Big Data Security Market Size (2025 – 2030)

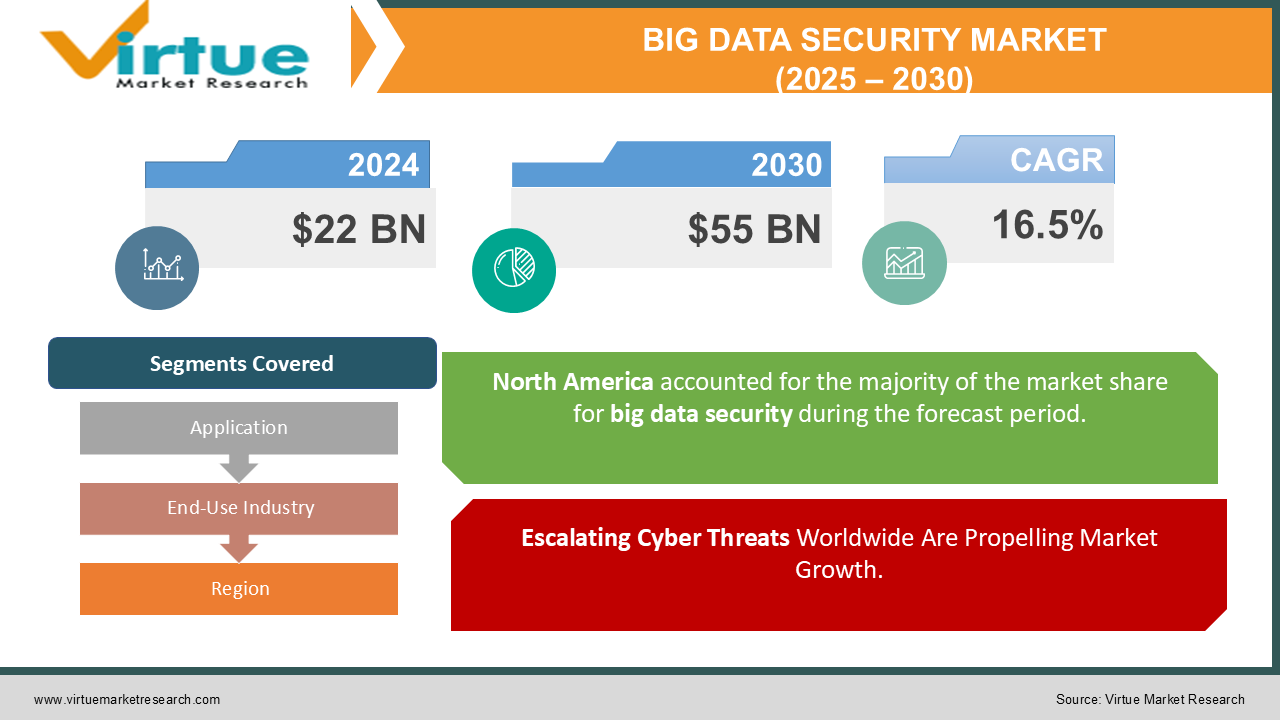

The Global Big Data Security Market was valued at USD 22 billion in 2024 and is projected to grow at a CAGR of 16.5% from 2025 to 2030. The market is estimated to reach USD 55 billion by 2030.

The Big Data Security Market focuses on solutions and services designed to secure vast volumes of data generated by businesses and institutions. This includes encryption, network security, endpoint security, and real-time threat detection. With increasing adoption of digital transformation and big data analytics, protecting sensitive data is becoming a critical requirement, driving the growth of this market.

Key Market Insights

-

In 2024, over 2.5 quintillion bytes of data are generated daily, creating a massive demand for robust data security solutions.

-

The frequency and severity of cyberattacks, with damages costing $6 trillion annually in 2024, are pushing organizations to invest heavily in big data security.

-

Over 60% of enterprises use cloud platforms for data storage, necessitating advanced cloud security measures.

-

Real-time threat detection systems incorporating AI are becoming industry standards, reducing detection time by 75%.

-

BFSI and healthcare are the top adopters of big data security, collectively contributing over 40% of market revenue.

-

The region is experiencing rapid adoption, with a projected CAGR of 20%, due to expanding digital infrastructure and increasing cyber threats.

Global Big Data Security Market Drivers

Escalating Cyber Threats Worldwide Are Propelling Market Growth.

The proliferation of cyberattacks has become a pressing concern for organizations globally. In 2024, the number of data breaches increased by 23% compared to 2023, emphasizing the critical need for robust security frameworks. Cybercriminals are leveraging advanced techniques like ransomware, phishing, and zero-day exploits to target sensitive business and consumer data. Organizations are now prioritizing investments in big data security to prevent potential reputational and financial damages. Real-time analytics, combined with AI-based threat intelligence, plays a significant role in identifying vulnerabilities before exploitation occurs. Furthermore, industries such as BFSI, healthcare, and government have become prime targets due to the sensitive nature of their data, driving these sectors to adopt stringent data protection measures.

