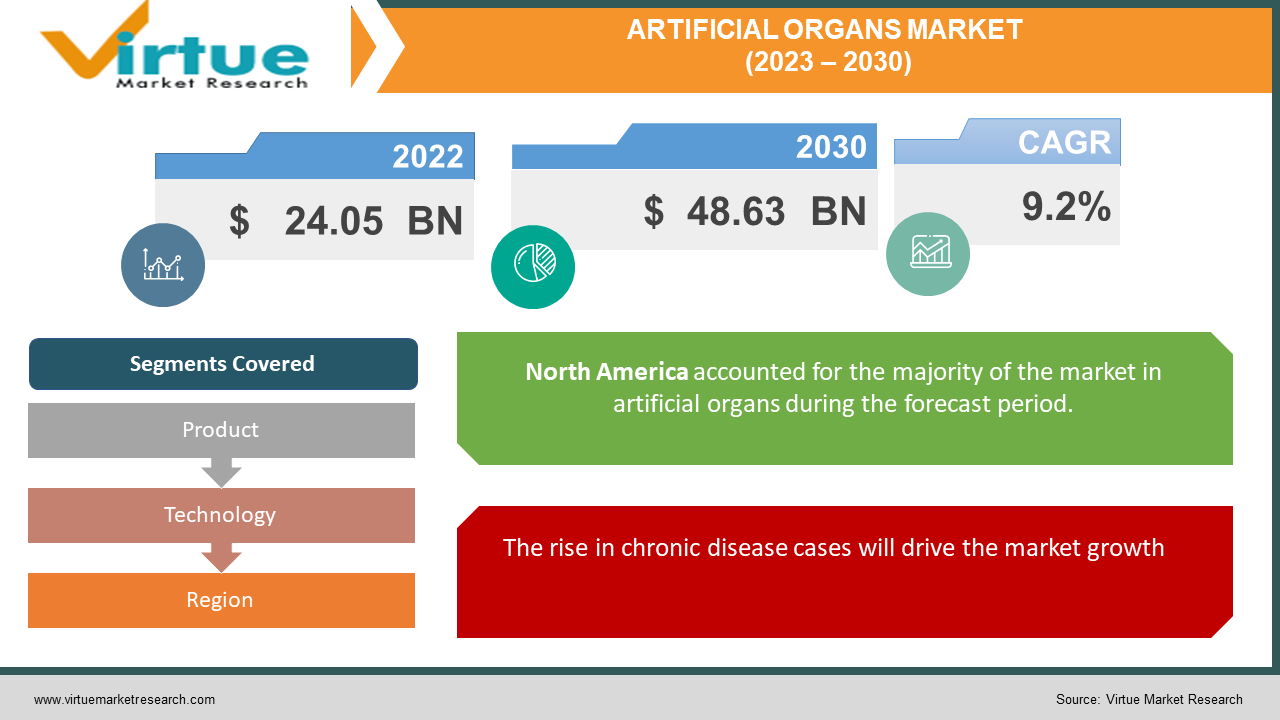

Global Artificial Organs Market Size (2023 - 2030)

According to our research report, the global artificial organs market is at USD 24.05 billion in 2022 and estimated to reach a total market valuation of USD 48.63 billion by 2030. The market is projected to grow with a CAGR of 9.2% per annum during the period of analysis.

Industry Overview

A medical device that is implanted or integrated into the body to duplicate or improve an organ's natural function is known as an artificial organ. According to the report's purview, artificial organs comprise both implanted gadgets like pacemakers and entirely artificial hearts as well as organ support systems like dialysis and extracorporeal membrane oxygenation (ECMO) machines.

Blood loss, substance addiction, severe trauma, and other acute disorders are the main causes of organ failure. Additionally, bad lifestyle choices like smoking, drinking too much alcohol, eating poorly, and not exercising have a significant influence on organ function. Additionally, it is anticipated that the availability of cutting-edge artificial support systems and advancements in healthcare facilities would increase the demand for bionics and artificial organs.

The expanding worldwide elderly population is largely generating demand for organ implants. Over 65s are more frequently getting and requesting organ transplants than ever before. The senior population has the biggest need for artificial devices since they are more prone to post-transplant malignancies. The HRSA estimates that 8,895 organ transplant operations involving Americans over 65 were carried out in 2021 (current estimates put that number at 3,114 in April 2022). As a result, the need for artificial devices is rising along with the life expectancy and the demand for organ donors.

