Automated Beverage Dispenser Market Size (2023 – 2030)

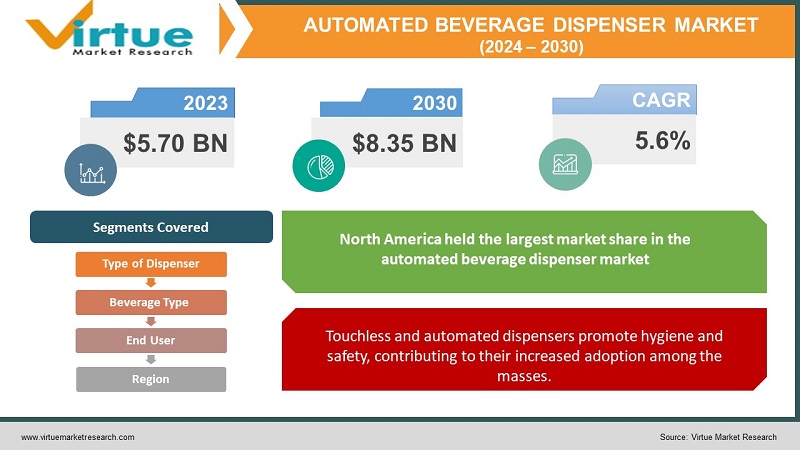

The Global Automated Beverage Dispenser Market was valued at USD 5.70 billion and is projected to reach a market size of USD 8.35 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.6%.

The landscape of automated beverage dispensers has undergone a remarkable transformation over time, emerging as a pivotal player in the beverage industry. Initially offering convenience and efficiency, these dispensers have evolved significantly to meet the changing demands of both consumers and businesses. In the present, they stand as integral components of the food service sector, especially in the wake of the COVID-19 pandemic, where touchless and self-service technologies have gained prominence. Looking ahead, this dynamic market is poised for continued growth, with opportunities lying in expanding into emerging markets, introducing innovative features like IoT connectivity, and catering to diverse customer preferences. However, challenges such as high initial costs and maintenance remain to be addressed as the market advances into the future.

Key Market Insights:

The automated beverage dispenser market has witnessed a substantial shift in recent years. In the past, these dispensers were primarily known for their convenience in offering standard beverages like soda and water. However, the contemporary market has seen a remarkable diversification in terms of the beverages these machines can dispense. From a limited range of options, they now provide a wide array of choices, including hot and cold beverages, alcoholic drinks, and even customized blends. This expansion has been instrumental in attracting a broader consumer base and increasing the market's versatility.

Geographically, North America has dominated the automated beverage dispenser market, with the United States being a significant contributor. The region's vibrant food service industry and consumer preference for convenience have propelled the market's growth. Nevertheless, the Asia-Pacific region is emerging as a key player, displaying the highest Compound Annual Growth Rate (CAGR). This is attributed to the rapid expansion of the food service sector in countries like China and India. As urbanization and changing lifestyles drive the demand for quick and efficient beverage solutions, the Asia-Pacific region is expected to witness substantial market expansion in the coming years.

The COVID-19 pandemic has brought about a notable shift in market dynamics. With health and safety concerns at the forefront, touchless and self-service technologies have gained significant traction. These dispensers now play a critical role in ensuring hygiene and minimizing human contact in food service establishments. Furthermore, manufacturers are focusing on integrating IoT technology for remote monitoring and maintenance, as well as developing sustainable and eco-friendly materials for dispenser construction. As the market evolves, it is also embracing mobile app compatibility for pre-ordering and customization, further enhancing user convenience. With these developments, the automated beverage dispenser market is poised for continued growth, driven by both technological innovation and changing consumer behaviors.

Automated Beverage (Drink) Dispenser Market drivers:

Efficiency and Convenience in fast and accurate drink servings reduce wait times for customers while improving operational efficiency for businesses.

