Anti Satellite Weapons Market Size (2025-2030)

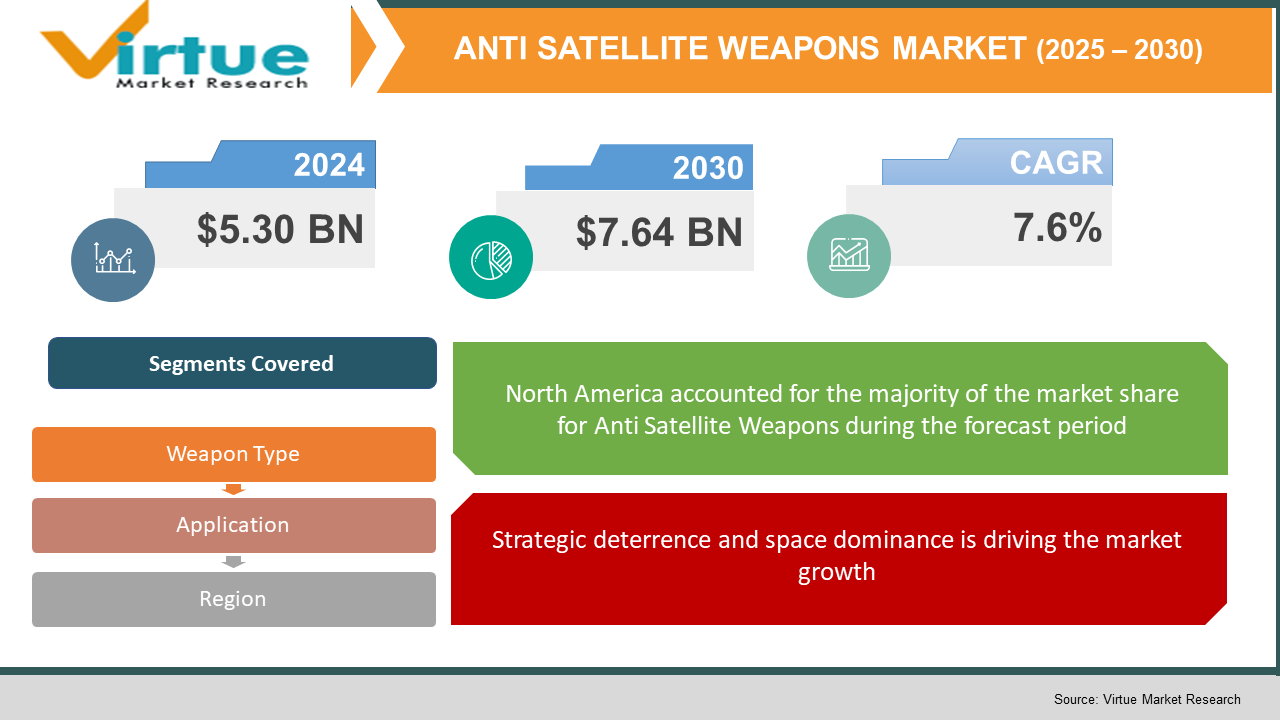

The global anti‑satellite (ASAT) weapons market was valued at approximately USD 5.30 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.6% from 2025 to 2030. By 2030, the market is expected to reach approximately USD 7.64 billion.

This niche market includes development and deployment of kinetic kill vehicles, direct‑ascent missiles, co‑orbital systems, high‑powered lasers, jammers, cyber technologies, and related ground‑based command systems designed to neutralize adversary satellites. Historically rooted in Cold War-era programs, the ASAT market gained renewed momentum in recent years as space has become an increasingly contested domain. Demonstration tests by the United States, Russia, China, and India—like China’s 2007 FY‑1C test and India’s 2019 Mission Shakti—highlight renewed geopolitical competition and capabilities expansion. In parallel, advancements in directed energy, microsatellites, jamming, and cyber operations have expanded the ASAT toolkit. Military space budgets are increasingly allocating funds for anti‑satellite research and deployment, as emerging space powers seek to achieve strategic deterrence, protect their own assets, and deny adversary situational awareness. As the militarization of space intensifies amid major power rivalry, the ASAT weapons market is at the heart of space security competition.

Key market insights:

India’s Mission Shakti in March 2019 achieved a hit on Microsat‑R in LEO within 168 seconds, marking its entry into the ASAT capability club.

Directed‑energy ASAT systems such as lasers and microwave weapons are advancing, with China developing orbital lasers since 2006 and co‑orbital systems being actively researched.

The involvement of private defense contractors and increased space budgets across Asia, North America, and Europe indicate a transition from ad hoc testing to formalized deployment and procurement programs.

