Geriatric Immune Health Supplements Market size (2023 - 2030)

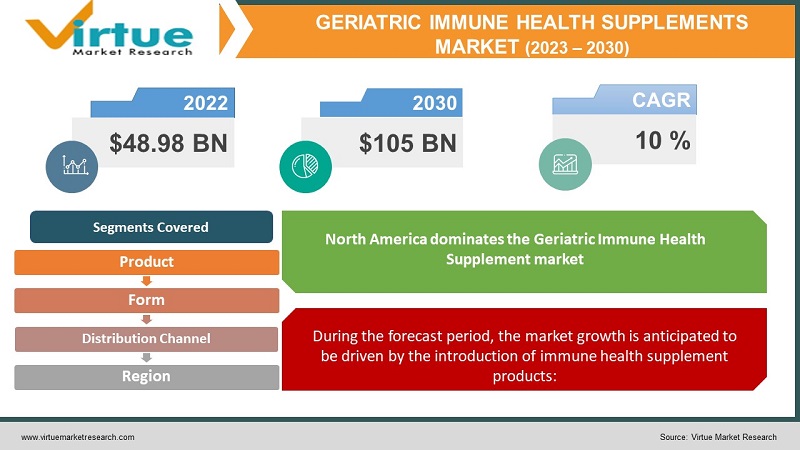

According to the report published by Virtue Market Research in Global Geriatric Immune Health Supplement Market was estimated to be worth USD 48.98 Billion in 2022 and is anticipated to reach a valuation of USD 105 billion by 2030. The market is projected to grow with a CAGR of 10% per annum during the period of analysis (2023 - 2030).

Industry Overview:

In recent years, there has been a significant increase in demand for dietary supplements such as vitamins, minerals, herbal items, and probiotics for strengthening immunity. Globally, people are becoming more aware of their immune systems' health and general well-being. The demand for immune health supplements has grown as a result of the aging population's expansion and adults' increasing knowledge of the need to strengthen their bodies' defenses. This has helped the industry expand. The body's immune system is significantly strengthened by immune health supplements, which also protect against many infectious diseases. Numerous studies have demonstrated a clear link between diabetes and the development of chronic illnesses. Infectious disease risk is also increased. Infectious disease risk is also increased. As a result, diabetes people are becoming more interested in taking supplements to boost their immune systems, which can be quite helpful in the fight against infectious diseases.

Supplements for immune health are crucial for managing several chronic problems, including indigestion, constipation, malabsorption, and chronic diseases including diabetes and obesity. Additionally, it promotes a healthy lifestyle, increases food intake and appetite, reduces the risk of nutrient deficiencies and other health issues, and lowers the risk of obesity. Patients of all ages, including newborns, adults, and geriatrics, who are prone to problems like diabetes, obesity, renal failures, chronic diseases, neurological diseases, and others are advised to take immune health supplements. The demand for immune health supplements has increased as a result of these causes.

Impact of Covid-19 on the Industry:

There is a substantial public interest in the usage of immune health supplements as a result of the COVID19 epidemic. The Council for Responsible Nutrition (CRN) estimates that in 2019, over 73 percent of Americans take dietary supplements and of those, roughly 32 percent take them to boost their immune system. Over the next years, the market is anticipated to be driven by rising consumer awareness of the need to preserve and enhance immunological health and well-being.

The COVID19 outbreak has benefited market expansion. The COVID19 pandemic has had a significant impact on the regions, including North America, Europe, and the Asia Pacific. The nations with the biggest number of COVID19 cases are the United States, the United Kingdom, India, Russia, and France. Over the upcoming years, a big population and the rising use of supplements to boost the body's immune system are expected to drive the market in these areas.

Due to the rising prevalence of chronic diseases and other problems among the senior population, the market for immune health supplements is anticipated to expand significantly throughout the forecast period. For instance, the World Health Organization said in September 2019 that there are approximately 10 million new instances of dementia each year and that there are over 50 million people worldwide who have the disease. According to the same source, Alzheimer's disease accounts for 60–70% of all instances of dementia and is the most prevalent type.

Market Drivers:

During the forecast period, the market growth is anticipated to be driven by the introduction of immune health supplement products:

Over the forecast period, the introduction of several immune health supplement products is anticipated to fuel market expansion. For instance, the biotechnology company Conagen Inc. declared in March 2020 that it had created a sustainable, proprietary lactoferrin protein that replicated the nutritional characteristics of lactoferrin found in breast milk.

