Bambara Beans Market Size (2024 – 2030)

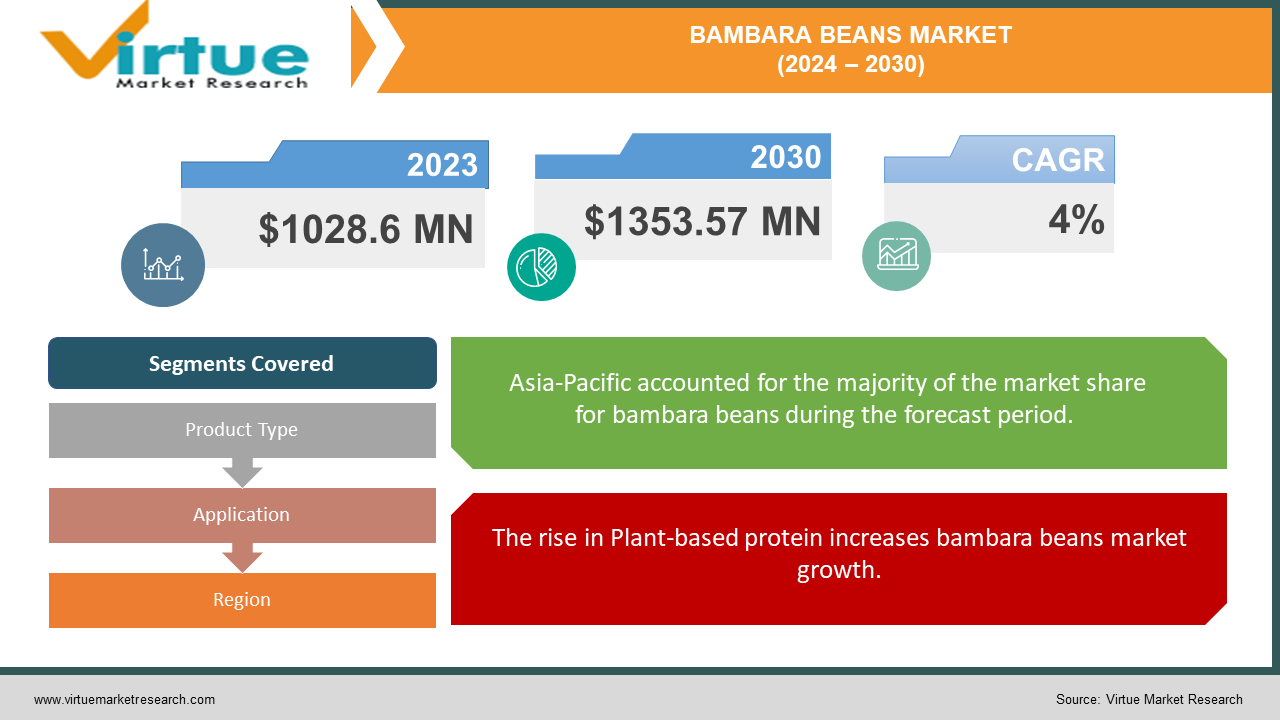

The Bambara Beans Market was valued at USD 1028.6 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1353.57 million by 2030, growing at a CAGR of 4%.

Bambara beans represent a variety of small, hard, spherical seeds akin to chickpeas, which mature beneath the soil similar to peanuts. Their hues encompass a spectrum ranging from black, red, and dark brown to white, cream, or a blend thereof. Renowned for their distinctive nutty and earthy taste, Bambara beans evoke a flavor profile reminiscent of a fusion between chickpeas and pinto beans.

Key Market Insights:

Bambara Bean stands as a comprehensive food source, boasting an average protein content of 19% and 6.5% fat, thereby serving as a significant contributor to dietary protein intake. Thriving in regions where it is cultivated, the Bambara Bean exhibits remarkable resilience to both impoverished soil conditions and drought.

Bambara Beans Market Drivers:

The rise in Plant-based protein increases bambara beans market growth.

The surge in demand for plant-based protein sources emerges as a primary catalyst propelling market growth. Bambara beans emerge as a favored alternative to meat and other animal-derived protein options owing to their abundant reservoir of protein, fiber, and essential nutrients. Anticipated escalation in the adoption of vegan and vegetarian lifestyles is set to drive significant growth in the demand for plant-based protein sources, thereby fostering the expansion of the Bambara Bean Market.

Moreover, the burgeoning awareness regarding the health benefits associated with Bambara bean consumption serves as another influential factor shaping market expansion. Renowned for their anti-inflammatory properties, these beans hold the potential to mitigate cholesterol levels, regulate blood sugar, and enhance digestive well-being. The burgeoning consumer focus on health and fitness is poised to further amplify the demand for Bambara beans.

