Commercial Seaweeds Market Size (2025 – 2030)

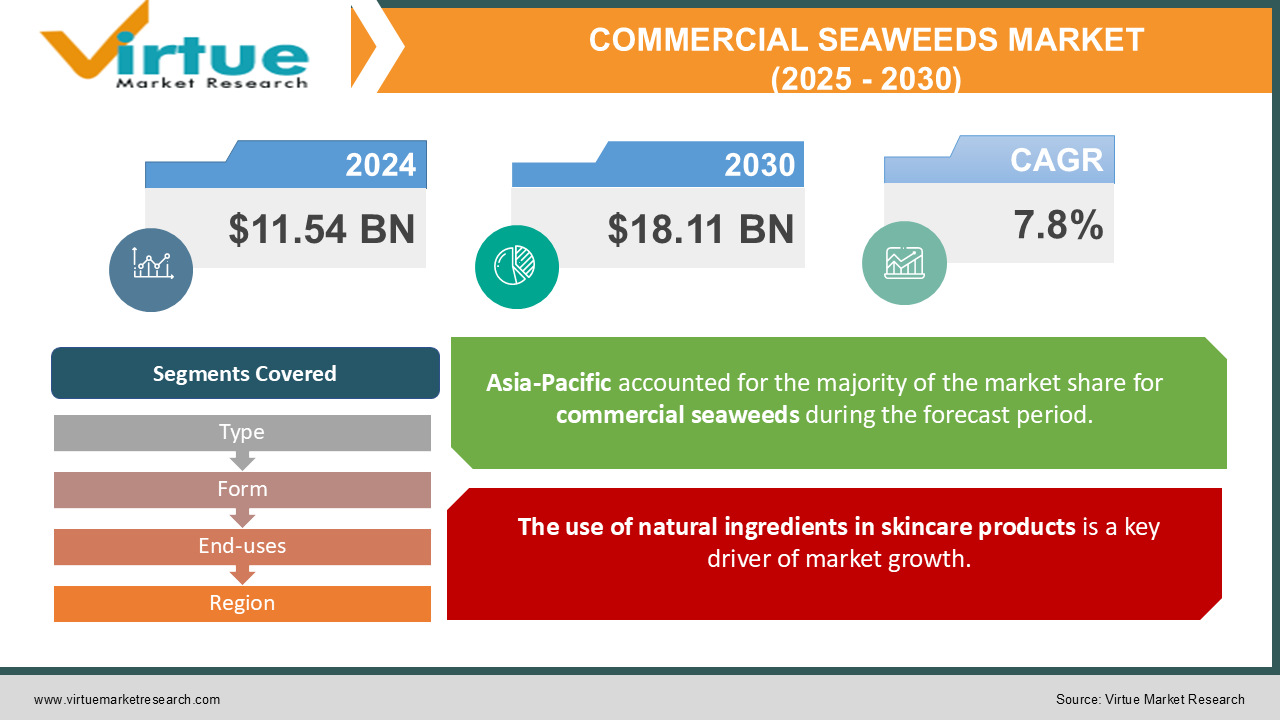

The Commercial Seaweeds Market was valued at USD 11.54 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 18.11 billion by 2030, growing at a CAGR of 7.8%.

Seaweed typically refers to marine organisms that live in the ocean and are discernible without the aid of a microscope. This term encompasses both flowering plants, such as eelgrass, that are submerged in marine environments and larger marine algae. Seaweed typically comprises various types of multicellular algae, including red, green, and brown varieties. These groups do not share a single multicellular ancestor, making them a polyphyletic group. Additionally, blue-green algae (Cyanobacteria) are sometimes included in discussions related to seaweed.

Farmers utilize seaweed extract in agriculture due to its effectiveness as a fertilizer that promotes crop growth. Advanced liquid seaweed extracts have demonstrated innovative approaches for enhancing agricultural productivity. As knowledge of seaweed’s role in agricultural practices has expanded, farmers have observed additional benefits, such as the improvement of plant root systems. Seaweed also plays a key role in boosting plants' resilience against diseases and environmental stressors, including cold and drought, while supporting the development of flowers, leaves, and fruit. Furthermore, seaweeds contribute to improving soil microbiology, water retention, and overall soil structure.

Key Market Insights:

-

Seaweed is renowned for its exceptional nutritional value and is widely incorporated into various diets.

-

It is rich in vitamins, minerals, antioxidants, and other essential nutrients, appealing to health-conscious individuals.

-

As a natural and sustainable food option, seaweed aligns with the preferences of environmentally aware consumers.

-

Cosmetic and personal care brands utilize seaweed extracts for their moisturizing properties.

-

Seaweed is also valued in skincare for its anti-aging benefits, making it a popular ingredient in beauty products.

Commercial Seaweeds Market Drivers:

The use of natural ingredients in skincare products is a key driver of market growth.