Global Anti‑Satellite (ASAT) Weapons Market Drivers

Strategic deterrence and space dominance is driving the market growth

In the evolving strategic landscape, satellites have become critical assets for communications, navigation, reconnaissance, and early warning. ASAT weapon development serves as a deterrent and a means to deny satellite-based advantages to adversaries. The 1967 Outer Space Treaty bans weapons of mass destruction in space but does not restrict conventional ASAT systems. Major powers are pursuing ASAT capabilities to safeguard national security interests by holding adversary satellites at risk. This driver has been reinforced through high-profile tests like China’s FY‑1C intercept, India’s Mission Shakti, and Russia’s 2021 Kosmos‑1408 satellite shootdown. As economies and militaries rely more heavily on space for digital infrastructure, control over space assets translates directly into geopolitical leverage. Countries including the United States, China, Russia, India, and others are funding ASAT programs to achieve strategic competition, build credibility, and potentially deter aggression. For states with limited missile defense capabilities, ASAT systems present a cost‑effective asymmetrical alternative. Strategic deterrence and the pursuit of space dominance continue to propel investment and R&D in antisatellite weapon systems across multiple nations.

Technological advancement in directed energy and micro-satellite systems is driving the market growth

ASAT capabilities are diversifying beyond kinetic interceptors to include directed-energy weapons (DEWs), microsatellites, cyber attacks, jammers, and co-orbital approaches. China’s programs include ground-launched kinetic missiles, co-orbital ASAT spacecraft, and laser dazzling systems that can degrade optical sensors. Directed-energy development has seen global funding rise significantly, with US DEW budgets growing from approximately USD 1.6 billion in 2014 to USD 6.4 billion in 2023. Microsatellite and cube satellite technology allows nations to deploy affordable counter-space platforms capable of maneuvering in orbit. These technological advances lower barriers to entry and expand tactical options beyond more expensive kinetic interceptors. Furthermore, cyber and electronic warfare technologies enable hard-to-trace jamming, spoofing, and hijacking of satellite links. This broad technological base enhances ASAT weapon portfolios, increases market complexity, and expands potential applications from strategic deterrence to tactical battlefield effects.

Geopolitical competition and rising space militarization is driving the market growth

Escalating tensions among the United States, China, Russia, and India, along with growing strategic interest by regional powers, have accelerated space militarization. The formation of the U.S. Space Force and China’s Strategic Support Force institutionalized military space operations. Russia continues to test ASAT missiles and co-orbital systems, while India conducted Mission Shakti in 2019 . The European Union, Japan and Gulf states are also pursuing space defense capabilities through alliances and partnerships. Defense budgets increasingly allocate funds toward space warfare tools, and bilateral/multilateral cooperation aims to standardize offensive and defensive capabilities. International dynamics are fueling a space ASAT arms race, expanding procurement by both state and private sectors. As geopolitical rivalries deepen and jurisdictions seek strategic advantage, the ASAT weapons market is experiencing growth and increasing attention from national security architects.

Global Anti‑Satellite (ASAT) Weapons Market Challenges and Restraints

Proliferation risk and space debris management is restricting the market growth

ASAT tests, especially those involving kinetic force, produce significant orbital debris that can threaten all space users. China’s 2007 FY‑1C test created more than 3,000 trackable debris pieces, with debris expected to persist for decades, raising concerns about Kessler syndrome. Russia’s 2021 destruction of Kosmos‑1408 generated hazardous debris near the ISS. Such activities undermine orbital sustainability and risk causing cascading collisions that could affect civilian infrastructure. Awareness of these hazards has triggered calls for international mitigation norms, transparency measures, and space traffic regulation. Programs aimed at debris tracking and removal are emerging, yet remain costly and complex. The debris concerns impose constraints on testing and weapon deployment strategies. Some states may hesitate to conduct visible tests due to reputational costs and strategic backlash, complicating national ASAT development plans. Managing proliferation risk and debris remains a critical restraint on ASAT activity.

Legal ambiguity and lack of international norms is restricting the market growth

Although the Outer Space Treaty limits weapons of mass destruction, it has no explicit constraints on conventional ASAT systems. Consequently, many states have conducted kinetic ASAT tests with little legal or diplomatic repercussion. The fragmented international legal framework, absent clear treaties or norms governing ASAT testing and deployment, generates operational risk and uncertainty for weapon development programs. Ambiguities over dual-use technologies, satellite jamming, and co-orbital vehicles complicate oversight. Proposals for new legal instruments—including bans on debris-generating tests—lack enforcement mechanisms and consensus among major powers. Diplomatic efforts, like moratoria by the U.S., are voluntary and nonbinding. Without normative clarity, national programs remain subject to geopolitical shifts, raising the possibility of an uncontrolled expansion of ASAT capabilities. Developers face reputational and legal uncertainties, especially when tests produce debris that imperils third-party assets.

