Digital Remittance Market Size (2024 – 2030)

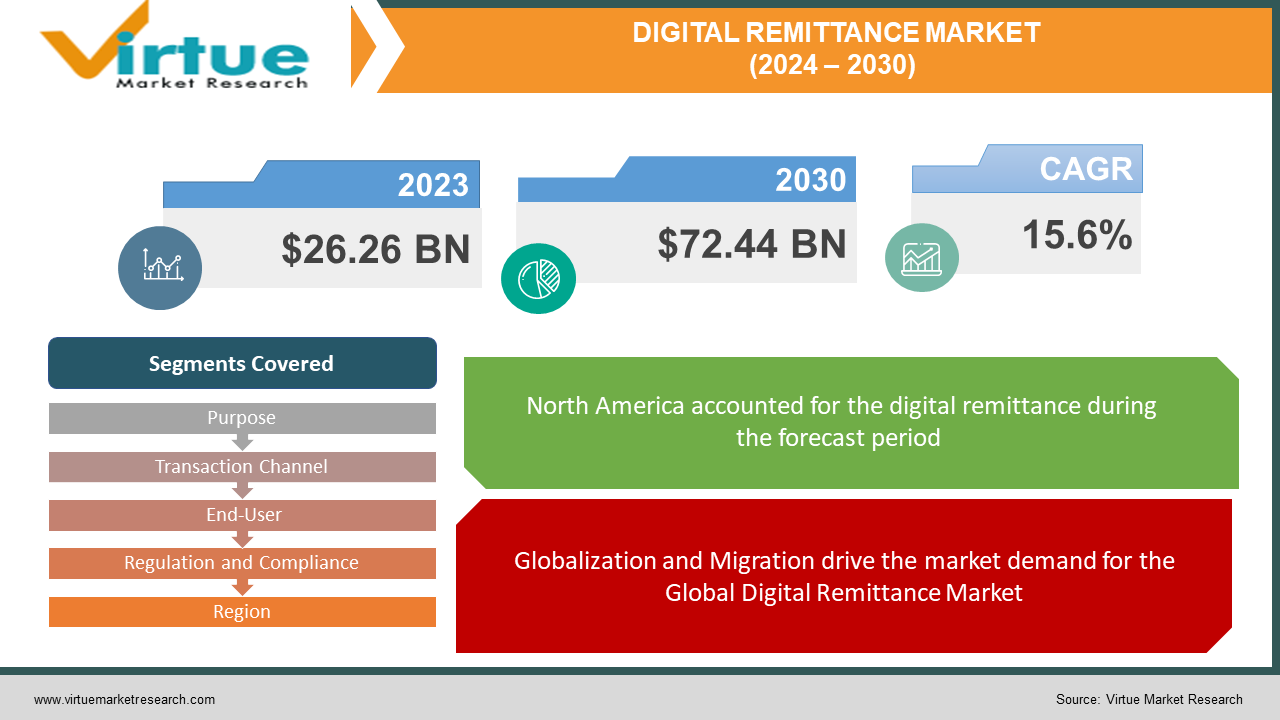

The Global Digital Remittance Market is valued at USD 26.26 Billion and is projected to reach a market size of USD 72.44 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 15.6%.

The Global Digital Remittance Market continues to evolve, driven by long-term market drivers such as globalization, as well as short-term factors like the COVID-19 pandemic. While the pandemic has posed challenges, it has also accelerated digital adoption and innovation in the remittance industry. With the increasing adoption of mobile payment technologies, opportunities for blockchain integration, and partnerships between remittance providers and fin-tech companies, the digital remittance market is poised for continued growth and transformation in the years to come.

Key Market Insights:

Vibratory The Global Digital Remittance Market has witnessed significant growth over the past decade, driven by various factors that have reshaped the way people transfer money across borders. As businesses expand globally and individuals migrate for employment opportunities, the need for fast, secure, and cost-effective ways to send money back home has grown exponentially. Digital remittance solutions have emerged as a convenient alternative to traditional methods such as bank transfers and money transfer operators, offering lower fees, faster transaction times, and greater accessibility.

With the proliferation of smartphones and internet connectivity, more people are embracing digital wallets and mobile money solutions for everyday transactions, including remittances. Mobile apps offered by remittance providers enable users to initiate transfers, track transactions, and receive funds directly into their mobile wallets, offering convenience and flexibility.

A trend observed in the digital remittance industry is the expansion of partnerships and collaborations between remittance providers and fintech companies. Remittance providers are increasingly partnering with fintech startups to leverage their innovative technologies and reach new customer segments. These partnerships enable remittance companies to offer a wider range of services, such as digital wallets, bill payments, and micro-loans, catering to the evolving needs of their customers.

