Ethernet Passive Optical Network (EPON) Market Size (2024 -2030)

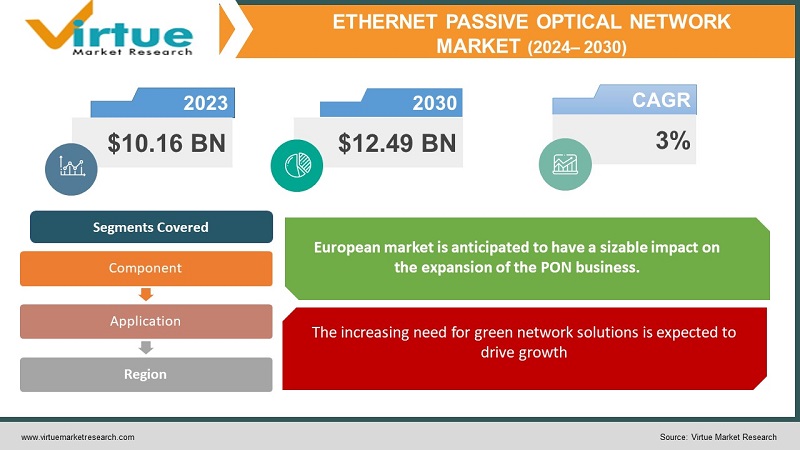

In 2023, the Global Ethernet Passive Optical Network Market was valued at USD 10.16 Billion and is projected to reach a market size of USD 12.49 Billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3%.

Industry Overview

A fiber-optic telecommunications technology called a passive optical network (PON) is used to provide end users with broadband network access. The network's major goal is to offer a solution that is simple to set up, maintain, and update. This is accomplished utilizing PON, which enables a single fiber to transmit services to numerous premises, and unpowered optical splitters. Due to the use of unpowered optical splitters, passive optical networks are thought of as a greener alternative to standard networks. As the optical signals move through the network, optical splitters gather and divide them. In contrast to a traditional network, powered equipment is only required at the receiving end and acts as a source of the signal.

The market for 4G carriage services is anticipated to increase as a result of rising network technology development and a growing need for faster networks. Throughout the forecast period, demand for Gigabyte Passive Optical Network (GPON) equipment has increased due to the rising need for bandwidth and the increasing penetration of telecom and internet services. The need for creating Ethernet Passive Optical Network (EPON) hardware is anticipated to increase as a result of data-intensive services like video on demand, videoconferencing, and Voice over Internet Protocol (VoIP).

As opposed to other traditional networks, the global demand for eco-friendly solutions has expanded as a result of the growing awareness of global warming. Additionally, it is anticipated that growing digitization and the desire for safe, secure, and dependable operation would support the market for passive optical networks. The desire for a high-speed network at home for accessing smart technologies and the rise in fiber-to-the-home deployments for quick access to data, movies, voice, and services are both factors in the expansion. Over the projected period, demand is also anticipated to increase as smart grids, e-governance services, and cloud computing becomes more widely adopted.

Impact of Covid-19 on the Industry

The world has adopted precautionary precautions as a result of the current COVID-19 pandemic. While many businesses are finding a way to let their staff work from home, schools are closing, and communities are encouraged to stay at home. The telecom firms are also working hard to develop full-fiber infrastructure to provide a broadband network that is superfast, ultrareliable, and future-proof.

Market Drivers

The increasing need for green network solutions is expected to drive growth

The global passive network (PON) equipment market is anticipated to develop throughout the projected period due to the rising need for green network solutions. Solutions for passive optical local area networks (POL) are more environmentally friendly than those for traditional Ethernet local area networks built on copper. Workgroup switches are no longer used in POL; instead, optical splitters are used. Because it eliminates the use of thousands of KW of energy and serves as a more economical choice, it complies with HVAC regulations. Additionally, rack mount switches are not necessary, which decreases the need for non-renewable electrical equipment and lowers power consumption. One fiber of one type of optic is used in a passive optical network (PON) to connect to the WGT. Additionally, PON makes use of tiny passive optical splitters that are housed in enclosures throughout a structure, typically on each story. PON can therefore be put in electrical closets and generate no heat or power.

