Glass Fiber Epoxy Composite Market Size (2024 – 2030)

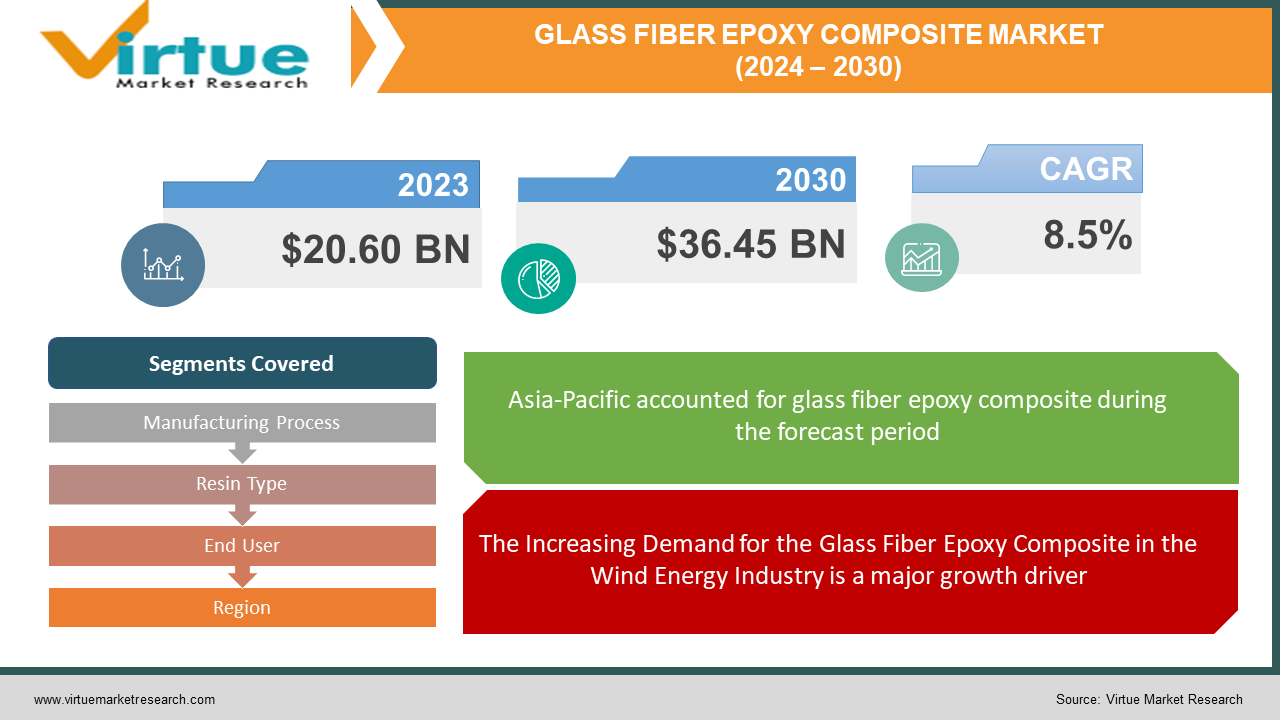

The Glass Fiber Epoxy Composite Market was valued at USD 20.60 billion in 2023 and is projected to reach a market size of USD 36.45 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 8.5%.

The Glass Fiber Epoxy Composite is a material that is comprised of a glass-fiber matrix and an epoxy resin. This provides electrical and thermal insulation. They are used for applications where resistance to high temperatures, mechanical strength, and dimensional stability are essential. Due to being versatile, the Glass-Fiber Epoxy Composite is used in many engineering sectors like automobile, aerospace & defense, electrical engineering, wind energy, and transportation industry.

Key Market Insights:

The total composite market was worth USD 34.32 billion in 2023. Glass Fiber Epoxy Composite dominates with a 60% market share while Carbon Fiber Epoxy Composite is the second largest market shareholder.

In terms of End-users, Construction was the dominant sector with the largest market share in the Glass Fiber Epoxy Composite Market in 2023.