Automated beverage dispensers have become a vital asset in the food and beverage industry due to their remarkable efficiency and convenience. These machines excel in delivering fast and accurate drink servings, significantly reducing wait times for customers, and enhancing operational efficiency for businesses. Whether it's a bustling fast-food restaurant or a high-traffic convenience store, these dispensers ensure that beverages are dispensed quickly and precisely, improving the overall customer experience and operational flow. The ability to serve drinks swiftly and accurately makes these dispensers indispensable tools for businesses aiming to streamline their service and meet the demands of today's fast-paced world.

Touchless and automated dispensers promote hygiene and safety, contributing to their increased adoption among the masses.

The COVID-19 pandemic has underscored the importance of hygiene and safety in public spaces, including food service establishments. Automated beverage dispensers have risen to the occasion by offering touchless and automated solutions that minimize human contact. These dispensers are equipped with features that reduce the need for physical interaction, such as touchless sensors or mobile app controls. As a result, they have gained widespread adoption among consumers and businesses alike, as they provide a safer way to access beverages without compromising on hygiene. This focus on safety has become a critical driver for the continued growth of the automated beverage dispenser market, particularly in a post-pandemic world.

Automated Beverage Dispensers allow for a wide range of drink options and customization, catering to diverse customer preferences.

Automated beverage dispensers have evolved to cater to diverse customer preferences. They now offer a wide range of drink options and the flexibility for customization. Customers can choose from various Flavors, and sizes, and even create their own unique blends. This level of customization enhances the customer experience by allowing individuals to tailor their beverages to their liking. Whether it's adjusting the sweetness level of a soda or creating a personalized coffee concoction, these dispensers empower consumers to enjoy their drinks just the way they want them. This focus on catering to individual tastes and preferences is a significant driver behind the popularity and continued growth of automated beverage dispensers in the market.

Automated Beverage (Drink) Dispenser Market Restraints and Challenges:

The initial investment required for installing automated beverage dispensers can be substantial, posing a challenge for small businesses.

One of the significant challenges hindering the adoption of automated beverage dispensers is the substantial initial investment required for their installation. These dispensers, while offering numerous benefits, often come with a considerable upfront cost. For small businesses, particularly those with limited capital, this financial barrier can be daunting. The expense includes not only the purchase of the dispensers themselves but also the necessary infrastructure and setup. Overcoming this hurdle requires careful financial planning and consideration of the long-term advantages these dispensers bring, such as increased efficiency and customer satisfaction.

Regular maintenance and servicing are necessary to ensure the proper functioning of these machines, which can add to operational expenses.

Beyond the initial investment, another challenge in the automated beverage dispenser market is the ongoing maintenance and servicing expenses. Like any mechanical equipment, these machines require regular upkeep to ensure they function correctly. Maintenance costs can add up over time and become a notable operational expense for businesses. Failure to perform adequate maintenance can result in downtime and disruptions to service, impacting customer satisfaction. To address this challenge, businesses must allocate resources for routine servicing and maintenance to keep their dispensers in optimal working condition.

Limited Compatibility with certain beverages or drink sizes, might restrict their versatility.

While automated beverage dispensers have expanded their capabilities, some models may still have limited compatibility with certain beverages or drink sizes. This limitation can restrict their versatility and limit the range of drinks a business can offer. For instance, if a dispenser is designed primarily for carbonated beverages, it may not effectively serve non-carbonated options. Similarly, constraints on drink sizes can be a drawback for businesses looking to provide larger or specialty-sized beverages. Overcoming this challenge involves selecting the right dispenser model that aligns with the specific beverage offerings and sizes a business intends to provide, ensuring that it meets customer demands effectively.

Automated Beverage (Drink) Dispenser Market Opportunities:

There is significant potential for market growth in emerging economies where the food service industry is expanding rapidly.

