Artificial Tears Market Size (2023 - 2030)

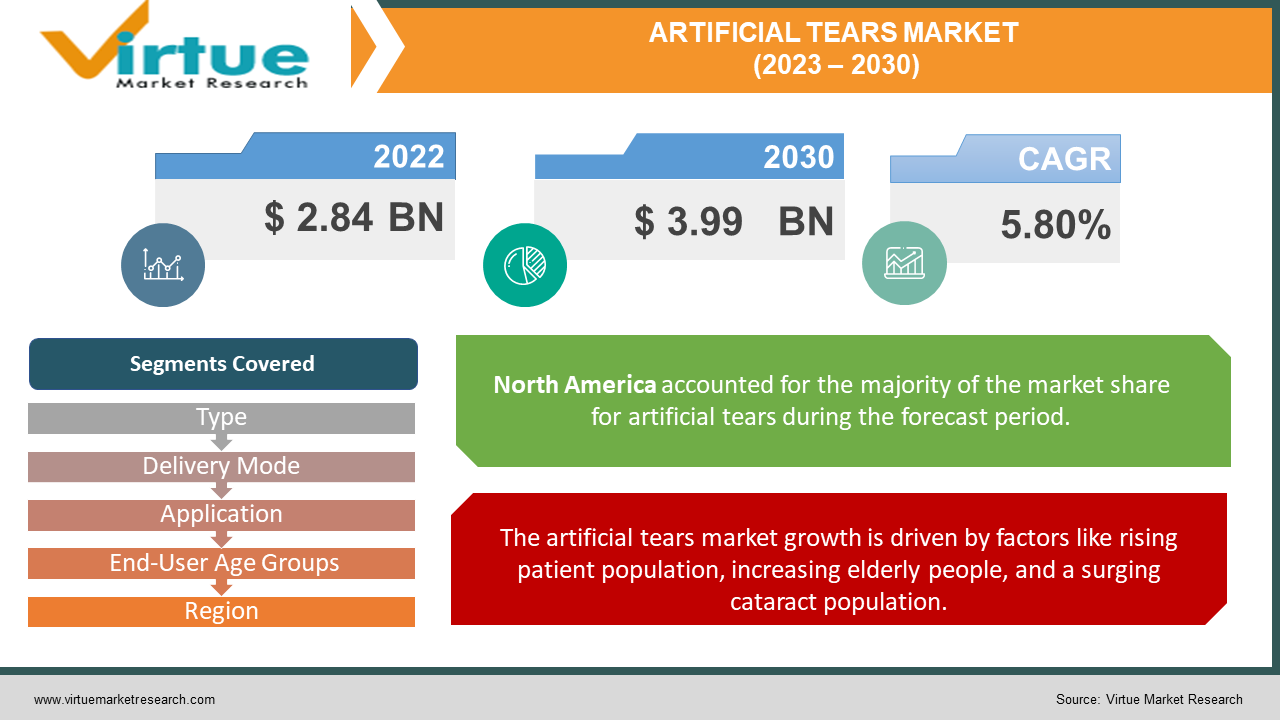

The global artificial tears market size is expected to reach 3.99 billion by 2030 from USD 2.84 billion in 2022 with a CAGR of 5.80% from 2022-2030.

Industry Overview:

Artificial tears are lubricating gels or eye drops used to add moisture to the eye. Artificial tears are specially manufactured to provide relaxation in patients with mild symptoms of dry eyes and also develop comfort. Artificial tears are generally classified into cellulose-derived tears, oil-based emulsion tears, propylene glycol-based tears, glycerin-derived tears, and polyethylene glycol.

COVID-19 Impact on Artificial Tears Market:

The sudden outburst of COVID-19 has created a positive impact on the artificial tears market. Due to the pandemic period, all employees are given work from home. People are more exposed to using computers, mobile phones, and laptops. Even children are having online classes as schools, colleges, and offices were shut down temporarily to avoid the virus spread. Due to this, many of them were diagnosed with dry eyes, itching, and allergies. During the first half of the pandemic period, all the manufacturing, and transportation were paused. Later, once the lockdown has come to an end, all have resumed their works. Teleconsultation and video consultations have come into existence due to the terrifying virus. The demand for artificial tears market is surging during the COVID-19 period, which significantly drives the market.

Market Drivers:

The artificial tears market growth is driven by factors like rising patient population, increasing elderly people, and a surging cataract population. Ophthalmologists using advanced technologies for treating patients boost the market growth. Air pollution is severe in highly developed and developing countries affecting the eye sight boosts the artificial tears market growth globally. The demand for artificial tears is increasing for post-surgery fuels the market growth.

