In Vitro Toxicology Testing Market Size (2024 – 2030)

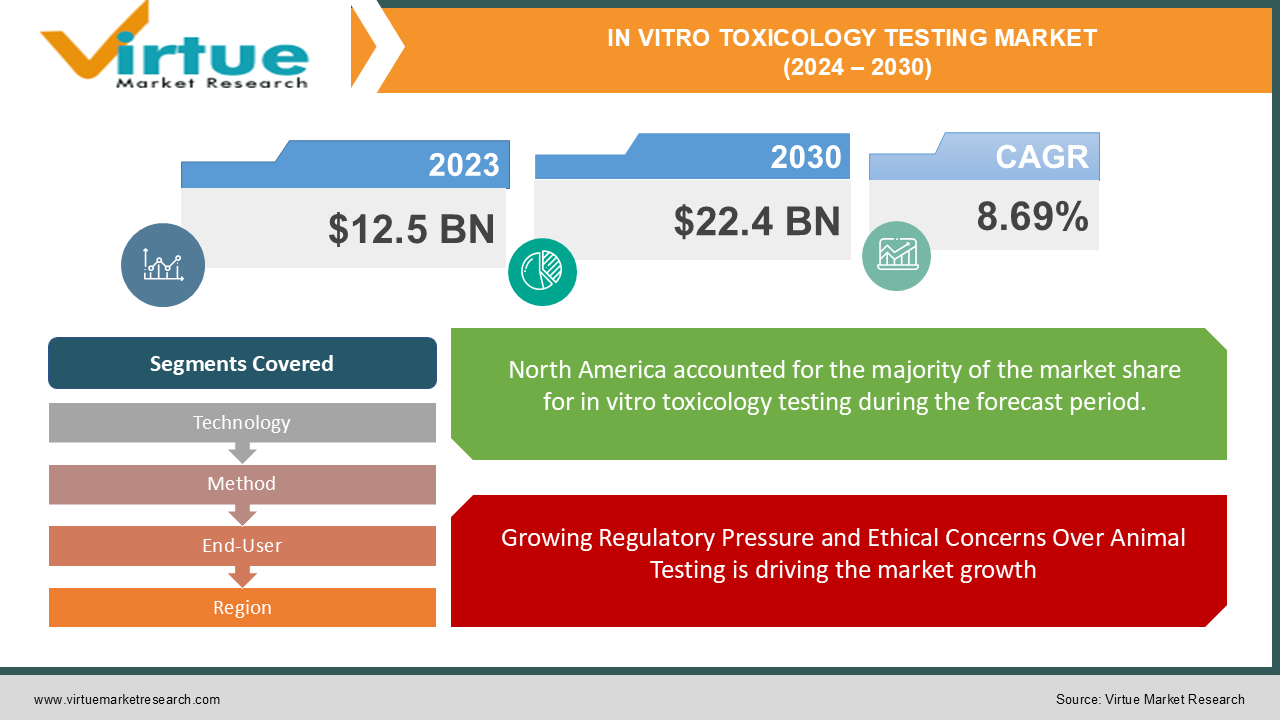

As of 2023, the Global In Vitro Toxicology Testing Market is valued at approximately USD 12.5 billion, and it is projected to grow to USD 22.4 billion by 2030, registering a compound annual growth rate (CAGR) of 8.69% during the forecast period.

The Global In Vitro Toxicology Testing Market has been experiencing significant growth due to the increasing need for alternative methods to animal testing and growing regulatory mandates across the globe. In vitro toxicology testing involves testing chemicals and pharmaceuticals in a controlled laboratory setting to evaluate their safety and potential toxic effects on human cells or tissues.

This market is driven by advancements in biotechnology, increasing awareness of ethical issues regarding animal testing, and regulatory support for the adoption of alternative testing methods. Furthermore, the pharmaceutical, cosmetics, and chemical industries are increasingly adopting in vitro toxicology methods to streamline product safety evaluations, enhance testing efficiency, and ensure regulatory compliance.

