Fungicides Market Size (2025 – 2030)

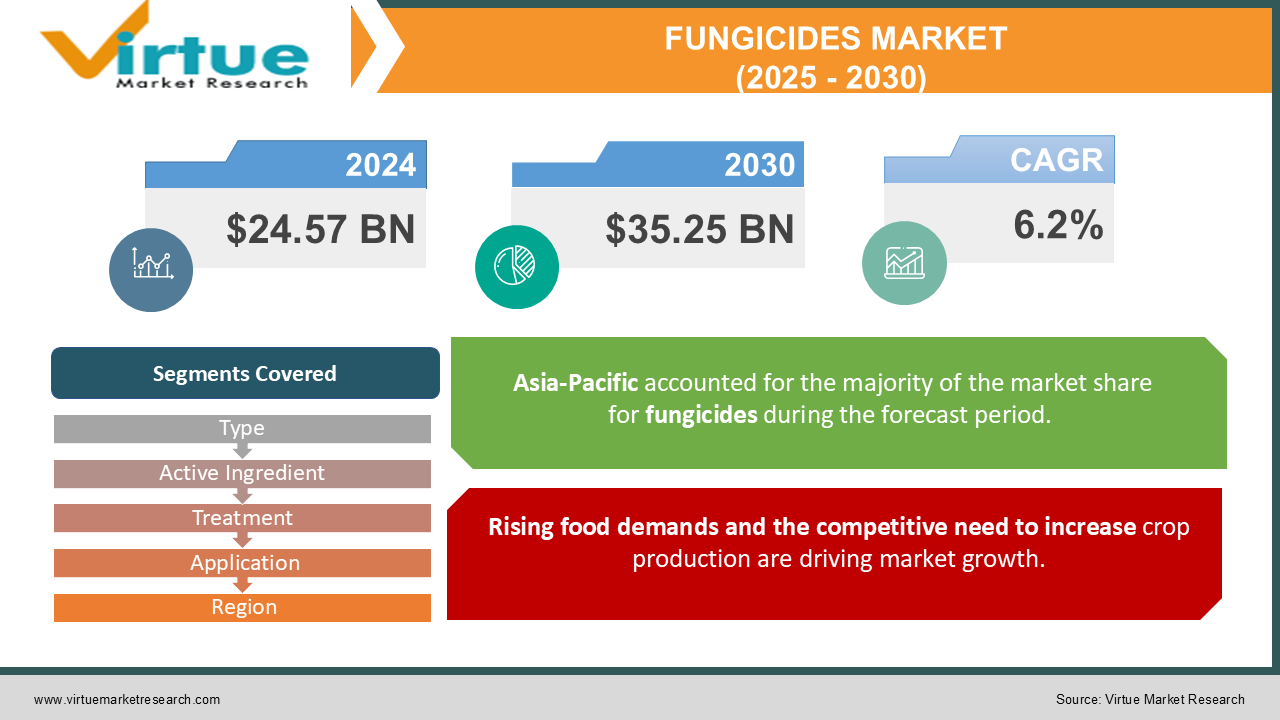

The Global Fungicides Market was valued at USD 24.57 billion in 2024 and is projected to reach a market size of USD 35.25 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.2%.

Fungicides are very important chemicals for controlling fungi overgrowth and prevention of fungal diseases over a variety of crops. Fungi are chlorophyll-less thallophytes and spore bearing organisms found almost everywhere in air, water and soil. Not all fungi cause diseases to plants, and some are actually very beneficial for agriculture. On the contrary of popular belief, many types of fungi are actually nutritious for soil, as they have the capabilities to decompose materials in soil, and increase overall crop yield. But, a few species of fungi have capacity to ruin crop yield due to their negative characteristics, leading to losses of harvest. Fungicides are used to control such invasive fungi, globally for agricultural produce, both for the prevention and control of disease.

As the use of different chemicals increased in the past few decades, a lot of side effects on health as well as on soil were seen in the fields. This caused forces to join together to study and develop bio-pesticides, including bio-fungicides. Today, many companies produce bio-fungicides and are gaining popularity among global markets.