The automated beverage dispenser market presents substantial growth opportunities in emerging economies where the food service industry is experiencing rapid expansion. As urbanization continues, consumer preferences shift towards convenience, and dining out becomes more popular, these regions offer fertile ground for market growth. Manufacturers and businesses can tap into this potential by strategically entering and establishing a presence in these markets. By understanding and adapting to the unique demands and preferences of consumers in emerging economies, they can capitalize on the burgeoning food service industry and increase market penetration.

Manufacturers can capitalize on opportunities by introducing innovative features such as IoT connectivity, mobile app integration, and sustainable materials.

To stay competitive and meet evolving consumer expectations, manufacturers have the opportunity to introduce innovative features to their automated beverage dispensers. Incorporating IoT connectivity allows for remote monitoring and maintenance, enhancing operational efficiency and reducing downtime. Mobile app integration enables customers to customize and pre-order their beverages, adding a layer of convenience. Moreover, the use of sustainable materials in dispenser construction aligns with the growing emphasis on environmental responsibility. Manufacturers can differentiate themselves in the market by embracing these technological advancements and sustainable practices, appealing to eco-conscious consumers and businesses.

Offering customizable solutions for different business types can open up new market segments.

The market can expand further by offering customizable solutions tailored to different types of businesses. Restaurants, bars, convenience stores, hotels, and various other food service establishments have unique requirements and preferences when it comes to automated beverage dispensers. By providing adaptable and customizable systems, manufacturers can address the specific needs of these diverse business segments. This approach not only opens up new market segments but also fosters stronger customer relationships, as businesses can acquire dispensers that align perfectly with their operations, ultimately enhancing their overall efficiency and customer service.

AUTOMATED BEVERAGE DISPENSER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Type of Dispenser, Beverage Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Coca-Cola Company, PepsiCo Inc., McDonald's Corporation, Starbucks Corporation, The 7-Eleven Group, The Wendy's Company Taco Bell Corp., Dunkin' Brands Group, Inc., Burger King Corporation, Nestle S.A., Wunder-Bar |

Automated Beverage (Drink) Dispenser Market Segmentation: By Type of Dispenser

-

Countertop Dispenser

-

Freestanding Dispenser

-

Built-in Dispenser

In 2022, Countertop Dispenser held the largest market share in the automated beverage dispenser market due to its widespread use in various food service establishments. Their versatility, accessibility, and ability to cater to high customer volumes have contributed to their dominance. These units are designed to sit atop countertops or beverage stations, making them easily accessible for customers in various food service settings. Their versatility and compact design allow businesses to offer a wide range of beverages without taking up significant floor space. Countertop dispensers are commonly found in fast-food restaurants, convenience stores, and cafeterias, where quick and convenient beverage service is essential.

Moreover, the Freestanding Dispenser is the fastest-growing segment. This growth can be attributed to the increasing adoption of self-service solutions in the food service industry, where businesses are looking for flexible and space-efficient options. Freestanding dispensers offer the convenience of accessibility without the need for countertop space, making them a preferred choice for businesses seeking to optimize their beverage service.

Automated Beverage (Drink) Dispenser Market Segmentation: By Beverage Type

-

Coffee Dispenser

-

Soda Dispensers

-

Alcoholic Beverage Dispensers

-

Juice Dispensers

-

Water Dispensers

-

Others

In 2022, the Coffee Dispenser segment accounted for the largest revenue share along with a CAGR of 5.4%, driven by the enduring popularity of coffee consumption worldwide. These dispensers cater to a broad range of coffee preferences, offering options like hot brewed coffee, iced coffee, and specialty coffee blends. They are commonly found in coffee shops, fast-food restaurants, and office breakrooms, where coffee is a staple beverage.

However, the Water Dispenser segment emerged as the fastest-growing category with a CAGR of 9.1%, driven by heightened awareness of the significance of hydration and the growing demand for easy access to clean drinking water across different environments. As concerns about health and well-being increase, water dispensers have gained traction in gyms, schools, offices, and public spaces, meeting the need for convenient and safe hydration solutions. This segment's rapid growth underscores the evolving consumer priorities and the emphasis on maintaining a healthy lifestyle through proper hydration.

