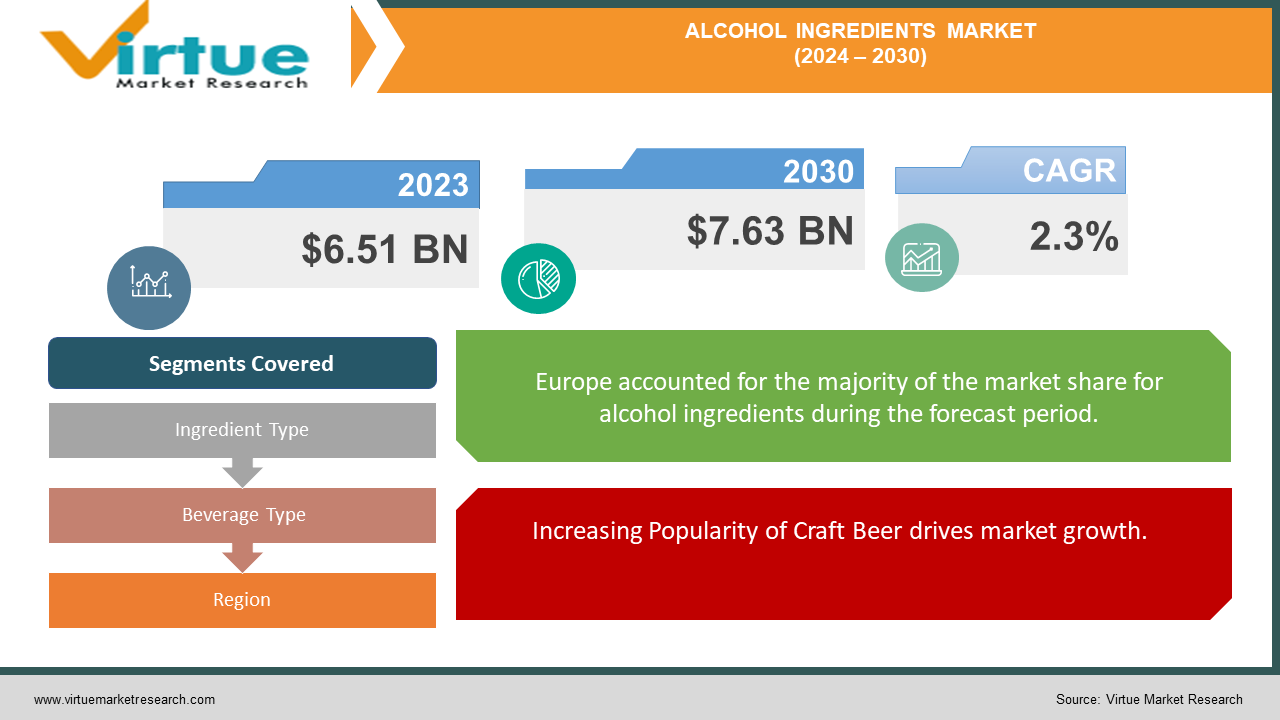

Alcohol Ingredients Market Size (2024 – 2030)

The Alcohol Ingredients Market was valued at USD 6.51 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 7.63 billion by 2030, growing at a CAGR of 2.3%.

Alcohol is produced through the fermentation of various ingredients, such as yeast, enzymes, colorants, flavorings, and salts, combined with grains, fruits, or vegetables. The diverse range of ingredients used for flavoring alcoholic beverages results in a wide array of tastes and profiles. Consequently, there is an increased demand for components used in alcohol production, which drives the global market for infusion ingredients. The significant rise in demand and consumption of alcoholic drinks has led to a greater requirement for yeast.

Key Market Insights:

The alcohol ingredients market focuses on the sourcing, supply, and distribution of a wide variety of components essential for the production of alcoholic beverages. This includes ingredients such as yeast, enzymes, and botanicals, as well as specialized additives and flavor enhancers.

Alcohol Ingredients Market Drivers:

Increasing Popularity of Craft Beer drives market growth.

In recent years, there has been a notable increase in the demand for craft brewing and distilling. This surge is driven by global consumer interest in unique and flavorful beers, which in turn fuels the market for alcoholic additives within the beer industry. The primary ingredients used in brewing include malt extract, adjuncts or grains, hops, beer yeast, and various beer additives. Adjuncts, such as maize (corn), rice, or sugar, serve as cost-effective alternatives to malted barley and are commonly used. Additionally, less conventional starch sources like agave in Mexico, potatoes in Brazil, millet, sorghum, and cassava root in Africa are utilized.

Brewing-grade malt extracts are crafted from high-quality malts, with specialty malts providing additional colors and flavors. These malts contribute to the desired unique character and flavor of specific beer styles. To enhance richness and complexity, these malts are often subjected to extended baking or roasting at elevated temperatures. The expansion of craft beer production and the emergence of microbreweries have further driven the demand for specialty malts.

Alcohol Ingredients Market Restraints and Challenges: High Volatility and Prices hinder market growth.

