposed by governments all around the world have disrupted supply chains in important sectors, severely impacting the intumescent coating business.

Market Drivers

One of the most important areas of action in the building and construction business is lightness. The use of cement coatings increases the total weight of the buildings, necessitating the installation of extra supports. This would raise the overall cost of the projects. As a result, intumescent coatings outperform their competitors because they are thinner, offer greater passive fire safety characteristics, and significantly reduce the overall weight of buildings and substrates. Because active fire protection measures are still widely used in some developing nations, the market for intumescent coatings is still increasing. Small builders and property/business owners in these areas are still unaware of intumescent coatings, their advantages, and job opportunities in the industry.

During the projection period, urbanization is likely to accelerate in emerging economies

Rising urbanization will drive market growth. This will increase the demand for intumescent coating in urban areas. Increased building construction as a result of increased government infrastructure spending could boost overall market figures. Furthermore, severe government laws surrounding fireproofing and fire safety across civil constructions, together with increasing residential and commercial projects, mostly in India and China, are expected to have a beneficial impact on the regional market environment.

Market Restraints

Prolonged exposure of intumescent coatings to hostile conditions alters their characteristics, resulting in the orange peel effect, which is a key issue connected with their usage. Coatings droop on substrates as a result of the incorrect application and pre-application surface treatments. Furthermore, when exposed to fire, the coatings expand and generate a burned layer. This produces smoke, which might impair the vision of persons attempting to flee a given region. Significant companies in the intumescent coatings sector are emphasizing the development of intumescent coatings that provide fire protection, release less smoke, have a finer film, and have good aesthetic properties. The worldwide intumescent coatings market will be driven by advancements in these sectors.

In these sectors, intumescent coatings are less popular because of their high cost. As a result, low-cost fire prevention technologies are used, but they do not provide the needed degree of performance and dependability. Cementitious coatings, for example, cause cracking, pitting, and adhesion loss. As a result, fire safety services, agencies, and intumescent coating producers can arrange different awareness campaigns, such as seminars, to promote these coatings in these areas. One of the primary development prospects in the intumescent coatings industry is urbanization. During the projection period, urbanization is likely to accelerate in emerging economies.

Intumescent Coatings Market Report Coverage:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Technology, Application, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Akzo Nobel N.V., Jotun, Contego International Inc., Hempel A/S, No-Burn Inc., Nullifire, The Sherwin-Williams Company, Carboline, Albi Protective Coatings, Isolatek International, Flame Control Coatings, Rudolf Hensel Gmb, PPG Industries, Inc., 3M |

Segmentation Analysis

Global Intumescent Coating Market- By Technology

- Water-based

- Solvent-based

- Epoxy-based

In 2021, the epoxy-based technology category led the market, accounting for more than 61.0 percent of worldwide revenue. In the case of a fire, epoxy-based intumescent coatings provide great passive fire protection by acting as an insulating barrier. These coatings are inert at ambient temperature, but when heated, they form a thick layer of char, which increases the amount of insulation in the case of a fire.

Solvent-based intumescent coatings are generally used in low heat and high humidity offshore oil and gas applications. When opposed to water-based coatings, they can be applied over broad surface areas with a high thickness. Additionally, solvent-based intumescent coatings are employed to generate aesthetic finishes over-complicated geometries and have increased adhesion as well as excellent water resistance. However, the high cost combined with the high VOC content is predicted to have a negative influence on the growth of the solvent-based intumescent coating industry.

Global Intumescent Coating Market- By Application

- Hydrocarbon

- Cellulosic

The cellulosic application category led the market in 2021, accounting for more than 53.0 percent of global sales. In the building sector, cellulosic intumescent coatings are often utilized to safeguard exposed steel buildings and help in fire escape by providing heat-resistant layers. The growing demand for intumescent coatings in the construction industry, particularly in industrial and commercial constructions, will propel market growth.

Furthermore, increased pressure from various health and safety agencies concerned with workplace human safety is likely to drive sector growth throughout the forecast period. Growing industrialization, along with increased infrastructure development activities, is expected to drive market expansion over the projection period, notably in the Asia Pacific and the Middle East. Furthermore, regulatory organizations’ rigorous fire protection in building standards are likely to enhance demand for cellulosic intumescent coatings throughout the forecast period.

