Global Digital Behavioural Health Market Size (2024 – 2030)

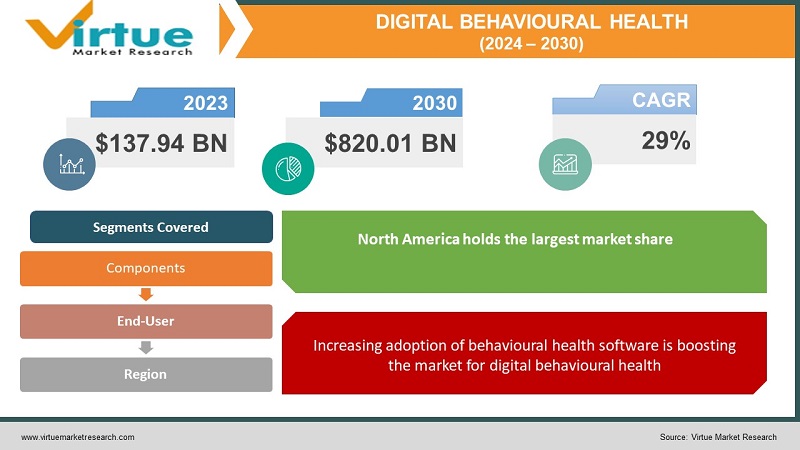

The Global Digital Behavioural Health Market was valued at USD 137.94 Billion and is projected to reach a market size of USD 820.01 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 29%.

Industry Overview

Patients are seeking therapy as stress, anxiety, and depression become more prevalent. As a result, healthcare institutions are using advanced systems to monitor behavioural/mental health, such as various software solutions. According to WHO data from 2019, depression is the most frequent mental illness and one of the top causes of disability worldwide. According to the same statistic, depression today affects 264 million individuals over the world.

Furthermore, the focus of healthcare professionals on providing quality care to patients, behavioural health modifications, increased government support for the enhancement of behavioural healthcare services, new products, and service launches, and partnerships among market players are propelling the overall market forward at a rapid pace. Ehave Inc. and Cognitive Apps Software Solutions Inc. formed cooperation in January 2021 to commercialize its AI-based Workforce Mental Health Analytical Platform in G20 countries. As a result, market growth is likely to accelerate throughout the forecast period.

Impact of Covid-19 on the Industry

An increase in tension, worry, despair, frustration, and dread has been reported among the population as a result of the current COVID–19 epidemic, which might increase the incidence of mental health issues. As a result, the growing number of people suffering from mental illnesses is predicted to enhance online platforms for treatment and diagnosis, driving the behavioural/mental health software industry. During the COVID-19 pandemic, the University of North Carolina (UNC) collaborated with Google Cloud to develop Heroes Health, a mental health app for first responders and healthcare workers, which was released in July 2020.

Increasing stress circumstances necessitating mental health management, government financing and incentives for EHR use in behavioural health institutions, and better health reforms are the primary drivers driving market development over the projection period. In addition, the COVID-19 epidemic has heightened attention on mental health EHR systems as a means of dealing with the crisis. For example, Credible Mental Health partnered with Change Healthcare in March 2020 to provide a free EHR software solution to behavioural health organizations affected by the COVID-19 problem. As a result, the aforementioned factors are projected to drive market expansion in this sector throughout the forecast period.

Market Drivers

Increasing adoption of behavioural health software is boosting the market for digital behavioural health

Governments are concerned about rising healthcare costs for the treatment of mental illnesses or behavioural health difficulties. Depression is a common mental illness that affects over 264 million people of all ages around the world. In 2020, the worldwide cost of treating mental diseases was USD 2.5 trillion; by 2030, this amount is anticipated to rise to USD 6 trillion (Source: Lancet Commission). Furthermore, significant mental diseases are predicted to cost the United States USD 193.2 billion in missed earnings each year (Source: National Alliance of Mental Illness). Every year, mental health issues cost Canada more than USD 42.4 billion (CAD 51 billion) (Source: Centre for Addiction and Mental Health).

The requirement for and development of unnecessary documentation (leading to clinician productivity loss) and inefficient revenue cycle management by behavioural health organizations are the primary causes of high treatment costs. The need to address these difficulties has increased interest in and use of behavioural health software as a method of decreasing prescription mistakes and paperwork, increasing productivity by assuring rapid access to patient data, improving workflow efficiency, and lowering healthcare costs. These advantages have prompted mental health software adoption, particularly among major hospitals and community clinics.

Emerging demand for mental health assistance will drive the market growth

Emerging regions such as Asia Pacific, Latin America, the Middle East, and Africa are likely to offer major growth prospects for participants in the behavioural health software industry, particularly those unable to fulfil the federal government's criteria in the United States. Healthcare providers in Australia will be encouraged to embrace EMR and EHR technologies as a result of government attempts to set standards, legislation, and infrastructure. The Australian government has taken several steps to encourage IT usage in healthcare to minimize mistakes and improve efficiency. In March 2013, the state of South Australia launched the "reconnect. sa" campaign, with the goal of linking all EHR systems in the state.

As part of the National E-Health Strategy, the Australian government is aggressively pushing for the electronic interchange of health information. The government set aside USD 485.1 million in the 2015-16 Federal Budget to improve eHealth governance procedures (Source: Australian Digital Health Agency). In Australia, such programs are responsible for boosting the use of EMRs and EHRs.

