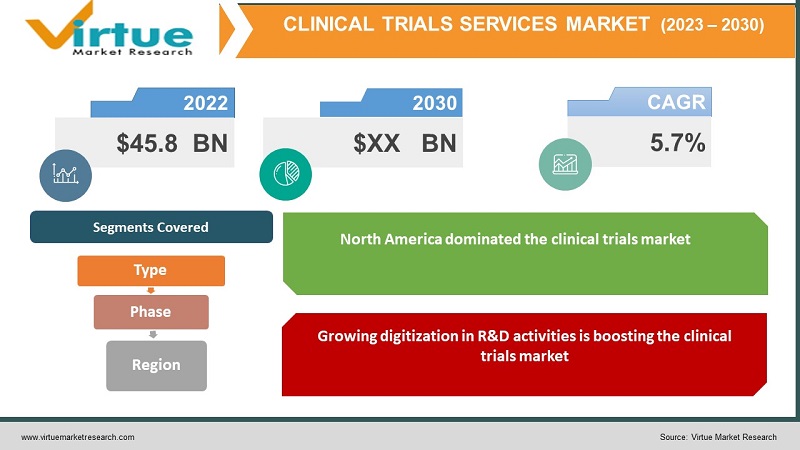

Clinical Trials Services Market Size (2023-2030)

The global clinical trials market is predicted to increase at a compound annual growth rate (CAGR) of 5.7% from 2022 to 2030, with a market value of $45.8 billion in 2022. The COVID-19 pandemic, on the other hand, slowed market growth in 2020. A rising number of chronic diseases, rising demand for biologics, rising need for personalized medicines and orphan medications, expanding pharmaceutical R&D investments, and technological advancements are all contributing to the market’s growth. The COVID 19 pandemic has poised to a significant increase in the number of clinical trials conducted around the world, which has aided the market's growth.

Industry Overview:

Clinical trials are human research studies that are used to assess a medicinal, surgical, or behavioral intervention. They're the steps for scientists to see if a new treatment, such as a new pharmaceutical, a new diet, or medical equipment (like a pacemaker), is safe and effective in humans enabling them to get approval from regulatory bodies as well. A clinical trial is frequently performed to determine whether a new treatment is more successful than the current treatment and/or has fewer negative side effects.

Clinical trials are also used to try to find novel techniques for diagnosing diseases early on before symptoms occur. Clinical trials are also used to see whether there are any ways to avoid disease. Clinical trials may also be used to evaluate the efficacy of procedures aimed at improving the physical state of people who are afflicted with a life-threatening disease or a chronic health condition.

COVID-19 Impact on Clinical Trials Services Market

The fast-evolving threat posed by COVID-19 is having an impact on people's lives, communities, enterprises, and industries all around the world. During the first half of 2020, the pandemic had a negative impact on the clinical trial ecosystem. It had an impact on a number of ongoing clinical trials in a variety of therapeutic areas. To combat this, researchers produced novel COVID-19 treatments and vaccines, which have aided the market's recovery and expansion. With the mounting burden of the COVID-19 pandemic, several organizations have moved their focus to the development of new COVID-19 treatments with the help of government and non-government organizations. As a result of the rising incidence of COVID-19 infections, more money is being invested in research and development, resulting in a larger market for clinical studies.

Market Drivers:

Growing digitization in R&D activities is boosting the clinical trials market:

Continuous research to assure better treatment processes for the patient's well-being is a vital driver driving the global clinical trials market forward. This market will see increased growth prospects as pharmaceutical and biopharmaceutical businesses grow in size. The demand for this industry is being boosted by increased patient flow in hospitals and clinics. Virtual clinical trials, which allow for the fast and safe collection of data from participants without the need to visit a lab or hospital, are also a major growth driver for the worldwide clinical trials market.

Development of vaccines and medicines for new lethal diseases supporting the growth of clinical trials market:

The COVID 19 pandemic has resulted in a considerable increase in the number of clinical trials conducted around the world, which has aided the market's growth. The rising prevalence of neurological illnesses including Parkinson's, Alzheimer's, and depression, as well as the aging population the report states that, in addition to trial digitalization, the rising incidence of chronic diseases and growing demand for customized pharmaceutical trials which in turn is ought to boost the market. Chronic diseases will account for over three-quarters of all fatalities worldwide by 2020, with developing countries accounting for 71% of deaths due to ischaemic heart disease (IHD), 75% of deaths due to stroke, and 70% of deaths due to diabetes. The demand for new treatments and trials is estimated to grow as the number of ailments increases.

Market Restrains:

Strict government rules and regulations hindering market growth:

Strict regulations in various countries, which result in complicated clinical trial protocols, will continue to limit market growth till 2027. The key challenges will continue to be lengthy approvals and stringent patient recruitment and enrolment. Obtaining approvals by the Institutional Review Board (IRB), contract and budget negotiation and approval, availability of an appropriate patient population, protocol design, and legal review is all be stumbling blocks to market growth.

Market Insights and Developments:

- WHO has initiated the world's largest clinical trials to aid in the development of a strong vaccination to combat COVID-19's effects. Approximately 12000 individuals have been enrolled in 500 hospital settings across 30 countries.