In terms of Resin Type, Thermoset Resin is the largest market share holder in the Glass Fiber Epoxy Composite Market.

In terms of Region, Asia-Pacific was a dominant player with a market share of 35% and is expected to be the fastest-growing region.

Market Drivers:

The Increasing Demand for the Glass Fiber Epoxy Composite in the Wind Energy Industry is a major growth driver.

The demand for the Glass Fiber Epoxy Composite is rising in the Wind Energy Industry due to its versatility. The Glass Fiber Epoxy Composite offers an excellent strength-to-weight ratio, crucial for wind turbine blades that need to withstand immense wind forces while being light enough for efficient rotation. The composites are highly resistant to harsh weather conditions like rain, snow, and extreme temperatures, ensuring long blade lifespans. Overall, the demand for glass fiber epoxy composite in the wind energy industry is expected to keep rising due to its unique combination of properties, cost-effectiveness, and alignment with sustainability goals. Exploring advancements in manufacturing and material science will further solidify its position as a key material for wind turbine blades in the future.

Growing Demand for the Glass Fiber Epoxy Composite from Automotive Industry.

The global demand for the Glass Fiber Epoxy Composite has been increasing due expanding automotive industry. The automotive industry encompasses a wide range of activities from design, development, production, and modification of automobiles. The Glass Fiber Epoxy Composite is an essential material for the production of lightweight, fuel-efficient vehicles with improved performance and design possibilities. The expanding automotive industry is a key driver for the Glass Fiber Epoxy Composites market.

Rising Demand from the Aerospace Industry is also driving market growth.

The Glass Fiber Epoxy Composite market is expected to witness growth due to the high demand from the expanding aerospace industry. It is widely used in the aerospace industry, due to its exceptional characteristics like high strength, lightweight nature, durability, corrosion, and chemical resistance. The Glass Fiber Epoxy Composite has become essential for the aerospace industry due to its application in a variety of activities from development, manufacturing, operations, and maintenance of both aircraft and spacecraft. The aerospace industry runs on fuel efficiency and performance, and the Glass Fiber Epoxy Composite is an ideal choice for it. The global aerospace and defense industry has been witnessing significant growth in the past few years, due to the growing passenger travel market and military expenditure. Thus, the growing aerospace and defense industry is expected to boost the demand for the Glass Fiber Epoxy Composite market.

Market Restraints and Challenges:

The Rising Cost of Raw Materials for Glass Fiber Epoxy Composites is a major challenge in the industry.

One of the key challenges faced by the Glass Fiber Epoxy Composites market is rising production costs. These elevated raw material costs can act as a restraint, influencing the use and adoption of the Glass Fiber Epoxy Composite across various industries. The rising cost of raw materials including resins, fibers, and additives is significantly the overall production cost. Manufacturers and end-users face the challenge of managing these higher costs, which is shrinking profit margins and affecting business across the supply chain.

Recycling of Glass Fiber Epoxy Composites is restricting the growth of the market.

Glass Fiber Epoxy Composites are made up by bonding two or more materials, but these composites are difficult to recycle and component separation. The recycling of the Glass Fiber Epoxy Composites is difficult to recycle due to complex and cross-linked material composition. This leads to environmental degradation as the final disposal of Glass Fiber Epoxy Composites has always been a challenge for many industries. As these Glass Fiber Epoxy Composites cannot be recycled, they lack an environmentally friendly alternative.

Market Opportunities:

Rising Demand of the Glass Fiber Epoxy Composites in Renewable Energy Industry.

The rising demand for environment-friendly and renewable energy is expected to boost the demand for the Glass Fiber Composites Market. Renewable energy is produced from renewable resources like wind energy, solar energy, geothermal and others. The Glass Fiber Epoxy Composites offer high strength, chemical and corrosion resistance, lightweight nature, and durability, making them an ideal choice as an alternative to different traditional components and structures used in renewable energy sources. In March 2023, according to the International Renewable Energy Agency (IRENA), a UAE-based international organization for increasing collaboration, developing understanding, and promoting the use of renewable resources, the capacity for worldwide renewable energy rose by 22% in 2022. Thus, rising demand for renewable energy is driving growth and opening opportunities in the Glass Fiber Epoxy Composites market.

