Global Genome Sequencing Equipment/Systems Market Size (2023– 2030)

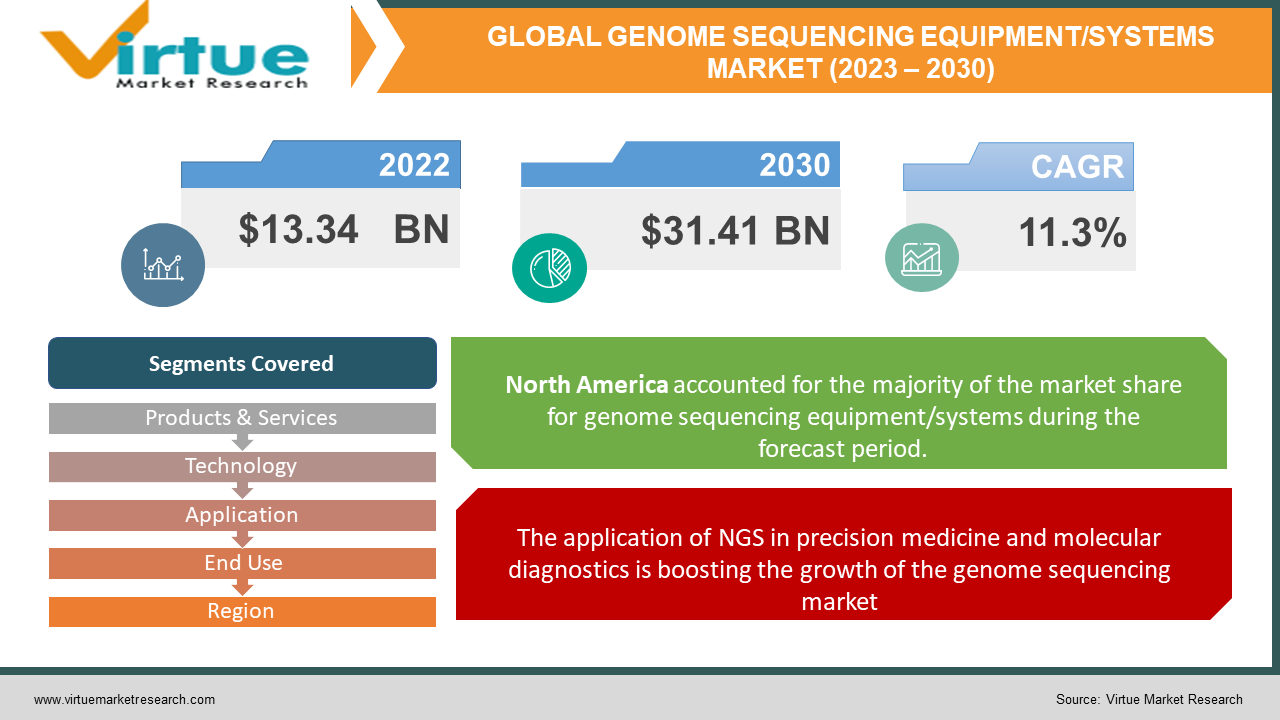

In 2022, the Global Genome Sequencing Equipment/Systems Market was valued at $13.34 billion, and is projected to reach a market size of $31.41 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 11.3%. Growing application of NGS in precision medicine and molecular diagnostics, declining costs of genome sequencing, and increasing government funding to support genomics projects are some factors majorly driving the growth of the market.

Industry Overview:

Genome sequencing systems are used to determine the nucleotide sequence of DNA, and it plays a key role in mapping the human genome. Many sequencing methods including Sanger sequencing, next-generation sequencing, and third-generation sequencing have a widespread adoption to determine genome sequencing cost-effectively and reduced time. The declining costs of genome sequencing and continuous advancements in next-generation sequencing systems is a key factor driving the market growth. Genome sequencing systems have wide use in biomarker discovery, agrigenomics, reproductive health, HLA typing, and, forensics, among others. Advancements in sequencing technology and Bioinformatics have enabled better identification of DNA variations. These advancements also aid in determining variants that pose an increased risk for disease. A large number of genes can be tested in a single diagnostic platform and at the same time with the widespread use of Next Generation Sequencing (NGS) and Whole-genome Sequencing (WGS), thus expanding the utility of DNA sequencing in clinical diagnosis. The emergence of global-scale projects related to NGS protocols provides new foundational knowledge about oncology and precision medicine. The growing incidence of cancer, increasing government funding to support genomics projects, increasing applications of NGS in cancer research, and the entry of new players in the genome sequencing systems market, are boosting the market. Furthermore, rising demand for quick and easy clinical diagnosis and increasing funding from public and private sectors are also contributing to the market growth. Key market players are heavily investing in cost-effective and enhanced consumables and portable sequencing technologies which is providing thrust to the global genome sequencing systems market.