Key Market Insights:

-

Among all types crops, cereals and grains were the largest end use segment of fungicides, accounting for about 35% of total fungicide market in 2024. This shows their vulnerability to fungal diseases than other crop varaieties.

-

Overall market share of chemical fungicides, as of 2024, still remains up to 75%, hence a robust dominance in the market. This is due to the fact that their efficacy is more than bio-fungicides, the later still being under developemnt and research.

-

Bio-fungicides have gained popularity since the COVID-19 pandemic. As per a global study, about 16.1% growth has been projected globally, from 2020 to 2024.

-

Fungicide treatments are provided in different formats. Among them, seed treatment is highly preferred prevention treatment by farmers due to its longevity of disease prevention has about 14% of total fungicide market share.

-

Foliar application method is the most preferred method as a means of disease control. It has about 70% of total market share.

-

Fungicides and other crop protection chemicals are heavily consumed in India. Since a wide variety of crops are grown in the nation's sizable agricultural sector, there is a significant need for fungicides.

Fungicides Market Drivers:

Rising food demands and the competitive need to increase crop production are driving market growth.

Consistent growth in population among developing countries and their rising needs of food products has caused the production rate of crops to be much more competitive than ever. This has led to farmers being more aggressive on use of chemicals to control and prevent crop diseases and losses. Especially in Middle and South Asia and Africa, about 60% of total hungry people of the world are currently living. Farming in these regions is also being impacted with weather patterns hence requiring farmers to use chemicals on regular basis.

Climate change has contributed to fungi overgrowth.

Changing weather patterns globally, due to global warming as well as increased greenhouse effect are contributing in fungi overgrowth. Loss of crop is being noticed due to excessive rains, hailstorms, changing temperature trends, shift in seasons and increased rate of diseases. All of these conditions also lead to favorable environment for fungi like increased rate of humidity and hot winds. Thus, it has became essential for farmers to use fungicides for control and prevention of fungal diseases among crops.

Reduced crop immunity and increased invasiveness of fungi.

In order to increase overall crop yield, biologically modified crops have been introduced in developing countries and have improved immunity for certain diseases. But, changing weather is leading to adverse impact of these biological modifications, and is leading to lower immunity against fungi. On the contrary, the invasiveness of fungi has increased and consistent research is being performed in order to reduce the impact of climate change on crops. But as research would take a lot of time, farmers need some way to control the fungi, opting for structured and planned use of fungicides.

Environmental impact of chemicals leading to demand of bio-fungicides.

Chemicals in any form have some merits, and some demerits. Aggressive use of fungicides to maintain competitive edge in agricultural produce has lead to industrialization of food chains. Overdose of fungicides is causing harm to natural qualities of the soil ecosystem, as well as saturation of chemicals in fruits and vegetables leading to health issues, including developments of critical neuromuscular problems, brain issues and cancers. Forces have been joining together to research and develop bbio-fungicides, which are more natuarl and eco-friendly.

Fungicides Market Restraints and Challenges:

Increased resistance to chemicals.

Use of same or similar fungicides over a long period of time has led to increased resistance in the fungi against that particular type of fungicide. Every fungicide behaves in a certain biological way and if fungi gains resistance against it, new ways to impact its overgrowth need to be researched. At the same time, efficacy of existing fungicides must be checked periodically in order to trace fungi behaviour.

Serious environmental impact.

Chemical fungicides, especially synthetic ones, with high concentrations have serious impact on the environment as they cause natural qualities of soil to be disturbed. Essential fungi are also being killed by overuse of chemicals, reducing overall soil nutrients and their ratios. This is leading to reduced yields. Some fruits and vegetables have excessive absorption of these chemicals, which can cause serious health issues when consumed. Animals and birds which come in contact with these chemicals are dying due to their high concentrations. These facts have increased concerns among environmentalists and diplomats and thus turned into campaigns against fungicides. Making safe fungicides possess a great challenge in this market.

Difficult and time-consuming research of bio-fungicides.

Bio-fungicides have usually less efficacy than chemicals and hence a lot of research needs to be done in order to improve their capacities. These research projects are often very expensive, requiring large amounts to be invested and take years to be reliably conclusive. These challenges lie in bio-fungicide markets and therefore lacking overall market share.

