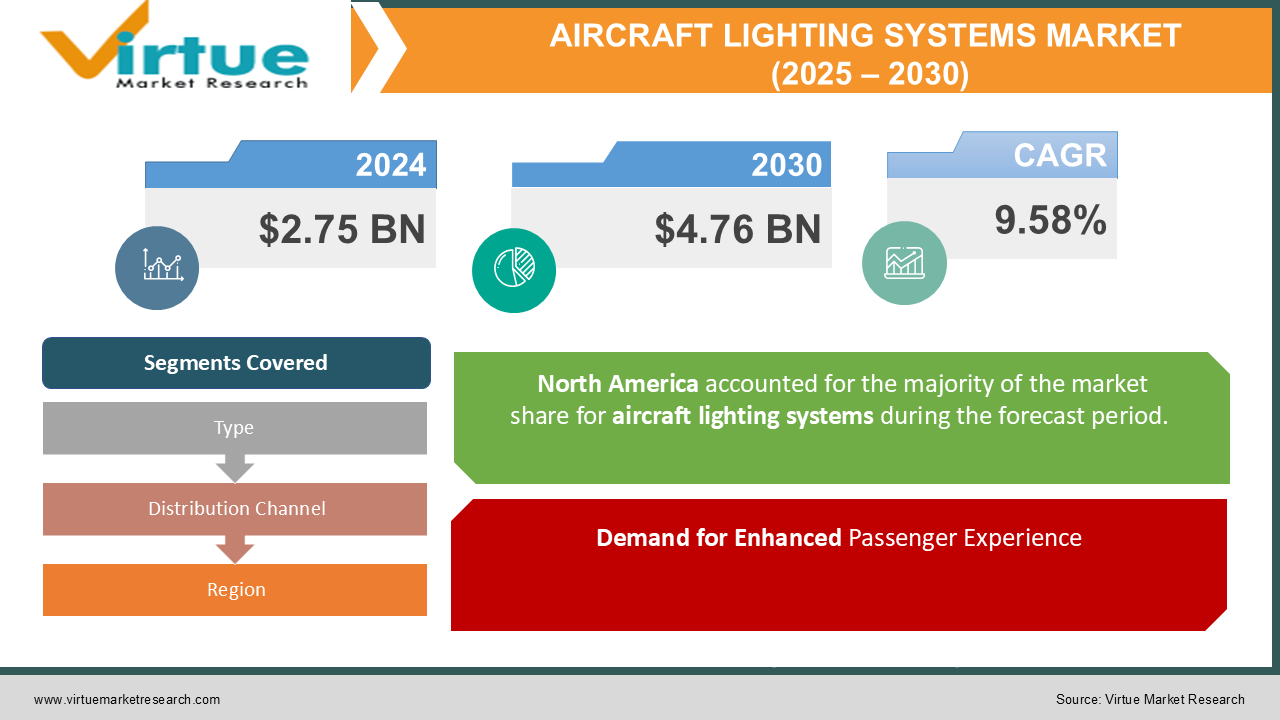

Aircraft Lighting Systems Market Size (2025 – 2030)

The Aircraft Lighting Systems Market was valued at USD 2.75 Billion in 2024 and is projected to reach a market size of USD 4.76 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.58%.

The aircraft lighting systems market represents a critical segment of the aerospace industry, emphasizing advancements in both functionality and aesthetics. Aircraft lighting serves multiple purposes, including safety, navigation, communication, and passenger comfort. From take-off to landing, these systems ensure operational efficiency and enhance the overall experience for crew and passengers. Modern aircraft lighting systems are transitioning from traditional incandescent and fluorescent bulbs to advanced LED and OLED technologies. These newer systems are not only more energy-efficient but also provide extended lifespans, reduced maintenance costs, and improved environmental sustainability. The growth of air travel demand, coupled with stringent safety regulations and a focus on passenger-centric designs, has catalysed the innovation and adoption of advanced lighting technologies across commercial, military, and general aviation sectors.

