Agricultural Biologicals Market Size (2025 – 2030)

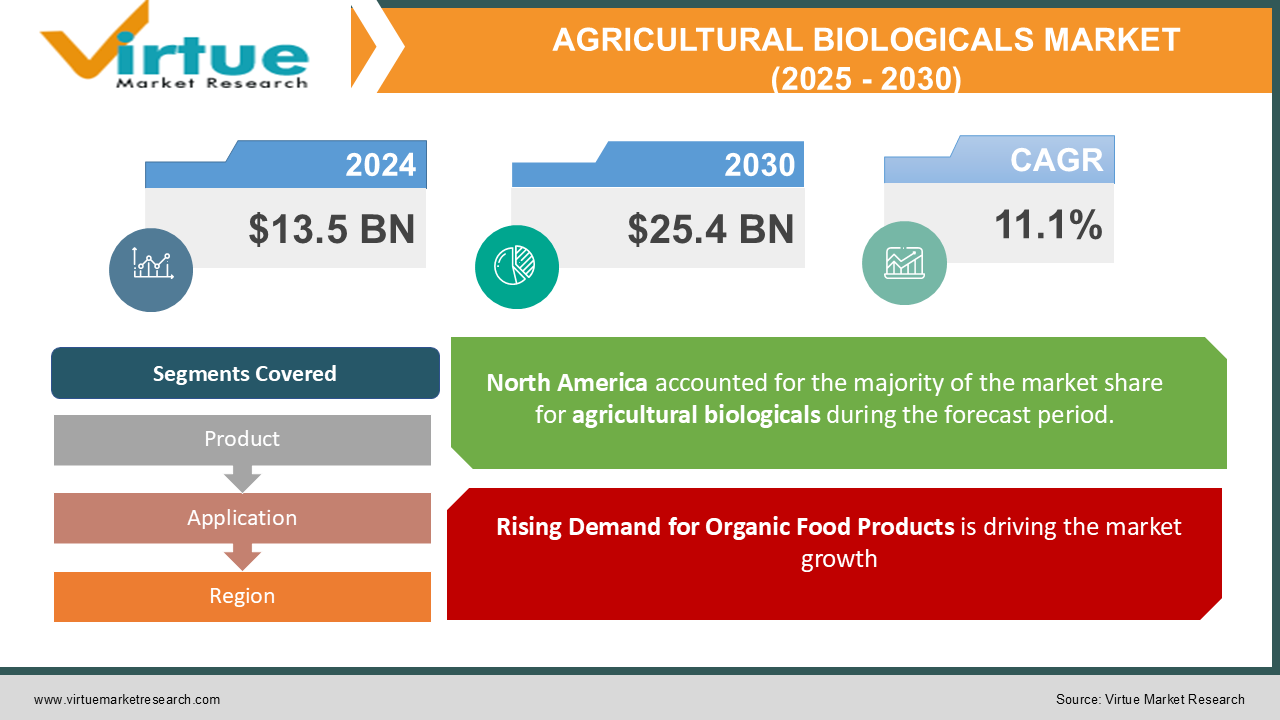

The Global Agricultural Biologicals Market was valued at USD 13.5 billion in 2024 and is projected to reach USD 25.4 billion by 2030, growing at a CAGR of 11.1% during the forecast period.

Agricultural biologicals, derived from natural sources such as microorganisms, plant extracts, and beneficial insects, provide sustainable alternatives to synthetic agrochemicals. Rising concerns over environmental sustainability, soil health degradation, and consumer demand for organic produce are key factors propelling the market. Additionally, advancements in biotechnologies and increasing government support for eco-friendly agricultural practices are further driving the adoption of agricultural biologicals globally.

Key Market Insights

-

Biopesticides dominate the market with over 40% share in 2024, driven by their effectiveness in pest control and reduced environmental impact.

-

The fruits & vegetables segment leads in application, accounting for approximately 35% of total market revenue in 2024.

-

North America is the largest regional market, contributing over 35% of global revenue due to strong regulatory support and a high adoption rate of sustainable farming practices.

-

Increasing global organic farming practices are fueling the demand for agricultural biologicals. Biostimulants are expected to witness the fastest growth, driven by their role in enhancing plant stress tolerance and improving nutrient efficiency.

-

Companies are focusing on research and development to produce multifunctional biological products that cater to diverse crop needs.

Global Agricultural Biologicals Market Drivers

1. Rising Demand for Organic Food Products is driving the market growth

The increasing global shift toward organic food, driven by consumer awareness regarding health and sustainability, has significantly boosted the demand for agricultural biologicals. Consumers prefer organic produce free from harmful residues of synthetic pesticides and fertilizers.

According to the Research Institute of Organic Agriculture (FiBL), the global organic food market reached over USD 150 billion in 2023, with a consistent growth trajectory. Agricultural biologicals, including biofertilizers and biopesticides, are integral to organic farming practices, offering a safer and eco-friendly alternative to conventional agrochemicals.

