Geothermal energy Market Size (2025-2030)

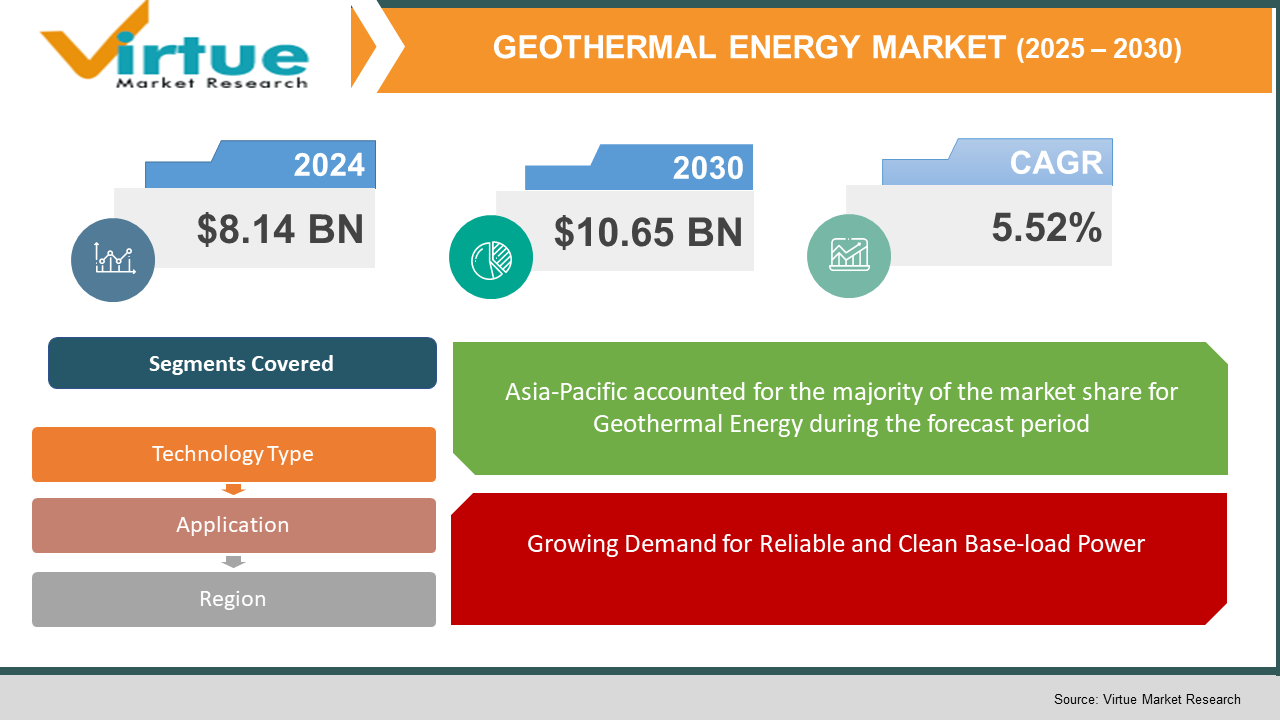

The Geothermal Energy Market was valued at USD 8.14 billion in 2024 and is projected to reach a market size of USD 10.65 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.52%.

The geothermal energy market is centered around harnessing the Earth's internal heat to generate power and provide heating solutions. This renewable energy source relies on naturally occurring geothermal reservoirs of steam or hot water located beneath the Earth's surface. The industry is primarily divided into electricity generation and direct-use applications, including heating buildings, agricultural processes, and industrial operations. Technologies such as dry steam, flash steam, and binary cycle power plants are commonly used depending on the temperature and pressure conditions of the geothermal resource.

Countries with volcanic activity or tectonic plate boundaries are typically more favorable for geothermal development. Regulatory frameworks, technological advances, and infrastructure investments also play crucial roles in shaping the landscape of the geothermal industry.

Key Market Insights:

Advancements in drilling techniques, notably Enhanced Geothermal Systems (EGS), are expanding the viability of geothermal projects. These innovations allow for the extraction of geothermal energy from regions previously deemed unsuitable due to geological constraints. The U.S. Department of Energy's Utah FORGE project demonstrated that improved drilling technologies reduced well completion costs by 25%, making geothermal energy more accessible and cost-effective.

