Global Digital Derm and Wound Therapeutics Market Size (2023 – 2030)

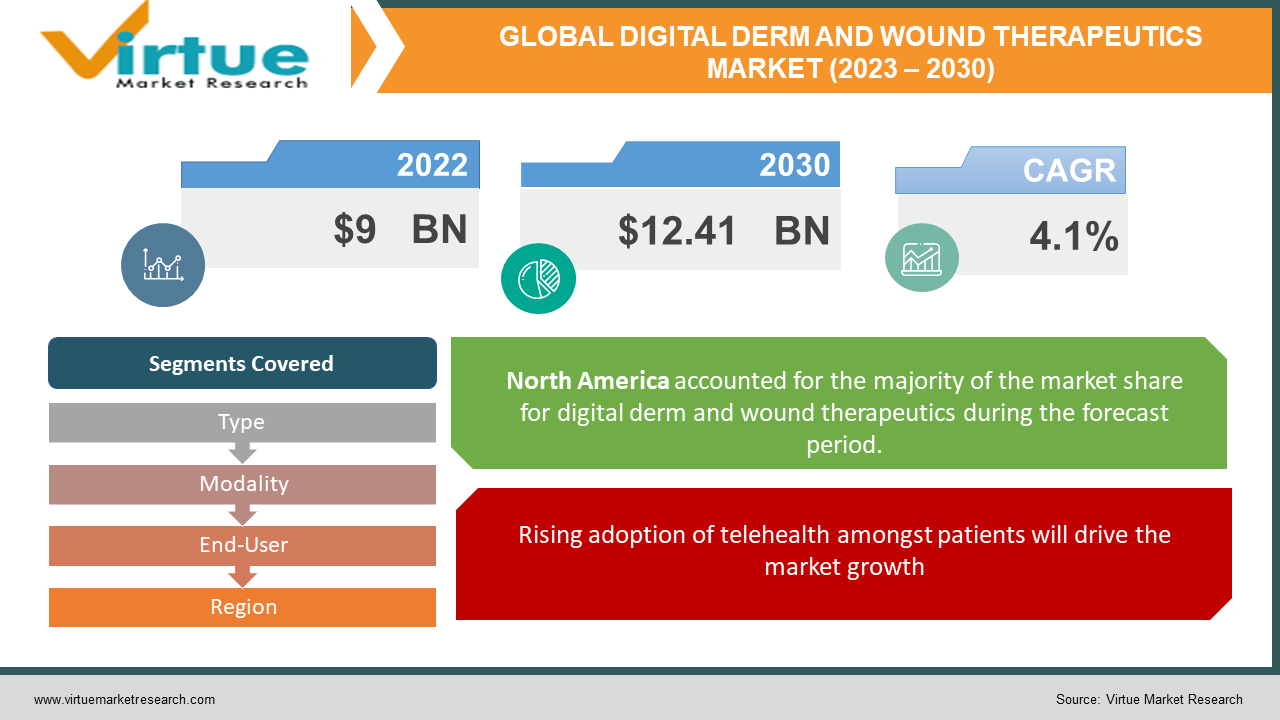

According to our research report, the global digital derm and wound therapeutics market was valued at USD 9 billion and is projected to reach a market size of USD 12.41 billion by 2030. The market is projected to grow with a CAGR of 4.1% per annum during the period of analysis (2023 - 2030).

Industry Overview

Teledermatology employs a variety of communication technologies to extend a dermatologist's reach to individuals who require their expertise. Teledermatology is essentially asynchronous (store-and-forward), with photos being stored on digital devices such as cellphones and PCs and then sent electronically to a referring dermatologist. The market is expected to increase at a healthy rate throughout the projected period, owing to rising prevalence of skin disorders caused by the ageing population and a scarcity of dermatologists. As a result, patients must wait a lengthy time for consultations. According to Walk-in Dermatology Management, LLC, there will only be 3.3 dermatologists accessible for every 100,000 individuals in August 2020.

Teleconsultations are being pushed by an increase in collaborations between pharmacies, insurance companies, and merchants and telehealth firms as people become more aware of the benefits of virtual visits, such as cheaper prices and increased accessibility. DermTech, for example, unveiled its DermTech Pigmented Lesion Assay in May 2020, a telemedicine solution that would allow remote usage of its non-invasive adhesive patch test for melanoma diagnosis.

