Catheter Market Size (2025 – 2030)

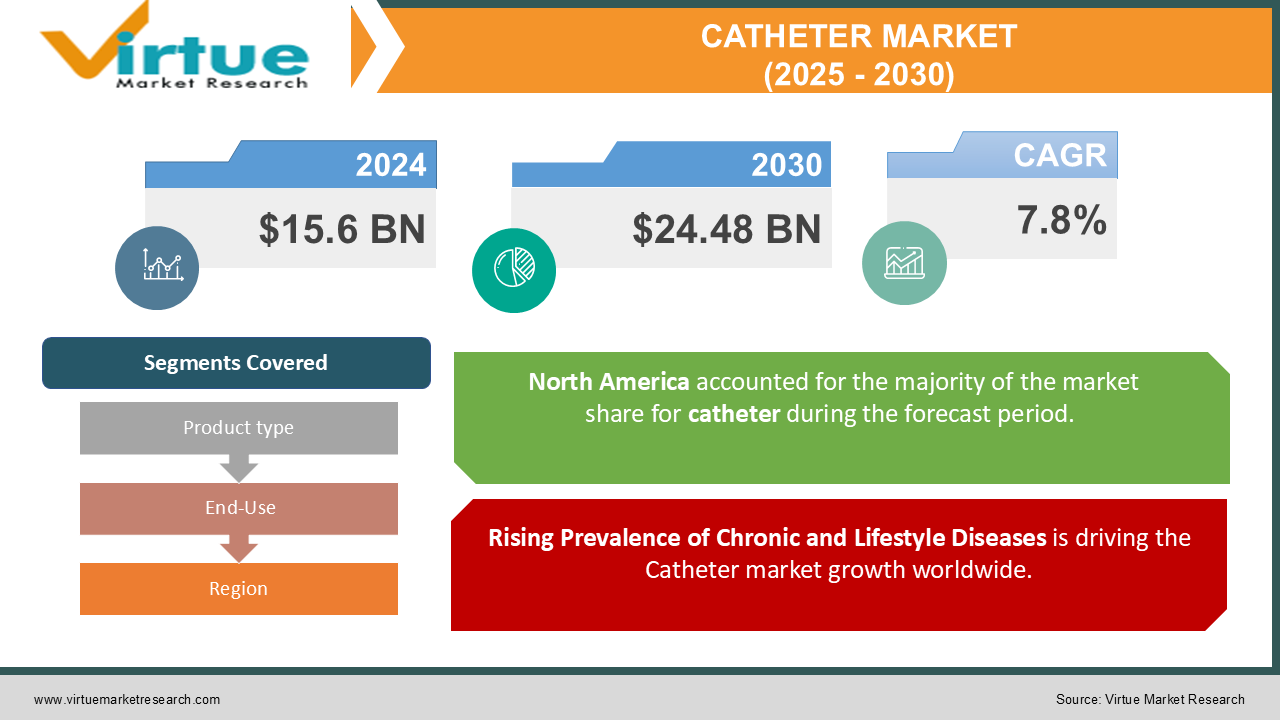

The Global Catheter Market was valued at USD 15.6 billion in 2024 and is projected to reach USD 24.48 billion by 2030, growing at a CAGR of 7.8% during the forecast period (2025–2030).

Catheters are flexible tubes used for various medical applications, including cardiovascular, urinary, and neurological procedures. They are essential in diagnosing and treating numerous health conditions, driving consistent demand across healthcare facilities.

The rising prevalence of chronic diseases such as cardiovascular disorders, diabetes, and urinary incontinence, coupled with an aging population, is significantly contributing to market growth. Additionally, advancements in catheter technologies, such as antimicrobial coatings and drug-delivery capabilities, are enhancing safety and efficiency, further fueling adoption.

Key Market Insights

-

The cardiovascular catheters segment dominated the market in 2024, accounting for 35% of the total revenue, driven by the rising incidence of heart-related disorders.

-

Urinary catheters held the second-largest share, owing to their widespread use in urology and bladder management.

-

Hospitals represented the largest end-use segment, contributing to over 50% of total revenue in 2024, due to the high volume of surgical procedures.

-

North America was the largest regional market, holding a 40% market share, supported by advanced healthcare infrastructure and a high prevalence of chronic diseases.

-

The market for antimicrobial and coated catheters is growing rapidly, driven by efforts to reduce catheter-associated infections (CAIs). Technological innovations, including bio-absorbable and sensor-enabled catheters, are creating new growth opportunities.

-

Emerging economies in Asia-Pacific are projected to exhibit the fastest growth, with a CAGR of 9.5%, due to rising healthcare expenditure and increasing awareness.