In Europe, the geothermal energy market is experiencing significant growth, with a projected compound annual growth rate (CAGR) of 9.0% over the forecast period. Countries like Turkey have expanded their geothermal capacity, and over 20 European nations are developing geothermal projects. The European Union's commitment to reducing greenhouse gas emissions and transitioning to renewable energy sources positions geothermal energy as a viable alternative for heating and cooling applications.

Geothermal Energy Market Drivers:

Government Incentives and Regulatory Support

Governments across the globe are increasingly implementing policies to support renewable energy development, including geothermal power. Incentives such as tax credits, feed-in tariffs, and grants help reduce the financial burden of high initial capital costs associated with geothermal projects. Streamlined permitting processes and land access reforms, particularly in the U.S. and Europe, have also played a critical role in accelerating project timelines. These measures significantly improve the economic viability and attractiveness of geothermal energy investments.

Growing Demand for Reliable and Clean Base-load Power

Unlike solar and wind, geothermal energy provides a constant, uninterrupted power supply, making it highly valuable for maintaining grid stability. As countries seek to reduce dependence on fossil fuels while meeting rising electricity demand, geothermal energy offers a dependable and sustainable alternative. Its base-load nature also makes it a crucial complement to intermittent renewables, ensuring energy security and reducing the need for fossil-fuel-based backup systems.

Technological Advancements in Drilling and Resource Utilization

Innovations in drilling technology, such as Enhanced Geothermal Systems (EGS), are unlocking previously inaccessible geothermal resources. These advancements allow for the expansion of geothermal energy projects beyond traditional high-temperature zones. Improved efficiency in heat exchangers, reservoir stimulation techniques, and hybrid system integration are also contributing to cost reductions and performance gains. As a result, geothermal energy is becoming more competitive with other forms of renewable energy.

Geothermal Energy Market Restraints and Challenges:

High Initial Capital Costs

Developing geothermal power plants requires significant upfront investment, particularly in exploration and drilling, which can account for over 40% of total project costs. The geological risks associated with finding viable reservoirs add to the financial uncertainty, often deterring private investors. Although operating costs are low, the long payback period can limit project feasibility without substantial government or institutional support.

Limited Geographical Availability

Commercial geothermal energy production is highly dependent on specific geological conditions, such as proximity to tectonic plate boundaries or volcanic activity. This limits the widespread applicability of geothermal projects, especially in regions lacking accessible high-temperature resources. While technologies like EGS aim to overcome this, they are still in early-stage deployment and not yet commercially widespread.

Environmental and Regulatory Hurdles

Although geothermal energy is cleaner than fossil fuels, it is not entirely free of environmental concerns. Issues such as land subsidence, water usage, and the release of trace gases like hydrogen sulfide can arise. Additionally, complex regulatory frameworks and lengthy permitting processes in some regions can delay project development, increasing costs and uncertainty for developers.

Geothermal Energy Market Opportunities:

The future of the geothermal energy market holds significant potential, driven by technological innovation and global decarbonization goals. Enhanced Geothermal Systems (EGS) and advanced drilling methods are expected to unlock geothermal resources in areas previously considered non-viable, greatly expanding the geographic scope of the industry. There is also growing interest in hybrid renewable systems that integrate geothermal with solar or wind to create more stable and efficient power generation. In urban areas, geothermal district heating and cooling systems are emerging as sustainable solutions for reducing emissions from buildings. Additionally, the push for electrification in developing economies presents new markets for off-grid or microgrid geothermal applications. With continued support from governments and multilateral institutions, geothermal could play a more prominent role in the global energy transition. As battery storage technologies improve, pairing them with geothermal could further enhance flexibility and reliability.

GEOTHERMAL ENERGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.52% |

|

Segments Covered |

By technology Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

. Ormat Technologies Inc., Calpine Corporation, Enel Green Power, Mitsubishi Heavy Industries, Toshiba Corporation etc. |

Geothermal Energy Market Segmentation:

Geothermal energy Market Segmentation: by Technology Type

- Binary Cycle Power Plants

- Flash Steam Power Plants

- Dry Steam Power Plants

Binary cycle power plants are designed to utilize lower-temperature geothermal resources, typically ranging between 85°C and 170°C. In these systems, geothermal fluid heats a secondary fluid with a lower boiling point, causing it to vaporize and drive turbines to generate electricity. This closed-loop process ensures minimal emissions and environmental impact. Due to their ability to operate in a wider range of geological settings, binary cycle plants have become increasingly popular. As of 2025, they are estimated to account for approximately 40–45% of the global geothermal power market revenue.