Low cost of investment and high return on investment

The global passive optical network (PON) equipment market is anticipated to grow significantly over the forecast period due to the low cost of ownership and good return on investment. Given that the cost of equipment installation is cheap, passive optical networks (PON) help reduce the total cost of ownership (TCO) by a significant amount. The highly efficient machinery can also provide a high rate of return on investment. With PON, a highly-centralized, passive distribution network is used to accomplish this low cost of ownership. PON also reduces the total cost of ownership significantly because it spends less on both capital and operating expenses. The riser closets and workgroup switches accounted for the bulk of the traditional network's construction investment.

The high growth of the PON Asia Pacific region can present lucrative growth opportunities in the global passive optical network (PON) market

The passive optical network (PON) market may offer profitable growth prospects due to the Asia Pacific region's high PON growth rate. One of the market's main drivers is the expanding need for passive optical networks in the Asia Pacific region, particularly in China. The switch from wireless to wired optical communication is now taking place in China. The widespread usage of electronic devices and the resulting huge volume of data traffic created by numerous consumers in China further encourage end users to transition from a wireless medium to a wired optical one. Optical fiber cable (OFC) connectivity is currently available in India from all district and state capitals to the block level.

Increasing Bandwidth requirements will provide business opportunities

Significant commercial prospects in the global passive optical network (PON) industry may arise as bandwidth requirements increase. One of the main prospects for the PON business is the growing need for larger bandwidths. One of the main issues for data centers, according to a poll with IT professionals as respondents, is the demand for increased bandwidth, which is predicted to increase in the future. A growing subscriber base encourages more devices to connect to networks and more data-intensive services to use those networks.

Market Restraints

High installation costs at operators’ interface and operational challenges are expected to restrain the growth

The expansion of the global passive optical network (PON) equipment market is anticipated to be constrained during the projected period by high installation costs at the operators' interface and operational difficulties. Although PON technology has several advantages, the main deterrent is still its high installation cost. Research done for the Broadband Forum found that 53 percent of the respondents indicated interoperability problems made their internal testing burden more difficult. Concerns about network performance were cited by 44% of respondents, and concerns about increased management cost by 41%. Additionally, the price of a gigabyte passive optical network (GPON), one of the most sophisticated PON technologies, is US$6.69 million.

The availability of a substitute technology will challenge the market growth

Over the projected period, the availability of substitute technologies is anticipated to restrain the growth of the global passive optical network (PON) equipment market. Alternative technologies like XGS-PON are a significant barrier for market players. An improved passive optical network standard called XGS-PON allows for 10 Gbps symmetrical data transport at faster speeds. Such innovative technologies tend to attract a lot of end consumers.

ETHERNET PASSIVE OPTICAL NETWORK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3% |

|

Segments Covered |

By Component, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Adtran Inc., Huawei Technologies Co. Ltd., Alcatel-Lucent S.A., Hitachi Communication Technologies, Inc., AT & T Inc., Freescale Semiconductor, Inc., Broadcom Corporation, Inc., Ericsson Inc., Calix Inc., ECI Telecom, Ltd |

Global Ethernet Passive Optical Network- By Component

-

ONT

-

OLT

The Optical Line Terminal (OLT) and ONT are two subcategories of the component segment. The ONU and splitters segments of the ONT segment are further divided. The OLT, which is the endpoint hardware component, includes a voice gateway, passive optical network cards, a gateway router, and a central processing unit. Using optical splitters, OLT can serve up to 128 ONT at a distance of up to 12.5 miles while transmitting a data signal of 1490 nm to customers. The ONT market is anticipated to expand significantly between 2016 and 2024, with a CAGR of over 21%. ONT is installed at the end-user location, whereas OLT is installed at the service provider's central site. Both GPON and EPON employ ONT and OLT.