Key Market Insights:

-

Over 70% of new commercial aircraft delivered in 2023 were equipped with advanced LED lighting systems.

-

Aircraft cabin lighting accounted for approximately 45% of the market share within the global lighting systems segment.

-

The average operational lifespan of LED-based aircraft lighting systems increased by 25% compared to 2020 standards.

-

60% of airlines incorporated customizable mood lighting in their premium cabins in 2023.

-

Sales of OLED lighting systems grew by 30% compared to the previous year.

-

The demand for emergency lighting systems increased by 18% due to heightened safety regulations.

-

Exterior lighting systems represented 35% of the total market revenue in 2023.

-

Dynamic cabin lighting solutions were implemented in 40% of newly manufactured aircraft.

-

Smart lighting systems, integrated with IoT, witnessed a growth of 22% in sales.

-

50% of airline customers cited improved cabin lighting as a factor in enhanced flight experience surveys.

Market Drivers:

1. Demand for Enhanced Passenger Experience

Airlines are increasingly focusing on enhancing the passenger experience to differentiate themselves in a competitive market. Lighting plays a pivotal role in creating a comfortable, aesthetically pleasing cabin environment. Dynamic mood lighting, tailored to different phases of flight, improves ambiance and helps mitigate jet lag. Furthermore, premium-class traveller's demand high-end features like customizable lighting systems that blend luxury with functionality. This consumer-centric demand drives airlines to adopt cutting-edge lighting technologies that ensure passenger comfort while maintaining operational efficiency.

2. Technological Advancements in Energy-Efficient Lighting

The shift toward energy-efficient lighting technologies, such as LEDs and OLEDs, is another significant market driver. These systems consume significantly less power, reducing operational costs and enhancing sustainability—critical factors for airlines aiming to meet environmental regulations. LED lighting systems also offer extended lifespans and reduced maintenance needs, further solidifying their appeal. Additionally, advancements in smart lighting systems allow integration with IoT, enabling automation, remote control, and real-time monitoring, which align with the broader industry trend toward digital transformation. This technological evolution is propelling the adoption of advanced lighting systems across all aircraft types.

Market Restraints and Challenges:

The Aircraft Lighting Systems Market, while experiencing remarkable growth, is also constrained by several factors that pose significant challenges to stakeholders. These issues are linked to high costs, stringent regulations, technical complexities, and market dynamics, which require innovative approaches and strategic planning for effective mitigation. One of the major challenges in the market is the high initial cost of advanced lighting systems. While LED and OLED technologies offer superior efficiency and performance, their upfront costs are significantly higher than traditional lighting solutions. For airlines operating on tight margins, this expense can deter immediate adoption, especially for smaller operators and regional airlines. Although the long-term savings in maintenance and energy consumption are undeniable, the financial barrier to entry remains a challenge for stakeholders, particularly in developing markets. Another significant restraint is the complexity of retrofitting older aircraft with advanced lighting systems. Retrofitting involves intricate processes, including rewiring, component integration, and compliance with safety standards, which can increase downtime and costs. The incompatibility of certain lighting technologies with legacy systems further complicates retrofitting efforts, leading to delayed upgrades or partial adoption. Airlines often weigh the cost of retrofitting against fleet renewal, which can impact the overall market potential. Stringent safety and regulatory standards are another hurdle in the Aircraft Lighting Systems Market. Regulatory bodies like the Federal Aviation Administration (FAA) and International Civil Aviation Organization (ICAO) impose strict requirements on the design, installation, and operation of lighting systems to ensure passenger and crew safety. While these regulations are essential, they often increase the development time and cost for manufacturers, as extensive testing and certification are required. These requirements can also slow down the pace of innovation, as new products must undergo rigorous scrutiny before market entry. Additionally, technical challenges related to system durability and performance in extreme conditions pose significant constraints. Aircraft lighting systems must operate reliably under varying temperatures, altitudes, and weather conditions. Ensuring consistent performance while minimizing maintenance needs is a challenge, particularly for exterior lighting systems like landing and anti-collision lights, which are exposed to harsh environments. Manufacturers must continually innovate to address these issues without compromising quality or efficiency. The shortage of skilled technicians and engineers specializing in advanced lighting systems is another critical challenge. As lighting technologies become more complex, the need for expertise in design, integration, and maintenance grows. However, the aerospace industry is facing a talent gap, which can delay production and increase costs. This issue is further compounded by the rapid pace of technological advancements, requiring ongoing training and skill development to keep up with market demands. Finally, supply chain disruptions remain a persistent challenge, particularly in the wake of the COVID-19 pandemic. Delays in the availability of raw materials and components have impacted the timely production and delivery of lighting systems. This issue is exacerbated by geopolitical tensions and trade restrictions, which have created uncertainties in the global supply chain. Airlines and manufacturers must navigate these disruptions carefully to maintain operational efficiency and meet market demands.

