DTC Genetic Testing Market Size (2023 – 2030)

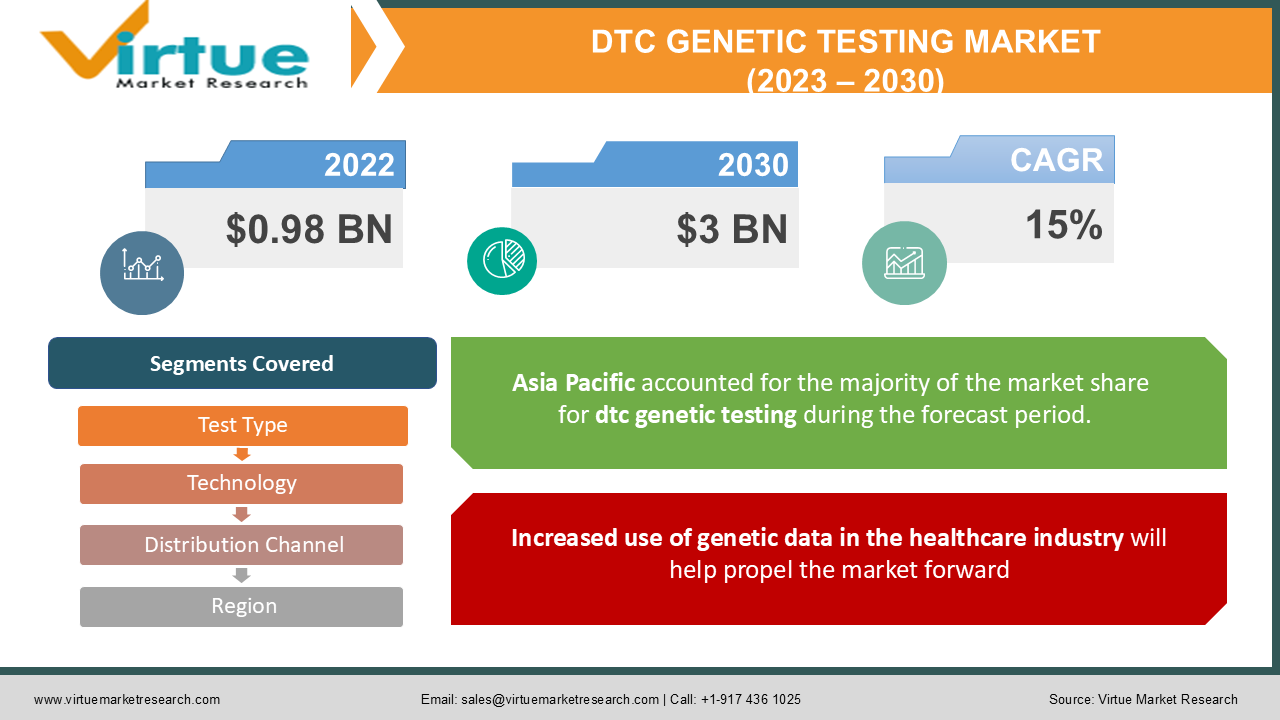

According to our research report, in 2022 the Global DTC Genetic Testing Market was valued at $0.98 billion, and is projected to reach a market size of $3 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 15%.

Industry Overview

The DTC genetic testing business is fragmented, with a few prominent firms and several small start-up companies offering higher-quality DTC tests at reduced prices, which will address affordability concerns and favorably affect market growth. Individuals' genetic information is provided directly to consumers without the intervention of any medical professional or health insurance organization. Customers may send their DNA samples to the firm and obtain immediate results. Direct-to-consumer genetic testing raises awareness of numerous genetic illnesses, aids in health prediction, and offers information on common features and ancestry, among other things. DTC genetic testing is simple to use, affordable, and provides accurate findings in less time. Such circumstances will help the market expand beneficially.

Growing public awareness of the availability of direct-to-consumer genetic testing in both developed and developing countries will drive market expansion throughout the forecast period. Several prominent industry players have focused their efforts on producing high-quality direct-to-consumer genetic testing options. These tests guarantee effective and precise genetic test results. The global Direct-To-Consumer (DTC) Genetic Testing Market is driven by this. In addition, firms like 23andMe have made a concerted effort to advertise their direct-to-consumer genetic testing through retail pharmacies and internet platforms. Promotional offers and nice discounts are also used to sell the products.

The rise in public awareness is likely to promote the growth of the direct-to-consumer (DTC) genetic testing market over the forecast period. Furthermore, rising income levels in developing nations are expected to fuel the expansion of the direct-to-consumer (DTC) genetic testing industry. The rise in the cost of DTC genetic testing, on the other hand, is expected to restrict the market's expansion in the timeframe term. Furthermore, the growing need for service customization will give further chances for the direct-to-consumer (DTC) genetic testing industry to flourish in the future years. However, flaws in DTC testing kits may provide a further barrier to expansion.

