Glass Break Detector Market Size (2024 – 2030)

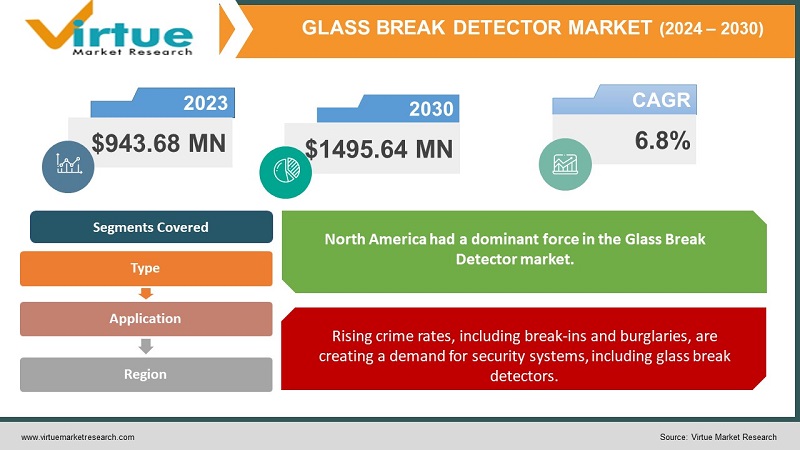

The Global Glass Break Detector Market was valued at USD 943.68 million and is projected to reach a market size of USD 1495.64 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.8%.

The Glass Break Detector market has evolved significantly over the years, transitioning from a niche security product to a pivotal component in enhancing safety measures across residential, commercial, and industrial sectors. In the past, limited awareness and lower crime rates kept the market relatively modest. However, today, it is experiencing substantial growth due to heightened security concerns driven by rising crime rates and the imperative need to protect valuable assets. This robust demand is further fuelled by ongoing technological advancements, evolving industry trends, and a plethora of emerging opportunities. As we look to the future, the Glass Break Detector market is poised for continued expansion as security remains a paramount priority in an increasingly uncertain world.

Key Market Insights:

The Glass Break Detector market has witnessed remarkable growth in recent years, with a compound annual growth rate (CAGR) of 5.8% from 2016 to 2021. The global market size reached USD 883.6 million in 2022 and is projected to surpass USD 1.4 billion by 2030. This substantial growth can be attributed to several factors, including the escalating crime rates in urban areas, particularly in regions like North America and Europe, where the market has witnessed robust adoption.

Regionally, North America continues to exert its dominance in the Glass Break Detector market, commanding more than 35% of the global share. This stronghold can be attributed to the persistent high prevalence of property crimes and the region's stringent security regulations. In contrast, the Asia-Pacific region is rapidly emerging as a promising market. Its growth trajectory is fuelled by factors such as rapid urbanization, an upswing in disposable incomes, and an increasingly acute awareness of security concerns. This shift signifies a significant opportunity for market players to expand their footprint and cater to a burgeoning customer base.

In terms of technology, the market is experiencing a notable transition towards wireless glass break detectors. This shift is primarily driven by the ease of installation and seamless integration capabilities with smart home security systems. Furthermore, the industry is witnessing a growing appetite for smart glass break detectors, which incorporate AI-based algorithms and remote monitoring features. As IoT technology continues to advance, these detectors offer real-time alerts and seamless synchronization with smartphones and security systems, further augmenting their appeal.

Glass Break Detector Market Drivers:

Rising crime rates, including break-ins and burglaries, are creating a demand for security systems, including glass break detectors.

Escalating incidents of break-ins and burglaries have spurred a heightened demand for security systems like glass break detectors. As criminal activities become more prevalent, homeowners, businesses, and industries are increasingly turning to these devices to bolster their security measures. Glass break detectors provide a proactive defense mechanism, instantly alerting occupants or security personnel when glass windows or doors are compromised, thereby acting as a crucial deterrent against unlawful intrusions.

Technological Advancements have led to the creation of more sophisticated glass break detectors that offer enhanced performance.