FUNGICIDES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type, Active Ingredient, Treatment, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bayer A.G., Sygenta, FMC Corporation, BASF SE, Nufarm, UPL Limited, Sumitomo Chemical, Dow, Rallis India Ltd., FMC, Gowan US, American Vanguard Corporation |

Fungicides Market Segmentation: By Type

-

Synthetic Fungicides

-

Bio-fungicides

Synthetic chemicals are used lot more than biochemicals, not just in the case of fungicides, but pesticides as a whole. In India, only 234 registered chemical pesticides are recognized, while 970 biopesticide products are recognized, but still chemical pesticides dominate Indian market and biopesticides share just 10.66% of total.

Fungicides Market Segmentation: By Active Ingredient

-

Dithiocarbamates

-

Benzimidazoles

-

Chloronitriles

-

Triazoles

-

Phenylamides

-

Strobilurins

-

Other Active Ingredients

Chemical active ingredients have largest market share with consistently positive CAGR of 4% for past 5 years. Among the key active ingredients, Dithiocarbamates are broad-spectrum contact fungicides, which are used to control a wide range of diseases on various crops, including vegetables, fruits, and ornamentals. Benzimidazoles are systemic fungicides, which are used on a wide range of crops, including fruits, vegetables, and cereals. Chloronitriles are also Systemic fungicides, but they are particularly suitable for fruits, such as grapes, apples, and cucurbits. Triazoles are broad spectrum fungicides, affecting a large variety of fungi and the most popular among all key ingredients, due to their effectiveness, versatility across various crops. Phenylamides are used to control specific types of fungal disease on vegetables including potatoes, grapes, and leafy ones. Strobilurins are another type of broad-spectrum fungicides effective on cereals, grains and vegetables. They are the second most popular segment of active ingredients.

Fungicides Market Segmentation: By Treatment

-

Seed Treatment

-

Soil Treatment

-

Foliar Spray

-

Chemigation

-

Post-Harvest

Seed Treatment is the most preferred preventive measure against fungi. Foliar spray is the method used as a control mechanism after the infection has affected the crop. Soil Treatments are performed in specific cases, for specific crops only, after testing of soil. Chemigation is performed via irrigation systems. Post-Harvest treatment is provided to ensure longevity of the harvest till its consumption.

Fungicides Market Segmentation: By Application

-

Cereals And Grains

-

Oilseeds And Pulses

-

Fruits And Vegetables

-

Other Applications

Among all types of crops where fungicides are used, cereals and grains need the most fungicides. In India, 5 million tons of these crop yields are lost due to fungal diseases.

Fungicides Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In global market regions, Asia-Pacific region dominates the fungicide market, with upto 61% share of Foliar spray products and China being the top country, with 32% of total market share.

North and South America has steady growth rates when it comes to fungicides with about 6.5 CAGR in past 5 years, 45% of total share dedicated to crops and cereals.

In Europe, Spain is the country with largest fungicide consumption, with nearly 18% of total european market share. In the upcoming 5 years, the fungicide market of europe is expected to grow upto USD 91 million.

Middle East and Africa have slower growth rate when it comes to fungicides with about 2% CAGR predicted for upcoming 5 years with USD 1.65 million market upto the end of 2030.

COVID-19 Impact Analysis on the Fungicides Market:

With the emergence of the COVID-19 outbreak in 2019, it has resulted in stricter restrictions in almost all sectors to avoid the spread of the virus. Due to the shutdown of travel and country borders, overall demand for fungicides kept fluctuating. Supply chains of raw materials were disrupted and hence it lead to reduced production of fungicides. Manufacturing facilities were shut down due to labour shortages as well as fluctuating prices of compounds and chemicals. Thus, COVID-19 had a negative impact on Fungicide Market.

Latest Trends/ Developments:

For makingg fungicides better, effective, safe and eco-friendly, reseqarch is going on in order make them effective with alternative modes of action. By introducing novel cell inhibitors, fungicides can be improved. A surge of biologgical fungicides is seen in the market due to investments increasing for them, researches being conducted and consistent rise in awareness about harms from chemicals. Curtting edge technologies like Nanotechnology, biologically modifies organisms, AI models and advanced resistance management strategies are being intruduced by key players in the market, revolutionizing the chemical industry.