COVID-19 outbreak impact on Genome Sequencing Equipment/Systems Market

An exponential increase in the COVID-19 cases has driven the demand for genome sequencing technologies in rapid genomic sequencing projects to detect viral spread and manage treatments in the future. The National Health Service of U.K., Genomics England, along with Genetics of Mortality in Critical Care formed a partnership with Illumina to develop whole-genome sequences of 35,000 COVID-19 affected citizens in the U.K. in May 2020. This has propelled the demand for DNA sequencing in the diagnosis of COVID-19. CVS Health launched Transform Oncology Care, a precision medicine program launched in December 2019, that leverages genomics technology in personalized cancer treatment plans. DNA sequencing has shifted proteomic and genomic research as it is a highly accurate and high-throughput technology used in various applications, including WGS, de novo assembly, and DNA resequencing. This technology is readily adopted in many academic research institutes for research studies. Illumina initiated NovaSeq 6000 Sequencing System at the Whitehead Institute for Biomedical Research, the U.S., in 2020. The COVID-19 pandemic has disrupted supply chains, impeded the shipping and delivery of products to customers, and restricted sales operations. This led to a decline in the sales of sequencing consumables, instrument services, and sequencing services, in 2020. A renewal in testing numbers is witnessed as countries slowly ease restrictions on movement. The COVID-19 pandemic accelerated the development of therapeutic drugs and vaccines and increased the need for developing more simple and precise testing technologies and the growth of testing structures.

MARKET DRIVERS:

The application of NGS in precision medicine and molecular diagnostics is boosting the growth of the genome sequencing market

NGS tools are used in personalized medicine, to recognize gen expression which aids the development of precision medicine, according to the patient’s characteristics. The discovery of new biomarkers for different diseases, especially cancer, has revolutionized the fields of medical diagnostics. A better understanding of genomics and rapid developments in sequencing technologies have increased the efficiency of biomarkers in disease detection. Precise diagnosis combined with personalized medicine increase survival rates and also reduce the financial burden on national health insurance programs and governments around the world. Several pharmaceutical companies are hugely investing in personalized medicine research which is likely to drive the market growth.

Declining costs of genome sequencing and increasing government funding to support genomics projects are propelling the market growth

The availability of efficient, and advanced NGS systems at low costs, along with the reduced cost of genome sequencing, is driving the adoption of the latest NGS technologies worldwide. Governments in many countries have made significant investments in genomics which have played a key role in the development of new technologies. Such initiatives are likely to increase the usage of genomics products, thereby, driving the overall market growth.

MARKET RESTRAINTS:

There is a dearth of trained professionals in the genome sequencing systems market which can be a restraining factor

The utilization of Genomics data includes different applications namely diagnostics, pharmacogenomics, and toxicogenomics. The scrutiny of massive volumes of data generated in genomics research has been a major restraining factor. Considering the complexities and the demand for profound knowledge in the field of genomics, it is necessary to recruit skilled professionals in analyzing and understanding the results of genomic sequencing data. The dearth of skilled professionals leads to several challenges faced by end-users in analyzing genomic data.

End-user budget constraints in developing economies are restraining the genome sequencing systems market growth

External fundings are majorly responsible for academic research and development activities in developing countries. High-quality and advanced premium equipment and technologies need funding which becomes a restraining factor for many academic and research institutes owing to budget limitations. Concrete results may take time despite continuous efforts by government bodies to provide funds for research. This limits the adoption of NGS technologies in developing countries.

GENOME SEQUENCING EQUIPMENT/SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

11.3% |

|

Segments Covered |

By Products & Services, Technology, Application, End Use and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Illumina, Inc., Thermo Fisher Scientific, ABBOTT LABORATORIES, QIAGEN N.V., Agilent Technologies, Inc., Bio-Rad Laboratories, DANAHER CORPORATION, Oxford Nanopore Technologies, Ltd., Myriad Genetics, Inc. F. Hoffmann-La Roche Ltd., Veritas Genetics, PACIFIC BIOSCIENCES OF CALIFORNIA, INC., and BGI |

This research report on the global Genome Sequencing Equipment/Systems Market has been segmented and sub-segmented based on products and services, technology, application, end-use, and region.