Global Catheter Market Drivers

Rising Prevalence of Chronic and Lifestyle Diseases is driving the Catheter market growth worldwide.

The increasing burden of chronic diseases, particularly cardiovascular diseases, diabetes, and kidney disorders, is a significant driver of the catheter market. For instance, according to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death globally, accounting for 17.9 million deaths annually.

Catheters are essential in managing these conditions, from diagnostic procedures like angiography to therapeutic interventions such as percutaneous coronary interventions (PCI). Similarly, the growing prevalence of urinary incontinence and bladder dysfunction among the elderly has led to increased use of urinary catheters in long-term care facilities.

Advancements in Catheter Technology is driving the global market growth

Technological innovations in catheter design and materials are improving patient outcomes and driving market growth. The development of catheters with antimicrobial coatings and drug-eluting properties is reducing the risk of catheter-associated infections (CAIs), a significant concern in clinical settings.

Additionally, bio-absorbable and steerable catheters are gaining traction for their ability to provide precise navigation in complex procedures. Smart catheters equipped with sensors and data-transmitting capabilities are emerging as valuable tools in monitoring and personalized medicine.

Aging Population and Rising Surgical Procedures is driving the catheter market growth

The aging global population is driving demand for catheters, as older adults are more susceptible to chronic conditions requiring catheterization. According to the United Nations, the population aged 65 and above is expected to reach 1.5 billion by 2050, representing a substantial patient pool.

Simultaneously, the increasing volume of minimally invasive and surgical procedures is bolstering demand. Catheters are indispensable in many surgeries, including cardiovascular interventions, urinary tract surgeries, and diagnostic imaging.

Global Catheter Market Challenges and Restraints

Risk of Catheter-Associated Infections (CAIs) is restricting the market growth

Catheter-associated infections, such as urinary tract infections (CAUTIs) and bloodstream infections (CLABSIs), are significant challenges in the market. These infections not only compromise patient safety but also lead to increased healthcare costs and longer hospital stays.

Despite advancements in antimicrobial coatings, compliance with proper catheter usage and maintenance protocols remains inconsistent across healthcare settings. Regulatory scrutiny and the need for rigorous testing to meet safety standards can also hinder the adoption of new products.

High Cost of Advanced Catheters is restricting the market growth

The high cost of advanced catheters, such as drug-eluting and sensor-enabled catheters, limits their adoption in low- and middle-income countries. Many healthcare providers in resource-constrained settings rely on traditional, less expensive catheters, which may lack the benefits of newer technologies.

Additionally, the cost associated with research, development, and regulatory approvals for innovative catheter designs poses a barrier for smaller manufacturers, restricting market competition.

Market Opportunities

The Global Catheter Market offers significant growth opportunities driven by increasing investments in healthcare infrastructure and the growing adoption of minimally invasive procedures. Emerging economies, particularly in Asia-Pacific and Latin America, are witnessing rapid healthcare advancements, creating lucrative markets for catheter manufacturers.

Government initiatives to improve access to quality healthcare, coupled with rising awareness of advanced medical technologies, are expected to drive demand in these regions. For instance, India and China are investing heavily in healthcare infrastructure, fostering the adoption of catheters for diagnostic and therapeutic purposes.

The rise of home healthcare services represents another growth avenue. The growing preference for home-based catheterization, particularly for urinary and intravenous applications, is boosting demand for portable and user-friendly catheter designs.

Advances in materials science are paving the way for innovative catheters with enhanced biocompatibility, flexibility, and functionality. The integration of smart technologies, such as sensors and wireless connectivity, is set to revolutionize the catheter market by enabling real-time monitoring and improved patient outcomes.

CATHETER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Product type, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, B. Braun Melsungen AG, Teleflex Incorporated, Coloplast Group, Convatec Group plc, Smiths Medical, Cook Medical, Edwards Lifesciences Corporation |

Catheter Market Segmentation - By Product Type

-

Cardiovascular Catheters

-

Urinary Catheters

-

Intravenous Catheters

-

Specialty Catheters

-

Neurovascular Catheters

The cardiovascular catheters segment held the leading position in the medical devices market, capturing a substantial revenue share in 2024. This significant market dominance is primarily driven by the escalating prevalence of cardiovascular diseases, such as coronary artery disease, heart failure, and arrhythmias, which have become major health concerns globally. The increasing reliance on minimally invasive interventional cardiology procedures, including angioplasty, stenting, and valvuloplasty, has further fueled the demand for a wide range of cardiovascular catheters. These procedures offer less invasive alternatives to traditional open-heart surgeries, resulting in faster recovery times and improved patient outcomes. This combination of factors has solidified the cardiovascular catheters segment as the dominant force in the medical devices market.