Because 3D bioprinting is utilized to create artificial organs, it is essential for the area of organ transplantation. Since it reduces the possibility of organ rejection, 3D bioprinting is becoming increasingly popular. Furthermore, artificial intelligence is set to revolutionize the global trends for artificial gadgets. Currently, several nations are focused on a method that gives a tailored assessment of organ and donor eligibility. This tool will be very useful in helping patients decide whether to accept donated organs or wait for better possibilities when making decisions regarding organ retrieval.

Impact of Covid-19 on the Industry

Due to an increase in daily cases throughout the world, the market need for COVID-19 vaccination has increased. Consequently, there will be a rise in the need for quick diagnostic tests. For instance, real-time PCR (RT-PCR) is the most affordable and efficient approach for the diagnosis of COVID-19 testing, according to several studies. Elective procedures were postponed to reduce the danger of coronavirus infection after the abrupt COVID-19 pandemic breakout prompted the introduction of strict lockdown measures across several nations. Because of COVID-19, it is now much more difficult for surgeons to meet the requirements for artificial organ implants, which are performed in an infection-free operating room. This is hurting the market.

Market Drivers

The rise in chronic disease cases will drive the market growth:

With a growing population comes an increase in chronic illness cases, which is a key reason driving the market. With rising COVID-19 instances, the market is booming in the projected period of 2022–2030.

The dearth of organ donors will drive the market growth:

There is a severe shortage of organ donors nowadays. As a result, patients must wait a year before receiving an organ to treat their ailment, but fake organs aid them while they wait for their turn to receive genuine organs, which is what is driving the market. Additionally, improvements in medical bionics, rising public knowledge of artificial organs, an ageing population, rising home haemodialysis popularity, and an increase in accidents and serious injuries all have a favourable impact on the artificial organ business.

Market Restraints

The high cost of surgical operation will act as a market restraint:

On the other hand, it is anticipated that the high expense of the surgery and growing public awareness of the risk connected with artificial organs would restrain market expansion. During the forecast period of 2022–2030, a shortage of experts with the necessary skills is expected to provide a challenge to the artificial organ market.

ARTIFICIAL ORGANS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9.2% |

|

Segments Covered |

By Product, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Zimmer Biomet, Medtronic, Abbott, ABIOMED, INC, Berlin Heart Gmbh, Biomet, Inc, Boston Scientific Corporation, Edward Lifesciences Corporation, Ekso Bionics, Heartware International, Inc, Iwalk, Inc., Jarvik Heart, Inc, SynCardia Systems, LLC |

This research report on the global artificial organs market has been segmented and sub-segmented based on, product, technology, and Geography & region.

Global Artificial Organs Market- By Product

-

Artificial Organs

-

Kidney

-

Heart

-

Lungs

-

Liver

-

Pancreas

-

-

Artificial Bionics

-

Cochlear implant

-

Exoskeleton

-

Bionic limbs

-

Vision bionics

-

Brain bionics

-

With a market share of nearly 70.9 per cent in 2021, artificial organs dominated the industry. The industry is expanding as a result of increased demand for liver, heart, kidney, and lung transplants. In the United States, the median waiting period for a kidney transplant is 5 years. While on the waiting list, several variables are taken into account, including body size, blood type, distance from a donor, and degree of disease. Therefore, the problem of meeting unmet demand has driven the manufacturers to create wearable artificial kidneys, bio-lungs, and artificial pancreas.

During the projection period, the artificial bionics segment is anticipated to see the quickest CAGR. The growing need for cochlear implants, eyesight, exoskeletons, limbs and brain bionics are the main drivers of the market's expansion. The market for artificial organs and bionics is also expanding as a result of advantageous reimbursement policies and expedited FDA approval for implants. For instance, the U.S. Food and Drug Administration approved the Cochlear Nucleus Implants of Cochlear Limited to treat single-sided deafness and unilateral hearing loss in January 2022.

Global Artificial Organs Market- By Technology

-

Mechanical bionics

-

Electronic bionics

With a market share of 67.1 per cent in 2021, mechanical bionics prevailed. The prevalence of organ failure is increasing, and mechanical bionics are becoming more affordable. Since a mechanical prosthetic heart valve lasts far longer than the alternatives, there is a high demand for them. Rapid FDA approvals and reimbursement policies are further factors promoting expansion. For example, the FDA approved Abbott's Portico with FlexNav TAVR system in September 2021 to treat patients with symptomatic aortic stenosis who may be at high or very high risk for open-heart surgery.

During the anticipated period, the artificial organs and bionics market is anticipated to develop at the fastest rate in the electronic bionics category. Approximately 1.0 billion individuals worldwide live with a physical handicap, and 190.0 million adults experience primary functional difficulties, according to Bionics Queensland. The logistical and budgetary obstacles are still significant in the majority of developing nations. For many people with disabilities, getting prosthetics like fake hands, limbs, and legs is their only choice. These prostheses are myoelectrical-controlled batteries and electronic devices that may induce nerve movement via sensors. Mobility in artificial organs is made possible by these sensory electric technologies. Mobility is achieved through machine learning, intelligent clothing, and element modelling. The need for electronic bionics is also anticipated to increase due to factors like an increase in traffic accidents, an increase in amputees, and people who are born without limbs.