Market Restraints:

Factors that impede the artificial tears market growth are adverse effects associated with dry eye syndromes like blurred vision and irritation and COVID-19.

ARTIFICIAL TEARS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.80% |

|

Segments Covered |

By Type, Delivery Mode, Application, End-User Age Groups, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Johnson & Johnson (the U.S.), Bausch + Lomb (the U.S.), Novartis International AG (Switzerland), Akorn Inc. (the U.S.), Rohto Pharmaceutical Co., Ltd. (Japan), Allergan plc (Republic of Ireland), VISUfarma (Netherlands), Otsuka Pharmaceutical Co., Ltd. (Japan), NovaMedica LLC (Russia), OASIS Medical, Inc. (the U.S.), ENTOD Research Cell UK Ltd (the U.K.), Santen Pharmaceutical Co., Ltd. (Japan), Abbott Medical Optics Inc. (the U.S.) |

Segment Analysis

The research report on the global artificial tears market has been segmented and sub-segmented based on type, delivery mode, application, and end-user age groups.

Artificial Tears Market - By Type

-

Glycerin Derived Tears

-

Cellulose Derived Tears

-

Polyethylene glycol & Propylene glycol-based artificial tears

-

Sodium Hyaluronate Based Tears

-

Oil-based Emulsion Tears

-

Others

Glycerin-derived tears type segment is said to hold the largest share over the artificial tears market. The segment growth is attributed to ease of availability and the capability of keeping the eyes moist for a long time. Glycerin has advantages like obstructing the adverse effects of high osmolality on the ocular surface and upgrading epithelial cell growth.

Artificial Tears Market - By Delivery Mode

-

Eye Drops

-

Ointments

By delivery mode, eye drops are said to dominate the artificial tears market throughout the timeline period. In general, tears are easily obtained in the form of eye drops and are considered as the front-line treatment for patients with eye dry syndrome. The easy and wide availability of eye products and easy applications propel the artificial tears market growth.

Artificial Tears Market - By Application

-

Dry Eyes Treatment

-

Contact Lenses Moisture

By application, the dry eyes treatment segment holds for the majority of the share in the artificial tears market. The segment growth is due to the increasing use of contact lenses in users due to the rising use of mobile phones, computers for long hours. The rising use of electronic devices and increasing launch of product launches by the market key players fuel the growth of the market.

Artificial Tears Market - By End-User Age Groups

-

20 to 40 Years

-

41 to 60 Years

-

Above 60 Years

Above 60 years end-user age group segment is likely to lead the artificial tears market throughout the timeline period. Both men and women who are above 50 years are affected by some health conditions resulting in dry eyes. Moreover, 20 to 40 years are teens who are more exposed to dry eyes due to light emission from computers, long use of mobile phones, and growing air pollution levels.

Regional Analysis

-

North America is dominating the artificial tears market with a lion's share globally. The region is expected to have continuous dominance over the upcoming years. Factors like increasing robust expenses in healthcare, high prevalence of dry eye syndrome, and other eye diseases such as allergies are escalating the artificial tears market growth in the region. The United States is leading the market with the highest share across the region. Around 6.8% of the U.S population is affected by dry eye syndrome as per the 2013 National Health and Wellness Survey.

-

The European artificial tears market is scheduled to grow with considerable growth and a CAGR of 5.2% throughout the historical period. The factors owing to the region's growth are surging dry eye syndrome cases, increasing population, and advanced technologies. In 2019, Novaliq GmbH, a German-based pharma company partnered with Jiangsu Hengrui Medicine Co Ltd, China. The partnership is to develop, manufacture, innovative drugs called CyclASol(R) and NOV03 for treating dry eye diseases in patients. In Germany, in 2020, 7.4 million people were diagnosed with dry eye, as per the National Study and Wellness Survey. The market is driven by growing older people, and the rising occurrence of dry eyes. In the U.K., one in four people suffers from dry eye that causes red eyes, fatigue, and itchy eyes. In Germany, the number of cataract surgeries has risen, as per Organization for Economic Co-operation and Development (OECD), boosting the increasing demand for artificial tears market in the region.

-

However, the artificial tears market in Asia-Pacific is slated to record the largest share during the historical period. The growth in the region attributes to increasing awareness in people regarding ocular diseases, a strong patient population, and rising healthcare expenses. In June 2018, Novaliq GmbH enlarged geographically making its product available in Australia. Latin America and the Middle East & African regions are expected to have a constant growth rate in the artificial tears market.