Market opportunities

The anti‑satellite weapons market presents significant opportunities in several technical and strategic domains. Kinetic interceptors remain a core frontier, attracting demand from nations seeking strategic deterrence and satellite denial capabilities. Modern ASAT missiles are evolving: lighter, more affordable, and capable of precise low-earth-orbit engagements. Directed energy systems represent an emerging frontier, with military budgets allocating increasingly to laser and microwave weapons for reversible disabling of sensors or permanent satellite damage. These systems offer low-debris and on-demand options. Co-orbital satellites present another opportunity; they can provide flexible, reversible ASAT capacity, facilitating stealth, loiter, and orbital rendezvous as part of broader military doctrine. Cyber and electronic warfare tools for satellite command link disruption enable deniable and low signature effects. All these ASAT technologies are supported by rising demand for space situational awareness (SSA), ground-based command infrastructure, and SSR (surveillance, reconnaissance, tracking) systems. Nations and private sector defense contractors are investing heavily to develop test ranges, telescopes, radar systems, and microsatellite constellations for ASAT demonstration and verification. Additionally, space traffic and debris mitigation services represent niche opportunity areas adjacent to ASAT proliferation; private companies can offer debris tracking and remediation services under international agreements. As geopolitical competition and space reliance grow, demand for ASAT weapons and support services—including testing, integration, remote sensing, command-and-control infrastructure—will expand. The challenge of balancing operational capability with orbital sustainability will drive innovation in low-debris, directed-energy, reversible, and cyber-capable systems, positioning ASAT technology as a core component of national defense in the next decade.

ANTI SATELLITE WEAPONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.6% |

|

Segments Covered |

By weapon Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lockheed Martin, Northrop Grumman, Boeing, Raytheon, Thales, Airbus, CASC, DRDO, Roscosmos, and Rafael. |

Anti Satellite Weapons Market segmentation

Anti Satellite Weapons Market By Weapon Type:

• Kinetic kill vehicles (direct‑ascent missiles)

• Co‑orbital microsatellites

• Directed‑energy weapons (lasers, microwave)

• Electronic warfare and jamming systems

• Cyber ASAT tools

Kinetic kill vehicle systems, particularly direct‑ascent missiles, are the dominant segment in the ASAT market. These systems have been tested by the US, Russia, China, and India, underscoring their operational viability. They deliver high-confidence destruction of target satellites in low earth orbit within seconds. Despite the debris concerns, nation‑state doctrines favor kinetic interceptors for their clear deterrent value and technical maturity. Market and procurement data show that most ASAT funding is allocated to missile interceptor development and test ranges. While advanced directed-energy and cyber systems are growing, direct-ascent kinetic interceptors remain the preferred platform for strategic penetration and denial missions.

Anti Satellite Weapons Market By Application:

• Strategic military deterrence

• Counter-reconnaissance / intelligence denial

• Tactical battlefield satellite disruption

• Space traffic and debris mitigation (dual‑use)

Strategic military deterrence is the primary application of ASAT weapons. Countries seek ASAT capabilities to deter adversaries by credibly signaling they can degrade or destroy critical space assets. This deterrence strategy has driven operational testing by China, India, and Russia . Strategic-level investment in ASAT systems supports national defense doctrines, space force development, and negotiated arms control leverage. While tactical battlefield satellite disruption is increasingly relevant in regional conflicts, the dominant usage remains strategic denial of satellite-based ISR and communication infrastructure. This is reflected in higher defense budget allocations for strategic ASAT capabilities, especially kinetic interceptors and ground-based control systems.

Anti Satellite Weapons Market Regional segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the dominant region in the global ASAT weapons market. The United States leads in R&D, command infrastructure, directed energy research, and integration with the Space Force. Although the US has refrained from kinetic tests since 2008, it continues to develop and test laser and cyber ASAT technologies. Deep defense budgets, a robust aerospace industry, and existing test sites underpin its market dominance. Russia and China follow, investing heavily in kinetic interceptors, co‑orbital systems, and laser research. Europe, Japan, and Gulf countries have emerging programs but remain smaller players. With more advanced architecture and integration across space and terrestrial defense, North America leads the ASAT weapons market in both innovation and expenditure.