Key Market Insights:

-

Cell culture technology holds the largest market share, accounting for over 40% of the total revenue, driven by advancements in 3D cell cultures and organ-on-chip technologies.

-

The pharmaceuticals segment is the largest end-user, contributing more than 50% of total market revenue, as the industry increasingly adopts in vitro toxicology testing for early-stage drug development and safety assessments.

-

North America dominates the market, contributing over 35% of the total market revenue, owing to the presence of major industry players and regulatory bodies supporting in vitro testing methods.

-

The rising adoption of high-throughput screening (HTS) and automation in toxicology testing is expected to drive market growth, with projected adoption rates increasing by 20% by 2028.

Global In Vitro Toxicology Testing Market Drivers:

Growing Regulatory Pressure and Ethical Concerns Over Animal Testing is driving the market growth

The increasing global focus on reducing animal testing in toxicology studies is a major driver for the in vitro toxicology testing market. Several countries, particularly in Europe and North America, have imposed stringent regulations on animal testing, urging industries like pharmaceuticals and cosmetics to adopt alternative methods. This shift is not only driven by ethical concerns but also by the need to comply with regulatory frameworks such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) in Europe and the U.S. Food and Drug Administration (FDA) requirements. In vitro toxicology testing methods offer a reliable alternative that can yield accurate safety data for chemicals, drugs, and other substances without the use of animal models. These methods reduce the ethical concerns associated with animal testing while providing a faster and more cost-effective approach to toxicity assessments. The market is expected to benefit from the ongoing developments in this space as both regulatory bodies and industries push for broader adoption of these methods.

Advancements in Cell Culture Technologies and High-Throughput Screening (HTS) is driving the market growth

One of the most significant drivers of the in vitro toxicology testing market is the rapid advancement in cell culture technologies and high-throughput screening (HTS) platforms. New 3D cell cultures, organ-on-chip technologies, and tissue engineering are transforming how toxicology studies are conducted. These advancements allow for the development of more accurate and human-relevant models that better mimic the complex biological environments of human tissues. High-throughput screening has also revolutionized toxicology testing by enabling the simultaneous testing of thousands of compounds. The use of automation and HTS systems increases efficiency, reduces the time required for testing, and minimizes costs. These technological advancements have enabled industries to accelerate their safety testing processes while improving data accuracy, further fueling the market’s growth.

Increasing Demand from the Pharmaceuticals, Cosmetics, and Chemical Industries is driving the market growth

The pharmaceutical, cosmetics, and chemical industries are major end-users of in vitro toxicology testing. In particular, the pharmaceutical sector heavily relies on these methods for drug development and safety evaluation, especially in the early stages of drug discovery. With the rise of personalized medicine and the need to test a growing number of drug candidates, pharmaceutical companies are increasingly turning to in vitro testing as a more efficient alternative to traditional methods. Similarly, the cosmetics industry is increasingly adopting in vitro methods due to regulatory bans on animal testing for cosmetic products, particularly in regions like the European Union. The chemical industry also relies on these testing methods to assess the toxicity of various compounds and ensure regulatory compliance. The growing demand across these industries is expected to propel market growth in the coming years.

Global In Vitro Toxicology Testing Market Challenges and Restraints:

Technical Limitations and Incomplete Replacement of Animal Models is restricting the market growth

Despite the numerous benefits of in vitro toxicology testing, there are still technical limitations that restrict the complete replacement of animal models in toxicity studies. While in vitro methods can accurately model certain aspects of human biology, they may not fully replicate the complex interactions within a living organism. This challenge is particularly relevant for testing systemic toxicity and long-term effects. Furthermore, many regulatory bodies and industries still rely on animal testing for specific types of toxicity studies, such as chronic toxicity and reproductive toxicity, where in vitro methods have yet to be fully validated. These limitations pose a challenge to the broader adoption of in vitro toxicology testing and necessitate further advancements in the field to overcome current technical constraints.