Impact of Covid-19 on the Industry

The COVID-19 epidemic boosted the demand for direct-to-consumer genetic testing. Technology advancements have cleared the path for new commercial prospects in direct-to-consumer genetic testing amid the epidemic. The growth in the prevalence of chronic illnesses and the launch of tailored testing kits for specific treatment areas have supported the rapid spread of direct-to-consumer genetic testing. The need for such kits has risen as a result of such adaption and changes in services. The fact that these kits are available on internet platform services will also have a favorable impact on market statistics.

Market Drivers

The market will expand due to rising demand for customized direct-to-consumer genetic testing services

Customers are eager to pay for the diagnosis and treatment of specific requirements, therefore demand for tailored direct-to-consumer genetic tests is increasing. The growing popularity of pharmacogenetics will boost industry statistics for direct-to-consumer genetic testing. Pharmacogenetics is a well-known example of gene-based personalization, in which genetic variations govern the medical therapy that best suits the company's needs. Furthermore, consumer knowledge is used to evaluate and regulate customized tests. The service provider provides descriptive information on the analytical and clinical validity of the tests, which is in high demand in the business.

Increased use of genetic data in the healthcare industry will help propel the market forward

Since the late 1990s, the clinician's cancer "toolkit" of surgery, radiation, and chemotherapy has been increasingly supplemented by therapies that target specific molecular pathways in cancer growth and development. Genomic information can now assist clinicians in deciding on treatment strategies by classifying a tumor according to its mutations and corresponding. In some cases, patients have been spared costly and complex procedures, such as bone marrow transplants, based on a molecular diagnosis.

Market Restraints

This type of testing cannot tell definitively whether you will or will not get a particular disease

DTC genetic testing frequently fails to offer clear information on whether or not the customer will acquire an illness. Most DTC genetic testing is confined to a few key genetic variations associated with the phenotypes of interest, resulting in low discriminatory power. Diseases are polygenic in the sense that they are impacted by several genetic variations. Disease incidence is determined by environmental and lifestyle variables such as age, sex, race, diet, exercise, and stress, in addition to hereditary factors. As a result, DTC genetic testing does not ensure that a customer with a high genetic risk score would develop a disease.

DTC Genetic Testing Market Report Coverage:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

15% |

|

Segments Covered |

By Test Type, Technology, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

23andMe, Inc., Ancestry.com, LLC, Any Lab Test Now, Color Health, Inc., Direct Laboratory Services, LLC, DNA Diagnostics Center, Easy DNA, Full Genomes Corporation, Inc., Gene by Gene, Ltd., Genesis Healthcare, Helix OpCo LLC, Laboratory Corporation of America® Holdings |

This research report on the global DTC genetic testing market has been segmented and sub-segmented based on test type, technology, distribution channel, and region.

Global DTC Genetic Testing Market- By Test Type

- Carrier Testing

- Predictive Testing

- Ancestry & Relationship Testing

- Nutrigenomic Testing

- Skincare Testing

Ancestry and relationship testing, carrier testing, nutrigenomic testing, predictive testing, and skincare testing are the different types of tests available in the direct-to-consumer genetic testing market. The ancestry & relationship testing sector had over 40% of the market share in 2021, thanks to lower costs for genetic ancestry tests in recent years, which has boosted demand. In addition, interest in ancestry tests has exploded in developed countries, including the United States, bolstering segmental momentum. Ancestry testing, also known as genetic genealogy, allows people to learn about their family history through historical records. It gives insights into an individual's ancestry by studying DNA variations among persons with comparable backgrounds. FamilyTreeDNA, for example, offers Familial Finder DNA testing to uncover DNA matches and family ties. This also aids in determining ancestral history by comparing DNA to DNA from archaeological excavation sites. As a result, ancestry and connection tests are in increased demand, which will grow the entire industry.

Global DTC Genetic Testing Market- By Technology

- Targeted analysis

- Single nucleotide polymorphism (SNP) chips

- Whole Genome Sequencing (WGS)

By technology, the direct-to-consumer genetic testing market is fragmented into whole-genome sequencing (WGS), targeted analysis, and single nucleotide polymorphism (SNP) chips. In 2021, the entire genome sequencing industry brought in roughly USD 212 million in sales. One way for examining complete genomes is whole-genome sequencing. This method allows for high-resolution genomic selection and aids in the identification of chromosomal areas linked to genetic impacts on various phenotypes.