Digital Remittance Market Drivers:

Globalization and Migration drive the market demand for the Global Digital Remittance Market.

The increasing globalization of economies and the rise in international migration have been fundamental drivers of the digital remittance market. As people move across borders for employment, education, and other opportunities, the need to send money back to their home countries has grown. Digital remittance solutions offer a convenient, efficient, and cost-effective way to transfer funds internationally, catering to the needs of migrants and their families.

Technological Advancements have boosted the market for Global Digital Remittance Market.

Advances in technology, particularly in mobile and internet connectivity, have fueled the growth of the digital remittance market. The widespread adoption of smartphones and the internet has made it easier for people to access remittance services through mobile apps and online platforms. Moreover, innovations such as mobile wallets, blockchain technology, and biometric authentication have enhanced the security, speed, and convenience of digital remittance transactions.

Regulatory Changes drive the market demand for Global Digital Remittance Market.

Regulatory reforms aimed at promoting financial inclusion and reducing the costs of remittance transfers have also influenced the digital remittance market. Governments and regulatory authorities in various countries have implemented measures to streamline remittance processes, reduce transaction fees, and enhance transparency in the remittance industry. These regulatory changes have facilitated the growth of digital remittance channels and encouraged the adoption of digital payment solutions.

Demographic Trends have boosted the market for Global Digital Remittance Market.

Demographic factors such as population growth, urbanization, and demographic shifts can also impact the digital remittance market. Changes in demographics, such as the increasing number of young, tech-savvy migrants, can drive demand for digital remittance services. Moreover, shifts in consumer preferences, lifestyle choices, and family structures influence the adoption and usage of digital remittance channels among different demographic segments.

Global Digital Remittance Market Restraints and Challenges:

Compliance with regulatory requirements and anti-money laundering (AML) regulations poses a significant challenge for digital remittance providers. As the regulatory landscape evolves and becomes more stringent, remittance companies must invest in robust compliance systems and processes to mitigate the risk of financial crime and ensure regulatory compliance across multiple jurisdictions.

Security threats, such as data breaches, fraud, and cyber-attacks, pose a significant challenge to the digital remittance market. Remittance providers must implement robust security measures, including encryption, authentication mechanisms, and fraud detection systems, to safeguard customer data and prevent unauthorized access to financial transactions.

Limited access to reliable internet connectivity and digital infrastructure in certain regions can impede the adoption of digital remittance services. In rural and underserved areas, inadequate technological infrastructure, lack of access to smartphones or computers, and low digital literacy rates can hinder the use of digital payment solutions for remittance transfers.

Global Digital Remittance Market Opportunities:

Digital remittance offers a pathway to financial inclusion for millions of unbanked and under-banked individuals worldwide. By leveraging mobile technology and digital platforms, remittance providers can extend their services to underserved populations, empowering them with access to formal financial services and enabling greater participation in the global economy.

The growing adoption of smartphones and internet connectivity, particularly in emerging markets, presents a vast opportunity for the expansion of digital remittance services. Remittance providers can capitalize on this trend by tapping into new customer segments, exploring untapped markets, and diversifying their product offerings to meet the evolving needs of consumers.

The adoption of blockchain technology holds immense potential to revolutionize the digital remittance landscape. Block-chain-based remittance platforms offer increased security, transparency, and efficiency in cross-border transactions, reducing costs and settlement times. Moreover, blockchain enables instant peer-to-peer transfers with minimal fees, providing an alternative solution for remittance senders and recipients.

The Global Digital Remittance Market can be segmented based on various factors to better understand its dynamics and target different customer segments effectively. Here are some common segmentation criteria:

DIGITAL REMITTANCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15.6% |

|

Segments Covered |

By Purpose, Transaction Channel, End-User, Regulation and Compliance, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Western Union, MoneyGram International, PayPal Holdings, Inc., TransferWise Ltd. (now known as Wise), Remitly, WorldRemit, Ria Financial Services, OFX Group Limited, Xoom Corporation (a PayPal service), Azimo |

Global Digital Remittance Market Segmentation: By Purpose

-

Personal Remittances

-

Business Remittances

Personal remittances stand tall as the largest segment in the Global Digital Remittance Market. These transfers, often driven by familial ties and obligations, constitute a significant portion of the overall remittance flows worldwide. Migrant workers, residing in distant lands, utilize digital channels to send money back home to support their families' financial needs. Whether it's for education expenses, healthcare bills, or daily sustenance, personal remittances serve as a lifeline for countless households, bridging the geographical gap between loved ones.

