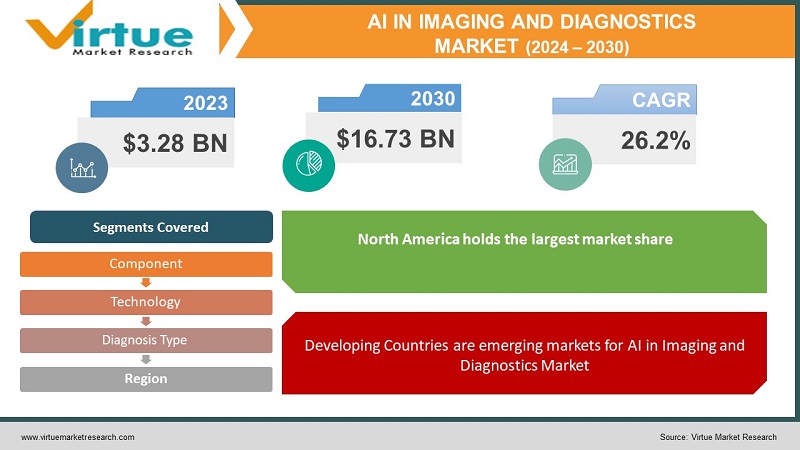

Global AI in Imaging and Diagnostics Market Size (2024 – 2030)

According to our research report, the Global AI in the imaging and diagnostics market was valued at USD 3.28 billion and is projected to reach a market size of USD 16.73 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 26.2%.

Industry Overview

Over the projected period, the expanding ageing population, along with increased investment in the healthcare ecosystem, is predicted to favourably affect overall market growth. Developed countries have faced this demographic problem and have invested in providing people with inexpensive and improved healthcare systems, giving the industry a boost. Lung and breast cancer are commonly detected via X-ray imaging. A computed tomography (CT) scan can also reveal tiny abnormalities in the lungs that an x-ray would miss. In the medical field, X-rays are used for confirmation, diagnosis, and support.

Furthermore, X-ray imaging technology is utilised to diagnose a wide range of disorders, including fractures, infection, cancer, and arthritis. As a result, the rising number of cases linked with these illnesses is estimated to have a favourable influence on market growth. Furthermore, the elderly are particularly susceptible to arthritis. Precision medicine's future depends on the capacity to assess massive datasets of varied biology (e.g., metabolic, genomic, neuroimaging) and clinical variables simultaneously while adding crucial clinical domain knowledge. With such increasing demands, AI's function is projected to expand.

Several medical imaging devices will be connected to the cloud shortly, where AI algorithms will evaluate the data and assist human physicians in screening, analysing, and diagnosing patients. The significance of using artificial intelligence to interpret medical photos is immense. Only roughly 4,000 radiologists serve Mexico's 130 million inhabitants. In nations like Mexico, AI in medical imaging may have the greatest impact. At the 105th RSNA Scientific Assembly and Annual Meeting in December 2019, IBM Watson Health showcased current clients and collaborations for its IBM Watson Health Imaging artificial intelligence (AI) platform. Clinical Review 3.0, a technology that examines medical imaging scans and their related reports to uncover possibly overlooked results, was recently introduced in the United Kingdom.

Impact of Covid-19 on the Industry

Pandemics like COVID-19 need additional people, equipment, consumables, and other resources to guarantee complete readiness for hospital safety and, if necessary, patient care. The COVID-19 pandemic is a catalyst for AI progress by providing chances to use these technologies to improve healthcare.

The presence of COVID-19 has been diagnosed using AI and radionics, which are being used with X-ray and CT scans as enhanced imaging techniques in the diagnosis and follow-up of the infection. This is because AI algorithms and radiomics for chest X-rays can assist in the implementation of large-scale screening programmes. When human radiologists are unavailable, Zhongnan Hospital in China utilises AI to read CT images and identify COVID-19 symptoms. Similarly, before individuals engage with medical personnel or other patients, the Tampa General Hospital (Florida, US) employs AI-driven technology to screen them for COVID-19. The Massachusetts General Hospital in Boston, Massachusetts, also deployed AI-powered robots to collect vital signs and care for COVID-19 patients. This may allow healthcare workers to decrease human touch.