Bambara Beans Market Restraints and Challenges:

Despite the favorable growth factors, the Bambara bean market faces several hurdles that could potentially hinder its expansion. Among these challenges, a notable obstacle is the lack of awareness surrounding Bambara beans, particularly in regions where they are not traditionally consumed. This knowledge deficit could result in low market penetration and constrained demand, thus posing barriers to the market's growth trajectory.

Moreover, the outlook for the Bambara bean market takes into account the ramifications of supply chain disruptions stemming from ongoing geopolitical issues worldwide. Factors such as trade tariffs, restrictions, production losses, and the availability of alternative options are carefully considered in assessing the Bambara bean market's size and future projections. Furthermore, the divergence in the impact of inflation between food consumed at home versus in food service establishments is duly acknowledged. Drawing correlations between past economic downturns and current market trends aids in accurately forecasting the potential impact on the Bambara bean business landscape.

Bambara Beans Market Opportunities:

The Bambara bean market is poised for development as sustainable agricultural practices gain increasing traction. Positioned as an ideal crop for sustainable farming, Bambara beans thrive in suboptimal soil conditions and exhibit resilience to drought. The forthcoming adoption of sustainable agricultural techniques by more farmers is anticipated to enhance the availability and affordability of Bambara beans, thereby fostering market expansion.

A significant driving force propelling the growth of the Bambara bean market is the rapid evolution of lifestyles. Additionally, the dynamic shifts in consumer preferences and the surge in demand for plant-based food products are expected to contribute significantly to the overall increase in demand for Bambara beans over the forecast period. Furthermore, the burgeoning interest in veganism and the growing population of health-conscious consumers are anticipated to emerge as primary drivers for the Bambara bean market on a global scale. Moreover, mounting concerns regarding the adverse health effects of sugar are further bolstering the growth prospects of the Bambara bean market.

BAMBARA BEANS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Believe in Bambara, African Flavour’s, Tanzania Agricultural Research Institute, God’s Time FOB Leader Foods , Amafu Stock Trading, Zhengzhou Taizy Trading Co., Elite Trading Company, Bambara Nut Company, Crop Development Centre, Keystone Seed Ltd |

Bambara Beans Market Segmentation: By Product Type

-

Whole

-

Split

The whole Bambara beans segment holds dominance within the market. With approximately 65% carbohydrates, 18% protein, and a bounty of essential amino acids such as isoleucine, leucine, lysine, methionine, phenylalanine, threonine, and valine, Split Bambara beans stand out as a nutritious option.These legumes hold significant appeal for health-conscious consumers due to their high protein content and abundance of essential nutrients.

Bambara Beans Market Segmentation: By Application

-

Food & Beverages

-

Animal Feed

The food & beverage segment has secured the largest share of revenue within the market. Bambara beans hold a prominent place in traditional African cuisine, often featured in stews, soups, sauces, and various culinary preparations. Recognized for their wholesomeness and nutrient-rich profile, Bambara beans offer consumers a high protein, fiber-rich, and well-rounded dietary option. Additionally, their gluten-free nature and low glycemic index make them a favored choice for individuals with conditions such as celiac disease or Diabetes.

During the forecast period, the Animal Feed segment is expected to experience accelerated revenue growth. Particularly prominent in the poultry and livestock sectors, Bambara beans are valued as a valuable component of animal feed. Renowned for their high protein content, amino acid profile, and nutritional value, Bambara beans are favored by livestock farmers for their cost-effectiveness and efficient feed conversion rate.

Anticipated growth in demand for animal protein during the projection period aligns with the increasing emphasis on environmentally sustainable animal husbandry practices. Bambara beans lend themselves well to cultivation using eco-friendly agricultural techniques like intercropping, which promotes biodiversity while minimizing the use of chemical inputs such as pesticides and fertilizers. This resonates with evolving consumer preferences favoring animal products sourced from environmentally and socially responsible practices. Moreover, Bambara beans stand out as a safe and nutritious feed option for animals, being non-GMO, non-allergenic, and free from toxic ingredients.

Bambara Beans Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region emerges as the frontrunner in the Bambara beans market, attributed to the rising per capita consumption of grains and pulses. Meanwhile, the Middle East and Africa are poised for significant growth over the forecast period, driven by increasing awareness regarding the health benefits associated with Bambara beans.