Market Restraints

Concerns over data privacy will act as a market restraint

Providers in mental health are most concerned about data privacy. Behavioural health practitioners are prohibited from sharing information about patients suffering from mental illness or drug misuse with anybody who is not involved in the patient's treatment. Any healthcare practitioner unrelated to the case can view the patient's data thanks to the integration of data utilizing behavioural IT solutions. In the United States, the HIPAA Journal reported 365 healthcare data breaches in 2018, up 68% from the total number of breaches documented in 2012. HIPAA-covered corporations and business partners paid roughly USD 28.7 million for HIPAA infractions in 2018, according to HIPAA Journal.

Emerging economies have financial constraints that are hampering the market for digital behavioural health market

The most difficult task for healthcare institutions, especially in emerging nations, is overcoming budgetary restraints. Nonetheless, the amount of data kept has become so significant that IT infrastructure has begun to serve as the backbone of healthcare organizations. Behavioural health software solutions are currently somewhat expensive software solutions. These systems' maintenance and software update expenses might occasionally exceed the program's purchase price. Support and maintenance services, which include software upgrades in response to changing user needs, are recurrent expenses that can account for over 30% of the total cost of ownership. This makes it difficult for behavioural health organizations to justify expenditure when they are focused on establishing EHRs and upgrading RCM systems, at least in the short term.

Digital Behavioural Health Market Report Coverage:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

29% |

|

Segments Covered |

By Components, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cerner Corporation, Core Solutions, Inc., Epic Systems Corporation, Mindlinc, Netsmart Technologies, Inc., NextGen Healthcare Information Systems LLC, Qualifacts Systems, Inc., Valant, Inc., Welligent Inc. |

This research report on the global digital behavioural health market has been segmented and sub-segmented based on components, end-user, Geography & region.

Global Digital Behavioural Health Market- By Components

- Support Services

- Software

- Integrated Software

- Standalone Software

The behavioural health software industry is divided into software and support services based on components. In 2021, the behavioural health software market is likely to be dominated by the support services segment. The constant need for support services (such as software upgrades and maintenance) is a primary driver of its expansion.

Global Digital Behavioural Health Market- By End- User

- Community Clinics

- Hospitals

- Private Practices

The behavioural health software industry has been divided into community clinics, hospitals, and private practices based on end-users. The community clinics sector is predicted to have the biggest share in 2021. Behavioural health software use in this market is projected to be driven by expanding government measures to assist these institutions and increased patient preference for community clinics.

Global Digital Behavioural Health Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

North America has the largest revenue share of the market researched and is likely to keep that position during the projection period. The adoption rate of behavioural/mental health-related software is increasing as the weight of sadness and stress due to career or personal life grows. According to Mental Health America 2020, more than 45 million individuals in the United States have a mental health problem, accounting for 18.57 per cent of the population. In addition, the number of young people experiencing major depressive episodes (MDE) climbed by 99,000 over the previous year's figures.

Furthermore, market players are constantly releasing new products and using various other growth tactics to strengthen their position in the area. TELUS Health will introduce Espri, a new mental health app, in October 2020 to target the growing mental health requirements of Canadian first responders and healthcare personnel.

Global Digital Behavioural Health Market- By Companies

- Cerner Corporation

- Core Solutions, Inc.

- Epic Systems Corporation

- Mindlinc

- Netsmart Technologies, Inc.

- NextGen Healthcare Information Systems LLC

- Qualifacts Systems, Inc.

- Valant, Inc.

- Welligent Inc.

NOTABLE HAPPENINGS IN THE GLOBAL DIGITAL BEHAVIOURAL HEALTH MARKET IN THE RECENT PAST:

- Business Expansion: - In February 2021, With the debut of its unique technology software, "Snapclarity," CloudMD Software & Services Inc., a Canadian health technology company, expanded its mental health services into the United States.

- Product Development: - In February 2021, to help behavioural health and human services providers enhance operational efficiency, Battery Ventures created a cloud-based software platform for mental health institutions and special education groups.

Chapter 1. GLOBAL DIGITAL BEHAVIOURAL HEALTH MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL DIGITAL BEHAVIOURAL HEALTH MARKET– Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. GLOBAL DIGITAL BEHAVIOURAL HEALTH MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. GLOBAL DIGITAL BEHAVIOURAL HEALTH MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.GLOBAL DIGITAL BEHAVIOURAL HEALTH MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL DIGITAL BEHAVIOURAL HEALTH MARKET– By Components

6.1. Support Services

6.2. Software

6.2.1. Integrated Software

6.2.2. Standalone Software

Chapter 7. GLOBAL DIGITAL BEHAVIOURAL HEALTH MARKET– By End Use

7.1.Community Clinics

7.2. Hospitals

7.3. Private Practices

Chapter 8. GLOBAL DIGITAL BEHAVIOURAL HEALTH MARKET– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. GLOBAL DIGITAL BEHAVIOURAL HEALTH MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Cerner Corporation

9.2. Core Solutions, Inc.

9.3. Epic Systems Corporation

9.4. Mindlinc

9.5. Netsmart Technologies, Inc.

9.6. NextGen Healthcare Information Systems LLC

9.7. Qualifacts Systems, Inc.

9.8. Valant, Inc.

9.9. Welligent Inc.

Download Sample

Choose License Type

2500

4250

5250

6900