GLASS FIBER EPOXY COMPOSITE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.5% |

|

Segments Covered |

By Manufacturing Process, Resin Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hexcel Corporation, Owens Corning, Hexion Inc, Solvay S.A, AOC LL, Ashland Global Holdings Inc, BASE SE, Huntsman Corporation, Sika AG, Mitsubishi Chemical Corporation |

Glass Fiber Epoxy Composite Market Segmentation: By Manufacturing Process

-

Lay-up

-

Compression Molding

-

Resin Injection

-

Resin Transfer Molding

-

Filament Winding

-

Pultrusion

-

Others

In terms of the manufacturing process, the Lay-up process holds the largest market share of about 28% due to being versatile, cost-effective, and flexible. It can create complex shapes and sizes for a variety of applications. Adjustments and modifications are also possible during production, helping in complex designs, as well as it’s affordable for small-scale production or prototypes. While the Lay-up process dominates the market, other processes facilitating specific needs, like Compress Molding hold a 22% market share, used widely for the high-volume production of simple shapes efficiently. The Resin Injection process holds an 18% market share due to its good dimensional accuracy and repeatability. The Resin Transfer Molding process is used for the production of complex shapes with tight tolerance and holds a 15% market share. Filament Winding and Pultrusion hold 12% and 4% respectively. This wide variety of manufacturing processes is also a key factor in the growth of the Glass Fiber Epoxy Composite Market.

Glass Fiber Epoxy Composite Market Segmentation: By Resin Type

-

Thermoset Composites

-

Thermoplastic Composites

In terms of Resin Type, Thermoset Composites hold the largest market share. Thermoset resins are moisture and high-temperature resistant, making them an ideal choice for high-corrosive and high-temperature applications. The Glass fibers formulated with thermoset resins produce thermoset composites that offer high strength, toughness, and moisture resistance. These Thermoset Composites are widely used in construction, transportation, pipes & tanks, electronics, and infrastructure industries.

Glass Fiber Epoxy Composite Market Segmentation: By End User

-

Wind Energy

-

Aerospace & Defense

-

Sporting Goods

-

Automotive & Transportation

-

Electrical & Electronics

-

Pipe & Tank

-

Construction

-

Marine

-

Others

In the Glass Fiber Epoxy Composite Market, the Construction sector holds the largest market share of about 35% in 2023. The Glass Fiber Epoxy Composites are popular in the construction sector due to characteristics like durability, corrosion resistance, and high strength-to-weight ratio. Pipes and tanks, roofing and siding panels, structural components, and window and door frames are some examples.

Automotive & Transportation is the second largest dominant player with an estimated 30% market share. Wind Energy, Sporting Goods, Electronic industry are also witnessing rising demand for glass fiber epoxy composites.

Glass Fiber Epoxy Composite Market Segmentation: By Region

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

In 2023, the largest market share holder in the Glass Fiber Epoxy Composite market was the Asia-Pacific region with a 35% market share. Asia-Pacific is also expected to be the fastest-growing region for the Glass Fiber Epoxy Composite Market in the future. The increasing demand for the Glass Fiber Epoxy Composite from wind energy, aerospace & defense, automotive & transportation, and construction industries is driving growth in the market. Rising growth in the Asia-Pacific region due to the presence of established glass fiber epoxy composite manufacturers and increased wind energy capacity in India and China.

COVID-19 Impact Analysis on the Global Glass Fiber Epoxy Composite Market:

COVID-19 has severely impacted the Global Glass Fiber Epoxy Composite Market. The lockdown due to the COVID-19 pandemic led to a disruption of the supply chain and production. The pandemic led to reduced production capacity and logistics challenges leading to delayed deliveries and increased raw material prices. The aerospace, automotive, construction and, marine sectors experienced a drop in demand due to travel restrictions, and delayed manufacturing activities and projects. The reduction in the number of COVID-19 cases and the easing of lockdown restrictions led to an increase in demand in the market again.