Digital Transformation and IoT Expansion is driving market growth:

The global shift towards digital transformation is generating unprecedented data volumes. Technologies such as the Internet of Things (IoT) are contributing significantly to this data surge, with over 30 billion connected devices expected by 2025. These devices often operate with minimal security protocols, making them vulnerable entry points for cyberattacks. Organizations are increasingly adopting end-to-end big data security solutions to secure IoT ecosystems. The integration of blockchain for tamper-proof data storage and AI-driven anomaly detection systems is further propelling market growth. The increasing reliance on edge computing also underscores the need for secure data flow between devices and central systems.

Compliance with Data Protection Regulations is driving market growth:

Data protection laws worldwide are becoming more stringent, with frameworks like GDPR in the EU and CCPA in the U.S. imposing significant penalties for non-compliance. These regulations mandate organizations to safeguard customer data and report breaches promptly. In 2024, penalties under GDPR alone amounted to $1.4 billion, underscoring the importance of compliance. This has driven companies to adopt advanced encryption, access controls, and monitoring tools to meet regulatory requirements. The adoption of secure data governance strategies is not just a legal obligation but also a means to build consumer trust and brand loyalty, particularly in sectors handling highly sensitive data, such as healthcare and banking.

Global Big Data Security Market Challenges and Restraints

High Implementation Costs is restricting market growth:

The deployment of big data security solutions is capital-intensive, often requiring substantial investments in hardware, software, and skilled personnel. Many small and medium-sized enterprises (SMEs) find it challenging to allocate budgets for comprehensive security systems, particularly as cybersecurity spending is competing with other operational priorities. Additionally, integrating big data security with existing IT infrastructure can lead to operational disruptions and higher costs. Cloud-based security solutions offer a cost-effective alternative, but concerns over data sovereignty and shared security responsibilities with providers remain hurdles. As a result, organizations often resort to partial implementations, leaving gaps in their defense strategies.

Complexity of Securing Diverse Data Ecosystems is restricting market growth:

Modern organizations operate in complex data environments involving multiple data sources, platforms, and formats. Securing these ecosystems presents a significant challenge, as traditional security solutions often fail to provide holistic protection. The rise of hybrid and multi-cloud environments further complicates this landscape. Cybersecurity professionals must address issues such as misconfigurations, lack of visibility, and inconsistent security protocols across platforms. Moreover, insider threats, whether intentional or accidental, pose a unique challenge, accounting for 34% of breaches in 2024. These factors necessitate continuous monitoring, real-time threat detection, and coordinated response mechanisms, which can be resource-intensive to manage.

Market Opportunities

The Big Data Security Market is poised for growth, fueled by the convergence of advanced technologies and evolving cybersecurity threats. Cloud adoption, for instance, is at an all-time high, with 90% of organizations using some form of cloud infrastructure. This shift offers opportunities for vendors to provide tailored cloud security solutions, addressing unique challenges like data residency and real-time access monitoring. Similarly, the adoption of AI and machine learning in threat detection is revolutionizing the market, reducing detection time and improving response accuracy. Industries such as retail and e-commerce present untapped opportunities, as they transition to big data analytics for customer insights, necessitating robust data security. Emerging markets in Asia-Pacific and Latin America are also ripe for expansion, driven by digital infrastructure development and increasing cyberattacks. Vendors focusing on managed security services are set to benefit, as many organizations prefer outsourcing complex security tasks. Furthermore, partnerships between cybersecurity firms and government bodies to protect critical infrastructure will create new avenues for growth.

BIG DATA SECURITY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

16.5% |

|

Segments Covered |

By Application, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IBM Corporation, Symantec (NortonLifeLock), McAfee, Palo Alto Networks, Check Point Software Technologies, Splunk Inc., Rapid7, Cisco Systems, Microsoft Corporation, Fortinet |

Big Data Security Market Segmentation - By Application

-

Encryption

-

Network Security

-

Identity and Access Management

-

Endpoint Security

-

Real-time Threat Detection

Network Security dominates the market, accounting for over 35% of revenue in 2024. This is due to its critical role in protecting data transmission and communication across enterprise networks, a key focus area given the rise of remote work and cloud-based operations.

Big Data Security Market Segmentation - By End-Use Industry

-

BFSI

-

Healthcare

-

IT and Telecom

-

Government

-

Retail and E-commerce

The BFSI sector is the leading segment, contributing 38% of market revenue in 2024. This dominance stems from stringent regulatory requirements and the high volume of sensitive financial data generated, necessitating advanced security measures.

Big Data Security Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America leads the Big Data Security Market, holding a 40% share in 2024. The region’s dominance is attributed to the presence of major tech companies, high adoption of big data analytics, and stringent data protection regulations like CCPA. The U.S., in particular, has a robust cybersecurity ecosystem, driven by continuous innovation and significant government investments in securing critical infrastructure.