In an unprecedented time of one week, Providence St. Joseph Health (Seattle, US) deployed an AI-powered chatbot to screen and triage over 40,000 patients, classifying them by the amount of care required and allowing physicians and nurses to focus on at-risk clients. As a result, physicians are utilising AI's enhanced capabilities to respond to demands efficiently and swiftly.

Market Drivers

A growing number of cross-industry collaborations and partnerships is boosting the market for AI in Imaging and Diagnostics

The rising use of AI in Imaging and Diagnostics in the healthcare industry is due to a growing understanding of the benefits given by AI methods and their broad application areas. Various prominent healthcare firms are forming alliances and collaborations with premier AI technology providers to develop breakthrough AI-based solutions for healthcare applications. These methods allow these market players to provide sophisticated solutions to their clients while also bolstering their standing in this fast-paced market.

Developing Countries are emerging markets for AI in Imaging and Diagnostics Market

Players in the AI in the medical diagnostics market could expect considerable growth prospects in emerging regions such as India, China, and Brazil. This is mostly due to the increasing patient population in these nations. According to the National Institute of Health and Family Welfare (NIHFW), there are around 2 to 2.5 million cancer patients in India at any given time, with approximately 0.7 million new cases recorded each year. Furthermore, healthcare industries in rising economies like India and China are quickly expanding, resulting in the introduction of new medical technology, particularly sophisticated imaging equipment.

Market Restraints

Medical professionals' reluctance to utilise AI-based technology is hampering the market growth

Digital health has grown rapidly, allowing healthcare practitioners to aid patients with innovative treatment techniques. AI technologies provide doctors with tools to help them diagnose and treat patients more efficiently. However, doctors have been seen to be wary of new technology. Medical professionals, for example, have the assumption that AI will eventually replace doctors. Doctors and radiologists feel that qualities like empathy and persuasion are human abilities, and that technological advances cannot eliminate the need for a doctor. Furthermore, there is a risk that patients would become overly reliant on these technologies and will forego critical in-person treatments, thus jeopardising long-term doctor-patient relationships.

AI IN IMAGING AND DIAGNOSTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

26.2% |

|

Segments Covered |

By Component, Technology, Diagnosis Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Aidence Butterfly Network, Inc. Day Zero Diagnostics Digital Diagnostics (Formerly Known as Idx) Enlitic GE Healthcare Google (Subsidiary of Alphabet, Inc.) Heartflow, IBM, Informationalai, Intel, Microsoft, Corporation, Nvidia, Prognos, Quibim |

This research report on the global digital AI in Imaging and Diagnostics market has been segmented and sub-segmented based on Type, Product Geography & region.

Global AI in Imaging and Diagnostics Market- By Components

- Hardware

- Software

- Services

The market is divided into Hardware, Software, and Services based on components. In 2021, software held the greatest market share, and it is estimated to increase at a CAGR of 36.04 per cent over the forecast period. Due to the development of AI-based software for diagnosis in healthcare to boost test precision, the software has emerged as the market's leading category. The AI Platforms and AI Solutions segments of the software market are investigated. One of the important reasons driving the expansion of this market is the increased need for AI-powered and cloud-based enhanced diagnostic solutions that aid in enhancing diagnostic precision when evaluating medical pictures of patients.

Global AI in Imaging and Diagnostics Market- By Technology

- Machine Learning

- NLP

- Context-Aware Computing

- Computer Vision

The market is divided into Machine Learning, Natural Language Processing, Context-Aware Computing, and Computer Vision based on technology. The highest market share was held by Computer Vision, which is estimated to increase at a CAGR of 31.87 per cent over the projection period. In 2021, the second-largest market was Machine Learning, which is estimated to expand at the fastest rate.

Global AI in Imaging and Diagnostics Market- By Diagnosis Type

- Radiology

- Oncology

- Neurology & Cardiology

- Chest & Lungs

- Pathology

- Others

The market is divided into Radiology, Oncology, Neurology & Cardiology, Chest & Lungs, Pathology, and Others based on Diagnosis Type. In 2021, neurology and cardiology held the biggest market share, with a predicted CAGR of 33.52 per cent during the projection period. The healthcare landscape is being redrawn by artificial intelligence (AI), and neurology is no exception. Over the last several years, various AI applications in the field of neurovascular illnesses have been explored and even brought to market as software packages. Furthermore, Artificial Intelligence is improving cardiac care by allowing doctors to anticipate electrocardiogram (ECG) irregularities rapidly, inexpensively, and correctly without requiring the third invasive step in the CVD diagnosis route.