Global Ethernet Passive Optical Network- By Application

-

FTTx

-

Mobile Backhaul

Fiber to the x (FTTx) and mobile backhaul are two subcategories of the passive optical network (PON) market application sector. The phrase "fiber to the x" (FTTx) refers to a broadband network architecture that makes use of optical fiber deployment. FTTx is further divided into three categories: fiber-to-the-building, fiber-to-the-curb/cabinet, and fiber-to-the-home (FTTH) (FTTC). Over the projection period, demand is anticipated to be driven by the rising need for high-speed internet connection at home for smart devices, as well as by the increasing use of smart grids, e-governance services, and cloud computing.

Throughout the projection period, the market for mobile backhaul is anticipated to expand significantly. The satellite communication infrastructure is used to create and implement mobile backhaul solutions.

Global Ethernet Passive Optical Network- By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

Throughout the projected period, the European market is anticipated to have a sizable impact on the expansion of the PON business. Government involvement in the area as a partner and financial supporter is credited with the expansion. Along with raising awareness of PON services, the regional government contributes significantly to the creation of a strong ecosystem of industry participants, goods, and services. A CAGR of 20% is predicted for the Asia Pacific PON market during the projected period due to the region's rising demand for increased bandwidth from nations like China, India, and Japan. Regional growth is also predicted to be fueled by rising internet data usage and investments in R&D.

Global Ethernet Passive Optical Network- By Companies

-

Adtran Inc.

-

Huawei Technologies Co. Ltd.

-

Alcatel-Lucent S.A.

-

Hitachi Communication Technologies, Inc.

-

AT & T Inc.

-

Freescale Semiconductor, Inc.

-

Broadcom Corporation, Inc.

-

Ericsson Inc.

-

Calix Inc.

-

ECI Telecom, Ltd

NOTABLE HAPPENINGS IN THE GLOBAL ETHERNET PASSIVE OPTICAL NETWORK MARKET IN THE RECENT PAST:

-

Product Launch: - In 2022, the Coexistence portfolio was introduced by CommScope, a U.S.-based infrastructure provider firm, to help PON networks be upgraded so they could supply more services and boost data speeds without having to replace or add fiber to their existing PON infrastructure.

-

Product Launch: - In 2022, Gigabit Passive Optical Networking will be used to launch data services by AirFiber Networks, an internet service provider based in India (GPON). To reach more than 100,000 users in a year, AirFiber Networks will be able to offer high-speed internet services in Bangalore and underserved regions around the state of Tamil Nadu thanks to Nokia's GPON solution.

-

Product Launch: - In 2022, The 5G PON technology was introduced by Nokia, a Finnish telecommunications firm. It is the next development in PON (passive optical network) progression and allows the convergence of high-end services on a single fiber infrastructure.

Chapter 1.GLOBAL ETHERNET PASSIVE OPTICAL NETWORK– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.GLOBAL ETHERNET PASSIVE OPTICAL NETWORK– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.GLOBAL ETHERNET PASSIVE OPTICAL NETWORK– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.GLOBAL ETHERNET PASSIVE OPTICAL NETWORK- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL ETHERNET PASSIVE OPTICAL NETWORK- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.GLOBAL ETHERNET PASSIVE OPTICAL NETWORK– By Component

6.1. ONT

6.2. OLT

Chapter 7.GLOBAL ETHERNET PASSIVE OPTICAL NETWORK– By Application

7.1. FTTx

7.2. Mobile Backhaul

Chapter 8. GLOBAL ETHERNET PASSIVE OPTICAL NETWORK– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9.GLOBAL ETHERNET PASSIVE OPTICAL NETWORK– Key Players

9.1. Adtran Inc.

9.2. Huawei Technologies Co. Ltd.

9.3. Alcatel-Lucent S.A.

9.4. Hitachi Communication Technologies, Inc.

9.5. AT & T Inc.

9.6 Freescale Semiconductor, Inc.

9.7. Broadcom Corporation, Inc.

9.8. Ericsson Inc.

9.9. Calix Inc.

9.10. ECI Telecom, Ltd

Download Sample

Choose License Type

2500

4250

5250

6900