It also captures both small and large variants, identifies causative variants, and delivers massive amounts of data in a short amount of time. Whole-genome sequencing is generally utilized for detecting many sorts of disorders, pharmacogenomics and medication trials, family hereditary diseases as well as unusual tumor forms. Such diversified applications encourage the need for whole-genome sequencing technology. As a result, the aforementioned factors will drive overall market trends.

Global DTC Genetic Testing Market- By Distribution Channel

- Online Platform

- Over the counter

The direct-to-consumer genetic testing market is divided into two categories based on distribution: internet platforms and over-the-counter testing. Because of the increased use of healthcare apps and expanding internet usage, the online platforms segment is expected to rise at a CAGR of around 15.5 percent through 2028. Furthermore, buyers may peruse a wide range of a company's product offers through internet platforms. As a result, the ease with which internet platforms may do business will shape the market landscape. Furthermore, firms that sell direct-to-consumer genetic testing kits prefer internet channels because they allow them to reach a worldwide client base that helps the industry grow.

Global DTC Genetic Testing Market- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

The United States, Canada, and Mexico in North America, Germany, France, the United Kingdom, the Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, and the Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, and the Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Saudi Arabia, the United Arab Emirates, South Africa, Egypt, Israel, and the Rest of Middle East in the Middle East.

In 2021, the North American industry had a market share of over 39% and is expected to rise significantly in the next years. Rising public awareness about direct-to-consumer genetic testing is credited with high regional growth in the United States and Canada. Furthermore, increased internet usage among residents in densely populated areas of the country would help the industry expand. Similarly, across the area, a simplified regulatory procedure will support market expansion. The Food and Drug Administration, for example, simplifies requirements to verify that tests are analytically and clinically valid without the participation of a healthcare intermediary. All of these reasons are driving up demand for genetic testing sold directly to consumers.

Global DTC Genetic Testing Market- By Companies

- 23andMe, Inc.

- Ancestry.com, LLC

- Any Lab Test Now

- Color Health, Inc.

- Direct Laboratory Services, LLC

- DNA Diagnostics Center

- Easy DNA

- Full Genomes Corporation, Inc.

- Gene by Gene, Ltd.

- Genesis Healthcare

- Helix OpCo LLC

- Laboratory Corporation of America® Holdings

23andMe, Inc., Ancestry, Color Genomics, Easy DNA, Family Tree DNA, Full Genome Corporation Inc., Helix OpCo LLC, Karmagenes SA, Living DNA Ltd., Mapmygenome, Identigene, Pathway genomics, Genesis Healthcare Co., My Heritage, 24 Genetics, The Skin DNA Company Pty Ltd, DNA Forensics Laboratory Pt. Ltd., and DNA Diagnostic Center are some of the major players in the direct- To maintain market competition in the direct-to-consumer genetic testing market, these industry participants are using numerous growth strategies that include continual innovations and technological upgrades.

NOTABLE HAPPENINGS IN THE GLOBAL DIGITAL FREIGHT SHIPPING MARKET IN THE RECENT PAST:

- Merger & Acquisition: - In November 2021, 23andme announced the closing of its acquisition of lemonaid health.

- Merger & Acquisition: - In February 2021, 23andMe going public at $3.5B via a merger with Branson's blank check company.

Chapter 1. Global DTC Genetic Testing Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global DTC Genetic Testing Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Global DTC Genetic Testing Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global DTC Genetic Testing Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global DTC Genetic Testing Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global DTC Genetic Testing Market – By Test Type

6.1. Carrier Testing

6.2. Predictive Testing

6.3. Ancestry & Relationship Testing

6.4. Nutrigenomic Testing

6.5. Skincare Testing

Chapter 7. Global DTC Genetic Testing Market – By Technology

7.1. Targeted analysis

7.2. Single nucleotide polymorphism (SNP) chips

7.3. Whole Genome Sequencing (WGS)

Chapter 8. Global DTC Genetic Testing Market – By Distribution Channel

8.1. Online Platform

8.2. Over the counter

Chapter 9. Global DTC Genetic Testing Market- By Region

9.1. North America

9.2. Europe

9.3. Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. Global DTC Genetic Testing Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. 23andMe, Inc.

10.2. Ancestry.com, LLC

10.3. Any Lab Test Now

10.4. Color Health, Inc.

10.5. Direct Laboratory Services, LLC

10.6. DNA Diagnostics Center

10.7. Easy DNA

10.8. Full Genomes Corporation, Inc.

10.9. Gene by Gene, Ltd.

10.10. Genesis Healthcare

10.11. Helix OpCo LLC

10.12. Laboratory Corporation of America® Holdings

Download Sample

Choose License Type

2500

4250

5250

6900