- Nykode Therapeutics has dosed the first unvaccinated individual in its Phase I/II VB-D-01 clinical trial of its T cell-specific Covid-19 vaccine candidate.

CLINICAL TRIALS SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.7% |

|

Segments Covered |

By Type, Phase, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Clinipace, Laboratory Corporation of America, ICON PLC, Eli Lilly and Company, Novo Nordisk AS, Syneos Health, Pfizer, PAREXEL International Corporation, Bio-Optronics, Inc., Forte Research Systems |

Market Segment:

The global Clinical Trials Services market has been segmented based on the type, and phases.

Clinical Trials Services Market - By Type

- Pilot studies and feasibility studies

-

- Prevention trials

- Screening trials

- Treatment trials

-

- Multi-arm multi-stage

-

- Cohort studies

- Case-control studies

- Cross-sectional studies

-

Clinical Trials Services Market - By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

Phase III clinical studies are used to compare the effects of a new treatment to those of previously available medications, or to validate and expand on the safety and effectiveness findings from Phase I and II trials. Because of their increasing complexity and requirement for a bigger patient pool, these clinical studies continue to have a higher demand for outsourcing services than Phase II and Phase I trials.

Phase III is predicted to dominate the industry, with Phase I is estimated to increase at the fastest rate. Phase III is one of the most important stages in determining whether or not a new intervention is effective and useful in clinical practice. In 2021, phase III clinical trials dominated the market with a 54.3 % share. This is due to the high level of complexity connected with this phase.

Clinical Trials Services Market- By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

In 2021, North America dominated the clinical trials market, accounting for XX% of total revenue. Over the predicted period, the region is estimated to maintain its dominance. This can be linked to the region's increased R&D and adoption of new clinical research technology. Market key players such as IQVIA and PRA Health Sciences, for example, are to boost market growth by incorporating virtual services into clinical trial protocols.

The clinical trial market in the Asia Pacific is estimated to grow at a high CAGR of XX percent over the projected period, owing to the growing availability of a large patient pool that makes candidate recruiting easier. India, China, South Korea, and Singapore are the leading countries in this market. This region has such a large and diversified population with diseases that exist in both developed and developing countries is one of the main reasons for its great potential. As a result, multiple types of studies can be carried out in these areas. Due to the vast population, it facilitates faster patient recruitment and improved retention of trial participants, allowing organizations to complete trials on schedule.

In the European region, Germany has the most clinical trials, with XX studies recorded in Western Europe in 2020, while Poland has the most clinical trials in Eastern Europe, with XX trials published in 2020. The European countries will also see significant growth, with a CAGR of XX% projected. Some countries in Central and Eastern Europe will have a plethora of clinical trial development prospects.

Single country studies accounted for 85.2 % of all clinical trials in the Middle East and Africa in 2020, compared to a ten-year average of 80.0 %. In 2020, multinational trials accounted for 14.8 % of all trials, compared to an average of 20.0 % during the previous ten years. Infectious Disease was the most common therapy area for industry-sponsored clinical trials in the Middle East and Africa in 2020, accounting for XX% of all trials, up from XX% on average over the previous ten years. Phase III studies accounted for 51.5 percent of industry-sponsored clinical trials in the Middle East and Africa in 2020, up from 51.2 percent 10 years before. Phase II trials came in second in 2020, with a 28.2 percent share, down from a ten-year average of 30.2 percent. Phase I trials were in third place in 2020, with a 12.4 percent stake, up from 7.5 percent ten years before. In 2020, phase IV trials had a 7.9% market share, down 3.2 percent from the ten-year average of 11.1 percent.

Key players in the Market

- Clinipace,

- Laboratory Corporation of America,

- ICON PLC,

- Eli Lilly and Company,

- Novo Nordisk AS

- Syneos Health

- Pfizer

- PAREXEL International Corporation

- Bio-Optronics, Inc.

- Forte Research Systems

Chapter 1. CLINICAL TRIALS SERVICES MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. CLINICAL TRIALS SERVICES MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. CLINICAL TRIALS SERVICES MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. CLINICAL TRIALS SERVICES MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. CLINICAL TRIALS SERVICES MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. CLINICAL TRIALS SERVICES MARKET – By Type

6.1 Pilot studies and feasibility studies

6.1.1. Prevention trials

6.1.2. Screening trials

6.1.3. Treatment trials

6.2. Multi-arm multi-stage

6.2.1. Cohort studies

6.2.2. Case-control studies

6.2.3. Cross-sectional studies

Chapter 7. CLINICAL TRIALS SERVICES MARKET– By Phase

7.1 Phase I

7.2. Phase II

7.3. Phase III

7.4. Phase IV

Chapter 8. CLINICAL TRIALS SERVICES MARKET – By Region

8.1. North America

8.2. Europe

8.3.The Asia Pacific

8.4.Latin America

8.5. Middle-East and Africa

Chapter 9. CLINICAL TRIALS SERVICES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Clinipace,

9.2. Laboratory Corporation of America,

9.3. ICON PLC,

9.4. Eli Lilly and Company,

9.5. Novo Nordisk AS

9.6. Syneos Health

9.7. Pfizer

9.8. PAREXEL International Corporation

9.9. Bio-Optronics, Inc.

9.10. Forte Research Systems

Download Sample

Choose License Type

2500

4250

5250

6900