Global Intumescent Coating Market- By End-User

- Construction

- Oil & Gas

- Automotive

- Others

The oil and gas end-use sector led the market, accounting for more than 44.0 percent of worldwide revenue in 2021. Rising investment in exploratory activities, deep-water projects, marginal fields, and refining capacity development will drive product demand in this area. Furthermore, increased government attention on adhering to severe fire safety laws, as well as expanding exploration activities in the industry, are likely to drive market expansion during the forecast period.

Increasing gas utilization in the energy mix and rising shale gas output is predicted to drive the oil and gas sector forward throughout the projection period. As a result, the market is likely to expand. Because of their capacity to tolerate greater temperatures than their competitors, epoxy-based coatings are widely used in the oil and gas industry.

Global Intumescent Coating Market- By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

The Asia Pacific led the intumescent coatings market in 2021, accounting for more than 34.0 percent of global sales. The existence of numerous end customers, accessibility to raw material sources, and rising industrialization and urbanization, particularly in India and China, are expected to enhance the demand for intumescent coatings in the area. The availability of raw materials, along with less severe VOC emission rules in the area compared to North America and Europe, has created enormous prospects for the growth of end-use industries such as construction, automotive, marine, and others.

The cheap labor costs in Asia Pacific's growing nations have enticed various foreign investors to establish manufacturing plants in the area. As a result, the increasing number of manufacturing facilities is expected to promote building activity in the area, which is expected to drive demand for intumescent coatings throughout the forecast period.

Global Intumescent Coating Market- By Companies

- Akzo Nobel N.V.

- Jotun

- Contego International Inc.

- Hempel A/S

- No-Burn Inc.

- Nullifire

- The Sherwin-Williams Company

- Carboline

- Albi Protective Coatings

- Isolatek International

- Flame Control Coatings

- Rudolf Hensel Gmb

- PPG Industries, Inc.

- 3M

NOTABLE HAPPENINGS IN THE GLOBAL INTUMESCENT COATINGS MARKET IN THE RECENT PAST:

- Merger &Acquisition: - In January 2021, Dux Paint and its subsidiary firms, Hawthorne Coating and Hood Products were acquired by StanChem Polymers. Dux, established in New Jersey, provided industrial protective coating solutions for refinishing, wood, automotive, and direct-to-metal applications. The strategic purchase sought to strengthen the company's technological skills as well as to expand the fire-retardant and intumescent product category into the larger industrial protective coatings market.

- Business Partnership: - In September 2021, No-Burn Inc and Huntsman Building Solutions established a relationship that would allow Huntsman Building Solutions to provide a variety of No-Burn intumescent coatings to contractor clients in the United States. Customers (contractors) would benefit from simple access to No-fire Burn's protective coating products as a result of the relationship.

Chapter 1. Global Intumescent Coating Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Intumescent Coating Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Global Intumescent Coating Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Intumescent Coating Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.Global Intumescent Coating Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Intumescent Coating Market – By Technology

6.1. Water-based

6.2. Solvent-based

6.3. Epoxy-based

Chapter 7. Global Intumescent Coating Market – By Application

7.1. Hydrocarbon

7.2. Cellulosic

Chapter 8. Global Intumescent Coating Market – By End-User

8.1. Construction

8.2. Oil & Gas

8.3. Automotive

8.4. Others

Chapter 9. Global Intumescent Coating Market – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. Global Intumescent Coating Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Akzo Nobel N.V.

9.2. Jotun

9.3. Contego International Inc.

9.4. Hempel A/S

9.5. No-Burn Inc.

9.6. Nullifire

9.7. The Sherwin-Williams Company

9.8. Carboline

9.9. Albi Protective Coatings

9.10. Isolatek International

9.11. Flame Control Coatings

9.12. Rudolf Hensel Gmb

9.13. PPG Industries, Inc.

9.14. 3M

Download Sample

Choose License Type

2500

4250

5250

6900