One of the main challenges hindering the global growth of the alcohol ingredients market is the volatility in pricing and inconsistent supply of raw materials. In an effort to keep production costs manageable, mass-produced beers often use less expensive alternative ingredients. For example, many popular beers now replace traditional hops with rice or corn to reduce expenses. The unprecedented increases in transportation, service, and raw material costs have a detrimental impact on the profitability of ingredient suppliers.

Furthermore, research conducted by scientists from China, the United Kingdom, and the United States has revealed that the production of malted barley—a crucial ingredient in beverages such as beer, whiskey, and scotch—may be significantly affected by climate change. This conclusion was reached through predictions concerning future heat and drought trends.

Alcohol Ingredients Market Opportunities:

Launching New Flavors creates opportunities in the market.

The surge in alcoholic beverage consumption has intensified brand and ingredient competition, leading to the creation of new flavors. Beers are gaining popularity not only for traditional varieties offered by major breweries but also for a diverse range of flavors. Craft beers that feature combinations of salty, fruity, and tart notes, along with innovative ingredients and flavors, are particularly favored by millennials globally.

ALCOHOL INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2.3% |

|

Segments Covered |

By Ingredient Type, Beverage Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Dohler Group, KoninklijkeDsm NV, Ashland Global Holdings Inc., Chr Hansen Holding AS, Rahr Corporation Givaudan, Lesaffre International, Esseco Group, Lallemand Inc. |

Alcohol Ingredients Market Segmentation: By Ingredient Type

-

Yeast

-

Enzymes

-

Colorants

-

Flavors and Salts

-

Malt Ingredients

-

Other Ingredients

The malt ingredients segment is the leading contributor to the market. Malt plays a pivotal role in the alcoholic beverage industry, providing the sugars and carbohydrates necessary for imparting beer with its distinctive flavor and high alcohol content. This segment commands a significant market share due to its extensive use in products like beer and spirits. For example, the Australian whiskey company Starward has recently introduced Australian Single Malt Whisky to the U.S. market.

Yeast, a single-celled fungus, is essential for the fermentation or leavening of most alcoholic beverages, including beer, wine, and whiskey. The primary types of yeast used in alcohol production are ale yeast and lager yeast, each of which encompasses a variety of specific strains. While traditional alcoholic beverages such as feni in India or rice wine in Vietnam have long been consumed, the Asia-Pacific region has seen rapid urbanization and westernization in recent years, driving an increased demand for commercially produced alcoholic drinks.

Enzymes are extensively utilized in alcohol production due to their ability to enhance, accelerate, and catalyze the fermentation process, resulting in higher product yields and reduced production costs. The use of industrial alcohol enzymes also allows brewers to utilize locally available, less costly raw materials. The introduction of suitable enzymes at various stages of brewing facilitates faster maturation, making the process more appealing to manufacturers.

Alcohol Ingredients Market Segmentation: By Beverage Type

-

Beer

-

Spirits

-

Wine

-

Other Spirits

The beer segment holds the largest market share, driven by the growing global production of beer. Major beer-producing regions such as Asia-Pacific and Europe are key contributors to the demand for ingredients in beer. As the popularity of craft beer increases, there is a heightened focus on quality, diverse consumer flavors, and revenue potential for brewers, further boosting the need for ingredients. Governments in various countries, including Australia, New Zealand, Belgium, Mexico, China, and the United Kingdom, are supporting the craft beer industry and the establishment of new breweries due to its positive effects on economic growth, job creation, and consumer willingness to pay a premium for superior-tasting beers.

Whiskey, often associated with sophistication and refinement, drives consumer demand for unique and distinctive drinking experiences. The growing interest in whiskey is influenced by changing lifestyles and an increase in socializing among working professionals, which is propelling the industry forward. There is a rising demand for premium and super-premium whiskeys in both developed and developing countries, such as India, China, South Korea,

Australia, the United States, France, and Germany. For instance, the Scotch whisky market is expected to grow rapidly due to the rising consumer preference for high-end products. Scotch whisky is produced using malted barley and unmalted grains like maize or wheat.

Rum, a spirit derived from sugar, can be made from molasses, syrup, or pure cane sugar. Blackstrap molasses, a versatile byproduct of sugar cane refinement, is used to make rum, enhance the color of fermented malt beverages, and add flavor. Additional ingredients such as caramelized sugar, fruit extracts, and spices contribute to a broader range of flavors. Modern mass-produced rums often blend different ages of rum to achieve a consistent flavor and add caramel to ensure uniform color across batches. Craft rum is increasingly preferred over commercial rum for its smooth flavor, superior quality, and authentic taste.

Alcohol Ingredients Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

Europe remains the largest revenue contributor to the market. In the UK, there is an increasing demand for alcohol as consumers seek out unique flavors and visually appealing hues. This trend

is driving growth in the market for alcohol-related ingredients such as colorants, flavors, and salts used in creating innovative alcoholic beverages. Additionally, malt—primarily produced in the UK from high-quality malting barley sourced from domestic farmers, particularly in the eastern regions—is a staple ingredient. Barley malt remains the most favored all-malt product for brewing in the country.

