Automotive Trusted Platform Module Market Size (2023 - 2030)

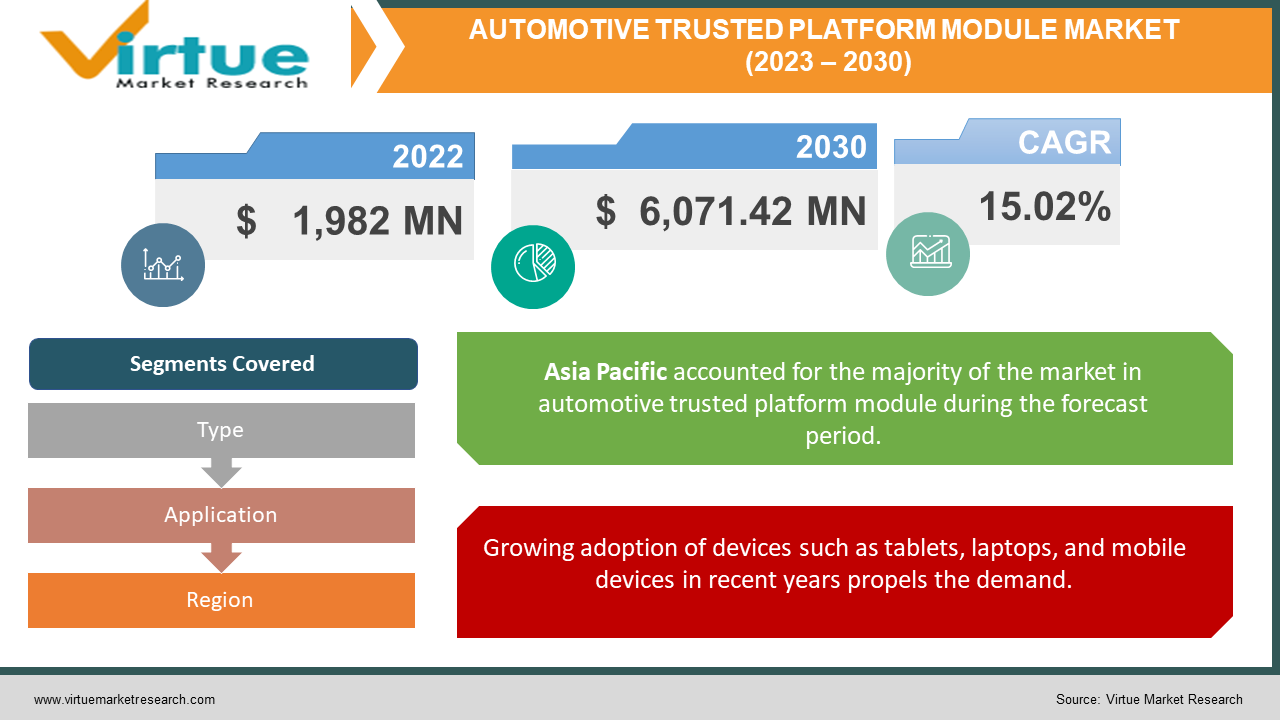

According to our research report, the global Automotive Trusted Platform Module market size is estimated to be at USD 1,982 million in 2022 and expected to reach USD 6,071.42 million by 2030. The market is projected to grow with a CAGR of 15.02% per annum during the period of analysis (2023 - 2030).

Industry Overview:

Using authentication and other procedures to guarantee the security of the computing environment, a chip called a "Trusted Platform Module" is utilized in a device to secure the veracity and dependability of the software platform. The usage of the Trusted Platform Module for data encryption, disc encryption, and data protection ensures the integrity of the platform. Modern technology is utilized to safeguard the keys, encrypt data on computer storage devices, and provide authenticity to trusted boot pathways. Rising digitization and the availability of multiple platforms make it essential to safeguard customer privacy and security.The Rivest"Shamir" Adleman (RSA) encryption keys specific to the host system are kept on a trusted platform module, a dedicated chip used on endpoint devices. This allows for hardware authentication. Using authentication and attestation procedures, a TPM stores platform measures to guarantee the reliability of the software platform and promote safer computing across all environments. This technology can be used by full disc encryption utilities like dm-crypt and BitLocker to safeguard the encryption keys for the computer's storage devices and provide integrity authentication for a trusted boot pathway that includes firmware and the boot sector. Data protection necessitates authentication. Over the projected period, these variables are likely to influence the market.

