Genomics Informatics Market Size (2024 – 2030)

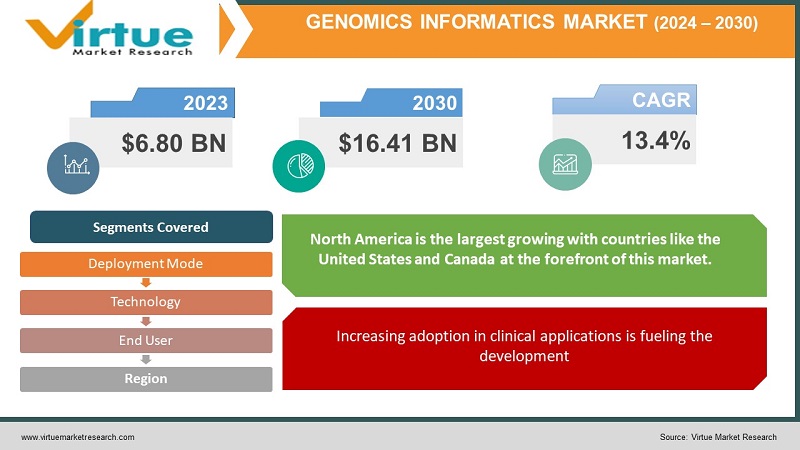

The Global Genomics Informatics Market was valued at USD 6.80 billion and is projected to reach a market size of USD 16.41 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.4%.

Genomic informatics is the study of how to extract biological information from genomic sequences using computer and statistical methods. After the successful completion of the Human Genome Project in 2003, vast amounts of data were generated. Bioinformatics tools were in the initial stages of development. Presently, with technological advancements including NGS, BLAST, and other AI tools, this market is growing substantially. Shortly, with extensive R&D activities, personalized medicine, and integration of technologies, this market will hold tremendous potential. During the forecast period, this market will see good growth.

Key Market Insights:

In 2022, the National Human Genome Research Institute published a report predicting that genomics research will generate between 2 and 40 exabytes of data within the next decade.

Human genome funding by the NIH was around 4.77 billion U.S. dollars in fiscal year 2022.

The error rate in NGS data was ranging between 0.1% to 1%. This small error resulted in wrong data interpretation affecting the research and healthcare sector. To tackle this, quality control and improved sequencing technologies are being incorporated.

Genomics Informatics Market Drivers:

Technological advancements are contributing to the market progress.

Over the years, there have been many improvements and breakthroughs through research activities to broaden human understanding. Many databases and software tools have been aiding human knowledge. Next-generation sequencing (NGS) tools, BLAST, FASTA, artificial intelligence, machine learning, data analytics, and other cloud-based solutions have been the main reasons for the growth rate. All these tools have helped in the generation of more data. Analyzing and interpreting data has become easier. With a growing need to find effective solutions and manage the acquired data, more research activities to develop complex software are being given prominence.

Increasing adoption in clinical applications is fueling the development.

Over the years, a greater number of youngsters have been showing interest in the development of medications for diseases and disorders that have no cure. Clinical research has become very crucial for achieving this. Personalized and precision medicine have been the focus. They involve developing treatments by analyzing the genetic makeup of an individual. This allows an understanding of genes, sequences, drug targets, and other regions. With increasing healthcare applications and professionals, more workforce is helping in discoveries thereby enlarging the market.

Genomics Informatics Market Restraints and Challenges:

Data privacy, costs, data integration, and complexity of interpretation are the main barriers that the market is experiencing.

One of the major concerns about this market is the security of data. Since it involves sensitive information, it can readily be misused to exploit the company and create threats by introducing harmful pathogens into the environment. Secondly, the price associated is a big hindrance. Installation, maintenance, and software require a lot of money. Additionally, high budgets are necessary for training the workforce and personnel. Thirdly, integration can hamper the growth rate. Clinical records, sequence, and other data can be inconsistent and difficult to comprehend. Furthermore, since this is relatively a new field, understanding sequencing can be a restraint. Limited knowledge about data regarding rare genetic diseases, psychological issues, and other uncommon disorders persists and requires more comprehension.