The Glass Break Detector market has been significantly influenced by ongoing technological advancements. These innovations have given rise to more sophisticated and sensitive detectors that offer enhanced performance and accuracy. Modern detectors employ cutting-edge sensor technologies and signal processing algorithms, reducing false alarms while increasing their ability to detect subtle glass breakage sounds accurately. This technological progress has improved the reliability and effectiveness of these devices, making them more appealing to consumers and businesses alike.

Integration with Smart Homes is driving the adoption of glass break detectors as part of comprehensive security solutions.

The integration of glass break detectors into smart home security systems has become a driving force behind their adoption. As more households embrace smart technology, homeowners seek comprehensive security solutions that can be seamlessly integrated into their existing setups. Glass break detectors that can communicate with smartphones and central monitoring systems, providing real-time alerts and control, offer a convenient and holistic approach to home security, contributing to their growing popularity.

Regulations and standards related to security and safety are encouraging the adoption of glass break detectors in various industries.

Stringent regulations and safety standards in various industries are encouraging the adoption of glass break detectors. These standards often require the implementation of specific security measures, including the use of glass break detectors, to ensure the safety and protection of assets and personnel. Compliance with these regulations not only enhances security but also minimizes legal liabilities, making glass break detectors an integral part of safety and security protocols across industries such as retail, banking, and healthcare.

Glass Break Detector Market Restraints and Challenges:

High Initial Costs for installing glass break detectors may deter budget-conscious consumers.

One significant restraint in the Glass Break Detector market is the high initial cost of installation. This expense can deter budget-conscious consumers from adopting these security devices. The purchase and installation of glass break detectors often involve professional services and equipment costs, which might be perceived as a barrier to entry. However, it's essential to note that the long-term benefits of enhanced security and peace of mind often outweigh the initial investment.

Glass break detectors are sensitive to various sounds, which can result in false alarms if not properly calibrated.

Glass break detectors' sensitivity to a range of sounds poses a challenge in terms of false alarms. These detectors are designed to respond to specific audio frequencies associated with glass shattering. However, other loud noises, such as thunder, loud music, or even a dropped object, can trigger false alarms if the detectors are not properly calibrated or if their sensitivity settings are too high. Addressing this challenge requires precise calibration and ongoing maintenance to minimize false alerts and maintain user confidence.

Integrating glass break detectors with existing security systems or smart home setups might lead to compatibility issues.

Integrating glass break detectors with existing security systems or smart home setups may lead to compatibility issues. Not all detectors seamlessly interface with all security platforms or communication protocols, potentially causing operational problems. This challenge necessitates careful consideration during the selection process to ensure that the chosen glass break detectors are compatible with the existing infrastructure. Manufacturers and service providers are working towards improving interoperability to mitigate this issue and offer smoother integration experiences for consumers and businesses alike.

Glass Break Detector Market Opportunities:

Emerging economies with growing concerns about security provide significant growth opportunities for manufacturers and service providers.

One of the most promising opportunities in the Glass Break Detector market lies in emerging economies where security concerns are on the rise. These regions, characterized by rapid urbanization and increasing disposable incomes, present significant growth potential for manufacturers and service providers. As more households and businesses seek to protect their assets and loved ones, there is a growing demand for security solutions, including glass break detectors. Capturing these markets through effective marketing strategies and tailored offerings can result in substantial growth.

Development of Custom Solutions for specific industry needs can open up niche markets.

The development of custom solutions to address specific industry needs represents a compelling opportunity. Different industries often have unique security requirements, and offering specialized glass break detectors tailored to these needs can open up niche markets. For instance, designing detectors optimized for the healthcare sector, financial institutions, or critical infrastructure facilities can provide a competitive edge and foster growth in these specialized segments.

Investment in Research and Development can lead to innovations that can further drive market growth.

Investment in R&D is pivotal for driving innovation within the Glass Break Detector market. Manufacturers that allocate resources to enhance detector capabilities, such as increased sensitivity, reduced false alarms, and improved integration with smart technologies, are likely to stay ahead in a competitive landscape. Innovations can lead to the development of next-generation detectors that cater to evolving security demands, creating new market opportunities and sustaining long-term growth.

