Glass Filled Nylon Market Size (2024 – 2030)

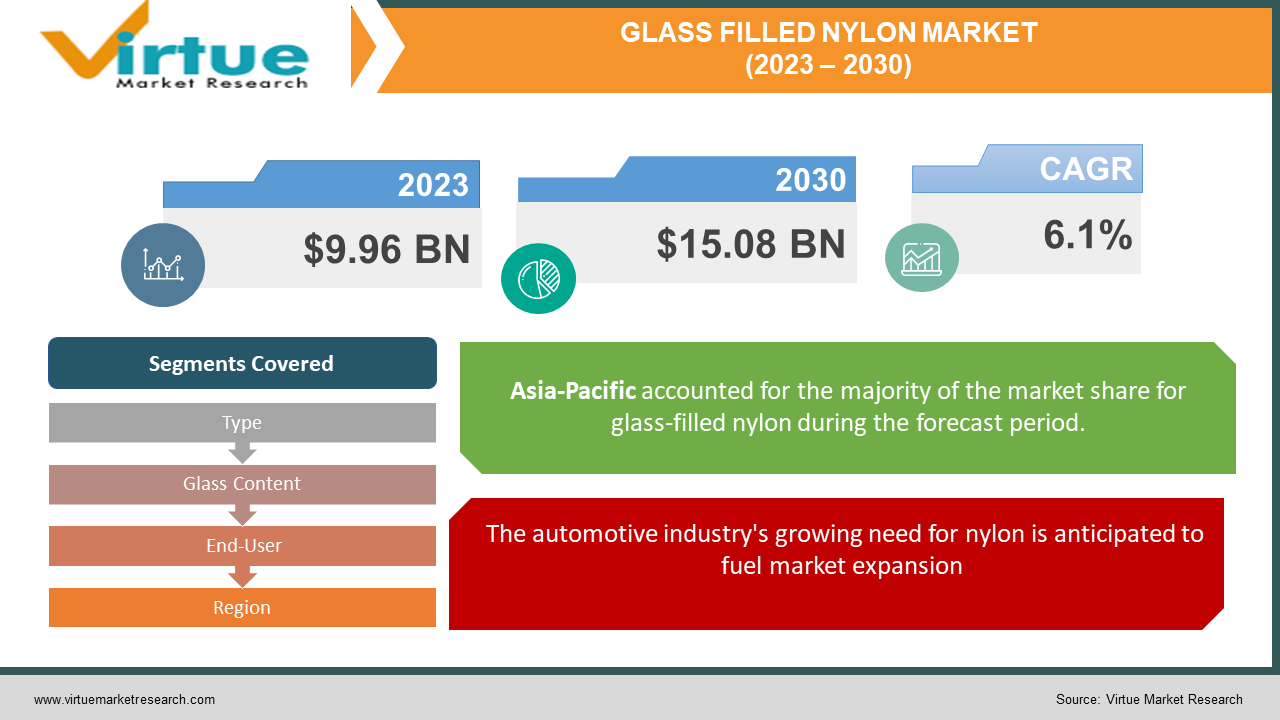

The Global Glass Filled Nylon Market was valued at USD 9.96 billion in 2023 and is projected to reach a market size of USD 15.08 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.1%.

Glass fibers and nylon compounds are mixed to create Glass Filled Nylon, a type of technical plastic. The reinforcement offered by the glass fibers improves the strength, stiffness, heat resistance, and dimensional stability of the Nylon material. Glass Filled Nylon is also known as glass fiber reinforced nylon or glass-reinforced nylon. Lack of stiffness, high rate of moisture absorption, low heat resistance, and high rate of thermal expansion are just a few of the drawbacks of nylon. Combining glass fibers with nylon compounds can significantly improve the material's properties. Glass-filled nylon weighs more than unfilled nylon, but it is still lighter than metal, thus it's a good option for weight loss programs. Glass fibers reinforce the polymer chains and slow their movement, increasing the material's stiffness and strength. By reducing creep deformation and thermal expansion, the glass fibers improve the material's dimensional stability and heat resistance.

Key Market Insights:

Known for its strength and heat resistance, glass-filled nylon is a synthetic polyamide thermoplastic that is widely used in engineering. Glass powder is mixed with nylon resin to create it, or glass fibers can be extruded into the plastic. Glass spheres can be added to the base powder for 3D printing nylon powders in different proportions. Glass adds significantly to the strength, hardness, and rigidity of nylon; it also improves its dimensional stability, wear resistance, and creep resistance compared to nylon alone. Additionally, higher maximum service temperatures are possible with glass-filled nylon.

