GLOBAL HEMOPHILIA MARKET SIZE (2023 - 2030)

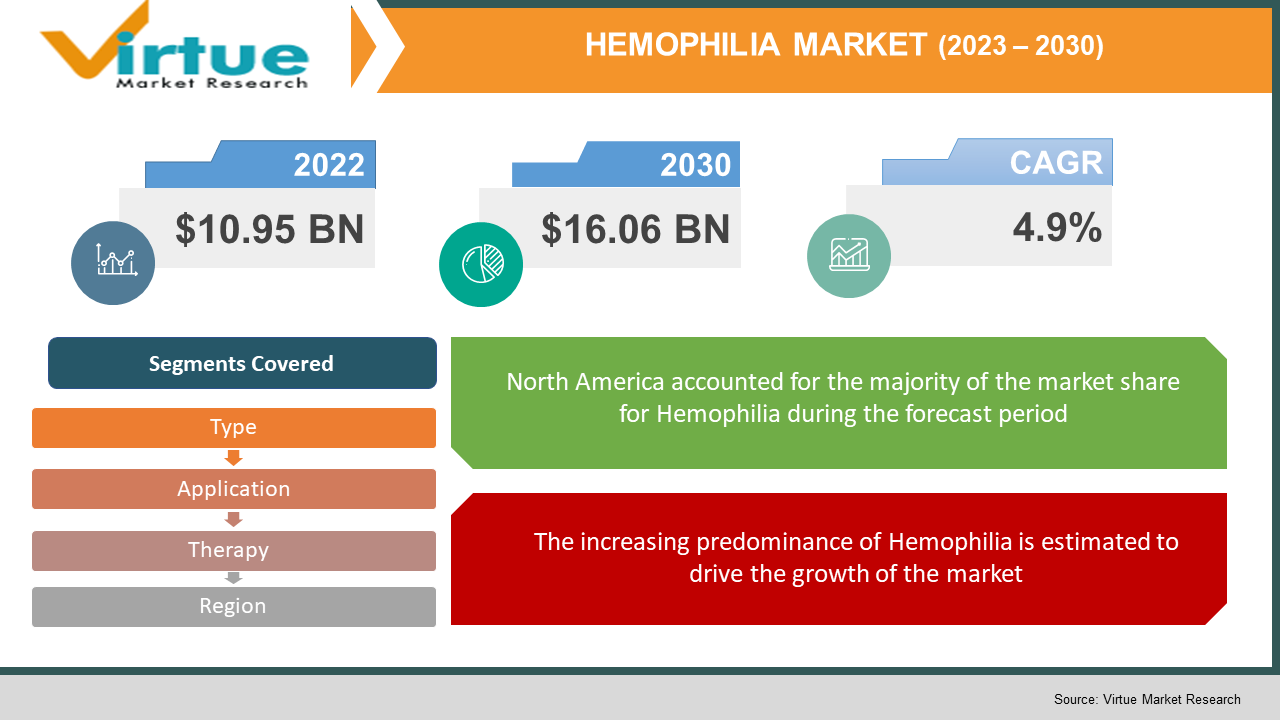

The global Hemophilia Market size is estimated to grow to USD 10.95 Billion in 2022 to USD 16.06 billion by 2030. This market is witnessing a healthy CAGR of 4.9% from 2023 - 2030. The increasing predominance of hemophilia and new products and medication launches for the treatment of hemophilia are majorly driving the growth of the industry.

Industry Overview:

Hemophilia is a hereditary disease in which blood does not coagulate due to insufficient determinants of coagulation. This causes unknown bleeding, pain, swelling and tension in the joints, urine and stool blood, and nosebleeds. Hemophilia management includes quality medical care provided by doctors and nurses who have a comprehensive understanding of the illnesses that help hemophiliacs prevent certain serious complications increase. Often, the best treatment option is the Comprehensive Hemophilia Treatment Center (HTC). Hemophoresis refers to blood convection or flushing of tissues. Desmopressin increases the levels of endogenous factor VIII of hemophilia A.

The large fluctuations between individuals in response to desmopressin are spectacular. Based on expert judgment, prevention with SHL-FVIII concentrate is the standard treatment for patients with severe hemophilia A and may also be considered for certain patients with moderate disease. Hemophilia is primarily a hereditary disorder that interferes with the body's ability to form blood clots, a process required to stop bleeding. Hemophilia occurs in severe, moderate, and mild forms (depending on plasma clotting factor activity levels).