Market Opportunities:

Despite the challenges, the Aircraft Lighting Systems Market offers abundant opportunities driven by evolving technological advancements, growing environmental consciousness, and increasing demand for personalization and luxury in aviation. These opportunities can be leveraged by stakeholders through strategic investments, partnerships, and innovation. One of the most promising opportunities lies in the development of sustainable and eco-friendly lighting solutions. With global aviation facing intense scrutiny over its carbon footprint, airlines are actively seeking ways to reduce their environmental impact. Energy-efficient lighting systems, such as LEDs and OLEDs, align with this goal by consuming less power and generating less heat compared to traditional systems. Manufacturers can capitalize on this trend by introducing products that meet both efficiency and sustainability standards, appealing to environmentally conscious airlines and passengers alike. The rise of smart lighting technologies also presents significant growth potential. These systems can integrate seamlessly with the Internet of Things (IoT) to enable automation, real-time monitoring, and advanced features like adaptive lighting. For instance, smart cabin lighting systems can dynamically adjust brightness and colour temperature based on the time of day or flight phase, enhancing passenger comfort. This innovation not only improves the in-flight experience but also optimizes energy usage, creating a win-win situation for airlines and passengers. Another lucrative opportunity lies in the luxury and premium segment of the market. As competition among airlines intensifies, differentiating through superior cabin experiences has become a priority. Advanced lighting systems that offer customizable mood settings, ambient lighting, and touchless controls are increasingly being adopted in first and business-class cabins. Airlines that invest in these premium features can attract high-value passengers, thereby boosting revenue and market share. The retrofitting market is another area ripe with opportunities. As many airlines look to extend the lifespan of their existing fleets, retrofitting older aircraft with modern lighting systems has become a cost-effective solution. This trend is particularly prominent in the commercial aviation sector, where upgrading cabins with state-of-the-art lighting can significantly enhance passenger satisfaction without the need for new aircraft purchases. Manufacturers and service providers specializing in retrofitting can capitalize on this growing demand by offering tailored solutions that minimize downtime and costs. Emerging markets also present untapped potential for the Aircraft Lighting Systems Market. Rapid economic growth and increasing air travel demand in regions like Asia-Pacific and the Middle East have led to significant investments in aviation infrastructure. As new airports and airlines emerge, the demand for advanced lighting systems is expected to rise, creating opportunities for market expansion. Stakeholders can establish a strong foothold in these regions through strategic partnerships and localized product offerings. Lastly, advancements in lightweight materials and wireless technologies offer opportunities to enhance efficiency and reduce costs. By utilizing lightweight components, manufacturers can help airlines achieve better fuel efficiency and lower operating costs. Similarly, wireless lighting systems eliminate the need for extensive wiring, reducing aircraft weight and simplifying installation processes. These innovations not only address key market challenges but also open new avenues for growth and differentiation.

AIRCRAFT LIGHTING SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.58% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell Aerospace, Collins Aerospace, Zodiac Aerospace, Diehl Aviation, Astronics Corporation, STG Aerospace, Cobham PLC, Aveo Engineering Group, Oxley Group, Luminator Technology Group |

Aircraft Lighting Systems Market Segmentation: by Type

-

Cabin Lighting

-

Exterior Lighting

-

Emergency Lighting

-

Cockpit Lighting

Cabin lighting remains the most dominant type in the market, driven by its critical role in enhancing passenger comfort and aesthetics. The fastest-growing segment, smart cabin lighting, leverages IoT and automation to offer dynamic, personalized lighting solutions that improve energy efficiency and passenger satisfaction.

