Healthcare Cold Chain Logistics Market size (2025 –2030)

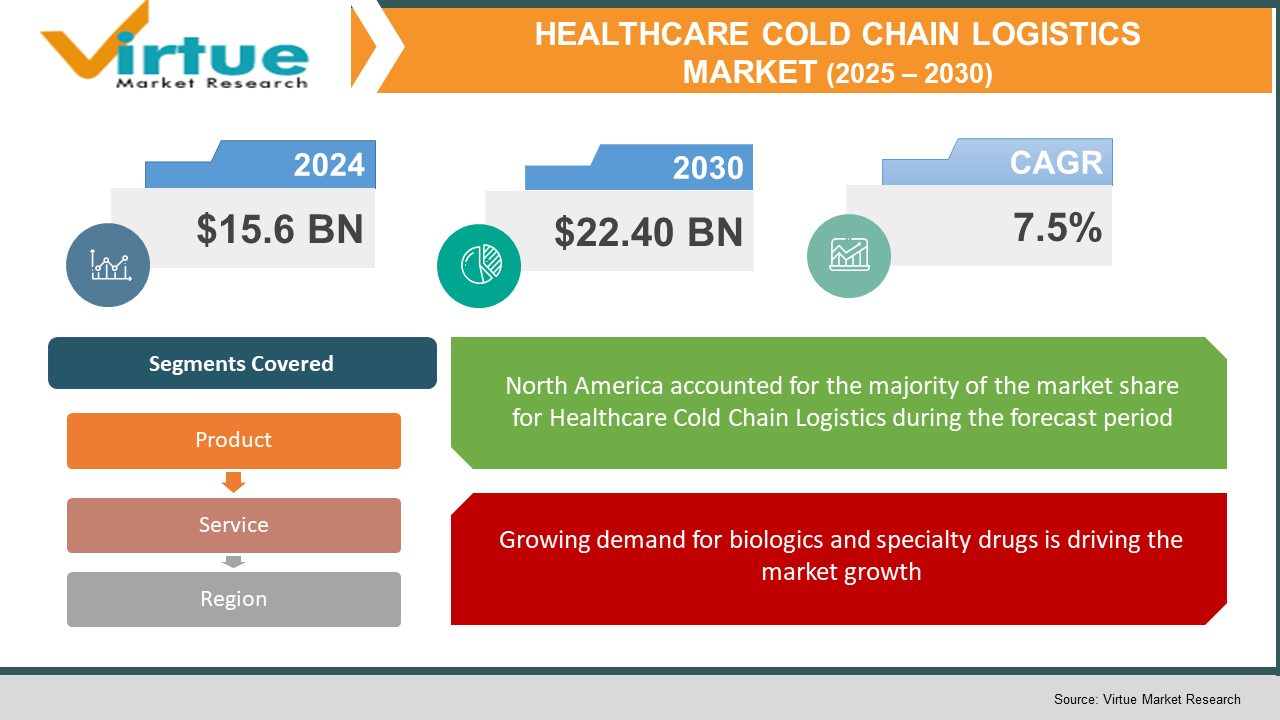

The Global Healthcare Cold Chain Logistics Market was valued at USD 15.6 billion in 2024 and will grow at a CAGR of 7.5% from 2025 to 2030. The market is expected to reach USD 22.40 billion by 2030.

The Healthcare Cold Chain Logistics Market focuses on the transportation and storage of temperature-sensitive medical products, including vaccines, biologics, and pharmaceuticals. The rising demand for biologics and personalized medicines, along with stringent regulatory requirements for pharmaceutical storage, is driving the expansion of this market. Cold chain logistics ensure the integrity and quality of healthcare products throughout their supply chain, making it a critical component of the pharmaceutical and healthcare industry.

Key market insights:

- The increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders is driving the demand for temperature-controlled biologics and specialty drugs, boosting the healthcare cold chain logistics market.

- The pharmaceutical sector is the largest consumer of healthcare cold chain logistics, accounting for over 60% of the market demand due to the growing production and global distribution of biologics and vaccines.

- North America dominates the market, holding a 35% share due to advanced logistics infrastructure, strict regulatory compliance, and high pharmaceutical production. However, Asia-Pacific is expected to be the fastest-growing region.

- Innovations in IoT-based monitoring solutions and blockchain technology are improving temperature tracking, reducing spoilage, and increasing supply chain transparency in healthcare cold chain logistics.

- Rising investments in ultra-low temperature storage solutions are becoming a key trend, especially with the increasing use of mRNA-based therapies and cell and gene therapies.

- The demand for outsourced logistics services is growing, with third-party logistics (3PL) providers accounting for more than 50% of the market share as pharmaceutical companies focus on their core operations.

- Regulatory frameworks such as the Good Distribution Practice (GDP) guidelines by the European Medicines Agency and FDA regulations in the U.S. are shaping operational strategies and investments in the sector.