During the forecast period, the global market for immune health supplements is anticipated to rise due to the rising prevalence of chronic illnesses and other disorders in senior patients:

Due to the rising prevalence of chronic diseases and other problems among the senior population, the market for immune health supplements is anticipated to expand significantly throughout the forecast period. For instance, the World Health Organization said in September 2019 that there are approximately 10 million new instances of dementia each year and that there are over 50 million people worldwide who have the disease. According to the same source, Alzheimer's disease accounts for 60–70% of all instances of dementia and is the most prevalent type.

Market Restraints:

The high cost of immune supplements will challenge the market growth:

The adverse effects, the high price of immune health supplement products, and the lack of knowledge about nutritional diet among low- and middle-income countries are the main reasons that limit the growth of the global market for immune health supplements. In rural areas of low- and middle-income economies in Africa and the Asia Pacific region, there is a deficient level of understanding about nutritional goods and diseases linked to nutritional inadequacies. This is anticipated to slow down the uptake of medical nutritional products in these areas and impede the expansion of the market.

GERIATRIC IMMUNE HEALTH SUPPLEMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Product, Form, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bayer AG, Pfizer Inc., Sun Pharmaceutical Industries Limited, Swisse Wellness Pty Ltd., GlaxoSmithKline Inc., Abbott Laboratories, Amway Corp., The Nature's Bounty Co., Herbalife Nutrition of America, Inc., Himalaya Global Holdings Ltd., American Health, Unilever, Sanofi, Novartis, Boehringer Ingelheim |

Global Geriatric Immune Health Supplement - By Product

-

Vitamin and Mineral Supplements

-

Vitamin C Supplements

-

Vitamin D Supplements

-

Vitamin B complex Supplements

-

Multivitamins

-

Selenium Supplements

-

Zinc Supplements

-

Others

-

-

Herbal Supplements

-

Probiotic Supplements

-

Others

In 2020, the market was dominated by the vitamin and mineral supplement category, which had the highest revenue share at 64.5 percent. The segment is being driven by consumers' growing choice of supplements to strengthen their immune systems across the globe. Vitamins C, D, and B complex, multivitamins, and minerals like zinc and selenium, which strengthen the immune system, have been shown to have numerous health benefits and are widely available, which are driving the segment's rise. Sales of vitamin C appear to be up worldwide during the COVID-19 outbreak. The category growth is anticipated to pick up speed during the forecast years as a result of people becoming more aware of the benefits of taking preventive measures.

Throughout the projected period, the herbal supplement market is anticipated to grow at a CAGR of over 12.0 percent. The segment is being driven by the high desire among consumers to use herbal supplements rather than nutraceuticals to boost the body's immune health without any adverse effects. Over the forecast years, it is also expected that the growing vegan population will propel the market.

Global Geriatric Immune Health Supplement - By Form

-

Capsules

-

Tablets

-

Powder

-

Liquid

-

Gel

-

Soft gels

-

Others

In 2020, the tablet market segment dominated and contributed 32.8 percent of total revenue. Due to their longer shelf lives, lower prices, and greater convenience, the majority of vendors produce supplements in tablet form. During the projection period, it is also projected that the segment will be driven by the immune health supplements that are becoming more and more popular in tablet form due to their simple and precise dose.

Over the projection period, the softgels category is anticipated to have the highest CAGR of 12.4%. The simple method of administration provided by the gels to take vitamins and minerals is credited with this rise.

Global Geriatric Immune Health Supplement - By Distribution Channel

-

Pharmacies/Drug Stores

-

Supermarkets and Hypermarkets

-

E-commerce

-

Others

In 2020, the segment of pharmacies and drugstores dominated the market and accounted for 58.9 percent of total revenue. The biggest sales of the products in pharmacies or drug shops are anticipated to increase as a result of increasing consumer desire and the accessibility of a wide range of products. Due to steep discounts and the accessibility of a broad selection of goods in the regions of North America and Europe, supermarkets and hypermarkets retained a substantial revenue share in 2020. Additionally, it is projected that the expansion of supermarkets in developing nations would fuel the segment's rise over the forecasted years.

Global Geriatric Immune Health Supplement - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

The market was dominated by North America in 2020, which had the highest revenue share (37.1%). The factors expected to drive regional expansion in the immune health supplements market over the projected years are the greatest immune health supplement customer base and rising individual awareness. Additionally, a rising trend among Americans to purchase preventive supplements is anticipated to fuel market expansion in this area.

The market is anticipated to see the quickest CAGR of 12.8% in the Asia Pacific over the forecast period. Over the upcoming years, it is projected that rising per capita income and an expanding consumer base in Asian nations like China, India, and South Korea would fuel demand for immune support supplements in these areas. Additionally, this region is expected to develop at the greatest rate over the next years due to rising awareness of and spending on health-improving products.