Impact of Covid-19 on the Industry

The market's effect from the COVID-19 pandemic is predicted to be strong throughout the analysis period. This is because the usage of telemedicine/teledermatology accelerated dramatically during the COVID-19 epidemic. To restrict the spread of the coronavirus, lockdown and social distancing measures were implemented, which resulted in a considerable drop in the number of patient visits/consultations. The American Association of Dermatology conducted a poll of dermatologists in the United States in 2020, and found a 43 percent drop in weekly patient consultations during the lockdown period compared to the pre-COVID level. During the lockdown in France, there was 60% drop-in specialist appointments and a 40% drop in general practitioner (GP) consultations. Because of the decrease in inpatient visits and the loosening of rules, telemedicine has become quite popular among clinicians, particularly dermatologists. Furthermore, a questionnaire completed by teledermatology patients during the COVID-19 pandemic in December 2020, according to Dermatology online journal, revealed that more than 90% of patients would utilise telehealth services again, and about 80% of patients would suggest the services to others.

During the COVID 19 lockout, the number of dermatologists in the United States who gave telehealth consultations nearly quadrupled. Furthermore, rising initiatives from various commercial and governmental groups to restrict the disease's spread would aid market expansion. Furthermore, rules were simplified, and virtual consultation coverage was expanded to guarantee that physicians could give treatment to patients. The Centers for Medicare & Medicaid Services (CMS) announced regulation amendments on March 30 that would make it simpler for individuals in the United States to get medical treatment via telemedicine.

Market Drivers

Rising adoption of telehealth amongst patients will drive the market growth

Increased receptivity among patients and providers is one of the primary drivers of market growth. In a 2017 poll done by the National Business Group on Health, over 96 percent of firms in the United States with 500 or more employees claimed they would give insurance coverage for telehealth services by 2019. In November 2020, One Touch Telehealth will release Version 5.0 of its software; with the surge in video telehealth during a pandemic, virtual care is appropriate for every user type in any healthcare context. This will aid in the spread of telehealth workflow operational efficiency. As a result, the aforementioned aspect aided market expansion throughout the anticipated period.

The rising prevalence of skin diseases is propelling market growth

The number of dermatological services has increased significantly as the prevalence of skin disorders such as skin cancer, eczema, and psoriasis has increased. According to the American Association of Dermatology, around 50 million Americans have acne, 30 million have eczema, and 7.5 million have psoriasis. Every day, around 9,500 people in the United States are diagnosed with skin cancer. As a result, the rate of increase in skin problems will force the tele dermatology industry forward.

Market Restraints

Poor reimbursement facilities in underdeveloped countries will act as a market restraint

Despite the fact that many nations have developed payment regulations for teledermatology services, incorrect and inadequate compensation, particularly in poor countries, remains a substantial barrier to their implementation. In underdeveloped nations, the cost of health care has long been a major concern. As a result, developing economies have rushed to accept these services without sufficient strategy or preparation.

GLOBAL DIGITAL DERM AND WOUND THERAPEUTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.1% |

|

Segments Covered |

By Type, Modality, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

analyzed Iagnosis, Honeywell Life Care Solutions, Philips Healthcare, AMD Global Telemedicine INC, GE Healthcare, Aerotel Medical Systems, Click Diagnostics, Dermlink, Allscripts Healthcare Solutions Inc., McKesson Corporation. |

This research report on the Global Digital Derm and Wound Therapeutics Market has been segmented and sub-segmented based on Type, Modality, End-User and Geography & region.

Global Digital Derm and Wound Therapeutics Market- By Type

- Products

- Services

- Digital Consultation

- Digital Monitoring

- Tele- Education

- Others

The market is divided into two types: services and products. In 2020, the services sector was the most prominent. It significantly reduces referrals, and patients do not have to wait in huge lines to be seen. According to the Merritt Hawkins Survey, the average waiting time for a consultation has grown from 28.8 days in 2014 to 32.2 days in 2017. This is due to a dermatological scarcity in the United States. As a result, a growing number of hospitals are adopting virtual visits, further benefiting the services segment.