Impact of Covid-19 on the Industry:

Growth is being slowed down by Covid-19's effect on the market, though. Due to the cessation of industrial activities, which also resulted in a decrease in the need for integration services and sales of new embedded security interface products, the embedded security hardware industry has seen a major reduction in sales. However, as part of the Mozilla Open-Source Support Program, a participant like Mozilla announced in March 2020 the establishment of a COVID-19 Solutions Fund (MOSS). Through this fund, they will give grants totaling up to USD 50,000 to open-source technology initiatives that are addressing the COVID-19 pandemic in some way, together with embedded security solutions from Mozilla.

Market Drivers:

Growing adoption of devices such as tablets, laptops, and mobile devices in recent years propels the demand:

The need for the TPM market is being driven by the increasing adoption of devices like tablets, laptops, and mobile devices in recent years. The TPM chip is plugged into the device or computer's motherboard. When a user attempts to log into a bank account or the authenticator app, it is helpful to turn off the home security alarm.

In this situation, the user's ability to access money is stopped if they are unable to log in within a limited amount of time. TPM makes ensuring that the platform, mobile device, or PC is secure and protected from outside software intrusions. Thus, it is anticipated that rising tablet, laptop, and mobile device adoption will fuel the TPM market's demand.

Rising demand for TPM in IoT computing will drive the market growth:

With an increasing number of wireless technologies connecting, it to the outside world, the car is quickly expanding into a significant component of the IoT. The market sales of linked automobiles will surpass those of conventional cars in the upcoming years. Improved connection has many advantages, but it also creates a lot of opportunities for criminal hackers and online intruders to try to get access to systems. The number of automotive cybersecurity incidents increased by 99% between 2018 and 2019, according to Upstream Security's 2020 Global Automotive Cybersecurity info.

Market Restraints:

Less Awareness About the Benefits of TPM in Lower Economic Regions:

Spreading awareness in underdeveloped economies will act a as challenge to the market growth. The lack of awareness in the developing economies restraints the market growth as the majority of the Asian pacific nations is underdeveloped or in the developing stage.

AUTOMOTIVE TRUSTED PLATFORM MODULE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

15.02% |

|

Segments Covered |

By Type, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IBM, AMD, HP, Intel, Infineon, Lenovo, Microsoft, Nationsnz, Nuvoton, Samsung |

This research report on the global automotive trusted platform module market has been segmented and sub-segmented based on, and Geography & region.

Global Automotive Trusted Platform Module- By Type

-

Integrated

-

Discrete

The TPM market is divided into discrete, integrated, and other types according to the type. The fastest increase is projected for Integrated TPM, with a CAGR of about 15.01 percent, from 2021 to 2026. The demand for the integrated TPM is growing as a result of the growing safety threats. Most device manufacturers include TPM into their products at the manufacturing stage to eliminate safety hazards. The first TPM created especially for industrial applications, OPTIGATM TPM SLM 9670, was introduced by Infineon Technologies in March 2019. It safeguards the identity and integrity of connected, automated factories' industrial PCs, controllers, servers, and others, and manages access to critical data. During the projected period, this market's growth will be accelerated by these types of cutting-edge product introductions.