2. Environmental Concerns and Soil Health Degradation is driving the market growth

Synthetic chemicals used in conventional farming have led to severe environmental issues, including soil degradation, water contamination, and loss of biodiversity. Agricultural biologicals address these concerns by providing natural solutions that improve soil fertility and promote sustainable farming practices.

For example, biofertilizers enrich soil microbiota, enhancing nutrient availability and reducing dependency on chemical fertilizers. Similarly, biopesticides provide targeted pest control with minimal environmental impact, aligning with global initiatives for sustainable agriculture.

3. Technological Advancements in Biologicals is driving the market growth

Technological innovations in biotechnology and microbial formulations have accelerated the development of agricultural biologicals. New-generation biological products are more effective, stable, and easier to apply, ensuring better adoption rates among farmers.

Additionally, precision agriculture tools, such as drones and IoT-enabled devices, facilitate the efficient application of biologicals, reducing costs and improving outcomes. These advancements are encouraging large-scale adoption of agricultural biologicals, especially in developed markets.

Global Agricultural Biologicals Market Challenges and Restraints

1. Limited Awareness Among Farmers is restricting the market growth

Despite the benefits of agricultural biologicals, their adoption remains constrained by limited awareness, particularly in developing regions. Small-scale farmers, who form the majority of the agricultural workforce in these areas, often lack knowledge about the benefits and application methods of biological products.

To address this, companies and governments are implementing farmer education programs, field demonstrations, and subsidy schemes to promote the use of agricultural biologicals. However, overcoming the knowledge gap remains a significant challenge.

2. Regulatory and Standardization Issues is restricting the market growth

The regulatory environment for agricultural biologicals varies widely across regions, creating inconsistencies in product approval and commercialization. The lack of global standardization in the production and use of biologicals hampers market growth, especially for multinational companies.

For example, while North America and Europe have well-defined frameworks for biopesticides and biofertilizers, emerging markets often lack clear regulations, delaying product launches. Manufacturers must navigate complex approval processes and invest significantly in compliance, increasing costs and time-to-market.

Market Opportunities

The Global Agricultural Biologicals Market is poised for substantial growth, driven by a confluence of factors. The growing emphasis on sustainable agriculture, driven by increasing consumer awareness and stringent environmental regulations, is a key driver. Expanding organic farming acreage, fueled by growing consumer demand for organic produce, is creating a significant market for biopesticides, biofertilizers, and other biological solutions. Advancements in biotechnology are enabling the development of novel and more effective biological products, further accelerating market growth. The rising adoption of Integrated Pest Management (IPM) practices, which combine biological and chemical control methods, is boosting demand for biopesticides and other biological solutions. IPM reduces the reliance on synthetic chemicals, aligns with environmental regulations, and improves overall farm productivity. Developing countries in Asia-Pacific, Latin America, and Africa are witnessing increasing adoption of agricultural biologicals due to government initiatives and international collaborations. For instance, programs like India’s Paramparagat Krishi Vikas Yojana (PKVY) promote organic farming, creating significant growth opportunities for the biologicals market. Innovations in biostimulant technology are also driving market growth. The development of advanced biostimulants that enhance plant resilience to abiotic stresses, such as drought and salinity, is particularly valuable in regions facing the impacts of climate change. These products not only improve crop yields but also enhance overall farm sustainability. Finally, collaborations and partnerships between private companies, research institutions, and government agencies are fostering innovation and expanding market reach. Collaborative R&D initiatives are focused on producing cost-effective, multifunctional biological solutions tailored to specific regional needs, accelerating the adoption of these technologies and driving sustainable agricultural practices worldwide.

AGRICULTURAL BIOLOGICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

11.1% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bayer AG, Syngenta AG, BASF SE, UPL Limited, Marrone Bio Innovations, Valent BioSciences, Koppert Biological Systems, Arysta LifeScience, Novozymes A/S, Certis USA LLC |

Agricultural Biologicals Market Segmentation - By Product

-

Biopesticides

-

Biostimulants

-

Biofertilizers

Biopesticides currently dominate the agricultural biologicals market due to their effectiveness in controlling pests while minimizing environmental impact. These naturally derived products, such as microbial pesticides (based on bacteria, fungi, or viruses) and plant-based pesticides (derived from plants), offer a safer and more sustainable alternative to traditional chemical pesticides. They target specific pests while minimizing harm to beneficial insects, pollinators, and the environment. Biostimulants, on the other hand, are witnessing rapid growth owing to their crucial role in enhancing plant metabolism and stress tolerance. These substances, derived from natural sources like seaweed extracts, humic substances, and amino acids, stimulate natural plant processes, improving nutrient uptake, enhancing photosynthesis, and increasing resistance to biotic and abiotic stresses. This translates to improved crop yields, better quality, and increased resilience to environmental challenges, making biostimulants an increasingly valuable tool for sustainable agriculture.