Flash steam power plants are the most prevalent type of geothermal power plant, especially in regions with high-temperature geothermal resources exceeding 180°C. These plants bring high-pressure hot water to the surface, where a sudden drop in pressure causes some of the water to vaporize, or "flash," into steam. This steam then drives turbines to produce electricity. Flash steam plants are known for their high efficiency and are widely used in countries with abundant high-temperature geothermal reservoirs. As of 2025, flash steam plants are projected to contribute to approximately 50–55% of the global geothermal power market revenue.

Dry steam power plants are the oldest type of geothermal power generation, utilizing steam directly from geothermal reservoirs to drive turbines. This method requires geothermal resources that produce dry steam without water, which are relatively rare and typically found in specific volcanic regions. While these plants are highly efficient and have low operational costs, their deployment is limited by the scarcity of suitable geothermal resources. Consequently, dry steam power plants represent a smaller segment of the market, accounting for approximately 5–10% of the global geothermal power market revenue in 2025.

Geothermal energy Market Segmentation: by Application

- Electricity Generation

- Direct Use (heating, greenhouse agriculture, industrial processes)

- Geothermal Heat Pumps (GHPs) for space heating and cooling

Geothermal electricity generation uses steam or hot water from underground reservoirs to drive turbines and produce electricity. This application is dominant in regions with high-temperature geothermal resources, such as the U.S., Indonesia, and Kenya. It is often used for base-load power due to its continuous, stable output. In 2025, electricity generation is estimated to account for approximately 50–55% of the total geothermal market share.

Direct-use applications involve channeling geothermal heat directly into buildings, greenhouses, aquaculture facilities, and industrial operations without converting it to electricity. This approach is widely used in countries with easily accessible geothermal resources at moderate temperatures, such as Iceland and Turkey. It provides cost-effective, local heating solutions with minimal environmental impact. In 2025, this segment is estimated to hold around 10–15% of the global geothermal market share.

Geothermal heat pumps use the consistent temperature beneath the Earth’s surface to provide efficient heating and cooling for buildings. They are widely adopted in residential and commercial sectors, especially in North America, Europe, and parts of Asia. GHPs are scalable, low-emission systems that are gaining popularity as part of sustainable construction practices. As of 2025, this segment is projected to represent approximately 30–35% of the overall geothermal market share.

Geothermal energy Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

With about 37% market share, Asia-Pacific leads the global geothermal energy market, driven by countries like Indonesia, the Philippines, and Japan. Indonesia, for instance, aims to achieve 7 GW of geothermal capacity by 2025, leveraging its vast geothermal resources. The region's rapid economic growth, increasing energy demand, and supportive government policies contribute to its dominant position in the market.

North America, particularly the United States, holds a significant share of the geothermal market. The U.S. has implemented policies to expedite geothermal project permitting, aiming to tap into the vast potential of regions like Nevada's Great Basin. These initiatives, coupled with technological advancements, position North America as a key player in the geothermal sector. It has 30% of world’s total market share.

With about 15% market, Europe's geothermal market is expanding, with countries like Turkey, Italy, and Germany investing in geothermal projects. The European Union's ambitious renewable energy targets and supportive regulatory frameworks further drive the expansion of geothermal power capacity across the continent.

South America's geothermal market is growing, with countries like Mexico and Chile exploring their geothermal potential. Mexico, for example, is one of the largest contributors to clean electricity generation through geothermal energy in the region. Government support and increasing energy demand are key factors propelling the market forward. It has 10% market share.

The Middle East & Africa region, particularly East Africa, is gradually exploring its geothermal potential. Kenya leads in geothermal development, with significant contributions to its electricity generation from geothermal sources. The region's focus on renewable energy and sustainable development goals supports the growth of the geothermal market. This region has 8% of total market share.

COVID-19 Impact Analysis on the Global Geothermal Energy Market:

The COVID-19 pandemic had a mixed impact on the geothermal energy market. In the short term, project development faced significant delays due to supply chain disruptions, workforce shortages, and restrictions on movement. Exploration and drilling activities, which require specialized equipment and skilled labor, were particularly affected. Investment in new geothermal projects slowed as governments and private investors redirected funds to address immediate public health and economic crises.