According to a report by the World Federation of Hemophilia in October 2021, men are more prevalent than women because of the sexual association of this condition. Hemophilia occurs worldwide and in all racial groups. According to the Global Hemophilia Federation Global Report published in October 2021, 165,379 patients with hemophilia A, 33,076 patients with hemophilia B, and 11,159 patients with unknown types of hemophilia worldwide. 209,614 people, including humans, have been diagnosed with hemophilia. Such a tremendous prevalence of hemophilia around the world leads to increased adoption of treatments for hemophilia and drives the market growth

.COVID-19 impact on Hemophilia Market

Individuals with chronic medical conditions such as hemophilia are susceptible to infections and need to take special precautions to minimize the risk of contracting COVID19, so COVID19 Global outbreaks are estimated to impact the market. In addition, according to an August 2020 study entitled "The Impact of the Covid19 Pandemic on the Prevention of Hemophilia in Children: The Experience of the Hemophilia Treatment Center in West Bengal, India," published in the Journal of Dental and Medical Sciences. The average annual bleeding rate was 2.4 before the lockdown but increased significantly to 8.2 during the lockdown in children who received regular prevention. Of the various reasons they did not visit the hemophilia treatment center, the most important reasons were the lack of transportation (97.5%), the fear of being infected with the coronavirus (95%), and The high cost of alternative transportation (90%). This slowed market growth during the pandemic.

Specific factors driving market growth include increased prevalence of hemophilia, favorable government initiatives, and increased research and progress aimed at developing new therapies.

MARKET DRIVERS:

The increasing predominance of Hemophilia is estimated to drive the growth of the market

Hemophoresis indicates the convection of blood or flushing of tissues. According to the Centers for Disease Control and Prevention (CDC), hemophilia is usually a "hereditary bleeding disorder" in which blood does not coagulate properly. Further CDC updates indicate that this can lead to instinctive bleeding and injuries and post-surgery bleeding, where the blood contains several proteins called coagulation factors that stop bleeding. Patients with hemophilia have reduced levels of either factor VIII (8) or factor IX (9). The severity of hemophilia experienced by a person depends on the number of factors in the blood. The lower the amount of factor, the more likely it is to bleed, which can lead to serious health problems.

New products and medication launches for the treatment of hemophilia are also driving the growth of the market

Hemophoresis is applied to blood convection or flushing of tissues. In January 2022, Biomarin announced the results of a phase III trial using the gene therapy valoctocogener oxaparvovec for severe hemophilia A.

MARKET RESTRAINTS:

Accessibility to the treatment and the high cost of the treatment is also hampering the growth of the market

Despite advances in the treatment of hemophilia A, there are still administrative disadvantages and treatment costs are rising rapidly. The establishment of inhibitors, the relatively short half-life of molecules that must be infused frequently to maintain active concentrations, and the high cost of replacement therapy pose challenges for clinicians and third-party payers. The challenge in dealing with severe hemophilia A is the establishment of inhibitors. Once this inhibitor is established, administration requires induction of immune regulation and tolerance, which can be complex and costly. Treatment guidelines for establishing inhibitors are inadequate, and there are data to guide clinical management decisions. An additional challenge in the administration of hemophilia A is the individual patient variation in pharmacokinetic response to recombinant factors and the need for frequent dosing. These make treatment planning for individual patients very difficult. Therefore, these issues are hampering the growth of the hemophilia management market.

HEMOPHILIA MARKET REPORT COVERAGE:

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.9% |

|

Segments Covered |

By Type, Application, Therapy and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bayer AG, BioMarin Pharmaceutical, Inc. CSL Behring, Kedrion, Novo Nordisk, Pfizer, Inc., Roche (Chugai Pharmaceutical Co.), Sanofi (Genzyme Corporation), Takeda Pharmaceutical (Shire Plc.).

|

This research report on the Hemophilia Market has been segmented and sub-segmented based on type, application, Therapy, and region.

Hemophilia Market - By Type:

-

Hemophilia A

-

Hemophilia B

-

Hemophilia C

-

Others

Based on the type, the market is divided into hemophilia types A, B, C, etc. The classification is based on the lack of coagulation factors in a particular patient. It is commonly observed that type A is the most common type and is four times more common than type B hemophilia.

According to statistics published on WebMDLLC in 2019, the prevalence of type A varies from country to country, ranging from 5,414.5 cases per 100,000 men. In addition, about 50.60% of patients suffer from severe hemophilia A, which is associated with severe bleeding symptoms. In addition, most available products are used to treat hemophilia A.

However, Type B is estimated to be the fastest-growing segment during the forecast period due to its strong pipeline products. In addition, Type B accounts for approximately 20% of hemophilia cases worldwide, of which 50% have factor IX levels above 1%.

Hemophilia Market - By Application:

-

On-Demand

-

Prophylaxis

Based on Treatment, The treatment and hemophilia market is divided into prevention and on-demand treatment. On-demand held the largest market share in 2021, and prevention was estimated to be the fastest-growing segment during the forecast period.