With advent of newer airborne vehicles like drnes, efficient use of fungicides is possible, with more effective foliar application and less cost. This has lead to less side effets and increased sustainability.

Key Players:

-

Bayer A.G.

-

Sygenta

-

FMC Corporation

-

BASF SE

-

Nufarm

-

UPL Limited

-

Sumitomo Chemical

-

Dow

-

Rallis India Ltd.

-

FMC

-

Gowan US

-

American Vanguard Corporation

One of India's top producers of agricultural chemicals, Dhanuka Agritech Limited, had a deal in November 2024 to purchase the worldwide rights to the active components triadimenol and iprovalicarb. Dhanuka intends to increase its presence in over 20 countries with this acquisition, including those in Asia, including India, LATAM, and EMEA. In August 2024, Syngenta India launched fungicide ‘Miravis Duo’ and ‘Reflect Top’ in which the Miravis Duo, powered by ADEPIDYN technology, is approved for use in Tomato, Chili, Groundnut, and Grape.

Chapter 1. Fungicides Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fungicides Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fungicides Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fungicides Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fungicides Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fungicides Market – BY TYPE

6.1 Introduction/Key Findings

6.2 Synthetic Fungicides

6.3 Bio-fungicides

6.4 Y-O-Y Growth trend Analysis BY TYPE

6.5 Absolute $ Opportunity Analysis BY TYPE, 2025-2030

Chapter 7. Fungicides Market – BY ACTIVE INGREDIENT

7.1 Introduction/Key Findings

7.2 Dithiocarbamates

7.3 Benzimidazoles

7.4 Chloronitriles

7.5 Triazoles

7.6 Phenylamides

7.7 Strobilurins

7.8 Other Active Ingredients

7.9 Y-O-Y Growth trend Analysis BY ACTIVE INGREDIENT

7.10 Absolute $ Opportunity Analysis BY ACTIVE INGREDIENT, 2025-2030

Chapter 8. Fungicides Market – BY APPLICATION

8.1 Introduction/Key Findings

8.2 Cereals And Grains

8.3 Oilseeds And Pulses

8.4 Fruits And Vegetables

8.5 Other Applications

8.6 Y-O-Y Growth trend Analysis BY APPLICATION

8.7 Absolute $ Opportunity Analysis BY APPLICATION, 2025-2030

Chapter 9. Fungicides Market – By Treatment

9.1 Introduction/Key Findings

9.2 Seed Treatment

9.3 Soil Treatment

9.4 Foliar Spray

9.5 Chemigation

9.6 Post-Harvest

9.7 Y-O-Y Growth trend Analysis By Treatment

9.8 Absolute $ Opportunity Analysis By Treatment , 2025-2030

Chapter 10. Fungicides Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Component

10.1.2.1 By Light Type

10.1.3 By Power System

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Component

10.2.3 By Light Type

10.2.4 By Power System

10.2.5 By By Treatment

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Component

10.3.3 By Light Type

10.3.4 By Power System

10.3.5 By By Treatment

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Component

10.4.3 By Light Type

10.4.4 By Power System

10.4.5 By By Treatment

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Component

10.5.3 By Light Type

10.5.4 By Power System

10.5.5 By By Treatment

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Fungicides Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Bayer A.G.

11.2 Sygenta

11.3 FMC Corporation

11.4 BASF SE

11.5 Nufarm

11.6 UPL Limited

11.7 Sumitomo Chemical

11.8 Dow

11.9 Rallis India Ltd.

11.10 FMC

11.11 Gowan US

11.12 American Vanguard Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Fungicides Market was valued at USD 24.57 billion and is projected to reach a market size of USD 35.25 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.2%.

Increasing food scarcity, competitive crop yields, changing weather patterns and loss of crop due to invasive fungal diseases has led to increase in fungicide market size.

Seed Treatment, Soil Treatment, Foliar Spray, Chemigation and Post-Harvest are f few segments in fungicide market by treatment.

Asia-Pacific is the most dominant region for the Global Medical Tourism Market.

Bayer A.G., Sygenta, FMC Corporation, BASF SE, Nufarm, UPL Limited etc.