Catheter Market Segmentation - By End-Use

-

Hospitals

-

Ambulatory Surgical Centers

-

Diagnostic Centers

-

Others

Hospitals dominated the medical devices market in 2024, holding a significant revenue share. This dominance is primarily attributed to the high volume of surgical and diagnostic procedures conducted within these settings. Hospitals serve as the primary centers for complex medical interventions, requiring a wide range of medical devices, including surgical instruments, implantable devices, diagnostic imaging equipment, and life support systems. The concentration of patient care within hospitals creates a substantial demand for these devices, driving the significant market share held by this segment.

Catheter Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America holds the largest market share of 40%, supported by advanced healthcare infrastructure, high healthcare expenditure, and a well-established reimbursement framework. The U.S. leads the regional market, driven by the high prevalence of chronic diseases and the growing adoption of advanced catheter technologies. Canada contributes to regional growth through its focus on improving healthcare access and outcomes.

COVID-19 Impact Analysis

The COVID-19 pandemic had a mixed impact on the global catheter market. While the demand for urinary and intravenous catheters increased due to the surge in hospitalizations, elective procedures such as cardiovascular interventions and diagnostics were deferred, temporarily affecting market growth. Post-pandemic, the market is experiencing a strong recovery as healthcare systems resume elective procedures and prioritize infection control. The pandemic has also underscored the importance of robust healthcare infrastructure, driving investments in advanced medical technologies, including catheters.

Latest Trends/Developments

Several key trends are shaping the future of the catheter market. To address the critical issue of catheter-associated infections, manufacturers are developing innovative catheters with advanced antimicrobial coatings, significantly reducing the risk of infection. The increasing adoption of minimally invasive surgical techniques is driving demand for steerable and bio-absorbable catheters, offering patients faster recovery times and reduced complications. The emergence of smart catheters equipped with sensors and wireless connectivity is revolutionizing patient care, enabling real-time monitoring, data transmission, and improved clinical decision-making. Rising healthcare investments in emerging markets like Asia-Pacific and Latin America are creating new growth opportunities for catheter manufacturers. Finally, sustainability initiatives are gaining traction, with manufacturers focusing on eco-friendly catheter designs and materials to minimize environmental impact and promote responsible healthcare practices. These trends are collectively driving innovation and transforming the catheter market, leading to safer, more effective, and patient-centric solutions.

Key Players

-

Medtronic plc

-

Boston Scientific Corporation

-

Abbott Laboratories

-

B. Braun Melsungen AG

-

Teleflex Incorporated

-

Coloplast Group

-

Convatec Group plc

-

Smiths Medical

-

Cook Medical

-

Edwards Lifesciences Corporation

Chapter 1. Catheter Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Catheter Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Catheter Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Catheter Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Catheter Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Catheter Market – By Product

6.1 Introduction/Key Findings

6.2 Cardiovascular Catheters

6.3 Urinary Catheters

6.4 Intravenous Catheters

6.5 Specialty Catheters

6.6 Neurovascular Catheters

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Catheter Market – By End-Use

7.1 Introduction/Key Findings

7.2 Hospitals

7.3 Ambulatory Surgical Centers

7.4 Diagnostic Centers

7.5 Others

7.6 Y-O-Y Growth trend Analysis By End-Use

7.7 Absolute $ Opportunity Analysis By End-Use, 2025-2030

Chapter 8. Catheter Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By End-Use

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By End-Use

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By End-Use

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By End-Use

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By End-Use

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Catheter Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Medtronic plc

9.2 Boston Scientific Corporation

9.3 Abbott Laboratories

9.4 B. Braun Melsungen AG

9.5 Teleflex Incorporated

9.6 Coloplast Group

9.7 Convatec Group plc

9.8 Smiths Medical

9.9 Cook Medical

9.10 Edwards Lifesciences Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 15.6 billion in 2024 and is projected to reach USD 24.48 billion by 2030, growing at a CAGR of 7.8%.

Key drivers include the rising prevalence of chronic diseases, technological advancements in catheter design, and an aging global population.

Segments include Product Type (Cardiovascular Catheters, Urinary Catheters, Intravenous Catheters, Specialty Catheters) and End-Use (Hospitals, Ambulatory Surgical Centers, Diagnostic Centers).

North America dominates the market with a 40% share, supported by advanced healthcare systems and high healthcare expenditure.

Major players include Medtronic, Boston Scientific, Abbott Laboratories, B. Braun, and Teleflex.