Food Certification Market Size (2025-2030)

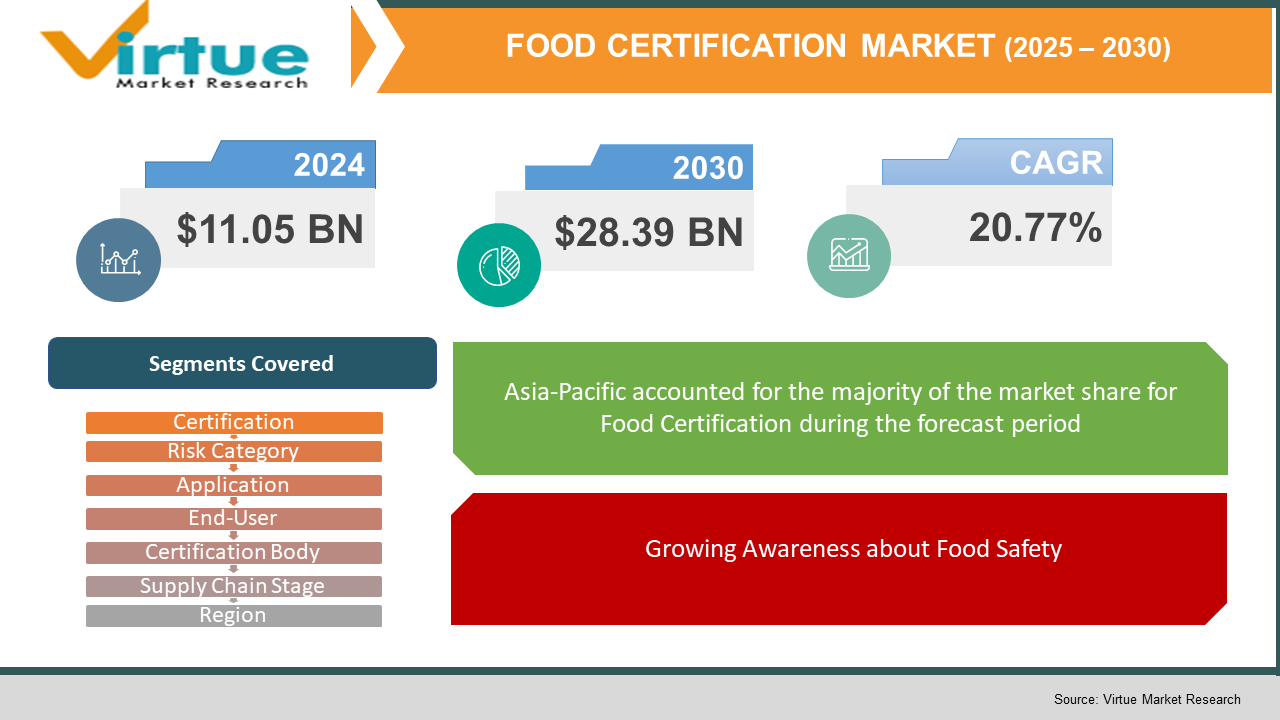

The Food Certification Market was valued at $11.05 billion in 2024 and is projected to reach a market size of $28.39 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 20.77%.

The food certification market is changing quickly, especially since foodborne illnesses are still a big health issue. The World Health Organization (WHO) says about one in ten people get sick each year from contaminated food, leading to around 420,000 deaths. This reality has made the food and beverage industry rely more on certification to build trust with consumers and ensure safety. As more people in cities have extra money, they're buying more packaged foods. This shift means buyers are paying closer attention to product labels and certification info. Public awareness efforts, like India's Food Safety and Standards Authority (FSSAI) projects, including the BHOG project and “Eat Right Station,” are making it clearer how important certification is for the food we eat daily, whether it’s for religious offerings or meals on the go. Plus, technology is helping businesses streamline food safety processes, improving accuracy and compliance in certification. Many companies are opting to have third-party organizations handle quality assurance to keep up with global standards.

Key Market Insights:

The use of artificial intelligence (AI) in predicting toxicity is picking up speed. The market is expected to grow by about 29.2% each year from 2023 to 2032. Machine learning is leading the way, making up 41% of the market in 2023 and helping make toxicity assessments more accurate and efficient.

Pharma and biotech companies are starting to team up with AI firms to improve their toxicology assessments. These partnerships focus on using AI to make drug development more efficient, like the collaboration between SyntheticGestalt and Enamine to enhance compound properties with AI models.