On the other hand, business remittances emerge as the fastest-growing segment in the digital remittance landscape. Unlike personal remittances, which cater to individual needs, business remittances cater to the financial requirements of enterprises operating across borders. In an increasingly globalized economy, businesses engage in cross-border trade, procurement, and payroll activities, necessitating seamless and efficient payment solutions. Digital remittance services tailored for businesses offer features such as bulk transfers, invoice management, and integration with accounting software, facilitating smooth financial transactions and fostering international trade relations.

Global Digital Remittance Market Segmentation: By Transaction Channel

-

Online Platforms

-

Mobile Applications

-

Agent Networks

-

Banks and Financial Institutions

Online platforms represent the largest sub-segment in the digital remittance market due to their widespread adoption and convenience. These platforms allow users to initiate remittance transactions conveniently from their computers or laptops, offering features such as real-time exchange rates, multiple payment options, and transaction tracking.

Mobile applications are the fastest-growing sub-segment in the digital remittance market, driven by the increasing penetration of smartphones and mobile internet connectivity. Mobile apps offer users the flexibility to send and receive money anytime, anywhere, using their smartphones. With features like biometric authentication, push notifications, and integration with mobile wallets, mobile apps provide a seamless and user-friendly remittance experience.

Global Digital Remittance Market Segmentation: By End-User

-

Individual Consumers

-

Small and Medium Enterprises (SMEs)

-

Large Enterprises

At the forefront of the Global Digital Remittance Market are individual consumers, constituting the largest segment. These consumers, often migrants or expatriates, rely on digital remittance services to send money to their families and loved ones across borders. With the advent of digital platforms and mobile applications, individual consumers can initiate remittance transactions conveniently from their smartphones or computers, facilitating the transfer of funds for various purposes such as family support, education, healthcare, and daily expenses.

Amidst the evolving landscape of digital remittance, small and medium enterprises (SMEs) emerge as the fastest-growing segment. SMEs, encompassing a diverse array of businesses, are increasingly leveraging digital remittance solutions to streamline their cross-border payment processes. These enterprises engage in international trade, procurement, and payroll activities, necessitating efficient and cost-effective payment solutions. Digital remittance services tailored for SMEs offer features such as bulk transfers, invoice management, and integration with accounting software, empowering businesses to manage their finances seamlessly and expand their global footprint.

Global Digital Remittance Market Segmentation: By Regulation and Compliance

-

Regulated Remittance Corridors

-

Non-Regulated Remittance Corridors

Leading the way in the Global Digital Remittance Market are regulated remittance corridors, emerging as the largest segment. These corridors operate within a regulatory framework established by governments and financial authorities to ensure transparency, security, and consumer protection in remittance transactions. Remittance providers operating in regulated corridors adhere to strict compliance requirements, including anti-money laundering (AML) and know-your-customer (KYC) regulations, to maintain the integrity of the financial system and prevent illicit activities.

Meanwhile, non-regulated remittance corridors represent the fastest-growing segment in the digital remittance market. These corridors operate in regions or countries where regulatory oversight is less stringent or nonexistent, allowing for greater flexibility and innovation in remittance services. Remittance providers operating in non-regulated corridors have the opportunity to offer innovative solutions, competitive pricing, and enhanced customer experiences without the burden of excessive regulatory requirements. This flexibility attracts consumers seeking alternative remittance options and drives the growth of non-regulated corridors in the digital remittance landscape.

Global Digital Remittance Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Leading the charge in the Global Digital Remittance Market is North America, emerging as the largest segment. The region boasts a robust digital infrastructure and a high level of digital adoption among consumers and businesses alike. With a large population of migrants and expatriates, North America serves as a major hub for remittance transactions, facilitating the flow of funds to various countries around the world. Digital remittance services in North America offer convenience, speed, and security, catering to the diverse needs of senders and recipients.

Meanwhile, the Asia-Pacific region emerges as the fastest-growing segment in the Global Digital Remittance Market. Rapid urbanization, economic growth, and increasing migration within the region contribute to the surge in remittance flows. Countries like India, China, and the Philippines witness significant remittance inflows from overseas workers, driving the demand for digital remittance services. Digital platforms and mobile applications play a crucial role in facilitating remittance transactions in the Asia-Pacific region, offering users a seamless and convenient way to send and receive money across borders.

COVID-19 Impact Analysis on Global Digital Remittance Market:

The pandemic-induced lockdowns and travel restrictions have disrupted the livelihoods of millions of migrant workers worldwide. Many migrants faced job losses, reduced working hours, or were unable to travel back to their home countries. As a result, the volume of remittances sent by migrant workers declined, impacting the digital remittance market, which heavily relies on migrant remittances as a key driver of transaction volume. The global economic downturn triggered by the pandemic has led to currency devaluations and exchange rate fluctuations in many countries. The depreciation of currencies in remittance-receiving countries has reduced the value of remittances sent by migrants, affecting both senders and recipients. Moreover, the uncertainty surrounding the economic outlook has deterred some migrants from sending remittances, further dampening transaction volumes in the digital remittance market.