The growing demand for effective skincare products featuring natural ingredients is currently driving the expansion of the commercial seaweeds market. Seaweeds, also known as marine macroalgae, are highly valued for their rich nutrient composition, which includes essential vitamins, minerals, amino acids, antioxidants, and fatty acids. These unique bioactive compounds offer antioxidant, anti-inflammatory, and anti-aging benefits, all of which play a vital role in promoting skin health and rejuvenation. The global skincare industry is adapting to this rising consumer demand by incorporating various seaweed species into a wide array of products.

Seaweed is becoming a preferred ingredient in facial cleansers, toners, masks, serums, moisturizers, and body lotions, contributing to a positive outlook for the commercial seaweeds market. Additionally, seaweed extracts are known to protect the skin from environmental stressors like pollutants and UV radiation, which significantly contribute to premature aging. As consumers become increasingly aware of these advantages, the demand for seaweed-infused skincare products continues to grow, further fueling the expansion of the commercial seaweeds market.

Commercial Seaweeds Market Restraints and Challenges:

The high cost of seaweed cultivation is expected to hinder market growth.

In recent years, water pollution has risen substantially due to the contamination of toxic waste chemicals and plastics from industrial effluents. This has created significant challenges in harvesting algae from ocean beds, ultimately raising the final cost of algae in the market. The high cultivation costs are expected to limit market growth. Nevertheless, the rising government support for the cultivation and harvesting of macroalgae, intended to address the increasing demand in the food sector, is anticipated to help farmers and manufacturers overcome this obstacle.

Commercial Seaweeds Market Opportunities:

The growing emphasis on environmental sustainability is expected to create new opportunities in the market.

In recent years, global awareness of environmental issues has sparked the development of solutions aimed at reducing environmental stress. This growing consciousness about environmental welfare has led to significant shifts in consumer preferences, driving the demand for sustainable products. Macroalgae cultivation is recognized as a sustainable practice due to its rapid growth, nutrient-rich composition, and its ability to absorb carbon dioxide while releasing oxygen. The increasing demand for macroalgae production is also fueled by the rising popularity of veganism and plant-based products that align with animal welfare principles.

COMMERCIAL SEAWEEDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Type, Form, End-uses, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DowDuPont, Inc., J.M. Huber, Cargill, Inc. , Kerry Group Plc, Acadian Seaplants Limited, Corbion N.V., FMC Corporation, Ocean Harvest Technology limited , Gelymer S.A., Roullier Group |

Commercial Seaweeds Market Segmentation: By Type

-

Red Seaweed

-

Brown Seaweed

-

Green Seaweed

The red algae segment leads the market due to its remarkable functional properties. It is rich in proteins and vitamins, making it an excellent source of alternative proteins. Red algae is primarily utilized in the production of carrageenan, which serves as a food ingredient and has widespread applications in food processing.

Green algae, rich in beta-carotene, is acknowledged for its potential role in cancer prevention.

Brown algae is expected to see substantial growth, mainly driven by its rising consumption in Asian nations. In nations like China and Japan, it is commonly enjoyed with coconut milk, crushed ice, and jelly.

Commercial Seaweeds Market Segmentation: By Form

-

Flakes

-

Powder

-

Liquid

Seaweed powders are extensively used in both the food and cosmetics industries due to their convenience in transportation and storage. The process of converting macroalgae extracts into powder involves removing water, which helps extend its shelf life. Seaweed powder is sold in retail markets both as a cosmetic product and a dietary supplement. The growing popularity of plant-based proteins and vegan products is expected to drive the increasing demand for seaweed powders within the food sector.

Liquid commercial seaweed refers to seaweed that has been processed into a liquid form for a range of commercial uses. This liquid is typically derived from specific types of seaweed, processed, and often concentrated for ease of use, transportation, and storage. Known for its versatility and effectiveness, it is widely used in sectors such as agriculture, horticulture, cosmetics, and food and beverage (F&B). In agriculture and horticulture, liquid seaweed acts as a bio-stimulant or natural fertilizer due to its rich nutrient profile. It contains macro and micronutrients, amino acids, and plant hormones that can promote plant growth, enhance crop yields, and increase plant resistance to pests, diseases, and environmental stresses

Commercial Seaweeds Market Segmentation: By End-uses

-

Food & Beverages

-

Agricultural Fertilizers

-

Animal Feed Additives

-

Pharmaceuticals

-

Cosmetics & Personal Care

The growth of the seaweed market is largely driven by its emerging applications in food products. Stakeholders in the food and beverage industry have recognized algae biomass as a viable alternative protein source to meet global protein demands. Additionally, the increasing consumption of vegan products is expected to further boost market growth.

The functional and health benefits of edible seaweed are key factors fueling the commercial seaweed market. Seaweeds are becoming increasingly popular worldwide as a staple in diets, food flavor enhancers, and nutritious food options, while also being recognized for their weight loss benefits. Their antimicrobial properties, which assist in food preservation, have led to their use as both ingredients and standalone food items. The cosmetics and personal care segment is projected to see substantial growth, driven by the rising demand for antioxidant-rich products such as body lotions, moisturizing soaps, shampoos, and creams.