North America had a big share of AI in the predictive Food Certification Market, holding about 44% in 2022, due to its strong pharmaceutical industry and favorable regulations. At the same time, the Asia-Pacific region is anticipated to grow the fastest, fueled by rising investments in healthcare and a stronger focus on ethical research practices.

Food Certification Market Key Drivers:

Growing Awareness about Food Safety.

With the rise in foodborne illnesses—nearly 600 million cases and 420,000 deaths a year according to WHO—people are becoming more careful about what they eat. They want to know what’s in their food, leading to a demand for third-party certifications like ISO 22000, HACCP, organic, halal, and kosher. This push for transparency is encouraging more food producers to get certified to keep customers loyal and stand out.

Tighter Regulations and Trade Demands.

Food safety rules are getting stricter around the world, such as the FSMA in the U.S., which requires both domestic and imported foods to meet certain standards. This has led to more companies getting certified to lower legal risks, access new markets, and manage complicated global supply chains.

Tech Advances and Digital Tracking.

New tech tools like blockchain, AI, and IoT are making certification easier by allowing real-time tracking, cutting down paperwork, and making audits more precise. Collaborations, like the one between SGS and EezyTrace, are creating smarter systems for managing risks and verifying standards, boosting efficiency and trust in food certification.

Food Certification Market Restraints and Challenges:

Challenges Facing the Food Certification Market.

Even though there’s a growing demand for certified food, the Food Certification Market is facing some tough challenges. For small and medium-sized businesses (SMEs), the cost of getting certified can be high. The annual fees, audits, and upgrades to facilities can run into thousands of dollars, which makes it hard for many to afford. On top of that, there aren’t consistent international standards, so food producers who work in different countries often must deal with a maze of regional rules, adding to their costs and workload. Another issue is the lack of good infrastructure, like technical know-how, auditing staff, and digital systems, especially in developing areas. This can make it even harder for businesses to get certified, even though there’s a push for better regulations. Plus, there’s the problem of fake certificates, which can hurt the trust people have in real life. This makes it less appealing for honest operators to put money into compliance. These connected challenges are holding back market growth, showing a need for more affordable solutions, unified standards, stronger regulations, and better tracking systems.

Food Certification Market Opportunities:

Opportunities in the Food Certification Market.

A lot is going on in the Food Certification Market right now. As the middle class grows in places like Asia-Pacific and Latin America, more people are looking for safer and higher-quality foods. This is pushing up the demand for certifications, like organic and halal labels. At the same time, many consumers care about sustainability and want to see transparency in what they buy. This has led to a rise in eco-friendly labels, such as fair trade and insect protein certifications, which gives certification bodies a chance to expand. Tech is also playing a big role in all of this. Tools like digital platforms and blockchain are making certification easier and cheaper, while also helping build trust with consumers through verified information. With these trends—like people caring more about health, the shift to digital, and the rise of niche products—the food certification scene is a great place for both certification bodies and food producers to get creative and reach new customers.

FOOD CERTIFICATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

20.77% |

|

Segments Covered |

By certification, risk category, application, end user, certification body, supply chain stage, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SGS SA, Bureau Veritas, Intertek Group plc, DEKRA SE, TÜV SÜD, DNV GL, Eurofins Scientific, ALS Limited, AsureQuality Limited, UL LLC |

Food Certification Market Segmentation:

Food Certification Market Segmentation: By Certification

- ISO 22000 (Food safety management systems)

- BRC Food, SQF, IFS, FSSC 22000 (Global Food Safety Initiative standards)

- HACCP, GlobalG.A.P., USDA Organic, AHA, ISTA

- Organic Certification

- Allergen-free variants (Gluten-free, Non-GMO, Vegan, Free-from)

- Halal and Kosher certifications

- Sustainability certifications

The Dietary & Lifestyle Certification market is heating up, especially with free-from labels like gluten-free, allergen-free, and vegan, as well as Halal and Kosher certifications. This growth is driven by more awareness of food intolerances and ethical eating, particularly in North America where health-conscious and faith-based consumers are looking for these certifications. Halal certification is also spreading fast due to the growing Muslim population and its impact on trade, especially in Asia Pacific and the Middle East.