Global Healthcare Cold Chain Logistics Market Drivers

Growing demand for biologics and specialty drugs is driving the market growth

The increasing reliance on biologics and specialty drugs for treating chronic diseases is a key driver of the healthcare cold chain logistics market. Biologic drugs, including monoclonal antibodies, gene therapies, and mRNA vaccines, require stringent temperature control during storage and transportation. These drugs are highly sensitive to temperature fluctuations, and any deviations can compromise their efficacy and safety. The global biologics market is projected to reach USD 500 billion by 2030, driving significant demand for robust cold chain logistics solutions. Additionally, the rise of personalized medicine, which involves patient-specific therapies, is further increasing the need for precise temperature-controlled logistics. Pharmaceutical companies are investing in advanced cold storage facilities, refrigerated transport, and real-time monitoring solutions to meet the growing demand. As biologics continue to dominate the pharmaceutical industry, the healthcare cold chain logistics market is poised for steady growth.

Expansion of the global vaccine supply chain is driving the market growth

The COVID-19 pandemic highlighted the critical role of cold chain logistics in vaccine distribution. The rapid development and deployment of COVID-19 vaccines, including mRNA vaccines requiring ultra-low temperature storage, led to massive investments in cold storage infrastructure. Governments and healthcare organizations globally have since increased their focus on strengthening vaccine supply chains for future pandemics and routine immunization programs. Additionally, the growing emphasis on childhood immunization programs and the rise of new vaccines for diseases like malaria and tuberculosis are boosting the demand for cold chain logistics. Organizations such as Gavi, the Vaccine Alliance, and the World Health Organization (WHO) are driving initiatives to improve vaccine cold chain networks, particularly in developing regions. These efforts ensure that vaccines maintain their potency from manufacturing to administration, making cold chain logistics an essential component of global healthcare.

Technological advancements in temperature monitoring and logistics is driving the market growth

Technological innovations in temperature monitoring, data analytics, and real-time tracking are transforming healthcare cold chain logistics. IoT-enabled sensors, RFID tracking, and cloud-based monitoring systems provide end-to-end visibility into temperature conditions, reducing the risk of product spoilage. Artificial intelligence (AI) and machine learning (ML) are also being integrated into logistics planning, optimizing routes and minimizing delays that could impact temperature-sensitive shipments. Additionally, blockchain technology is improving transparency and security in the supply chain, ensuring compliance with regulatory standards. The integration of automation in cold storage facilities, such as robotic handling systems and automated warehouses, is further enhancing efficiency and reducing human error. These technological advancements are not only improving operational efficiency but also reducing costs, making cold chain logistics more accessible for pharmaceutical companies of all sizes.

Global Healthcare Cold Chain Logistics Market Challenges and Restraints

High operational and maintenance costs is restricting the market growth

Healthcare cold chain logistics involve significant costs related to infrastructure, energy consumption, and compliance with strict regulatory requirements. Maintaining temperature-controlled storage facilities and refrigerated transportation requires substantial investment, with ultra-low temperature freezers costing up to USD 20,000 per unit. Additionally, continuous energy supply and backup power systems are essential to prevent disruptions, further increasing operational costs. The need for specialized packaging materials, such as phase change materials (PCMs) and vacuum-insulated panels, adds to the overall expenses. Small and medium-sized pharmaceutical companies often struggle to afford these costs, limiting market participation. Furthermore, fluctuations in fuel prices and global supply chain disruptions can impact transportation costs, making healthcare cold chain logistics a financially intensive sector.

Regulatory compliance and logistical complexities is restricting the market growth

Healthcare cold chain logistics must adhere to stringent regulations imposed by health authorities such as the FDA, EMA, and WHO. Compliance with Good Distribution Practices (GDP) and Good Manufacturing Practices (GMP) requires meticulous documentation, regular audits, and strict temperature control measures. Non-compliance can lead to product recalls, financial losses, and reputational damage. Additionally, global logistics networks face challenges such as customs clearance delays, varying regulatory requirements across regions, and risks associated with cross-border transportation. The complexity of managing temperature-sensitive shipments in different climatic conditions further adds to the challenges. Pharmaceutical companies and logistics providers must invest heavily in regulatory training, monitoring technologies, and contingency planning to navigate these logistical hurdles effectively.

Market opportunities

The increasing investment in emerging markets presents a significant opportunity for the healthcare cold chain logistics industry. Regions such as Asia-Pacific, Latin America, and Africa are experiencing rapid growth in pharmaceutical manufacturing and healthcare infrastructure development. Governments and international organizations are investing in expanding cold storage capacities and improving logistics networks to support vaccine distribution and pharmaceutical supply chains. The rise of e-commerce in pharmaceuticals is also driving demand for direct-to-patient cold chain logistics solutions. Additionally, the growing focus on sustainability is leading to innovations in energy-efficient cold storage solutions, alternative refrigerants, and eco-friendly packaging materials. The integration of AI and blockchain technology into cold chain logistics is another major opportunity, enhancing supply chain visibility and efficiency. These factors indicate strong future growth potential for the market.