In terms of revenue share for the market in 2020, Europe occupied the second-highest position. The increased awareness of COVID19 and various government programs to increase population immunity are the main drivers of this region's sizable revenue share. Additionally, increased per capita income in European nations like the U.K., Germany, and France as well as rising consumer spending on supplements to boost immune function are the main factors projected to contribute to the considerable market expansion in this area.

Global Geriatric Immune Health Supplement- By Companies

-

Bayer AG

-

Pfizer Inc.

-

Sun Pharmaceutical Industries Limited

-

Swisse Wellness Pty Ltd.

-

GlaxoSmithKline Inc.

-

Abbott Laboratories

-

Amway Corp.

-

The Nature's Bounty Co.

-

Herbalife Nutrition of America, Inc.

-

Himalaya Global Holdings Ltd.

-

American Health

-

Unilever

-

Sanofi

-

Novartis

-

Boehringer Ingelheim

NOTABLE HAPPENINGS IN THE GLOBAL GERIATRIC IMMUNE HEALTH SUPPLEMENTS MARKET IN THE RECENT PAST:

-

Product Launch:- In 2021, The introduction of BioGlena powdered components for immune support was announced by Solabia-Algatech Nutrition. To fulfill the rising demand for immune-supporting and clean-label ingredients, the company is strategically trying to expand its microalgae portfolio.

-

Product Launch:- In 2021, In Australia, Royal DSM announced the release of ampli-D, a fast-acting vitamin D supplement. Increasing vitamin D levels in the body to enhance immunological function is a more efficient approach to do so. Australia served as the initial market for the product's introduction, and the Therapeutic Goods Administration (TGA) there approved its usage in dietary supplements.

-

Merger & Acquisition:-In 2021, In the United States, a daily probiotic supplement brand called TruBiotics was acquired by PanTheryx. Through innovation and investment, this purchase will hasten the expansion of the probiotics and microbiome category and increase the product lines for digestive and immune health in human nutrition.

-

Product Launch:- In 2020, In addition to the company's portfolio of category-leading pill-free supplements, Healthycell has announced the release of IMMUNE SUPER BOOST, a highest-dose immune booster.

Chapter 1.GLOBAL GERIATRIC IMMUNE HEALTH SUPPLEMENT MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.GLOBAL GERIATRIC IMMUNE HEALTH SUPPLEMENT MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.GLOBAL GERIATRIC IMMUNE HEALTH SUPPLEMENT MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.GLOBAL GERIATRIC IMMUNE HEALTH SUPPLEMENT MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL GERIATRIC IMMUNE HEALTH SUPPLEMENT MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.GLOBAL GERIATRIC IMMUNE HEALTH SUPPLEMENT MARKET– By Product

6.1. Vitamin and Mineral Supplements

6.1.1. Vitamin C Supplements

6.1.2. Vitamin D Supplements

6.1.3. Vitamin B complex Supplements

6.1.4. Multivitamins

6.1.5. Selenium Supplements

6.1.6. Zinc Supplements

6.1.7. Others

6.2. Herbal Supplements

6.3. Probiotic Supplements

6.4. Others

Chapter 7.GLOBAL GERIATRIC IMMUNE HEALTH SUPPLEMENT MARKET– By Form

7.1. Capsules

7.2. Tablets

7.3. Powder

7.4. Liquid

7.5. Gel

7.6. Soft gels

7.7. Others

Chapter 8. GLOBAL GERIATRIC IMMUNE HEALTH SUPPLEMENT MARKET– By Distribution Channel

8.1. Pharmacies/Drug Stores

8.2. Supermarkets and Hypermarkets

8.3. E-commerce

8.4. Others

Chapter 9. GLOBAL GERIATRIC IMMUNE HEALTH SUPPLEMENT MARKET– By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10.GLOBAL GERIATRIC IMMUNE HEALTH SUPPLEMENT MARKET– Key Players

10.1.Bayer AG

10.2. Pfizer Inc.

10.3. Sun Pharmaceutical Industries Limited

10.4. Swisse Wellness Pty Ltd.

10.5. GlaxoSmithKline Inc.

10.6. Abbott Laboratories

10.7. Amway Corp.

10.8. The Nature's Bounty Co.

10.9. Herbalife Nutrition of America, Inc.

10.10. Himalaya Global Holdings Ltd.

10.11. American Health

10.12. Unilever

10.13. Sanofi

10.14. Novartis

10.15. Boehringer Ingelheim

Download Sample

Choose License Type

2500

4250

5250

6900