The particular nylon formulation and glass fiber percentage determine how strong glass-filled nylon is. Other factors that impact strength include the overall fiber-to-resin ratio, the type and length of the glass fibers, and their distribution within the nylon matrix. Tensile strength, flexural strength, and impact resistance are generally increased with increasing glass fiber percentages.

Because of its excellent strength-to-weight ratio, glass-filled nylon has become more popular in the automotive industry. In the automotive sector, lowering weight is a crucial objective for increasing vehicle fuel efficiency. This can be done while simultaneously cutting expenses by substituting nylon composite for heavy metal components. The material is currently used in wire housings and connectors, engine covers, speedometer gears, brake fluid, windshield wiper parts, and more.

Glass-Filled Nylon Market Drivers:

The automotive industry's growing need for nylon is anticipated to fuel market expansion

Due to its excellent strength capabilities, there has been a surge in demand for Glass Filled Nylon in the Automotive Industry. Thanks to its many beneficial qualities, the material can withstand high temperatures and is suitable for a variety of industries, including the automotive. Glass Filled Nylon is used for making various automotive parts like the gears, bearings, manifolds, brakes, fuel tank caps, and many other components.

Diverse Uses in the Electrical and Electronics Industry fuelling the growth of the market.

Glass Filled Nylon is also used in the Electrical and Electronics industry on a large scale for making electrical components. Glass-filled nylon has the same electrical insulating properties as unfilled nylon. Because of this, products containing electrical or electronic components now have that option. They are used in making electronic items like printers, cameras, earphones, computer components, etc.

Glass-Filled Nylon Market Restraints and Challenges:

One of the challenges for the Glass-filled Nylon market is that the resultant composite made from the fusion of glass and nylon is more brittle than regular nylon. Hence, even if glass-filled nylon resists deformation, excessive force can increase the chance of fracture, which may push the industries to go for a better alternative thereby reducing its market. Nylon becomes more abrasive when glass fibers are included in it. As a result, compared to standard nylon, tools or print heads may wear down more quickly. Also, the increased cost of production makes Glass-filled nylon more costly than its unfilled equivalent because it requires more processing and additives which in turn leads to a decrease in demand by the industries to cut costs and choose cheaper alternatives. Also, with advancements in technology, the availability of new substitutes in the market can restrain the demand for Glass Filled Nylon and cause its market to shrink. These factors can pose challenges for the Glass-Filled Nylon Market and can cause the market to shrink over time if left unchecked.

Glass Filled Nylon Market Opportunities:

The key factor currently propelling the growth of the glass-filled nylon market is the material's superior qualities when compared to other materials and the growing demand for it in the automotive sector. Glass-filled nylon is increasingly being used as a metal replacement in industries like automotive due to its excellent strength-to-weight ratio. Thanks to glass-filled nylons' resilience to high temperatures, tensile strength, and other qualities, producers of consumer goods, including appliance makers, are also using them, as are industrial suppliers. The material has insulating properties, making it suitable for the production of wire connectors and electrical housings. This in the future can lead to an increase in demand for glass-filled nylon and propel the expansion of its market.

GLASS FILLED NYLON MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Type, Glass Content, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, LANXESS, Du Pont, Asahi Kasei Corporation, Arkema, Evonik, Ensinger GmbH |

Glass-Filled Nylon Market Segmentation: By Type

-

Polyamide 6

-

Polyamide 66

-

Polyamide 12

In 2023, based on the segmentation by type, Polyamide 6 emerged as the dominating segment. This can be accredited to Polyamide 6 exhibiting strong toughness and impact resistance, and its functioning well at low temperatures. It also absorbs moisture well and has high dimensional stability. The percentage of glass fiber can vary from 15% to 45%. As the amount of glass fiber increases, strength, and stiffness rise while toughness and impact resistance fall.

Whereas, it is also the fastest-growing segment based on type and is estimated to grow at a rapid pace due to its versatile and increasing number of applications in various industries.

Glass-Filled Nylon Market Segmentation: By Glass Content

-

10% Glass Filled

-

20% Glass Filled

-

30% Glass Filled

-

>30% Glass Filled

In 2023, based on the segmentation by Glass Content, 30% Glass Filled Nylon emerged as the dominating segment. This can be accredited to its high strength and rigidity. It is widely used in the Automotive Industry to make windshield wipers etc. and in electrical industries to make computer components and other electrical components, it is also the fastest growing sector estimated to expand at a fast pace reason being its large uses in various industries due to its physical and chemical properties.

Glass-Filled Nylon Market Segmentation: By End-User

-

Electronics and Electrical

-

Industrial

-

Automotive

-

Others

In 2023, based on the segmentation by End User, the automotive sector emerged as the dominating segment. This can be accredited to the versatile use of Glass Filled Nylon in the Automotive Industry to make various components like fuel caps, windshield wipers, brake fluid, and other components.