Genome Sequencing Equipment/Systems Market – By Products & Services

- Consumables

- Instruments

- Services

Based on Products & Services, the Genome Sequencing Systems Market is segmented into Consumables, Instruments, and Services. The consumables segment held the largest share of the genome sequencing systems market. The widespread usage of consumables in genomic systems and the increasing number of genomic tests performed worldwide are majorly driving the market growth. The constant addition of reagents and kits to make WGS more affordable and accessible drives the segment growth in the genome sequencing systems market. The exclusive reagents and advanced technology platforms of the service providers ensure accurate performance. They provide rapid turnaround time, technical support, and outstanding customer service which is anticipated to drive the services segment at a significant growth rate in the Genome Sequencing Systems market during the forecast period.

Genome Sequencing Equipment/Systems Market – By Technology

- Sanger Sequencing

- Next-Generation Sequencing

-

- Whole Genome Sequencing (WGS)

- Whole Exome Sequencing (WES)

- Targeted Sequencing & Resequencing

-

- Third Generation DNA Sequencing

-

- Nanopore Sequencing

- Single-Molecule Real-Time Sequencing (SMRT)

-

Based on Technology, the Genome Sequencing Systems Market is segmented into Sanger Sequencing, Next-Generation Sequencing, and Third Generation DNA Sequencing. The Third-Generation DNA Sequencing segment is projected to witness a significant CAGR during the forecast period in the genome sequencing systems market. This technology helps in addressing the issues of second-generation techniques as it involves easy sample preparation without requiring PCR amplification with faster speed. Moreover, it creates long reads exceeding numerous kilobases to detect repetitive sites of complex genomes.

Next-generation sequencing segment is projected to register a significant market share during the forecast period owing to revolutionary advances in these technologies and the reduced cost of sequencing which has made genome sequencing more accurate, faster, and affordable. Additionally, NGS technology is gaining traction as a routine clinical diagnostic test, specifically with the COVID-19 infection, which positively influences the segment’s revenue share.

Genome Sequencing Equipment/Systems Market – By Application

- Oncology

- Metagenomics

- Epidemiology

- Drug Discovery and Development

- Clinical Investigation

- Agrigenomics & Forensics

- HLA Typing/Immune System Monitoring

- Reproductive Health

- Consumer Genomics

- Others

Based on Application, the Genome Sequencing Systems Market is segmented into Oncology, Metagenomics, Epidemiology, Drug Discovery and Development, Clinical Investigation, Agrigenomics & Forensics, HLA Typing/Immune System Monitoring, Reproductive Health, Consumer Genomics, and Others. The Drug Discovery and Development segment held the largest share of the genome sequencing systems market. This growth can be attributed to the increasing research on diseases including cancer and genetic disorders and the declining cost of sequencing.

The Oncology segment is anticipated to account for a significant share in terms of revenue during the forecast period owing to the great potential of NGS technology in clinical research and development of cancer diagnostics and therapeutics.

The consumer genomics segment is estimated to witness the fastest growth rate during the forecast period owing to the rapid proliferation in genealogy, paternity testing, and personal health awareness. Biotechnology companies, such as Helix Opto LLC, and AncestryDNA, among others, are involved in the personal genome service in the consumer genomics sector.

Genome Sequencing Equipment/Systems Market – By End Use

- Academic Research

- Pharmaceutical & Biotechnology Companies

- Clinical Research

- Hospitals & Clinics

- Others

Based on End Use, the Genome Sequencing Systems Market is segmented into Academic Research, Pharmaceutical & Biotechnology Companies, Clinical Research, Hospitals & Clinics, and Others. The Academic Research segment registered the largest revenue share in the genome sequencing systems market owing to the wide adoption of Sanger technology and NGS in academic research projects. In addition, increasing funding programs for DNA sequencing products and drug discoveries in these entities is increasing the revenue share. The increasing healthcare expenditure and growing collaborations among leading companies and research institutes are boosting the market growth.

Genome Sequencing Equipment/Systems Market - By Region:

- North America

- Europe

- Asia-Pacific

- Rest of the World

Geographically, the North American Genome Sequencing Equipment/Systems Market accounted for the largest revenue share of the global genome sequencing systems market in 2021. This can be attributed to continuous technological developments, availability of technologically advanced healthcare infrastructure, high investment in R&D activities, and several government initiatives in the region to support research in drug development and treatment of cancer. For instance, BC Cancer Foundation, Personalized Onco-Genomics program utilizes transcriptome and whole-genome analysis to identify cancer genes and corresponding drugs. Such public initiatives are likely to boost the application of such technologies in the region.

The Genome Sequencing Equipment/Systems Market in Europe is anticipated to showcase a high growth rate during the forecast period owing to the increasing incidence of cancer, the increasing applications of next-generation sequencing, growing government funding to encourage genomics projects, and the growing utilization of genomics in personalized medicine.