On a broader scale, ISO 22000 leads food safety certifications, holding around 21-22% of the market. It covers everything from manufacturing to retail, following HACCP principles, and helping with international trade. This extensive reach ensures safety at every stage, giving certified organizations a solid framework for quality management that helps them meet regulations and improve operations for both local and export markets.

Food Certification Market Segmentation: By Application

- Meat, Poultry & Seafood

- Dairy Products

- Infant Foods

- Bakery & Confectionery

- Beverages (alcoholic & non‑alcoholic)

- Processed & Packaged Foods, Functional Foods, Frozen Foods, Organic Foods, Chocolates

The food certification market is seeing the fastest growth in beverages (both alcoholic and non-alcoholic) and infant foods. The rise in health-consciousness is boosting beverage certifications like organic, halal, and non-GMO, as new drink formats and functional options gain popularity. Infant food certification is also on the rise, thanks to parents wanting safe and quality nutrition. Labels like organic and allergen-free are becoming popular, making this a lively niche in the market.

Despite the growth in these areas, meat, poultry, and seafood remain the largest segments, holding about 30-36% of the market in regions like North America, Europe, and Asia-Pacific. Safety concerns and strict export rules make certifications like HACCP, ISO 22000, Halal, and Kosher vital. Regulations and past recalls show just how important safety certifications are in keeping this sector on top.

Food Certification Market Segmentation: By End User

- Food Manufacturers

- Retailers

- Restaurants, Food Service Orgs & Catering

- Packaging

- Online Food Delivery & Meal‑Kit Providers

The dietary and lifestyle certification market is booming, with labels like free-from, halal, kosher, and organic leading the way. More people are looking for allergen-free and ethical food choices, which is boosting demand, especially in emerging markets. Halal certifications are increasing in Muslim-majority areas, and gluten-free labels are popular in health-focused regions. Certifications that match clean-label and ethical trends show the fastest growth potential.

Food manufacturers are the main players in this market. As primary producers, they need certifications like ISO 22000 and HACCP to comply with food safety regulations. Their role in ensuring product quality drives them to obtain these certifications as part of their quality management practices.

Food Certification Market Segmentation: By Risk Category

- High-risk foods (especially meat, seafood, and dairy)

- Low-risk foods (e.g., shelf-stable products)

High-risk foods like meat, seafood, dairy, and fresh produce are seeing a big jump in certification demand. These foods spoil quickly and can easily get contaminated, so there are strict inspections and regular recalls. To get certified, products must go through pathogen tests, hygiene checks, and cold chain monitoring, which drives growth in audit services and traceability solutions. Global trade in animal products and the need for religious certifications like halal and kosher are also pushing this sector forward.

High-risk foods dominate the certification market, holding over 64% of the market as of 2021. This is mainly due to laws requiring certifications for export and consumers wanting safety in protein-rich foods. Their market lead comes from their perishable nature and complicated supply chains, which require close control to avoid contamination. So, high-risk food certification is a key part of food safety overall.

Food Certification Market Segmentation: By Certification Body

- Government agencies

- NGOs

- Third-party auditors (SGS, Bureau Veritas, Intertek, etc.)

Third-party auditors like SGS, Intertek, and Bureau Veritas are leading the way in food certification due to globalization and growing export markets. Their rapid growth comes from a wide network of labs in over 140 countries, the use of mobile testing units, and partnerships involving AI and digital tools. They offer essential certifications like ISO 22000 and HACCP, helping producers access new markets quickly. As technology drives audits and cross-border trade increases, these auditors are well-positioned for growth.

On the other hand, government agencies and NGOs play a crucial role in food certification through their regulatory power and trust. Organizations like the FSSAI and Ecocert lead local efforts with mandatory licensing and accreditation programs. Although they grow more slowly than commercial auditors, they have a strong influence through regulations and support, playing a key role in food safety governance.

Food Certification Market Segmentation: By Supply Chain Stage

- Growers

- Manufacturers

- Logistics

- Retailers

Manufacturers are quickly adopting food certifications because of rising demand for clean-label products and strict food safety rules. With foodborne illnesses affecting public health, production facilities are investing in certifications like ISO 22000 and HACCP to gain consumer trust and reach global markets. They've got support from strong regulations and the need for traceability, which they're tackling with tech-driven audits and digital compliance systems. This makes them the fastest-growing part of the certification process.