High Initial Investment Costs for Advanced Technologies is restricting the market growth

The adoption of in vitro toxicology testing, especially advanced methods like 3D cell cultures and organ-on-chip systems, requires significant initial investments in laboratory infrastructure, technology, and training. Small and medium-sized enterprises (SMEs) in the pharmaceutical and cosmetic industries may find it challenging to implement these technologies due to high costs. Additionally, developing and validating new in vitro methods that are accepted by regulatory authorities is a time-consuming and costly process. These financial and logistical challenges may limit the adoption of advanced in vitro toxicology testing methods, particularly in emerging markets with limited resources.

Market Opportunities:

The Global In Vitro Toxicology Testing Market presents several opportunities for growth, particularly through technological innovations, increased focus on personalized medicine, and expanding regulatory support for alternative testing methods. The rise of 3D printing in tissue engineering, combined with advances in artificial intelligence (AI) and machine learning, can open new avenues for more accurate and predictive toxicity models. Furthermore, emerging markets in Asia-Pacific, Latin America, and the Middle East are increasingly adopting in vitro testing due to the growing pharmaceutical and chemical industries in these regions. Moreover, the development of specialized in vitro models for niche applications, such as oncology or neurotoxicology, offers companies opportunities to provide tailored testing solutions. As the regulatory landscape continues to evolve in favor of non-animal testing methods, companies investing in advanced in vitro toxicology platforms are well-positioned to capitalize on the expanding demand for safer, more ethical testing solutions.

IN VITRO TOXICOLOGY TESTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.69% |

|

Segments Covered |

By Technology, Method, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thermo Fisher Scientific Inc., Agilent Technologies Inc., Bio-Rad Laboratories Inc., Merck KGaA, GE Healthcare, Charles River Laboratories International Inc., Eurofins Scientific, Cyprotex |

In Vitro Toxicology Testing Market Segmentation: By Technology

-

Cell Culture Technology

-

High-Throughput Screening (HTS)

-

Molecular Imaging

-

Toxicogenomics

Cell culture technology remains the dominant segment, accounting for over 40% of total market revenue. This technology is extensively used across industries due to its ability to provide reliable and reproducible results. The adoption of 3D cell culture and organ-on-chip technologies further drives this segment's dominance.

In Vitro Toxicology Testing Market Segmentation: By Method

-

Cell-Based Assays

-

Biochemical Assays

-

In Silico Models

-

Ex Vivo Models

Cell-based assays dominate the in vitro toxicology testing methods, accounting for more than 50% of the total revenue. These assays are widely used in the pharmaceutical and cosmetics industries for toxicity screening and safety evaluation of new compounds and formulations.

In Vitro Toxicology Testing Market Segmentation: By End-User

-

Pharmaceuticals

-

Cosmetics

-

Chemicals

-

Food & Beverage

The pharmaceutical industry is the largest end-user of in vitro toxicology testing, contributing more than 50% of the total market revenue. This dominance is driven by the need for efficient and ethical testing methods in drug development and safety assessments.

In Vitro Toxicology Testing Market Segmentation: Regional Segmentation

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America leads the Global In Vitro Toxicology Testing Market, accounting for 35% of total market revenue. The region's dominance is attributed to the presence of major industry players, advanced infrastructure, and supportive regulatory frameworks that encourage the adoption of alternative testing methods. Additionally, the growing focus on reducing animal testing and the increasing demand for personalized medicine further boost the market in North America.

COVID-19 Impact Analysis on In Vitro Toxicology Testing Market

The COVID-19 pandemic had a significant impact on the Global In Vitro Toxicology Testing Market. The demand for in vitro testing surged during the pandemic as researchers and pharmaceutical companies raced to develop and evaluate new drugs and vaccines. The need for rapid testing solutions drove the adoption of high-throughput screening and other in vitro methods, enabling faster safety evaluations without the need for animal models. Additionally, the pandemic underscored the importance of developing efficient and ethical testing methods that can be conducted in controlled laboratory environments. The shift toward remote working and the disruption of traditional testing facilities also accelerated the adoption of automated in vitro toxicology testing platforms.