Automated Beverage (Drink) Dispenser Market Segmentation: By End User

-

Restaurants

-

Bars and nightclubs

-

Convenience Stores

-

Hotels and Hospitality

-

Offices

-

Residential

-

Airports

-

Others

In 2022, Restaurants held the largest market share in the automated beverage dispenser market, accounting for 31.7% of the market share. The reason behind their dominance is the widespread presence of beverage dispensers in various dining establishments, ranging from fast-food outlets to fine-dining restaurants. The versatility of these dispensers allows restaurants to serve a wide range of beverages to cater to diverse customer preferences.

Moreover, Convenience stores emerged as the fastest-growing segment, with a notable CAGR of 9.1%. These stores have recognized the value of automated beverage dispensers in enhancing customer experience and driving additional sales. Offering quick and convenient access to a variety of beverages, including coffee, soda, and fresh juices, has significantly contributed to the segment's growth. In 2022, convenience stores accounted for 15.3% of the market share.

Automated Beverage (Drink) Dispenser Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, North America held the largest market share in the automated beverage dispenser market, representing 41.8% of the total market share., driven by the high demand for innovative solutions and the presence of key manufacturers. The United States, in particular, has been a significant contributor to this region's dominance. The market's growth in North America is driven by the robust food service industry, high consumer demand for convenience, and a strong presence of various types of beverage establishments.

However, the Asia-Pacific region is the fastest-growing segment, with a remarkable CAGR of 12.2%. In 2022, it accounted for 28.4% of the market share. Rapid urbanization, changing lifestyles, and the expanding food service sector, especially in countries like China and India, have fuelled the demand for automated beverage dispensers. The region's adoption is driven by the need for efficient and space-saving solutions in densely populated urban areas.

COVID-19 Impact Analysis on the Global Automated Beverage Dispenser Market:

The COVID-19 pandemic had a significant impact on the global automated beverage dispenser market. As lockdowns and restrictions were imposed worldwide, the food service industry, a major end-user of beverage dispensers, faced disruptions in operations, leading to a temporary decline in demand. Many restaurants, bars, and hospitality establishments scaled back their operations or temporarily closed, affecting dispenser usage. Additionally, heightened hygiene concerns prompted businesses to invest in touchless and contactless dispensing solutions, driving the adoption of more advanced and hygienic dispenser models. As the pandemic spurred a shift toward takeout and delivery services, some establishments incorporated automated beverage dispensers as part of their contactless service offerings. While the market experienced challenges, these innovations and adaptations have positioned it for recovery and continued growth as the industry evolves to meet changing consumer expectations.

Latest Trends/ Developments:

The beverage dispenser market is witnessing a transformative trend with the integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies. These innovations enable the development of smart beverage dispensing solutions that offer enhanced efficiency, customization, and data analytics capabilities. For instance, AI algorithms can analyze consumer preferences and usage patterns to optimize drink formulations and inventory management. IoT connectivity allows for remote monitoring and maintenance, reducing downtime and operational costs. Such advancements not only improve operational efficiency but also enhance the customer experience by offering personalized beverage options based on real-time data.

Another notable trend is the incorporation of customizable drink options and digital menus on dispenser screens. This innovation enhances customer engagement and satisfaction by providing a wide range of beverage choices and allowing customers to personalize their drinks. Digital menus enable businesses to showcase their beverage offerings with attractive visuals and descriptions, making it easier for consumers to explore and select their preferred beverages. This trend aligns with the growing demand for unique and tailored beverage experiences, especially in coffee shops, convenience stores, and fast-food restaurants.