GLASS BREAK DETECTOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.8% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc., Bosch Security Systems, Johnson Controls, Hikvision, Napco Security Technologies, Inc., Inovonics, Optex Group, Texecom, Interlogix, Digifort |

Glass Break Detector Market Segmentation: by Type

-

Acoustic Glass Break Detector

-

Shock Glass Break Detector

-

Hybrid Glass Break Detector

In 2022, Acoustic glass break detectors held the largest market share of 44.5% due to their effectiveness in detecting the sound frequencies associated with glass shattering. These detectors have been widely adopted in residential and commercial security systems. Their versatility extends to various settings, including homes, businesses, retail establishments, and offices, protecting glass doors and windows. Acoustic detectors boast rapid response times and low false alarm rates when appropriately calibrated. Technological advancements have further refined their performance, ensuring more accurate event detection and integration with smart homes.

Moreover, Hybrid glass break detectors, which combine acoustic and shock detection technologies, are the fastest-growing segment in the market with a CAGR of 11.6%. This growth was driven by their ability to offer enhanced detection accuracy and reduced false alarms. Hybrid detectors are versatile and suitable for various security scenarios, including homes, businesses, and critical infrastructure. They excel in scenarios where both acoustic and shock detection are essential for accurate threat identification. This includes environments where multiple types of glass or materials may be present.

Glass Break Detector Market Segmentation: by Application

-

Residential

-

Commercial

-

Industrial

In 2022, The Residential segment held the largest market share of 41.7% in the Glass Break Detector market. This dominance can be attributed to the growing awareness of home security and the increasing adoption of smart home systems. Rising concerns about break-ins and burglaries, coupled with the convenience of integrating glass break detectors into smart home security setups, drove this segment's growth.

Moreover, the Residential sector is also the fastest growing. The growth of the Residential segment was fueled by several factors, including rising concerns about break-ins and burglaries, the convenience of integrating glass break detectors into smart home security setups, and advancements in technology that made these devices more accessible and user-friendly.

The Commercial segment also represents a substantial portion of the market, with a market share of 32.3% in 2022. Commercial establishments, including offices, retail stores, and restaurants, prioritize security to protect their assets and ensure the safety of employees and customers. Glass break detectors are commonly used in these settings to secure glass doors and windows, contributing to the segment's significant market share.

Glass Break Detector Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

In 2022, North America had a dominant force in the Glass Break Detector market. The region accounted for the largest market share of 36.3%, in 2022. This stronghold can be attributed to factors such as a higher prevalence of property crimes, stringent security regulations, and a strong culture of security consciousness. The United States, in particular, has been a key market driver due to its large population and high adoption of security systems.

Moreover, the Asia-Pacific region exhibited the fastest growth rate. In 2022, it held 22.4% of the global market share. Rapid urbanization, increasing disposable incomes, and heightened security concerns in countries like China, India, and Japan were driving the adoption of security solutions, including glass break detectors. The Asia-Pacific region emerged as a lucrative market due to these factors.

The Europe region also held a substantial share of 29.7%, of the global Glass Break Detector market in 2020. The region's market was buoyed by a combination of factors including a robust commercial sector, a significant number of heritage buildings necessitating enhanced security measures, and an increased focus on safeguarding valuable assets. Countries like the United Kingdom, Germany, and France were prominent contributors to the European market.

COVID-19 Impact Analysis on the Global Glass Break Detector Market:

The COVID-19 pandemic had a multifaceted impact on the global Glass Break Detector market. Initially, as lockdowns and restrictions were imposed worldwide, the market experienced a slowdown in demand, primarily in early 2020, as residential and commercial construction projects were delayed or put on hold. However, as the pandemic underscored the importance of home and property security, a surge in demand for glass break detectors was witnessed as consumers and businesses sought to bolster their security measures during the crisis. Moreover, the shift toward remote work and the adoption of smart home technologies further fuelled the market's recovery, as these detectors integrated seamlessly into modern security systems. While supply chain disruptions and logistical challenges posed temporary setbacks, the market ultimately proved resilient, with a heightened emphasis on safety and security driving its continued growth and innovation.