HEALTHCARE COLD CHAIN LOGISTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Product, service, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DHL Supply Chain, FedEx, UPS Healthcare, Kuehne+Nagel, DB Schenker, AmerisourceBergen, Lineage Logistics, Cardinal Health, SF Express, and CEVA Logistics. |

Healthcare Cold Chain Logistics Market segmentation

Healthcare Cold Chain Logistics Market segmentation By Service:

- Storage

- Transportation

- Packaging

Storage is the largest segment, accounting for approximately 45% of market revenue. Temperature-controlled warehouses and distribution centers are critical for maintaining pharmaceutical product stability, and companies are investing in expanding storage capacity to meet growing demand.

Healthcare Cold Chain Logistics Market segmentation By Product:

- Vaccines

- Biopharmaceuticals

- Clinical Trial Materials

- Others

The vaccines segment holds the largest market share due to global immunization programs and pandemic-related vaccine distribution. The increasing demand for ultra-cold storage solutions for mRNA vaccines further supports this segment’s dominance.

Healthcare Cold Chain Logistics Market Regional segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America holds the largest market share due to its advanced healthcare infrastructure, strong pharmaceutical industry presence, and well-established cold chain logistics networks. The U.S. leads the region, with major investments in vaccine distribution, biologics transportation, and regulatory compliance initiatives. The presence of key logistics providers, such as UPS Healthcare and FedEx, further strengthens North America’s dominance.

COVID-19 Impact Analysis on the Healthcare Cold Chain Logistics Market

The COVID-19 pandemic significantly accelerated the growth of the healthcare cold chain logistics market. The urgent need for global vaccine distribution led to increased investments in cold storage facilities, ultra-low temperature freezers, and refrigerated transport. Logistics providers expanded their infrastructure, enhancing last-mile delivery solutions and integrating real-time tracking systems to meet the unprecedented demand. The pandemic also highlighted vulnerabilities in global supply chains, prompting governments and pharmaceutical companies to strengthen their cold chain capabilities. As a result, post-pandemic market expansion is expected to continue, with increased focus on preparedness for future health emergencies.

Latest trends/Developments

The adoption of AI-powered predictive analytics is transforming cold chain logistics by optimizing route planning and reducing spoilage risks. Sustainable refrigeration technologies, including solar-powered cold storage units, are gaining traction. Additionally, the integration of blockchain for end-to-end visibility is improving security and regulatory compliance. The rise of autonomous refrigerated vehicles and drone-based deliveries is also revolutionizing cold chain logistics, particularly in remote regions.

Key Players

- DHL Supply Chain

- FedEx

- UPS Healthcare

- Kuehne+Nagel

- DB Schenker

- AmerisourceBergen

- Lineage Logistics

- Cardinal Health

- SF Express

- CEVA Logistics

Chapter 1. HEALTHCARE COLD CHAIN LOGISTICS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. HEALTHCARE COLD CHAIN LOGISTICS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. HEALTHCARE COLD CHAIN LOGISTICS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. HEALTHCARE COLD CHAIN LOGISTICS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. HEALTHCARE COLD CHAIN LOGISTICS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. HEALTHCARE COLD CHAIN LOGISTICS MARKET – By Service

6.1 Introduction/Key Findings

6.2 Storage

6.3 Transportation

6.4 Packaging

6.5 Y-O-Y Growth trend Analysis By Service

6.6 Absolute $ Opportunity Analysis By Service , 2025-2030

Chapter 7. HEALTHCARE COLD CHAIN LOGISTICS MARKET – By Product

7.1 Introduction/Key Findings

7.2 Vaccines

7.3 Biopharmaceuticals

7.4 Clinical Trial Materials

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Product

7.7 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 8. HEALTHCARE COLD CHAIN LOGISTICS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Product

8.1.3. By Service

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Service

8.2.3. By Product

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Service

8.3.3. By Product

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Service

8.4.3. By Product

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Service

8.5.3. By Product

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. HEALTHCARE COLD CHAIN LOGISTICS MARKET – Company Profiles – (Overview, Packaging Product , Portfolio, Financials, Strategies & Developments)

9.1 DHL Supply Chain

9.2 FedEx

9.3 UPS Healthcare

9.4 Kuehne+Nagel

9.5 DB Schenker

9.6 AmerisourceBergen

9.7 Lineage Logistics

9.8 Cardinal Health

9.9 SF Express

9.10 CEVA Logistics

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Healthcare Cold Chain Logistics Market was valued at USD 15.6 billion in 2024 and will grow at a CAGR of 7.5% from 2025 to 2030. The market is expected to reach USD 22.40 billion by 2030.

Key drivers include the growing demand for biologics and specialty drugs, the expansion of the global vaccine supply chain, and advancements in temperature monitoring and logistics technologies

The market is segmented by Service (Storage, Transportation, Packaging); By Product (Vaccines, Biopharmaceuticals, Clinical Trial Materials, Others)

North America is the dominant region due to its advanced healthcare infrastructure, strong pharmaceutical industry, and well-established cold chain logistics networks

Leading players include DHL Supply Chain, FedEx, UPS Healthcare, Kuehne+Nagel, DB Schenker, AmerisourceBergen, Lineage Logistics, Cardinal Health, SF Express, and CEVA Logistics.