Sustainability and eco-friendliness have become paramount in dispenser designs to align with global green initiatives. Manufacturers are increasingly using eco-friendly materials in dispenser construction and adopting energy-efficient technologies to reduce environmental impact. Additionally, efforts are being made to minimize single-use plastic waste by introducing reusable and refillable beverage containers that can be easily integrated with automated dispensing systems. These sustainable designs resonate with environmentally conscious consumers and contribute to reducing the carbon footprint of the beverage dispenser industry.

Key Players:

-

The Coca-Cola Company

-

PepsiCo Inc.

-

McDonald's Corporation

-

Starbucks Corporation

-

The 7-Eleven Group

-

The Wendy's Company Taco Bell Corp.

-

Dunkin' Brands Group, Inc.

-

Burger King Corporation

-

Nestle S.A.

-

Wunder-Bar

In September 2023, Hop Robotics, aimed to streamline draft beverage dispensing using robotics and industrial automation. The South Carolina-based startup offered robotic units that could be integrated into venues to automate the dispensing of beverages on tap. This innovation not only ensured consistent and efficient service but also reduced labor-related challenges.

Chapter 1.Automated Beverage (Drink) Dispenser Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2.Automated Beverage (Drink) Dispenser Market– Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3.Automated Beverage (Drink) Dispenser Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4.Automated Beverage (Drink) Dispenser MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5.Automated Beverage (Drink) Dispenser Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6.Automated Beverage (Drink) Dispenser Market– By Type of Dispenser

6.1 Introduction/Key Findings

6.2 Countertop Dispenser

6.3 Freestanding Dispenser

6.4 Built-in Dispenser

6.5 Y-O-Y Growth trend Analysis By Type of Dispenser

6.6 Absolute $ Opportunity Analysis By Type of Dispenser, 2023-2030

Chapter 7.Automated Beverage (Drink) Dispenser Market– By Beverage Type

7.1 Introduction/Key Findings

7.2 Coffee Dispensers

7.3 Soda Dispensers

7.4 Alcoholic Beverage Dispensers

7.5 Juice Dispensers

7.6 Water Dispensers

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Beverage Type

7.9 Absolute $ Opportunity Analysis By Beverage Type, 2024-2030

Chapter 8.Automated Beverage (Drink) Dispenser Market– By End User

8.1 Introduction/Key Findings

8.2 Restaurants

8.3 Bars and nightclubs

8.4 Convenience Stores

8.5 Hotels and Hospitality

8.6 Offices

8.7 Residential

8.8 Airports

8.9 Others

8.10 Y-O-Y Growth trend Analysis By End User

8.11 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9.Automated Beverage (Drink) Dispenser Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type of Dispenser

9.1.3 By Beverage Type

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type of Dispenser

9.2.3 By Beverage Type

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type of Dispenser

9.3.3 By Beverage Type

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type of Dispenser

9.4.3 By Beverage Type

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type of Dispenser

9.5.3 By Beverage Type

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10.Automated Beverage (Drink) Dispenser Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 The Coca-Cola Company

10.2 PepsiCo Inc.

10.3 McDonald's Corporation

10.4 Starbucks Corporation

10.5 The 7-Eleven Group

10.6 The Wendy's Company Taco Bell Corp.

10.7 Dunkin' Brands Group, Inc.

10.8 Burger King Corporation

10.9 Nestle S.A.

10.10 Wunder-Bar

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Automated Beverage Dispenser Market was valued at USD 5.70 billion and is projected to reach a market size of USD 8.35 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.6%.

The key drivers include the growing demand for self-service options, the impact of COVID-19, and the trend toward touchless technologies.

The latest trends include AI and IoT integration, customizable drink options, and eco-friendly dispenser designs.

North America led the market in 2022, while the Asia-Pacific region is expected to witness the highest growth rate.

The Coca-Cola Company, PepsiCo Inc., McDonald's Corporation, Starbucks Corporation, The 7-Eleven Group, The Wendy's Company Taco Bell Corp., are some of the key players.