However, the pandemic also reinforced the importance of resilient and sustainable energy systems. Many countries incorporated renewable energy—including geothermal—into their recovery plans, recognizing its role in energy security and economic stability. The decline in global fossil fuel demand created opportunities for renewables to gain market share, and geothermal, as a base-load energy source, attracted renewed attention. Furthermore, the push for localized energy generation to reduce dependence on international supply chains benefited geothermal projects, which often serve regional or national grids. While growth temporarily slowed during 2020–2021, the post-pandemic period has seen renewed momentum in policy support and project planning for geothermal energy.

Latest Trends/ Developments:

The geothermal energy market is rapidly evolving, driven by technological innovations and growing global interest. Enhanced Geothermal Systems (EGS) are expanding the potential of geothermal by making previously inaccessible areas viable for energy production. Advancements in drilling, adapted from the oil and gas sector, have significantly improved efficiency and lowered costs. Hybrid systems combining geothermal with solar and wind are being developed to enhance grid stability and energy reliability. Governments, particularly in the U.S., are implementing supportive policies and expedited permitting processes to accelerate geothermal deployment. Direct-use applications, such as district heating and industrial processes, are becoming more common, highlighting the versatility of geothermal energy. Countries like Kenya and Indonesia are investing heavily in geothermal infrastructure, fueling global market expansion. Geothermal Heat Pumps (GHPs) are also gaining traction in residential and commercial sectors for efficient heating and cooling. As technologies mature and costs continue to fall, the International Energy Agency projects a dramatic decrease in next-generation geothermal costs by 2035. Overall, geothermal energy is emerging as a critical component of the clean energy transition.

Key Players:

- Ormat Technologies Inc.

- Calpine Corporation

- Enel Green Power

- Mitsubishi Heavy Industries

- Toshiba Corporation

- First Gen Corporation

- Reykjavik Geothermal

- Fervo Energy

- KenGen

- Berkshire Hathaway Energy

Chapter 1. Geothermal Energy Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GEOTHERMAL ENERGY MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GEOTHERMAL ENERGY MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GEOTHERMAL ENERGY MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. GEOTHERMAL ENERGY MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GEOTHERMAL ENERGY MARKET – By Technology Type

6.1 Introduction/Key Findings

6.2 Binary Cycle Power Plants

6.3 Flash Steam Power Plants

6.4 Dry Steam Power Plants

6.5 Y-O-Y Growth trend Analysis By Technology Type

6.6 Absolute $ Opportunity Analysis By Technology Type , 2025-2030

Chapter 7. GEOTHERMAL ENERGY MARKET – By Application

7.1 Introduction/Key Findings

7.2 Electricity Generation

7.3 Direct Use (heating, greenhouse agriculture, industrial processes)

7.4 Geothermal Heat Pumps (GHPs) for space heating and cooling

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. GEOTHERMAL ENERGY MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Technology Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Technology Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Technology Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Technology Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Technology Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GEOTHERMAL ENERGY MARKET – Company Profiles – (Overview, Technology Type , Portfolio, Financials, Strategies & Developments)

9.1 Ormat Technologies Inc.

9.2 Calpine Corporation

9.3 Enel Green Power

9.4 Mitsubishi Heavy Industries

9.5 Toshiba Corporation

9.6 First Gen Corporation

9.7 Reykjavik Geothermal

9.8 Fervo Energy

9.9 KenGen

9.10 Berkshire Hathaway Energy

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Geothermal Energy Market was valued at USD 8.14 billion in 2024 and is projected to reach a market size of USD 10.65 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.52%.

Government Incentives and Regulatory Support, Growing Demand for Reliable and Clean Base-load Power and Technological Advancements in Drilling and Resource Utilization are some of the key market drivers in the Electric Motorsports Market.

Binary Cycle Power Plants, Flash Steam Power Plants, Dry Steam Power Plants by Technology Type in the Geothermal Energy Market.

Asia-Pacific is the most dominant region for the Global Geothermal Energy Market.

Ormat Technologies Inc., Calpine Corporation, Enel Green Power, Mitsubishi Heavy Industries, Toshiba Corporation etc.