Global Automotive Trusted Platform Module- By Application

-

Mobile Security

-

Automotive

-

Banking, Transport, Pay TV & ID

-

Wearable

-

Banking

-

Transport

-

Security in IoT Connectivity

-

Others

This market is divided into the automotive, consumer electronics, retail, government, BFSI, general manufacturing, defense, aerospace, healthcare, and other sectors based on the end-user industry. Due to the increased adoption of IoT, and rising demand for laptops, personal computers, smartphones, and other gadgets, the consumer electronics industry is predicted to develop at the fastest CAGR of 16.22% from 2021 to 2026. The demand for these devices and TPM is sparked by improvements in digital technologies, economic growth, and affordability of these gadgets. In addition, a significant element driving the expansion of the TPM market at the moment is the rising demand for PCs and laptops for e-learning and work from home, which is being blamed on the global pandemic.

Global Automotive Trusted Platform Module- By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

Regionally, five main regions make up the globally trusted platform module (TPM) market: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The market in the Asia Pacific is anticipated to expand significantly over the coming years as a result of the region's accelerating rate of industrialization and increased use of e-commerce services. Six Southeast Asian nations have seen an increase of more than 65 million internet shoppers since the pandemic's start. By 2026, it is predicted that 350 million people in Southeast Asia would be doing their shopping online.

Additionally, an increase in IoT service usage is anticipated to boost market expansion in the region over the next few years. Additionally, the market in North America is anticipated to gain the highest share during the forecast period as a result of the region's growing demand for security systems and the rapid advancement of digital technology.

Due to technical developments in communication technologies like 4G and 5G, which have increased internet penetration in the Europe region, Europe is the second-largest contributor to the TPM market. The region's leading economies include those of France, Germany, Italy, France, and the United Kingdom.

The TPM market in Europe is expanding due to the widespread use of smart devices like tablets, smartphones, and computers in developed nations like Germany, France, and the United Kingdom. The need for TPMs in the Europe area is being driven by the growing requirement for cyber security alongside hardware-based solutions as a result of the sophistication of software-based attacks.

Global Automotive Trusted Platform Module- By Company

-

IBM

-

AMD

-

HP

-

Intel

-

Infineon

-

Lenovo

-

Microsoft

-

Nationsnz

-

Nuvoton

-

Samsung

NOTABLE HAPPENINGS IN THE GLOBAL AUTOMOTIVE TRUSTED PLATFORM MODULE MARKET IN THE RECENT PAST:

-

Business Collaboration: - In 2020, MERA, Mocana, and Osaka NDS have joined Automotive Grade Linux (AGL), a cross-industry collaboration creating an open-source platform for connected automotive technology. To provide scalable, end-to-end security and safeguard any AGL-based systems on board connected or autonomous vehicles, they intended to develop plug-and-play solutions that interface with the AGL platform.

-

Product Launch: - In 2020, QNX Black Channel Communications Technology, a new software solution with ISO 26262 ASIL D certification that OEMs and embedded software developers may utilize to guarantee secure data communication exchanges within their safety-critical systems, was recently introduced by BlackBerry Limited.

-

Product Launch: -In 2020, The S32G (a single-chip version of two processors), an automobile microprocessor, and an enterprise network processor from NXP were all made public. Due to its enterprise-class networking capabilities, the S32G serves as a gateway processor for connected automobiles. Additionally, it makes it possible for the newest data-intensive ADAS systems while giving cars secure communication skills.

Chapter 1. Global Automotive Trusted Platform Module Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Automotive Trusted Platform Module Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Global Automotive Trusted Platform Module Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Automotive Trusted Platform Module Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Automotive Trusted Platform Module Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Automotive Trusted Platform Module Market – By Type

6.1. Integrated

6.2. Discrete

Chapter 7. Global Automotive Trusted Platform Module Market – By Application

7.1. Mobile Security

7.2. Automotive

7.3.Banking, Transport, Pay TV & ID

7.4. Wearable

7.5. Banking

7.6. Transport

7.7. Security in IoT Connectivity

7.8. Others

Chapter 8. Global Automotive Trusted Platform Module Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Global Automotive Trusted Platform Module Market – key players

9.1. IBM

9.2. AMD

9.3. HP

9.4. Intel

9.5 Infineon

9.6. Lenovo

9.7. Microsoft

9.8. Nationsnz

9.9. Nuvoton

9.10. Samsung

Download Sample

Choose License Type

2500

4250

5250

6900