Genomics Informatics Market Opportunities:

Predictive and preventive healthcare has been providing the market with an ample number of opportunities. It involves the prevention of chronic diseases. Genomics software helps in analyzing the gene sequences to detect any abnormalities. Secondly, global expansion has been augmenting the growth rate. By exchange of information between different regions, interpretations and analysis can be done. This is beneficial because each region has a different lifestyle and environmental conditions creating different data. This exchange of information facilitates a greater understanding. Thirdly, this can be applied to drug repurposing. By identifying the therapeutic areas and the target mechanism, solutions for diseases can be found. Furthermore, AI and ML have been helping by providing insights for development.

GENOMICS INFORMATICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.4% |

|

Segments Covered |

By Deployment Mode, Technology, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Illumina, Inc., Thermo Fisher Scientific, Qiagen, BGI (Beijing Genomics Institute), Pacific Biosciences, Seven Bridges, DNAnexus, Sophia Genetics, Broad Institute, Bionano Genomics |

Genomics Informatics Market Segmentation: By Deployment Mode

-

On-Premise

-

Cloud-based

Based on deployment mode, cloud-based is both the largest and fastest-growing segment in the market holding a share exceeding 65%. This is due to its advantages like flexibility, cost-effectiveness, flexibility, availability, scalability, and major companies which offer this solution. During the forecast period, this segment is expected to further show lucrative growth.

Genomics Informatics Market Segmentation: By Technology

-

Next Generation Sequencing (NGS)

-

Sanger Sequencing

-

Microarray

Based on technology, next-generation sequencing is considered to be both the largest and fastest-growing segment in this market. This is because of continuous developments, availability of advanced software tools, clinical applications like drug discovery, genetic screening, and precision medicine, accessibility to massive amounts of data, greater workforce working in R&D, immense potential, and cost-effectiveness of diagnostic tools. Additionally, its future application in agriculture and ecological settings is being studied supporting the flourishment of the segment.

Genomics Informatics Market Segmentation: By End User

-

Pharmaceutical and Biotechnology Companies

-

Research and Educational Institutes

-

Hospitals and Clinics

-

Others

Pharmaceutical and biotechnology companies are the largest growing end users. This segment holds a rough share of 36% in this market. This is because of the availability of resources, funds, increased workforce, expertise, and access to databases, global outreach, collaborations, and other partnerships. However, research and educational institutions are the fastest growing owing to piqued curiosity amongst youngsters and researchers, Governmental support through initiatives and investments, rising number of institutions, accessibility to advanced technologies, and support from multinational companies. Moreover, educational institutions are providing basic knowledge by conducting laboratory sessions. These labs are equipped with publicly available tools and databases to increase the interest of students. They hold a total share of around 24%.

Genomics Informatics Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on region, North America is the largest growing with countries like the United States and Canada at the forefront of this market. This region is estimated to hold a share of around 40%. This is because of technological advancements, economic strength, research institutes, and the presence of key companies, easy access, demand, and investments. However, Asia Pacific is considered to be the fastest-growing region with a share of around 20%. Countries like China, India, and Singapore are the dominating ones. This is because of the presence of renowned research institutions, economic development, emerging markets, rising funds, technological improvements, Governmental support, and initiatives.

COVID-19 Impact Analysis on the Global Genomics Informatics Market:

The pandemic had a positive impact on the market. With the outbreak of the virus, it was very vital to develop a vaccine. Genetic sequencing was fundamental for studying the defense mechanism, target, and other sequencing. This led to an increase in the usage of genetics software and other informatics tools. Additionally, this was used to track the infection to prevent any further spreading. The efficacy of the vaccine was done using various genomic software and tools. Moreover, there was a significant increase in the funding of R&D activities for public health. Telemedicine was the new norm due to lockdowns, social isolation, and movement restrictions. Genomic services were used for counseling and other purposes. Furthermore, there were special initiatives taken to prevent any disruptions in the supply chain, transportation, and other logistics for healthcare equipment and other related services. Post-pandemic, the market maintained the upsurge by continuing the studies in this field.