Asia-Pacific is anticipated to experience growth throughout the forecast period. Social and cultural shifts have enhanced the potential of China's alcoholic beverage sector. The expansion of the bar scene has provided more venues for drinking, increasing the demand for alcoholic components. China, with its 251 brewing companies operating 550 breweries, has seen a rise in ingredient demand. Traditional Chinese alcohol, a grain-based spirit such as baijiu—which is made from sorghum, rice, wheat, and barley—is commonly consumed during formal events and holidays. Baijiu constitutes a significant portion of the global spirits market, reflecting its status as China's national beverage.

In the US, particularly in Michigan, there has been a concerted effort to increase the production of alcoholic substances such as malt. Agricultural producers and the US government are working to expand the cultivation of malting barley, hops, and high-quality barley. Canada is also contributing to market growth due to its higher proportion of heavy drinkers and the rise of new artisan distilleries producing a variety of liqueurs and spirits, including vodka and gin.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic led to the closure of many pubs, restaurants, and taprooms as governments implemented social distancing measures, negatively impacting the global alcohol ingredients market. A study by the Brewers Association revealed a 30.5 percent decline in total brewery sales in the United States in May compared to the previous year. During April, nearly 89% of brewing companies either halted or reduced their production due to decreased year-over-year sales. However, with the gradual improvement in the COVID-19 situation and the easing of restrictions on foodservice channels, the alcohol ingredients market is anticipated to recover and return to its previous levels of consumption this year.

Latest Trends/ Developments:

In response to evolving market demands, both large-scale and specialty brewers are adapting by incorporating a variety of fruits—such as berries, pineapple, and mango—as well as herbs and spices into their products. This trend is expected to generate ample opportunities for companies in the alcohol ingredients market.

Furthermore, the market is significantly influenced by the preferences of younger consumers, who seek authenticity in the quality and production methods of alcoholic beverages. This demand for unique tastes and experiences has driven substantial innovation and diversification in product lines, resulting in a broad array of novel infusions.

Key Players:

These are top 10 players in the Alcohol Ingredients Market :-

-

Archer Daniels Midland Company

-

Dohler Group

-

KoninklijkeDsm NV

-

Ashland Global Holdings Inc.

-

Chr Hansen Holding AS

-

Rahr Corporation Givaudan

-

Lesaffre International

-

Esseco Group

-

Lallemand Inc.

Chapter 1. Alcohol Ingredients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Alcohol Ingredients Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Alcohol Ingredients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Alcohol Ingredients Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Alcohol Ingredients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Alcohol Ingredients Market – By Ingredient Type

6.1 Introduction/Key Findings

6.2 Yeast

6.3 Enzymes

6.4 Colorants

6.5 Flavors and Salts

6.6 Malt Ingredients

6.7 Other Ingredients

6.8 Y-O-Y Growth trend Analysis By Ingredient Type

6.9 Absolute $ Opportunity Analysis By Ingredient Type, 2024-2030

Chapter 7. Alcohol Ingredients Market – By Beverage Type

7.1 Introduction/Key Findings

7.2 Beer

7.3 Spirits

7.4 Wine

7.5 Other Spirits

7.6 Y-O-Y Growth trend Analysis By Beverage Type

7.7 Absolute $ Opportunity Analysis By Beverage Type, 2024-2030

Chapter 8. Alcohol Ingredients Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Ingredient Type

8.1.3 By Beverage Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Ingredient Type

8.2.3 By Beverage Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Ingredient Type

8.3.3 By Beverage Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Ingredient Type

8.4.3 By Beverage Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Ingredient Type

8.5.3 By Beverage Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Alcohol Ingredients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland Company

9.2 Dohler Group

9.3 KoninklijkeDsm NV

9.4 Ashland Global Holdings Inc.

9.5 Chr Hansen Holding AS

9.6 Rahr Corporation

9.7 Givaudan

9.8 Lesaffre International

9.9 Esseco Group

9.10 Lallemand Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The alcohol ingredients market focuses on the sourcing, supply, and distribution of a wide variety of components essential for the production of alcoholic beverages. This includes ingredients such as yeast, enzymes, and botanicals, as well as specialized additives and flavor enhancers.

The top players operating in the Alcohol Ingredients Market are - Archer Daniels Midland Company, Dohler Group, KoninklijkeDsm NV, Ashland Global Holdings Inc., Chr Hansen Holding AS, Rahr Corporation, Givaudan, Lesaffre International, Esseco Group and Lallemand Inc.

The COVID-19 pandemic led to the closure of many pubs, restaurants, and taprooms as governments implemented social distancing measures, negatively impacting the global alcohol ingredients market.

The surge in alcoholic beverage consumption has intensified brand and ingredient competition, leading to the creation of new flavors. Beers are gaining popularity not only for traditional varieties offered by major breweries but also for a diverse range of flavors.

Asia-Pacific is anticipated to experience growth throughout the forecast period.