Global AI in Imaging and Diagnostics Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

The market is divided into four regions: North America, Europe, Asia Pacific, and the Rest of the World. In 2021, North America had the biggest market share, while Europe was the second-largest market. Because of the rising complexity and volume of data in healthcare, artificial intelligence (AI) is being used more often. Payers, suppliers of care, and life sciences businesses in North America have begun to use various forms of AI. Several hospitals in the US and Canada have begun to use machine learning for predictive analytics in hospital administration (like, predicting adverse events, the number of patients in the emergency department, and mortality rates,). Because of this predictability, hospitals have been able to take pre-emptive efforts to prepare for anticipated incidents.

Global AI in Imaging and Diagnostics Market- By Companies

- Aidence

- Butterfly Network, Inc.

- Day Zero Diagnostics

- Digital Diagnostics (Formerly Known as Idx)

- Enlitic

- GE Healthcare

- Google (Subsidiary of Alphabet, Inc.)

- Heartflow

- IBM

- Informationalai

- Intel

- Microsoft Corporation

- Nvidia

- Prognos

- Quibim

NOTABLE HAPPENINGS IN THE GLOBAL DIGITAL AI IN THE IMAGING AND DIAGNOSTICS MARKET IN THE RECENT PAST:

- Merger & Acquisition: - In June 2021, CardioLabs is acquired by AliveCor, paving the way for the development of Advanced Ambulatory Monitoring Services. With the acquisition, CardioLabs clients will have access to AliveCor'sKardiaMobile 6L, the world's first and only wireless, patchless, six-lead cardiac monitor.

- Business Expansion: - In May 2021, with Aidoctoexpandits footprint in Europe, Unfallkrankenhaus Berlin introduced AI to Germany. The Unfallkrankenhaus Berlin (UK) has chosen AIdoc's entire range of AI solutions to assist prioritise and speeding treatment for patients with life-threatening and urgent diseases.

- Business Collaboration: - In July 2020, TELUS Ventures and Zebra Medical Vision have announced their strategic partnership. This partnership involves an investment that will help Zebra-Med expand its footprint in North America and demonstrate its artificial intelligence (AI) solutions in the most cutting-edge modalities and clinical care settings.

Chapter 1. GLOBAL AI IN IMAGING AND DIAGNOSTICS MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL AI IN IMAGING AND DIAGNOSTICS MARKET– Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. GLOBAL AI IN IMAGING AND DIAGNOSTICS MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. GLOBAL AI IN IMAGING AND DIAGNOSTICS MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.GLOBAL AI IN IMAGING AND DIAGNOSTICS MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL AI IN IMAGING AND DIAGNOSTICS MARKET– By Components

6.1. Hardware

6.2. Software

6.3. Services

Chapter 7. GLOBAL AI IN IMAGING AND DIAGNOSTICS MARKET– By Technology

7.1. Machine Learning

7.2. NLP

7.3. Context-Aware Computing

7.4. Computer Vision

Chapter 8. GLOBAL AI IN IMAGING AND DIAGNOSTICS MARKET– By Diagnosis Type

8.1. Radiology

8.2. Oncology

8.3. Neurology & Cardiology

8.4. Chest & Lungs

8.5. Pathology

8.6. Others

Chapter 9. GLOBAL AI IN IMAGING AND DIAGNOSTICS MARKET– By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. GLOBAL AI IN IMAGING AND DIAGNOSTICS MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Aidence

10.2. Butterfly Network, Inc.

10.3. Day Zero Diagnostics

10.4. Digital Diagnostics (Formerly Known as Idx)

10.5. Enlitic

10.6. GE Healthcare

10.7. Google (Subsidiary of Alphabet, Inc.)

10.8. Heartflow

10.9. IBM

10.10. Informationalai

10.11. Intel

10.12. Microsoft Corporation

10.13. Nvidia

10.14. Prognos

10.15. Quibim

Download Sample

Choose License Type

2500

4250

5250

6900