Retailers play a big role in the food certification market, using certifications to ensure quality and set standards in their supply chains. They require suppliers to have GFSI-benchmarked certification to manage risk and maintain their brand image. Retailers are also pushing for transparency with things like blockchain traceability and labels, encouraging growers, manufacturers, and logistics partners to get certified. As the main link to consumers, retailers have a lot of influence over certification standards and market access.

Food Certification Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

In 2023, the Asia-Pacific region took the lead in the global Food Certification Market, making up about 30% of it. This growth is thanks to urbanization, new laws, and a growing focus on food safety. North America and Europe each held around 25%. North America has strict FDA rules and is very aware of consumer needs, while Europe benefits from strong regulations like BRC and IFS. Latin America and the Middle East & Africa both made up about 10% of the market, showing more investment in food safety and the use of certifications that meet local needs, like halal and organic standards.

COVID-19 Impact Analysis on the Food Certification Market:

The COVID‑19 pandemic quickly messed up food certification because of lockdowns, travel bans, and closed facilities, which meant audits were delayed or canceled and certifications took longer. Despite these issues, the crisis pushed many businesses to go digital. We started seeing more remote audits and the use of tech tools like blockchain, AI, and IoT to keep things compliant while staying safe. Consumers became pickier, demanding certified products and clear supply chains, which made manufacturers focus more on food safety, even with tighter budgets. Countries changed how they source food, shifting from global to local suppliers, which put more importance on tracking and certifying local products. In the long run, the pandemic raised the bar for hygiene and trust, making tech-based certification a key part of food supply chains instead of just something to check off a list.

Trends/Developments:

In January 2025, V-Label launched the C-Label, a worldwide certification for cell-based meats. This label guarantees that these products are transparent, made without animals, and free from pathogens and GMOs.

In November 2022, SGS rolled out the Food Contact Product Certification Mark. This certification checks that materials used in food containers and utensils meet safety and performance standards in key markets like the USA, EU, UK, Switzerland, and China, making it easier to trace products and access the market.

In November 2022, SCS Global Services introduced SCS-109 Plant-Based Certification. This program requires that food, beverage, and CBD products contain at least 95% plant-based ingredients, while body care items need to have at least 50%. It ensures there are no animal-derived ingredients.

In September 2022, Intertek launched a Vegan Certification. Their ATIC method—Auditing, Testing, Inspection, and Training—makes sure products are truly vegan, catering to plant-based shoppers.

Key Players:

- SGS SA

- Bureau Veritas

- Intertek Group plc

- DEKRA SE

- TÜV SÜD

- DNV GL

- Eurofins Scientific

- ALS Limited

- AsureQuality Limited

- UL LLC

Chapter 1. Food Certification Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Food Certification Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Food Certification Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Food Certification Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Food Certification Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Food Certification Market – By Certification

6.1 Introduction/Key Findings

6.2 ISO 22000 (Food safety management systems)

6.3 BRC Food, SQF, IFS, FSSC 22000 (Global Food Safety Initiative standards)

6.4 HACCP, GlobalG.A.P., USDA Organic, AHA, ISTA

6.5 Organic Certification

6.6 Allergen-free variants (Gluten-free, Non-GMO, Vegan, Free-from)

6.7 Halal and Kosher certifications

6.8 Sustainability certifications

6.9 Y-O-Y Growth trend Analysis By Certification

6.10 Absolute $ Opportunity Analysis By Certification, 2025-2030

Chapter 7. Food Certification Market – Application

7.1 Introduction/Key Findings

7.2 Meat, Poultry & Seafood

7.3 Dairy Products

7.4 Infant Foods

7.5 Bakery & Confectionery

7.6 Beverages (alcoholic & non‑alcoholic)

7.7 Processed & Packaged Foods, Functional Foods, Frozen Foods, Organic Foods, Chocolates

7.8 Y-O-Y Growth trend Analysis Application

7.9 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 8. Food Certification Market – By End User