Latest Trends and Developments:

The in vitro toxicology testing market is experiencing rapid growth due to increasing regulatory pressures for animal-free testing, advancements in technology, and growing awareness of ethical concerns surrounding animal testing. Key trends include the development of sophisticated organ-on-a-chip models that mimic human physiology with greater accuracy, enabling more reliable prediction of toxicity. Additionally, advancements in omics technologies, such as genomics, proteomics, and metabolomics, are providing valuable insights into molecular mechanisms of toxicity, leading to the development of more targeted and predictive in vitro assays. Furthermore, the integration of artificial intelligence and machine learning is accelerating the analysis of large-scale in vitro data, enabling the development of predictive models that can streamline the drug discovery and development process. These advancements are driving the adoption of in vitro toxicology testing as a preferred alternative to traditional animal testing, contributing to the development of safer and more effective drugs while minimizing ethical concerns.

Key Players:

-

Thermo Fisher Scientific Inc.

-

Agilent Technologies Inc.

-

Bio-Rad Laboratories Inc.

-

Merck KGaA

-

GE Healthcare

-

Charles River Laboratories International Inc.

-

Eurofins Scientific

-

Cyprotex

Chapter 1. In Vitro Toxicology Testing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. In Vitro Toxicology Testing Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. In Vitro Toxicology Testing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. In Vitro Toxicology Testing Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. In Vitro Toxicology Testing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. In Vitro Toxicology Testing Market – By Technology

6.1 Introduction/Key Findings

6.2 Cell Culture Technology

6.3 High-Throughput Screening (HTS)

6.4 Molecular Imaging

6.5 Toxicogenomics

6.6 Y-O-Y Growth trend Analysis By Technology

6.7 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. In Vitro Toxicology Testing Market – By Method

7.1 Introduction/Key Findings

7.2 Cell-Based Assays

7.3 Biochemical Assays

7.4 In Silico Models

7.5 Ex Vivo Models

7.6 Y-O-Y Growth trend Analysis By Method

7.7 Absolute $ Opportunity Analysis By Method, 2024-2030

Chapter 8. In Vitro Toxicology Testing Market – By End-User

8.1 Introduction/Key Findings

8.2 Pharmaceuticals

8.3 Cosmetics

8.4 Chemicals

8.5 Food & Beverage

8.6 Y-O-Y Growth trend Analysis By End-User

8.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. In Vitro Toxicology Testing Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Technology

9.1.3 By Method

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Technology

9.2.3 By Method

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Technology

9.3.3 By Method

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Technology

9.4.3 By Method

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Technology

9.5.3 By Method

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. In Vitro Toxicology Testing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Thermo Fisher Scientific Inc.

10.2 Agilent Technologies Inc.

10.3 Bio-Rad Laboratories Inc.

10.4 Merck KGaA

10.5 GE Healthcare

10.6 Charles River Laboratories International Inc.

10.7 Eurofins Scientific

10.8 Cyprotex

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global In Vitro Toxicology Testing Market was valued at USD 12.5 billion in 2023 and is projected to reach USD 22.4 billion by 2030, with a CAGR of 8.69%.

The key drivers include growing regulatory pressure to reduce animal testing, advancements in cell culture technologies and high-throughput screening, and increasing demand from the pharmaceutical, cosmetics, and chemical industries

The market is segmented by technology (cell culture, HTS), method (cell-based assays, biochemical assays), and end-user (pharmaceuticals, cosmetics, chemicals).

North America dominates the market, accounting for over 35% of the total market revenue, driven by advanced infrastructure and regulatory support.

Leading players include Thermo Fisher Scientific, Agilent Technologies, Bio-Rad Laboratories, Merck KGaA, and Charles River Laboratories.