Among the regional markets, Africa commands the largest revenue share in the Bambara beans market. Bambara beans play a vital role as both a food source and a source of income for small-scale farmers across Africa, particularly in the Sahel region. Given the challenging agricultural conditions characterized by erratic rainfall and frequent droughts in the Sahel, Bambara beans stand out as a resilient crop, offering local farmers a dependable option for cultivation.

In Europe, the rising trend toward plant-based diets fuels a growing demand for Bambara beans. Renowned for their protein content and mineral richness, Bambara beans serve as a flavorful meat substitute, aligning with the preferences of consumers adopting plant-based lifestyles. The United Kingdom stands out as a prominent importer of Bambara beans in Europe, with the market expected to expand moderately over the projected period. The surge in demand is primarily driven by the food and beverage industry, which constitutes the largest sector in the UK and is experiencing rapid growth. Bambara beans from the region find application in various food products, including protein bars, snacks, and plant-based meat alternatives, catering to the evolving dietary preferences of consumers.

COVID-19 Pandemic: Impact Analysis

The unprecedented COVID-19 pandemic in 2020 had a profound impact on the Bambara beans industry. The phases of the global Bambara beans supply chain, encompassing production, forming, distribution, and consumption, were significantly affected by lockdowns and restrictions imposed by governments worldwide.

The COVID-19 pandemic has also reverberated throughout the Bambara beans industry. With life upended by the pandemic, the beans-forming sector is witnessing a surge in trends such as organic and conventional practices, among others. Bambara beans businesses are diversifying their offerings with a wide array of varieties, including landraces, African legumes, vigna subterranean, starchy beans, and more. These varieties are readily available and offer simplicity in consumption, catering to evolving consumer preferences amidst the pandemic era.

Latest Trends/ Developments:

-

In 2022, the Bambara Nut Company revealed a strategic alliance with Flora EcoPower, to expand its production and distribution capacities. The collaboration seeks to enhance the accessibility of Bambara beans in the market while championing sustainable farming methods.

-

Additionally, in 2022, the Bambara Nut Company introduced a fresh line of roasted Bambara beans, available in a variety of flavors. Targeting health-conscious consumers seeking nutritious and protein-rich snacks, this product launch aims to cater to evolving dietary preferences.

Key Players:

These are the top 10 players in the Bambara Beans Market:-

-

Believe in Bambara

-

African Flavour’s

-

Tanzania Agricultural Research Institute

-

God’s Time FOB Leader Foods

-

Amafu Stock Trading

-

Zhengzhou Taizy Trading Co.

-

Elite Trading Company

-

Bambara Nut Company

-

Crop Development Centre

-

Keystone Seed Ltd

Chapter 1. Bambara Beans Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bambara Beans Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bambara Beans Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bambara Beans Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bambara Beans Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bambara Beans Market – By Product Type

6.1 Introduction/Key Findings

6.2 Whole

6.3 Split

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Bambara Beans Market – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverages

7.3 Animal Feed

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Bambara Beans Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Bambara Beans Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Believe in Bambara

9.2 African Flavour’s

9.3 Tanzania Agricultural Research Institute

9.4 God’s Time FOB Leader Foods

9.5 Amafu Stock Trading

9.6 Zhengzhou Taizy Trading Co.

9.7 Elite Trading Company

9.8 Bambara Nut Company

9.9 Crop Development Centre

9.10 Keystone Seed Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The surge in demand for plant-based protein sources emerges as a primary catalyst propelling market growth. Bambara beans emerge as a favored alternative to meat and other animal-derived protein options owing to their abundant reservoir of protein, fiber, and essential nutrients.

The top players operating in the Bambara Beans Market are - Believe in Bambara, African Flavour’s, Tanzania Agricultural Research Institute, God’s Time FOB Leader Foods, Amafu Stock Trading, Zhengzhou Taizy Trading Co., Elite Trading Company, Bambara Nut Company, Crop Development Centre, Keystone Seed Ltd.

The unprecedented COVID-19 pandemic in 2020 had a profound impact on the Bambara beans industry. The phases of the global Bambara beans supply chain, encompassing production, forming, distribution, and consumption, were significantly affected by lockdowns and restrictions imposed by governments worldwide.

The dynamic shifts in consumer preferences and the surge in demand for plant-based food products are expected to contribute significantly to the overall increase in demand for Bambara beans over the forecast period. Furthermore, the burgeoning interest in veganism and the growing population of health-conscious consumers are anticipated to emerge as primary drivers for the Bambara bean market on a global scale.

The Asia-Pacific region emerges as the frontrunner in the Bambara beans market, attributed to the rising per capita consumption of grains and pulses. Meanwhile, the Middle East and Africa are poised for significant growth over the forecast period, driven by increasing awareness regarding the health benefits associated with Bambara beans.