8.1 Introduction/Key Findings

8.2 Food Manufacturers

8.3 Retailers

8.4 Restaurants, Food Service Orgs & Catering

8.5 Packaging

8.6 Online Food Delivery & Meal‑Kit Providers

8.7 Y-O-Y Growth trend Analysis End User

8.8 Absolute $ Opportunity Analysis End User , 2025-2030

Chapter 9. Food Certification Market – By Risk Category

9.1 Introduction/Key Findings

9.2 High-risk foods (especially meat, seafood, and dairy)

9.3 Low-risk foods (e.g., shelf-stable products)

9.4 Y-O-Y Growth trend Analysis Risk Category

9.5 Absolute $ Opportunity Analysis Risk Category , 2025-2030

Chapter 10. Food Certification Market – By Certification Body

10.1 Introduction/Key Findings

10.2 Government agencies

10.3 NGOs

10.4 Third-party auditors (SGS, Bureau Veritas, Intertek, etc.)

10.5 Y-O-Y Growth trend Analysis Certification Body

10.6 Absolute $ Opportunity Analysis Certification Body , 2025-2030

Chapter 11. Food Certification Market – By Supply Chain Stage

11.1 Introduction/Key Findings

11.2 Growers

11.3 Manufacturers

11.4 Logistics

11.5 Retailers

11.6 Y-O-Y Growth trend Analysis Supply Chain Stage

11.7 Absolute $ Opportunity Analysis Supply Chain Stage , 2025-2030

Chapter 12. Food Certification Market , By Geography – Market Size, Forecast, Trends & Insights

12.1. North America

12.1.1. By Country

12.1.1.1. U.S.A.

12.1.1.2. Canada

12.1.1.3. Mexico

12.1.2. By Certification

12.1.3. Application

12.1.4. By Supply Chain Stage

12.1.5. End User

12.1.6. Risk Category

12.1.7. Certification Body

12.1.8. Countries & Segments - Market Attractiveness Analysis

12.2. Europe

12.2.1. By Country

12.2.1.1. U.K.

12.2.1.2. Germany

12.2.1.3. France

12.2.1.4. Italy

12.2.1.5. Spain

12.2.1.6. Rest of Europe

12.2.2. By Certification

12.2.3. By Supply Chain Stage

12.2.4. By Risk Category

12.2.5. End User

12.2.6. Software / Content Type

12.2.7. Certification Body

12.2.8. Countries & Segments - Market Attractiveness Analysis

12.3. Asia Pacific

12.3.1. By Country

12.3.2.1. China

12.3.2.2. Japan

12.3.2.3. South Korea

12.3.2.4. India

12.3.2.5. Australia & New Zealand

12.3.2.6. Rest of Asia-Pacific

12.3.2. By Certification

12.3.3. By Supply Chain Stage

12.3.4. Application

12.3.5. Certification Body

12.3.6. End User

12.3.7. Risk Category

12.3.8. Countries & Segments - Market Attractiveness Analysis

12.4. South America

12.4.3. By Country

12.4.3.3. Brazil

12.4.3.2. Argentina

12.4.3.3. Colombia

12.4.3.4. Chile

12.4.3.5. Rest of South America

12.4.2. By Certification

12.4.3. By Supply Chain Stage

12.4.4. Application

12.4.5. End User

12.4.6. Certification Body

12.4.7. Risk Category

12.4.8. Countries & Segments - Market Attractiveness Analysis

12.5. Middle East & Africa

12.5.4. By Country

12.5.4.4. United Arab Emirates (UAE)

12.5.4.2. Saudi Arabia

12.5.4.3. Qatar

12.5.4.4. Israel

12.5.4.5. South Africa

12.5.4.6. Nigeria

12.5.4.7. Kenya

12.5.4.12. Egypt

12.5.4.12. Rest of MEA

12.5.2. By Certification

12.5.3. Application

12.5.4. By Supply Chain Stage

12.6.5. Risk Category

12.5.6. Certification Body

12.5.7. End User

12.5.8. Countries & Segments - Market Attractiveness Analysis

Chapter 13. Food Certification Market – Company Profiles – (Overview, product, Financials, Strategies & Developments)

13.1 SGS SA

13.2 Bureau Veritas

13.3 Intertek Group plc

13.4 DEKRA SE

13.5 TÜV SÜD

13.6 DNV GL

13.7 Eurofins Scientific

13.8 ALS Limited

13.9 AsureQuality Limited

13.10 UL LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growth is mainly due to more people wanting safe food, stricter regulations, and a bigger focus on sustainable and organic options.

The food manufacturing, processing, retail, and hospitality industries mostly use certifications to ensure safety and gain customer trust.

Tech like blockchain and IoT helps with tracking products, making audits easier, and being more transparent about certifications.

Regulatory agencies set safety rules and make sure companies follow them, which is important for getting certified and staying legal

Trends include digital audits, certifications for plant-based foods, labels for vegan and allergen-free items, and a stronger focus on sustainability.