Despite the challenges posed by COVID-19, the pandemic has also created opportunities for innovation and collaboration in the digital remittance market. Remittance providers are leveraging technology to enhance the user experience, improve operational efficiency, and offer new value-added services to customers. Moreover, partnerships and collaborations between remittance providers, fintech companies, and financial institutions are fostering innovation in the industry, leading to the development of new payment solutions and business models tailored to the post-pandemic environment.

Latest Trends/ Developments:

Blockchain technology is gaining traction in the digital remittance market, offering enhanced security, transparency, and efficiency in cross-border transactions. Remittance providers are exploring blockchain-based solutions to streamline processes, reduce costs, and improve the speed of remittance transfers. Mobile wallets are becoming increasingly popular as a payment method for digital remittances. Remittance providers are integrating with mobile wallet platforms to offer users seamless and convenient ways to send and receive money directly from their mobile devices. This trend is driven by the widespread adoption of smartphones and the growing preference for mobile-based financial services.

Regulatory reforms aimed at promoting financial inclusion, reducing remittance costs, and enhancing consumer protection are shaping the digital remittance market. Governments and regulatory authorities are implementing measures to streamline remittance processes, encourage innovation, and foster competition among service providers, creating a more conducive environment for digital remittance services to thrive.

Key Players:

-

Western Union

-

MoneyGram International

-

PayPal Holdings, Inc.

-

TransferWise Ltd. (now known as Wise)

-

Remitly

-

WorldRemit

-

Ria Financial Services

-

OFX Group Limited

-

Xoom Corporation (a PayPal service)

-

Azimo

Chapter 1. Digital Remittance Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Digital Remittance Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Digital Remittance Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Digital Remittance Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Digital Remittance Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Digital Remittance Market – By Purpose

6.1 Introduction/Key Findings

6.2 Personal Remittances

6.3 Business Remittances

6.4 Y-O-Y Growth trend Analysis By Purpose

6.5 Absolute $ Opportunity Analysis By Purpose, 2024-2030

Chapter 7. Digital Remittance Market – By Transaction Channel

7.1 Introduction/Key Findings

7.2 Online Platforms

7.3 Mobile Applications

7.4 Agent Networks

7.5 Banks and Financial Institutions

7.6 Y-O-Y Growth trend Analysis By Transaction Channel

7.7 Absolute $ Opportunity Analysis By Transaction Channel, 2024-2030

Chapter 8. Digital Remittance Market – By Regulation and Compliance

8.1 Introduction/Key Findings

8.2 Regulated Remittance Corridors

8.3 Non-Regulated Remittance Corridors

8.4 Y-O-Y Growth trend Analysis By Regulation and Compliance

8.5 Absolute $ Opportunity Analysis By Regulation and Compliance, 2024-2030

Chapter 9. Digital Remittance Market – By End-Users

9.1 Introduction/Key Findings

9.2 Individual Consumers

9.3 Small and Medium Enterprises (SMEs)

9.4 Large Enterprises

9.5 Y-O-Y Growth trend Analysis By End-Users

9.6 Absolute $ Opportunity Analysis By End-Users, 2024-2030

Chapter 10. Digital Remittance Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Purpose

10.1.2.1 By Transaction Channel

10.1.3 By Regulation and Compliance

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Purpose

10.2.3 By Transaction Channel

10.2.4 By Regulation and Compliance

10.2.5 By End-Users

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Purpose

10.3.3 By Transaction Channel

10.3.4 By Regulation and Compliance

10.3.5 By End-Users

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Purpose

10.4.3 By Transaction Channel

10.4.4 By Regulation and Compliance

10.4.5 By End-Users

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Purpose

10.5.3 By Transaction Channel

10.5.4 By Regulation and Compliance

10.5.5 By End-Users

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Digital Remittance Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Western Union

11.2 MoneyGram International

11.3 PayPal Holdings, Inc.

11.4 TransferWise Ltd. (now known as Wise)

11.5 Remitly

11.6 WorldRemit

11.7 Ria Financial Services

11.8 OFX Group Limited

11.9 Xoom Corporation (a PayPal service)

11.10 Azimo

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Digital Remittance Market is valued at USD 26.26 Billion and is projected to reach a market size of USD 72.44 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 15.6%.

Globalization and Migration, Technological Advancements, Regulatory Changes, and Demographic Trends are the market drivers of the Global Digital Remittance Market.

Personal Remittances and Business Remittances are the segments under the Global Digital Remittance Market by Purpose.

North America is the most dominant region for the Global Digital Remittance Market.

Asia-Pacific is the fastest-growing region in the Global Digital Remittance Market.