Aircraft Lighting Systems Market Segmentation: by Distribution Channel

-

Direct Sales

-

Distributors

-

Online Platforms

Direct sales dominate the market, as manufacturers maintain close relationships with airlines and OEMs. However, online platforms are witnessing rapid growth due to their convenience and accessibility, particularly for smaller operators and retrofit projects.

Aircraft Lighting SystemsMarket Segmentation: by Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Middle East and Africa

-

Latin America

North America leads the market in terms of share, driven by high aviation activity, technological advancements, and established infrastructure. Asia-Pacific, on the other hand, is the fastest-growing region, fueled by economic growth, increasing air travel demand, and significant investments in new aircraft and airport infrastructure.

COVID-19 Impact Analysis:

The COVID-19 pandemic had profound effects on the Aircraft Lighting Systems Market, with disruptions spanning production, supply chains, and demand. During the initial phases of the pandemic, the aviation industry experienced unprecedented declines in passenger traffic, leading to reduced orders for new aircraft and associated lighting systems. Airlines focused on survival strategies, postponing fleet upgrades and new acquisitions. However, the market began to recover in the post-pandemic era, with airlines prioritizing health and safety innovations such as UV disinfection lighting systems to regain passenger confidence.

Latest Trends and Developments:

Recent trends in the Aircraft Lighting Systems Market emphasize sustainability, personalization, and technological integration. LED and OLED technologies continue to dominate due to their energy efficiency and durability. Innovations in smart lighting systems, capable of dynamic adjustments and IoT integration, have gained traction. The adoption of touchless controls and circadian rhythm lighting highlights the shift toward enhancing passenger well-being and hygiene. Additionally, advancements in lightweight materials and wireless systems are addressing efficiency challenges, paving the way for next-generation aircraft lighting solutions.

Key Players in the Market:

-

Honeywell Aerospace

-

Collins Aerospace

-

Zodiac Aerospace

-

Diehl Aviation

-

Astronics Corporation

-

STG Aerospace

-

Cobham PLC

-

Aveo Engineering Group

-

Oxley Group

-

Luminator Technology Group

Chapter 1. Aircraft Lighting Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aircraft Lighting Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aircraft Lighting Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aircraft Lighting Systems Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aircraft Lighting Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aircraft Lighting Systems Market – By Type

6.1 Introduction/Key Findings

6.2 Cabin Lighting

6.3 Exterior Lighting

6.4 Emergency Lighting

6.5 Cockpit Lighting

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Aircraft Lighting Systems Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 Online Platforms

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Aircraft Lighting Systems Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Aircraft Lighting Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Honeywell Aerospace

9.2 Collins Aerospace

9.3 Zodiac Aerospace

9.4 Diehl Aviation

9.5 Astronics Corporation

9.6 STG Aerospace

9.7 Cobham PLC

9.8 Aveo Engineering Group

9.9 Oxley Group

9.10 Luminator Technology Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Key factors driving the growth of the Aircraft Lighting Systems Market include advancements in energy-efficient lighting technologies like LEDs and OLEDs, increasing demand for enhanced passenger comfort and safety, regulatory requirements for improved lighting systems, and the rise of eco-friendly aviation solutions aimed at reducing operational costs and environmental impact.

Main concerns about the Aircraft Lighting Systems Market include the high costs of advanced lighting technologies, challenges in meeting stringent regulatory standards, the complexity of integrating new systems into existing aircraft, potential supply chain disruptions, and the need for continuous innovation to address evolving safety, energy efficiency, and performance demands.

Honeywell Aerospace, Collins Aerospace, Zodiac Aerospace, Diehl Aviation, Astronics Corporation, STG Aerospace, Cobham PLC.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.