Latest Trends/Developments:

In recent years, the Glass Break Detector market has witnessed significant advancements and trends. One noteworthy development is the seamless integration of these detectors with smart home ecosystems. Homeowners now have the convenience of remotely monitoring and controlling their security systems through smartphone apps and voice-activated devices. This trend aligns with the broader adoption of smart home technologies, where security is a crucial component of the connected home.

Wireless technology has also made a substantial impact on the market. The shift towards wireless glass break detectors has simplified installation, reduced clutter, and provided greater flexibility in device placement. Consumers and businesses appreciate the ease of integrating these detectors into their security systems without the hassle of complex wiring.

Furthermore, the incorporation of artificial intelligence (AI) and machine learning has improved the performance of glass break detectors. Advanced algorithms enable detectors to distinguish between genuine glass break events and false alarms more effectively. This enhancement has reduced false alerts, providing users with a higher level of accuracy and reliability in their security systems.

These developments reflect a broader industry focus on user customization, energy efficiency, and global expansion. As the market continues to evolve, it is likely to witness further innovations and enhancements in glass break detector technology to meet the ever-growing demand for robust security solutions in residential and commercial settings.

Key Players:

-

Honeywell International Inc.

-

Bosch Security Systems

-

Johnson Controls

-

Hikvision

-

Napco Security Technologies, Inc.

-

Inovonics

-

Optex Group

-

Texecom

-

Interlogix

-

Digifort

In March 2023, Inovonics specialty sensors were recognized as one of the "Top 30 Technology Innovations of 2022" by Security Sales & Integration magazine. These cutting-edge sensors include the EN1248 glass-break detector, offering advanced wireless security solutions for commercial environments. These sensors are designed with the latest sensor technology, providing application-specific solutions while seamlessly blending into commercial spaces.

In March 2021, Hikvision introduced its AX PRO wireless alarm system, designed to offer reliable intrusion detection while minimizing false alarms. This comprehensive security system includes remote video verification for breach detection, secure wireless transmission technology, and a variety of wireless alarm detectors. The AX PRO hub can connect up to 210 detectors, meeting specific security needs. Notable components include motion detectors, glass break detectors, door opening detectors, shock detectors, and environmental detectors.

Chapter 1. Glass Break Detector Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Glass Break Detector Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Glass Break Detector Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Glass Break Detector Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Glass Break Detector Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Glass Break Detector Market – By Type

6.1 Introduction/Key Findings

6.2 Acoustic Glass Break Detector

6.3 Shock Glass Break Detector

6.4 Hybrid Glass Break Detector

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis by By Type, 2024-2030

Chapter 7. Glass Break Detector Market – By Application

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Industrial

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Glass Break Detector Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By INDUSTRY VERTICAL

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Glass Break Detector Market – Company Profiles – (Overview, Glass Break Detector Market Portfolio, Financials, Strategies & Developments)

9.1 Honeywell International Inc.

9.2 Bosch Security Systems

9.3 Johnson Controls

9.4 Hikvision

9.5 Napco Security Technologies, Inc.

9.6 Inovonics

9.7 Optex Group

9.8 Texecom

9.9 Interlogix

9.10 Digifort

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Glass Break Detector Market was valued at USD 943.68 million and is projected to reach a market size of USD 1495.64 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.8%.

Rising crime rates, technological advancements, integration with smart homes, and security regulations are driving market growth.

Acoustic glass break detectors have the largest market share (44.5%) due to their effectiveness in detecting glass-shattering sounds and versatility across various settings.

North America holds the largest market share, accounting for over 35% of the global share.

Honeywell International Inc., Bosch Security Systems, Johnson Controls, Hikvision,Napco Security Technologies, Inc., and Inovonics are some of the key players.