Latest Trends/ Developments:

Companies in this industry are driven to increase their market share using a variety of tactics, including alliances, investments, and acquisitions. Along with maintaining competitive pricing, businesses are paying much to advance existing technologies and find new ones. This has also led to greater enlargement.

Epigenomics is the study of how an individual’s behavior and environmental factors affect the working of a gene. Pharmacogenomics, on the other hand, is the study of the role of genome/DNA in a drug response. Work in these two fields is increasing for the development of personalized medicine.

Key Players:

-

Illumina, Inc.

-

Thermo Fisher Scientific

-

Qiagen

-

BGI (Beijing Genomics Institute)

-

Pacific Biosciences

-

Seven Bridges

-

DNAnexus

-

Sophia Genetics

-

Broad Institute

-

Bionano Genomics

-

In October 2023, Sysmex Group Company, and leading global provider of genomic research and diagnostic solutions, announced its new partnership with Intelliseq, a genome informatics company and innovative provider of Next-Generation Sequencing (NGS) analysis solutions. This collaboration combined OGT's expansive SureSeq™ NGS portfolio with Intelliseq's state-of-the-art iFlow™ engine, resulting in a thorough NGS workflow—from sample to report.

-

In March 2022, Cloud-based biomedical data analysis software developer DNAnexus completed a $200 million financing intended to advance global adoption of its technology. DNAnexus said it would use the financing to accelerate the development of its core genomics and multi-omics platform, continue its international growth, and support the integration of new artificial intelligence (AI) and machine learning technologies and tools.

-

In June 2020, Illumina acquired cloud-based, rapidly configurable omics data analysis platform developer BlueBee to accelerate the sequencing giant’s analysis and sharing of next-generation sequencing (NGS) data at scale.

Chapter 1. Genomics Informatics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Genomics Informatics Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Genomics Informatics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Genomics Informatics Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Genomics Informatics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Genomics Informatics Market – By Deployment Mode

6.1 Introduction/Key Findings

6.2 On-Premise

6.3 Cloud-based

6.4 Y-O-Y Growth trend Analysis By Deployment Mode

6.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 7. Genomics Informatics Market – By Technology

7.1 Introduction/Key Findings

7.2 Next Generation Sequencing (NGS)

7.3 Sanger Sequencing

7.4 Microarray

7.5 Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Genomics Informatics Market – By End User

8.1 Introduction/Key Findings

8.2 Pharmaceutical and Biotechnology Companies

8.3 Research and Educational Institutes

8.4 Hospitals and Clinics

8.5 Others

8.6 Y-O-Y Growth trend Analysis By End User

8.7 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Genomics Informatics Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Deployment Mode

9.1.3 By End User

9.1.4 By Technology

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Deployment Mode

9.2.3 By End User

9.2.4 By Technology

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Deployment Mode

9.3.3 By End User

9.3.4 By Technology

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Deployment Mode

9.4.3 By End User

9.4.4 By Technology

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Deployment Mode

9.5.3 By End User

9.5.4 By Technology

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Genomics Informatics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Illumina, Inc.

10.2 Thermo Fisher Scientific

10.3 Qiagen

10.4 BGI (Beijing Genomics Institute)

10.5 Pacific Biosciences

10.6 Seven Bridges

10.7 DNAnexus

10.8 Sophia Genetics

10.9 Broad Institute

10.10 Bionano Genomics

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Genomics Informatics Market was valued at USD 6.80 billion and is projected to reach a market size of USD 16.41 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.4%.

Technological advancements and increasing adoption in clinical applications are the main drivers propelling the Global Genomics Informatics Market.

Based on End User, the Global Genomics Informatics Market is segmented into Pharmaceutical and Biotechnology Companies, Research and Educational Institutes, Hospitals and Clinics, and Others.

North America is the most dominant region for the Global Genomics Informatics Market.

Illumina, Inc., Thermo Fisher Scientific, and Qiagen are the key players operating in the Global Genomics Informatics Market.