COVID-19 Impact Analysis on the Big Data Security Market

The COVID-19 pandemic significantly impacted the Big Data Security Market, accelerating its growth and reshaping the cybersecurity landscape. As businesses transitioned to remote work, the volume of data transmitted through unsecured home networks increased dramatically, exposing critical vulnerabilities in existing cybersecurity infrastructures. During this period, organizations saw a sharp rise in cyberattacks, including a staggering 400% increase in phishing and ransomware incidents. This surge in attacks highlighted the urgent need for enhanced big data security solutions to safeguard sensitive information. The healthcare sector, in particular, faced unprecedented challenges as telemedicine became more widely adopted. The rapid shift to digital healthcare services amplified the need for secure patient data management and protection against cyber threats. As healthcare providers handled vast amounts of personal and medical data remotely, the demand for robust security solutions grew rapidly. Cloud-based security solutions also experienced heightened demand, as many organizations migrated their operations to digital platforms and cloud environments. With businesses adopting digital-first strategies, the need for scalable, flexible, and secure cloud infrastructures became critical to ensuring data integrity and compliance. The pandemic further emphasized the importance of real-time threat detection and rapid response capabilities. AI and machine learning technologies began to play pivotal roles in monitoring, identifying, and mitigating potential threats faster than traditional methods. These advanced technologies enabled businesses to adopt more proactive cybersecurity measures, moving from reactive defense mechanisms to predictive and automated responses. As a result, the COVID-19 pandemic has permanently altered the way organizations approach big data security. The need for comprehensive, advanced security frameworks has become a top priority across industries, with a focus on proactive measures, real-time monitoring, and secure digital transformation.

Latest Trends/Developments

The Big Data Security Market is undergoing significant transformations, driven by the adoption of innovative technologies and evolving security needs. One of the key developments is the integration of artificial intelligence (AI) and machine learning into cybersecurity systems. These technologies enable predictive threat detection, allowing organizations to identify potential threats before they escalate and significantly reducing response times to security incidents. Blockchain technology is also gaining momentum for its ability to provide secure data storage and create tamper-proof audit trails. This decentralized approach ensures data integrity, making it increasingly attractive for industries dealing with sensitive information, such as finance and healthcare. Similarly, the rise of zero-trust architecture is reshaping security strategies. By enforcing strict identity verification for every access request, zero-trust architecture ensures that only authorized users and devices can access critical systems, regardless of their location or network. As remote work continues to grow, organizations are investing more in endpoint security solutions to protect devices that access corporate networks. This trend is vital as remote work introduces new security challenges, particularly with personal devices accessing sensitive data. Additionally, managed security services are becoming increasingly popular. Businesses, particularly smaller ones, are opting for these outsourced solutions to effectively manage complex cybersecurity needs while minimizing costs. Finally, partnerships between cybersecurity firms and governments are becoming essential, particularly in securing critical infrastructure sectors like healthcare and energy. These collaborations aim to strengthen national and industry-specific security frameworks, addressing the growing cyber threats faced by these vital sectors. Collectively, these trends are reshaping the Big Data Security Market and driving the development of more advanced, efficient, and cost-effective security solutions.

Key Players

-

IBM Corporation

-

Symantec (NortonLifeLock)

-

McAfee

-

Palo Alto Networks

-

Check Point Software Technologies

-

Splunk Inc.

-

Rapid7

-

Cisco Systems

-

Microsoft Corporation

-

Fortinet

Chapter 1. Big Data Security Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Big Data Security Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Big Data Security Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Big Data Security Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Big Data Security Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Big Data Security Market – By End-Use Industry

6.1 Introduction/Key Findings

6.2 BFSI

6.3 Healthcare

6.4 IT and Telecom

6.5 Government

6.6 Retail and E-commerce

6.7 Y-O-Y Growth trend Analysis By End-Use Industry

6.8 Absolute $ Opportunity Analysis By End-Use Industry, 2025-2030

Chapter 7. Big Data Security Market – By Application

7.1 Introduction/Key Findings

7.2 Encryption

7.3 Network Security

7.4 Identity and Access Management

7.5 Endpoint Security

7.6 Real-time Threat Detection

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Big Data Security Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-Use Industry

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-Use Industry

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-Use Industry

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-Use Industry

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-Use Industry

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Big Data Security Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 IBM Corporation

9.2 Symantec (NortonLifeLock)

9.3 McAfee

9.4 Palo Alto Networks

9.5 Check Point Software Technologies

9.6 Splunk Inc.

9.7 Rapid7

9.8 Cisco Systems

9.9 Microsoft Corporation

9.10 Fortinet

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Big Data Security Market was valued at USD 22 billion in 2024 and is projected to grow at a CAGR of 16.5% from 2025 to 2030. The market is estimated to reach USD 55 billion by 2030.

Key drivers include escalating cyber threats, digital transformation, IoT expansion, and the need to comply with stringent data protection regulations.

The market is segmented by application (encryption, network security, identity and access management, etc.) and by end-use industry (BFSI, healthcare, IT and telecom, etc.).

North America is the dominant region, driven by advanced cybersecurity ecosystems and stringent regulatory frameworks.

Leading players include IBM Corporation, Symantec, McAfee, Palo Alto Networks, and Cisco Systems.