Artificial Tears Market - By Company

-

Johnson & Johnson (the U.S.)

-

Bausch + Lomb (the U.S.)

-

Novartis International AG (Switzerland)

-

Akorn Inc. (the U.S.)

-

Rohto Pharmaceutical Co., Ltd. (Japan)

-

Allergan plc (Republic of Ireland)

-

VISUfarma (Netherlands)

-

Otsuka Pharmaceutical Co., Ltd. (Japan)

-

NovaMedica LLC (Russia)

-

OASIS Medical, Inc. (the U.S.)

-

ENTOD Research Cell UK Ltd (the U.K.)

-

Santen Pharmaceutical Co., Ltd. (Japan)

-

Abbott Medical Optics Inc. (the U.S.)

In February 2021, Bausch + Lomb introduced Preservative Free Alaway, approved by the U.S FDA. It is the eye drop that is itch-free.

Notable Happenings in the global Artificial Tears Market

-

On April 03, 2020, Johnson & Johnson launched TECNIS Eyhance intraocular lens for those patients who have undergone cataract surgery. https://www.theweek.in/wire-updates/business/2019/10/31/pwr12-johnson%20and%20johnson%20vision.html

-

On October 16, 2019, Eyevance pharmaceuticals revealed the purchase of TOBRADEX ST and NATACYN from Novartis. The obtainment is to serve the ophthalmology professionals to treat patient's anterior and ocular surface conditions. https://www.prnewswire.com/news-releases/eyevance-pharmaceuticals-acquires-tobradex-st-and-natacyn-300939668.html

-

On October 07, 2019, Allergan Plc disclosed the launch of three over-the-counter REFRESH RELIEVA products. https://www.prnewswire.com/news-releases/allergan-expands-refresh-portfolio-with-new-refresh-relieva-lubricant-eye-drop-product-line-300931148.html

-

On November 17, 2020, Santen pharmaceuticals launched a long-lasting artificial tear treatment and online educational resource to support sufferers in the U.K. https://www.pharmiweb.com/press-release/2020-11-17/santen-launches-long-lasting-artificial-tear-treatment-and-online-educational-resource-to-support-sufferers-in-the-uk

-

On July 12, 2021, Bausch+Lomb unveiled the launch of Biotrue Hydration Boost Lubricant Eye Drops and Biotrue Micellar Eyelid cleaning wipes. Both the products are used to ease the symptoms concerned with irritated and dry eyes. https://www.prnewswire.com/news-releases/bausch--lomb-launches-biotrue-hydration-boost-lubricant-eye-drops-and-biotrue-micellar-eyelid-cleansing-wipes-301331203.html

Chapter 1. Artificial Tears Market – Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Artificial Tears Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Artificial Tears Market – Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Artificial Tears Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 .Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Artificial Tears Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Artificial Tears Market - By Type

6.1 Glycerin Derived Tears

6.2 Cellulose Derived Tears

6.3 Polyethylene glycol & Propylene glycol-based artificial tears

6.4 Sodium Hyaluronate Based Tears

6.5 Oil-based Emulsion Tears

6.6 Others

Chapter 7. Artificial Tears Market - By Delivery Mode

7.1 Eye Drops

7.2 Ointments

Chapter 8. Artificial Tears Market - By Application

8.1 Dry Eyes Treatment

8.2 Contact Lenses Moisture

Chapter 9. Artificial Tears Market - By End-User Age Groups

9.1 20 to 40 Years

9.2 41 to 60 Years

9.3 Above 60 Years

Chapter 10. Artificial Tears Market – By Region

10.1 North America

10.2 Europe

10.3 Asia-Pacific

10.4 Latin America

10.5 The Middle East

10.6 Africa

Chapter 11. Artificial Tears Market – Key players

11.1 Johnson & Johnson (the U.S.)

11.2 Bausch + Lomb (the U.S.)

11.3 Novartis International AG (Switzerland)

11.4 Akorn Inc. (the U.S.)

11.5 Rohto Pharmaceutical Co., Ltd. (Japan)

11.6 Allergan plc (Republic of Ireland)

11.7 VISUfarma (Netherlands)

11.8 Otsuka Pharmaceutical Co., Ltd. (Japan)

11.9 NovaMedica LLC (Russia)

11.10 OASIS Medical, Inc. (the U.S.)

11.11 ENTOD Research Cell UK Ltd (the U.K.)

11.12 Santen Pharmaceutical Co., Ltd. (Japan)

11.13 Abbott Medical Optics Inc. (the U.S.)

Download Sample

Choose License Type

2500

4250

5250

6900