Agricultural Biologicals Market Segmentation - By Application

-

Cereals & Grains

-

Fruits & Vegetables

-

Oilseeds & Pulses

-

Others

The fruits & vegetables segment dominates the plant growth regulators market, driven by the high economic value of these crops and the escalating consumer demand for organic produce. Consumers are increasingly prioritizing safe and healthy food choices, driving a shift towards sustainable agricultural practices. The use of plant growth regulators in fruits and vegetables is crucial for enhancing yield, improving fruit quality, and ensuring the production of safe and residue-free produce. Cereals & grains also constitute a significant application area, given their extensive cultivation worldwide to meet the growing global food demand. Plant growth regulators play a vital role in improving grain size, enhancing yield, and increasing resilience to various environmental stresses, such as drought and extreme temperatures, ensuring food security and sustainable agricultural practices.

Agricultural Biologicals Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America leads the agricultural biologicals market with over 35% share in 2024, driven by robust organic farming practices and strong regulatory support for sustainable agriculture. The U.S. and Canada are key contributors, boasting significant investments in R&D and technological advancements in this sector. Europe holds a substantial market share, characterized by stringent environmental regulations and a strong emphasis on sustainable farming practices. Countries like Germany, France, and Spain are at the forefront of adopting agricultural biologicals, supported by initiatives like the European Green Deal. The Asia-Pacific region is the fastest-growing market, fueled by increasing agricultural activities, government support for sustainable agriculture, and rising awareness of organic farming. Countries such as China, India, and Japan are witnessing rapid adoption of biopesticides and biofertilizers. Latin America is emerging as a key market, driven by the region's extensive agricultural exports and growing interest in sustainable farming practices. Brazil and Argentina are leading contributors, focusing on integrated pest management. The Middle East & Africa region is gradually adopting agricultural biologicals to address food security challenges and improve crop productivity under challenging climatic conditions.

COVID-19 Impact Analysis

The COVID-19 pandemic had a mixed impact on the Agricultural Biologicals Market. While initial disruptions in supply chains and labor availability hindered market growth, the pandemic also highlighted the importance of resilient and sustainable agricultural systems. Post-pandemic, the market witnessed a surge in demand for eco-friendly farming solutions as governments and organizations prioritized food security and sustainability. The increased focus on reducing dependency on synthetic agrochemicals further accelerated the adoption of agricultural biologicals.

Latest Trends/Developments

The market for agricultural biologicals is experiencing significant growth, driven by a confluence of factors. The integration of precision agriculture technologies, such as drones and IoT-enabled systems, is revolutionizing the application of these products. These technologies enable efficient and targeted delivery, reducing costs, minimizing environmental impact, and maximizing the effectiveness of biologicals. Furthermore, the development of new-generation biostimulants with multifunctional benefits, such as enhancing nutrient uptake, improving stress tolerance, and boosting plant immunity, is expanding their application potential and catering to diverse crop needs. Microbial-based solutions, including biofertilizers and biopesticides, are gaining significant traction due to their high efficacy, specificity, and sustainability. Recognizing the importance of environmental sustainability, companies are increasingly adopting eco-friendly packaging solutions, aligning with environmental regulations and consumer preferences. Finally, collaborative research and development efforts, driven by public-private partnerships, are fostering innovation in this sector. These partnerships facilitate knowledge sharing, accelerate product development, and promote the development of cost-effective and scalable solutions, ultimately driving the sustainable growth of the agricultural biologicals market.

Key Players

-

Bayer AG

-

Syngenta AG

-

BASF SE

-

UPL Limited

-

Marrone Bio Innovations

-

Valent BioSciences

-

Koppert Biological Systems

-

Arysta LifeScience

-

Novozymes A/S

-

Certis USA LLC

Chapter 1. Agricultural Biologicals Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Agricultural Biologicals Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Agricultural Biologicals Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Agricultural Biologicals Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Agricultural Biologicals Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Agricultural Biologicals Market – By Product

6.1 Introduction/Key Findings

6.2 Biopesticides

6.3 Biostimulants

6.4 Biofertilizers

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Agricultural Biologicals Market – By Application

7.1 Introduction/Key Findings

7.2 Cereals & Grains

7.3 Fruits & Vegetables

7.4 Oilseeds & Pulses

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Agricultural Biologicals Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Agricultural Biologicals Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Bayer AG

9.2 Syngenta AG

9.3 BASF SE

9.4 UPL Limited

9.5 Marrone Bio Innovations

9.6 Valent BioSciences

9.7 Koppert Biological Systems

9.8 Arysta LifeScience

9.9 Novozymes A/S

9.10 Certis USA LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 13.5 billion in 2024 and is projected to reach USD 25.4 billion by 2030, growing at a CAGR of 11.1%.

Key drivers include the rising demand for organic food, environmental concerns, soil health degradation, and technological advancements in biologicals.

Segments include Product (Biopesticides, Biostimulants, Biofertilizers) and Application (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Others).

North America dominates the market with over 35% of global revenue, driven by robust organic farming practices and regulatory support.

Key players include Bayer AG, Syngenta AG, BASF SE, UPL Limited, and Marrone Bio Innovations.