Latest Trends/Developments:

The Glass Fiber Epoxy Composites offer exceptional strength, stiffness, and impact resistance which led to rising demand in industries like aerospace, automotive, and sporting goods. Advanced manufacturing processes like resin infusion, and resin transfer molding, have enhanced the production quality and cost-effectiveness of glass fiber epoxy composite. These cutting-edge technologies have opened new opportunities in the glass fiber epoxy composite market, leading to an increased demand.

Key Players:

-

Hexcel Corporation

-

Owens Corning

-

Hexion Inc

-

Solvay S.A

-

AOC LLC

-

Ashland Global Holdings Inc

-

BASE SE

-

Huntsman Corporation

-

Sika AG

-

Mitsubishi Chemical Corporation

In February 2022, Westlake Chemical Corporation, a U.S.-based petrochemical firm acquired Hexion Inc.’s global epoxy business for an estimated USD 1.2 billion.

Chapter 1. Glass Fiber Epoxy Composite Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Glass Fiber Epoxy Composite Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Glass Fiber Epoxy Composite Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Glass Fiber Epoxy Composite Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Glass Fiber Epoxy Composite Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Glass Fiber Epoxy Composite Market – By Manufacturing Process

6.1 Introduction/Key Findings

6.2 Lay-up

6.3 Compression Molding

6.4 Resin Injection

6.5 Resin Transfer Molding

6.6 Filament Winding

6.7 Pultrusion

6.8 Others

6.9 Y-O-Y Growth trend Analysis By Manufacturing Process

6.10 Absolute $ Opportunity Analysis By Manufacturing Process, 2024-2030

Chapter 7. Glass Fiber Epoxy Composite Market – By Resin Type

7.1 Introduction/Key Findings

7.2 Thermoset Composites

7.3 Thermoplastic Composites

7.4 Y-O-Y Growth trend Analysis By Resin Type

7.5 Absolute $ Opportunity Analysis By Resin Type, 2024-2030

Chapter 8. Glass Fiber Epoxy Composite Market – By End User

8.1 Introduction/Key Findings

8.2 Wind Energy

8.3 Aerospace & Defense

8.4 Sporting Goods

8.5 Automotive & Transportation

8.6 Electrical & Electronics

8.7 Pipe & Tank

8.8 Construction

8.9 Marine

8.10 Others

8.11 Y-O-Y Growth trend Analysis By End User

8.12 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Glass Fiber Epoxy Composite Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Manufacturing Process

9.1.3 By Resin Type

9.1.4 By By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Manufacturing Process

9.2.3 By Resin Type

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Manufacturing Process

9.3.3 By Resin Type

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Manufacturing Process

9.4.3 By Resin Type

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Manufacturing Process

9.5.3 By Resin Type

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Glass Fiber Epoxy Composite Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Hexcel Corporation

10.2 Owens Corning

10.3 Hexion Inc

10.4 Solvay S.A

10.5 AOC LLC

10.6 Ashland Global Holdings Inc

10.7 BASE SE

10.8 Huntsman Corporation

10.9 Sika AG

10.10 Mitsubishi Chemical Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Glass Fiber Epoxy Composite Market was valued at USD 20.60 billion in 2023 and is projected to reach a market size of USD 36.45 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 8.5%.

Key drivers include the rising demand from aerospace, automobile, and wind energy industry.

Wind Energy, Aerospace & Defense, Sporting Goods, Automotive & Transportation Electrical & Electronics, Pipe & Tank, Construction, Marine, and Others are end users of the Global Glass Fiber Epoxy Composite Market.

Asia-Pacific is the dominant region with a market share of 35% in the Global Glass Fiber Epoxy Composites Market. The region dominates due to increasing demand from the construction, aerospace, and automobile industries.

Hexcel Corporation, Owens Corning, Hexion Inc, Solvay S.A, and AOC LLC are some leading players in the Global Glass Fiber Epoxy Composite Market.