Global Artificial Organs Market- By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

The market was led by North America in 2022 with a share of 45.4 per cent, and it is anticipated that this dominance will last the whole forecast period. The demand for artificial organs due to the increased prevalence of organ failure and the rise in transplant surgery are the causes of this expansion. Its supremacy is further aided by the existence of sophisticated healthcare facilities and a significant number of local branches of well-known biotechnology and medical device businesses including Zimmer Biomet, Arthrex, Inc., Medtronic, Novartis AG, and Stryker.

For instance, on March 10, 2022, Zimmer Biomet Holdings, Inc. announced Walken, an improving AI design that identifies patients1 who are predicted to have a worse result for gait speed ninety days following hip or knee surgical intervention. Walken adds powerful predictive analytic capabilities to ZBEdge, a collection of integrated smart, robotic technologies that were digitally created to provide transformational data-powered clinical insights to improve patient outcomes.

In the previous five years, there has been a huge growth in the number of donors in the U.S. The number of organ donors increased by 27.7% between 2015 and 2019, according to the U.S. Department of Health and Human Services. One of the key factors propelling the market for artificial organs and bionics is the rising need for kidney transplants. From 16,186 transplants in 2011 to 23,401 transplants in 2019 and 24,670 transplants in 2021, the number of kidney transplants has increased exponentially.

Due to rising economies like Japan, China, and India, the market in the Asia Pacific region is anticipated to expand at the quickest rate over the projected period. These nations have sizable populations and a high prevalence of chronic illnesses. The expansion of artificial organs and bionic devices is anticipated to be boosted by an increase in the number of chronic illnesses that cause organ failure.

For instance, Micro Life Sciences Pvt Ltd. received a USD 210 investment from Warburg Pincus in February 2022. (parent organisation of Meril group of companies). This investment will provide domestic medical devices with a solid worldwide reputation, enabling them to grow their international presence, draw in foreign expertise and scale-up clinical research initiatives.

The nations provide a wide range of cutting-edge surgical procedures and are seeing a surge in medical tourism. Many individuals can travel there for medical reasons thanks to the inexpensive cost of surgical treatments. Thus, the surge in medical tourism and the prevalence of chronic illnesses causing organ failure have both been major drivers of market expansion in the area.

Global Artificial Organs Market- By Companies

-

Zimmer Biomet

-

Medtronic

-

Abbott

-

ABIOMED, INC

-

Berlin Heart Gmbh

-

Biomet, Inc

-

Boston Scientific Corporation

-

Edward Lifesciences Corporation

-

Ekso Bionics

-

Heartware International, Inc

-

Iwalk, Inc.

-

Jarvik Heart, Inc

-

SynCardia Systems, LLC.

NOTABLE HAPPENINGS IN THE GLOBAL ARTIFICIAL ORGANS MARKET IN THE RECENT PAST:

- Regulatory Approval: - In 2021, Abbott's smallest mechanical heart valve received FDA approval. The device is intended to treat infants and young children who require mitral and aortic heart valves.

Chapter 1. Global Artificial Organs Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Artificial Organs Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Global Artificial Organs Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Artificial Organs Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Artificial Organs Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Artificial Organs Market – By Product

6.1. Artificial Organs

6.1.1 Kidney

6.1.2 Heart

6.1.3 Lungs

6.1.4 Liver

6.1.5 Pancreas

6.2. Artificial Bionics

6.2.1 Cochlear implant

6.2.2 Exoskeleton

6.2.3 Bionic limbs

6.2.4 Vision bionics

6.2.5 Brain bionics

Chapter 7. Global Artificial Organs Market – By Technology

7.1. Mechanical bionics

7.2. Electronic bionics

Chapter 8. Global Artificial Organs Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Global Artificial Organs Market - key players

9.1. Zimmer Biomet

9.2. Medtronic

9.3. Abbott

9.4. ABIOMED, INC

9.5. Berlin Heart Gmbh

9.6. Biomet, Inc

9.7. Boston Scientific Corporation

9.8. Edward Lifesciences Corporation

9.9. Ekso Bionics

9.10. Heartware International, Inc

9.11. Iwalk, Inc.

9.12. Jarvik Heart, Inc

9.13. SynCardia Systems, LLC.

Download Sample

Choose License Type

2500

4250

5250

6900