Commercial Seaweeds Market Segmentation - by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia Pacific region is the largest share of the global commercial seaweed market. The increasing use of commercial algae in traditional cuisines across countries such as China, Japan, and Vietnam has significantly boosted global demand in recent years. The increasing demand for macroalgae in the foodservice industry is further driving market expansion in the region. Additionally, the rising popularity of plant-based cosmetics and personal care products is expected to drive further market expansion in the coming years.

Seaweed farming is expanding rapidly worldwide, with Asia being the primary production hub. However, other regions are also starting to cultivate selective algae species to meet the growing global demand for products used in food, cosmetics, pharmaceuticals, and nutraceuticals. Seaweed is also applied in agriculture, animal feed, and biofuels, broadening its market reach.

North America is anticipated to experience significant growth due to the rising demand for plant-based products in the region, with the U.S. leading the market. The increasing popularity of vegan and vegetarian diets has driven the demand for plant-based proteins in a wide range of food products. Additionally, the increasing interest in functional foods and beverages has led to a higher utilization of algae in these products. Ongoing advancements in algae cultivation and harvesting technologies are anticipated to further drive market growth in the region.

In South America, the commercial seaweed market is expected to grow steadily, supported by the region’s vast geographical area, which includes various oceanic zones. However, the market holds considerable potential with advancements in farming techniques, the development of new strains, and the expansion of farming activities.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic had a notable impact on the commercial seaweed market, with production levels declining due to the closure of many manufacturing facilities within the sector. According to the United Nations Industrial Development Organization (UNIDO), seaweed farmers were directly affected by reduced demand for raw materials and falling prices. However, recent studies highlighting the potential health benefits of certain macroalgae compounds, such as their role in boosting immunity and aiding in cancer treatment, have sparked renewed global interest in seaweed. Additionally, the increasing demand for healthy foods to promote overall wellness and health is expected to drive product demand in the years ahead.

Latest Trends/ Developments:

September 2022: Cadalmin™ LivPure extract, a patented nutraceutical product developed by the ICAR-Central Marine Fisheries Research Institute (CMFRI) from seaweeds to address non-alcoholic fatty liver disease, is set to be launched soon. The product is made with 100% natural bioactive ingredients derived from carefully chosen seaweeds and is manufactured using environmentally sustainable green technology to promote liver health.

Key Players:

These are top 10 players in the Commercial Seaweeds Market :-

-

DowDuPont, Inc.

-

J.M. Huber

-

Cargill, Inc.

-

Kerry Group Plc

-

Acadian Seaplants Limited

-

Corbion N.V.

-

FMC Corporation

-

Ocean Harvest Technology limited

-

Gelymer S.A.

-

Roullier Group

Chapter 1. Commercial Seaweeds Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Commercial Seaweeds Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Commercial Seaweeds Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Commercial Seaweeds Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Commercial Seaweeds Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Commercial Seaweeds Market – By Type

6.1 Introduction/Key Findings

6.2 Red Seaweed

6.3 Brown Seaweed

6.4 Green Seaweed

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Commercial Seaweeds Market – By Form

7.1 Introduction/Key Findings

7.2 Flakes

7.3 Powder

7.4 Liquid

7.5 Y-O-Y Growth trend Analysis By Form

7.6 Absolute $ Opportunity Analysis By Form, 2025-2030

Chapter 8. Commercial Seaweeds Market – By End-uses

8.1 Introduction/Key Findings

8.2 Food & Beverages

8.3 Agricultural Fertilizers

8.4 Animal Feed Additives

8.5 Pharmaceuticals

8.6 Cosmetics & Personal Care

8.7 Y-O-Y Growth trend Analysis By End-uses

8.8 Absolute $ Opportunity Analysis By End-uses, 2025-2030

Chapter 9. Commercial Seaweeds Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Form

9.1.4 By End-uses

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Form

9.2.4 By End-uses

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Form

9.3.4 By End-uses

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Form

9.4.4 By End-uses

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Form

9.5.4 By End-uses

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Commercial Seaweeds Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 DowDuPont, Inc.

10.2 J.M. Huber

10.3 Cargill, Inc.

10.4 Kerry Group Plc

10.5 Acadian Seaplants Limited

10.6 Corbion N.V.

10.7 FMC Corporation

10.8 Ocean Harvest Technology limited

10.9 Gelymer S.A.

10.10 Roullier Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Seaweed is highly regarded for its nutritional value, making it a popular addition to various diets. Its rich content of vitamins, minerals, antioxidants, and other essential nutrients has made it a favored choice among health-conscious individuals seeking natural and sustainable food options.

The top players operating in the Commercial Seaweeds Market are - DowDuPont, Inc., J.M. Huber, Cargill, Inc., Acadian Seaplants Limited, and Kerry Group Plc.

The COVID-19 pandemic had a notable impact on the commercial seaweed market, with production levels declining due to the closure of many manufacturing facilities within the sector.

There are various potential future trends and opportunities for the Commercial Seaweeds Market.