COVID‑19 Impact Analysis on the Anti‑Satellite Weapons Market

The COVID‑19 pandemic had limited direct impact on ASAT weapons development given the nature of military programs, but it disrupted international supply chains, test schedules, and multinational collaboration activities. Travel restrictions and lockdowns delayed satellite launches, test range preparations, and coordination among space actor agencies. Facilities reliant on shared resources—such as radar, optical tracking, and specialized laboratories—experienced delays as lockdowns paused non‑essential research activities. Budget reallocation to public health and economic relief impacted defense contract timelines in some nations. However, strategic competition in space did not subside. In fact, by mid-2020, geopolitical tensions—particularly between the US, China, and Russia—prompted renewed urgency in space weaponization. The United States emphasized ASAT alternative technologies, including laser and cyber systems, and pushed forward experimental ground-based tests. China and Russia continued covert testing programs, while India completed internal development in preparation for new missions. By late 2021, nations were accelerating ASAT-capable satellite constellations and building debris awareness infrastructure. Thus, while COVID‑19 introduced short-term procedural and logistic challenges, it did not hinder core strategic ASAT programs. Instead, it reinforced reliance on domestic infrastructure, remote testing, and resilience in defense R&D cycles, amplifying long-term strategic momentum in space weaponization.

Latest trends/Developments

Recent developments in the ASAT market feature diversification of technological approaches and a shift toward low‑debris and reversible capabilities. Directed-energy systems—such as high-powered lasers and microwave weapons—are being refined for reversible sensor blinding and fully destructive applications . China and India continue laser ASAT research, and the US invests heavily in airborne and ground-based DEWs. Co-orbital microsatellite systems capable of inspection, proximity operations, and potential satellite disabling are entering testing and deployment phases. Cyber and electronic warfare ASAT tools—targeting satellite telemetry, tracking, or command links—offer low-signature disruption without physical debris. Nations also prioritize space situational awareness, strengthening tracking networks and debris cataloguing systems to manage collision risk . International norm-building efforts, such as the Biden administration's moratorium on kinetic tests, reflect increased political pressure to regulate space militarization . Commercial companies and defense primes are entering the space weapons arena, developing turnkey ASAT systems, SSA services, and testing infrastructure. Combined, these trends indicate a maturing market, moving from ad hoc verboten demonstrations to diversified, doctrinally supported, technologically innovative, and politically regulated ASAT capabilities.

Key Players:

Lockheed Martin

- Northrop Grumman

- Boeing

- Raytheon Technologies

- Thales Group

- Airbus Defence & Space

- China Aerospace Science and Technology Corporation

- Defence Research and Development Organisation (India)

- Roscosmos / Russian Aerospace Defense

- Rafael Advanced Defense Systems

Chapter 1. Anti Satellite Weapons Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. ANTI SATELLITE WEAPONS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. ANTI SATELLITE WEAPONS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

b4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. ANTI SATELLITE WEAPONS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ANTI SATELLITE WEAPONS MARKET – By Weapon Type

6.1 Introduction/Key Findings

6.1 Kinetic kill vehicles (direct ascent missiles)

6.2 Co orbital microsatellites

6.3 Directed energy weapons (lasers, microwave)

6.4 Electronic warfare and jamming systems

6.5 Cyber ASAT tools

6.6 Y-O-Y Growth trend Analysis By Weapon Type

6.7 Absolute $ Opportunity Analysis By Weapon Type, 2025-2030

Chapter 7. ANTI SATELLITE WEAPONS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Strategic military deterrence

7.3 Counter-reconnaissance / intelligence denial

7.4 Tactical battlefield satellite disruption

7.5 Space traffic and debris mitigation (dual use)

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. ANTI SATELLITE WEAPONS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Weapon Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Weapon Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Weapon Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Weapon Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Weapon Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. ANTI SATELLITE WEAPONS MARKET – Company Profiles – (Overview, Weapon Type Type , Portfolio, Financials, Strategies & Developments)

9.1 Lockheed Martin

9.2 Northrop Grumman

9.3 Boeing

9.4 Raytheon Technologies

9.5 Thales Group

9.6 Airbus Defence & Space

9.7 China Aerospace Science and Technology Corporation

9.8 Defence Research and Development Organisation (India)

9.9 Roscosmos / Russian Aerospace Defense

9.10 Rafael Advanced Defense Systems

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global anti‑satellite (ASAT) weapons market was valued at approximately USD 5.30 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.6% from 2025 to 2030. By 2030, the market is expected to reach approximately USD 7.64 billion.

Strategic deterrence, advances in directed‑energy and microsatellite systems, and geopolitical competition are key drivers

Segments include kinetic missiles, co‑orbital systems, directed‑energy, electronic warfare, and cyber ASAT tools; by application, strategic deterrence leads.

North America leads due to deep defense budgets, industrial infrastructure and test capability.

Leading players include Lockheed Martin, Northrop Grumman, Boeing, Raytheon, Thales, Airbus, CASC, DRDO, Roscosmos, and Rafael.