On the other hand, the Electrical and Electronics sector is expected to grow at a rapid pace being the fastest growth in the segment due to its higher adoption in the making of electrical components and items like connectors, motherboards, etc.

Glass-Filled Nylon Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on the segmentation by Region, Asia-Pacific emerged as the dominating region. The development of the market in the Asia Pacific area is aided by several factors, including the growth of government initiatives, support for production regulation, and easy access to raw materials. Also, the presence of a large number of industries serves as a factor to dominate another region for example the automotive industries in China and India.

On the other hand, Europe is estimated to expand at the fastest pace among the mentioned regions. The region's market for glass-filled nylon is expected to grow as a result of the rising industrial base, increased demand for electric and next-generation automobiles, and both.

COVID-19 Impact Analysis on the Global Glass-Filled Nylon Market:

Almost every sector of the economy was severely impacted by the COVID-19 Pandemic, including the retail, construction, and automobile industries. The global market for glass-filled nylon, however, was not an anomaly. The labor scarcity brought about by the lockdowns and other limitations in place during that period led to lower production. Also, because of limitations on the flow of raw materials, supply interruptions caused severe market turmoil. Nevertheless, the market for glass-filled nylon is anticipated to grow rapidly along with the industry as a whole as we recover from this epidemic.

Latest Trends/ Developments:

With the advancement in technology, new forms of glass-filled nylon are being developed to tackle the inherent problems and turn it into a better compound. For example, Strongest Ever Glass-Filled Nylon and PK 3D Printing Filaments Launched by Fortis3D. They are resilient in harsh conditions because of their excellent mechanical strength as well as their resistance to chemicals, high temperatures, impacts, and wear. The materials can be used for jigs and fixtures as well as industrial end-use products. These latest trends and developments can expand the horizon for the Glass-Filled Nylon Market and help push the market to greater capabilities.

Key Players:

-

BASF SE

-

LANXESS

-

Du Pont

-

Asahi Kasei Corporation

-

Arkema

-

Evonik

-

Ensinger GmbH

Recent Developments:

-

March 2023 Strongest ever Glass-Fiber Nylon and PK 3D printing filaments launched by Fortis3D.

-

March 2022 Formlabs Launches Glass Filled Nylon 12 for SLS 3D Printing.

Chapter 1. Glass-Filled Nylon Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Glass-Filled Nylon Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Glass-Filled Nylon Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Glass-Filled Nylon Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Glass-Filled Nylon Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Glass-Filled Nylon Market – By Deployment Mode

6.1 Introduction/Key Findings

6.2 Cloud-based

6.3 On-Premise

6.4 Y-O-Y Growth trend Analysis By Deployment Mode

6.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 7. Glass-Filled Nylon Market – By Organization Size

7.1 Introduction/Key Findings

7.2 Small and Medium-Scale Enterprise

7.3 Large-Scale Enterprise

7.4 Y-O-Y Growth trend Analysis By Organization Size

7.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 8. Glass-Filled Nylon Market – By End User

8.1 Introduction/Key Findings

8.2 BFSI

8.3 Healthcare

8.4 IT & Telecom

8.5 Retail

8.6 Advertising & Media

8.7 Automotive & Transportation

8.8 Manufacturing

8.9 Others

8.10 Y-O-Y Growth trend Analysis By End User

8.11 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Glass-Filled Nylon Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Organization Size

9.1.3 By End User

9.1.4 By Deployment Mode

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Organization Size

9.2.3 By End User

9.2.4 By Deployment Mode

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Organization Size

9.3.3 By End User

9.3.4 By Deployment Mode

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Organization Size

9.4.3 By End User

9.4.4 By Deployment Mode

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Organization Size

9.5.3 By End User

9.5.4 By Deployment Mode

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Glass-Filled Nylon Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Demandbase

10.2 Terminus

10.3 NextRoll Inc.

10.4 6sense

10.5 Engagio (Demandbase)

10.6 InsideView

10.7 Madison Logic

10.8 True Influence

10.9 Albacross

10.10 LiveRamp

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Glass Filled Nylon Market was valued at USD 9.96 billion in 2023 and is projected to reach a market size of USD 15.08 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.1%.

The surge in demand by the automotive electrical & and electronics industries is propelling the market for Glass Filled Nylon.

Based on Type, Glass Filled Nylon Market is segmented into Polyamide 6, Polyamide 66 and Polyamide 12.

Asia-Pacific is the most dominant region for the Global Glass Filled Nylon Market.

BASF SE, LANXESS, Du Pont, Asahi Kasei Corporation, Arkema, Evonik, Ensinger GmbH.