Global Digital Derm and Wound Therapeutics Market- By Modality

- Store and forward

- Real Time

- Others

During the projected period, the store-and-forward (SAF) segment is predicted to develop at a healthy rate. Because skin pictures are required for diagnosis, teledermatology is heavily reliant on the SAF modality. The segment's expansion is fueled by the growing usage of teledermatology for second views and substantial government backing. According to a study published in the journal Telemedicine and e-Health, in 2017, SAF was used by 729 percent of active non-governmental initiatives in the United States. The SAF segment is likely to increase as a result of this.

Throughout the projection period, the real-time category dominated the teledermatology market. The market is expected to grow due to an increase in video consultations for acne, hair loss, and aesthetic purposes.

Global Digital Derm and Wound Therapeutics Market- By End-User

- Healthcare Facilities

- Homecare

During the research period, the homecare category is predicted to increase at a significant rate. Significant cost savings in health care and growing acceptance of homecare services are two key aspects driving this segment's growth. Telemonitoring and education for senior patients, which eliminates the need for hospital visits, are also expected to boost market development.

Because of the growing number of government-funded pilot projects for teledermatology and telecommunications technologies to teach doctors in medical schools, the healthcare facilities category had the biggest share.

Global Digital Derm and Wound Therapeutics Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

In 2020, North America was worth USD 4.62 billion. The market in North America is likely to be driven by the presence of numerous large-scale companies such as DermatologistsOnCall and MDLive, as well as significant government backing and an increase in teleconsultations. The COVID-19 epidemic has accelerated reforms and acceptance of telehealth by governments, physicians, health systems, and insurance companies across all regions, which is projected to boost the market in the forecast term. Even in India, which has lagged behind in telehealth reform, the Ministry of Health and Family Welfare, in collaboration with NITI Aayog, established formal telemedicine guidelines in March 2020. Furthermore, Mckinsey predicts a significant increase in the usage of telehealth services in the United States by May 2020.

Global Digital Derm and Wound Therapeutics Market- By Comapnies

- analyzed Iagnosis

- Honeywell Life Care Solutions

- Philips Healthcare

- AMD Global Telemedicine INC

- GE Healthcare

- Aerotel Medical Systems

- Click Diagnostics

- Dermlink

- Allscripts Healthcare Solutions Inc.

- McKesson Corporation

NOTABLE HAPPENINGS IN THE GLOBAL DIGITAL DERM AND WOUND THERAPEUTICS MARKET IN THE RECENT PAST:

- Product Launch: - In May 2020, the Pigmented Lesion Assay test was released by DermTech. It is a telemedicine solution that will assist in doing a remote patch test for melanoma detection.

- Product Launch: - In April 2020, Sakhiya Skin Clinic in India has started providing free skin care treatments using teledermatology platforms.

Chapter 1.Global Digital Derm and Wound Therapeutics Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.Global Digital Derm and Wound Therapeutics Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.Global Digital Derm and Wound Therapeutics Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.Global Digital Derm and Wound Therapeutics Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.Global Digital Derm and Wound Therapeutics Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.Global Digital Derm and Wound Therapeutics Market – By Type

6.1. Products

6.2. Services

6.2.1 Digital Consultation

6.2.2. Digital Monitoring

6.2.3. Tele- Education

6.2.4. Others

Chapter 7.Global Digital Derm and Wound Therapeutics Market – By Modality

7.1. Store and forward

7.2. Real Time

7.3. Others

Chapter 8.Global Digital Derm and Wound Therapeutics Market – By End-User

8.1. Healthcare Facilities

8.2. Homecare

Chapter 9.Global Digital Derm and Wound Therapeutics Market- By Region

9.1. North America

9.2. Europe

9.3. Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10.Global Digital Derm and Wound Therapeutics Market – Key Companies

10.1. Analyzed Iagnosis

10.2. Honeywell Life Care Solutions

10.3. Philips Healthcare

10.4. AMD Global Telemedicine INC

10.5. GE Healthcare

10.6. Aerotel Medical Systems

10.7. Click Diagnostics

10.8. Dermlink

10.9. Allscripts Healthcare Solutions Inc.

10.10. McKesson Corporation.

Download Sample

Choose License Type

2500

4250

5250

6900