Prophylaxis is a regular injection of coagulation factor concentrate, a commonly used and widely accepted treatment among patients suffering from severe hemophilia, and as a result, its growth rate. It can be obtained. The length of this treatment is determined on the severity of the patient's condition. In addition, prophylactic treatment is anticipated to reduce productivity losses and improve quality of life.

Hemophilia Market - By Therapy:

-

Replacement therapy

-

ITI therapy

-

Gene therapy

Based on therapy, Treatments available on the market include immune tolerance induction therapy (ITI), replacement therapy, and gene therapy. Replacement therapy is estimated to be the largest segment in 2021, and gene therapy is anticipated to be the fastest-growing segment during the forecast period. Replacement therapy is considered the standard therapy used for treatment and helps to replace the patient's deficient clotting factors. The gene therapy segment is one of the new areas in that it identifies defective DNA bases and restores them functionally. AMT060 is a potential treatment developed by UniQure for the treatment of type B and is in clinical trials. This treatment works by restoring the patient's factor IX production by introducing a functional copy of the factor IX gene into the hepatocytes of type B patients. In addition, various corporate initiatives to develop gene therapy for hemophilia, including Spark Therapeutics Inc. UniQure; BioMarin promotes segment growth.

Hemophilia Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

Geographically, North America dominated the market and contributed more than 44.4% to the sales share. Increasing prevalence and increasing trends towards preventative treatment are projected to be the first drivers of regional growth. In the United States, the disease is diagnosed in people at a very young age.

However, the Asia Pacific region is estimated to witness the fastest growth during the forecast period. Early diagnosis of the disease in countries such as Japan, India, Indonesia, and Malaysia and increased per capita use of treatments for factor VIII and factor IX deficiencies are decisive factors.

Hemophilia Market Share by company

-

Bayer AG

-

BioMarin Pharmaceutical, Inc.

-

CSL Behring

-

Kedrion

-

Novo Nordisk

-

Pfizer, Inc.

-

Roche (Chugai Pharmaceutical Co.)

-

Sanofi (Genzyme Corporation)

-

Takeda Pharmaceutical (Shire Plc.).

Changed follow-up data from the Phase 1/2 Alta research of giroctocogene fitelparvovec, an analytical gene therapy for patients with moderately significant to serious haemophilia A, were announced by Pfizer Inc. and Sangamo Therapeutics, Inc., a genomic pharmaceuticals company. The results of the Alta research in patients with severe haemophilia A were to be presented at the 63rd American Society for Hematology Annual Meeting and Exposition, which will be held electronically and in Atlanta, GA from December 11-14. The oral presentation slides, which included follow-up data for the longest-treated patient up to 195 weeks, were available on Sangamo's website under Events and Presentations in the Investors and Media area.

NOTABLE HAPPENINGS IN THE HEMOPHILIA MARKET IN THE RECENT PAST:

-

Successful Trial - In April 2022, Freeline Therapeutics Holdings plc dosed the first patient in its Phase 1/2 B-LIEVE dose-confirmation clinical trial of FLT180a for the treatment of hemophilia B, a debilitating genetic bleeding disorder caused by a deficiency in the clotting factor IX protein.

-

Medical Trails - At the 15th Annual Virtual Congress of the European Association for Haemophilia and Allied Disorders in April 2022, BioMarin Pharmaceutical Inc. presented positive results from a two-year analysis of the Phase 3 GENEr8-1 study, as well as an overall safety update of valoctocogene roxaparvovec, an investigational gene therapy for the treatment of adults with severe haemophilia A. (EAHAD).

Chapter 1. HEMOPHILIA MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. HEMOPHILIA MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. HEMOPHILIA MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. HEMOPHILIA MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. HEMOPHILIA MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. HEMOPHILIA MARKET – By Type

6.1. Hemophilia A

6.2. Hemophilia B

6.3. Hemophilia C

6.4. Others

Chapter 7. HEMOPHILIA MARKET – By Application

7.1. On – Demand

7.2. Prophylaxis

Chapter 8. HEMOPHILIA MARKET – By Theraphy

8.1. Replacement Theraphy

8.2. ITI Theraphy

8.3. Gene Theraphy

Chapter 9. HEMOPHILIA MARKET - By Region

9.1. North America

9.2. Europe

9.3. Asia-P2acific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. HEMOPHILIA MARKET – By Companies

10.1. Bayer AG

10.2. BioMarin Pharmaceutical, Inc.

10.3. CSL Behring

10.4. Kedrion

10.5. Novo Nordisk

10.6. Pfizer, Inc.

10.7. Roche (Chugai Pharmaceutical Co.)

10.8. Sanofi (Genzyme Corporation)

10.9. Takeda Pharmaceutical (Shire Plc.)

Download Sample

Choose License Type

2500

4250

5250

6900