Asia Pacific Genome Sequencing Equipment/Systems Market is anticipated to witness a lucrative growth rate during the forecast period. This is attributed to the strategic initiatives by international firms to expand their presence given the high customer base. Factors such as the increasing prevalence of chronic diseases, increasing demand for genetic testing, advancements in healthcare infrastructure and research facilities, growing adoption of advanced sequencing processes, and growing investments for effective cost-effective products are driving the growth of genome sequencing equipment/systems market in APAC.

Major Key Players in the Market

- Illumina, Inc.

- Thermo Fisher Scientific

- ABBOTT LABORATORIES

- QIAGEN N.V.

- Agilent Technologies Inc.

- Bio-Rad Laboratories

- DANAHER CORPORATION

- Oxford Nanopore Technologies Ltd.

- Myriad Genetics Inc.

- F. Hoffmann-La Roche Ltd.

- Veritas Genetics

- PACIFIC BIOSCIENCES OF CALIFORNIA INC.

- BGI

Are some of the prominent companies in the genome sequencing systems market.

Notable happenings in the Global Genome Sequencing Equipment/Systems Market in the recent past:

Partnership- In January 2022, Singular Genomics announced its partnership with New England Biolabs® to offer NEBNext® Kits for the G4 Sequencing Platform. This partnership combines G4’s speed, accuracy, flexibility, and power with the NEBNext DNA and RNA Library Prep Kits to offer established and high-quality workflows to customers.

Investment- In March 2022, Illumina, Inc. invested in seven new genomics companies to enter the fourth global funding cycle of Illumina Accelerator Cambridge, UK, and the San Francisco Bay Area.

Expansion- In March 2021, Bio-Rad Laboratories, Inc., a global leader in life science research and clinical diagnostic products expanded diagnostics company partnerships by offering InteliQ products, various barcoded, load-and-go quality control tubes that offer efficiencies in workflow, along with Bio-Rad’s Unity QC data management solutions, which enhance laboratory’s analytical performance.

Product Launch- In January 2020, Illumina unveiled a New Sequencing System, in partnership with Roche, and Software Suite to expedite the availability of distributable NGS-based in-vitro diagnostic tests on the diagnostic (Dx) sequencing systems of Illumina.

Product Launch- In January 2020, Illumina announced designing a regulatory-cleared variety of the high-throughput NovaSeq system to address the rising demand for a Dx platform for supporting deeper sequencing at higher throughput.

Investment- In February 2020, GenapSys, raised USD 75 million to finance the expansion of its tabletop DNA sequencer globally and control coronavirus in the region.

Product Approval- In June 2020, Illumina was granted Emergency Use Authorization (EUA) by the FDA for its COVIDSeq Test in sequencing the full genome of the novel SARS-CoV-2 virus. This test combined with high-throughput NovaSeq 6000 hardware of Illumina has capabilities to process more than 3,000 samples and provides results within 24 hours.

Chapter 1. Genome Sequencing Equipment/Systems Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Genome Sequencing Equipment/Systems Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Genome Sequencing Equipment/Systems Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Genome Sequencing Equipment/Systems Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Genome Sequencing Equipment/Systems Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Genome Sequencing Equipment/Systems Market – By Products & Services

6.1. Consumables

6.2. Instruments

6.3. Services

Chapter 7. Genome Sequencing Equipment/Systems Market – By Technology

7.1. Sanger Sequencing

7.2. Next-Generation Sequencing

7.2.1. Whole Genome Sequencing (WGS)

7.2.2. Whole Exome Sequencing (WES)

7.2.3. Targeted Sequencing & Resequencing

7.3. Third Generation DNA Sequencing

7.3.1. Nanopore Sequencing

7.3.2. Single-Molecule Real-Time Sequencing (SMRT)

Chapter 8. Genome Sequencing Equipment/Systems Market – By Application

8.1. Oncology

8.2. Metagenomics

8.3. Epidemiology

8.4. Drug Discovery and Development

8.5. Clinical Investigation

8.6. Agrigenomics & Forensics

8.7. HLA Typing/Immune System Monitoring

8.8. Reproductive Health

8.9. Consumer Genomics

8.10Others

Chapter 9. Genome Sequencing Equipment/Systems Market – By End-User

9.1. Academic Research

9.2. Pharmaceutical & Biotechnology Companies

9.3. Clinical Research

9.4. Hospitals & Clinics

9.5. Others

Chapter10. Genome Sequencing Equipment/Systems Market- By Region

10.1. North America

10.2. Europe

10.3. Asia-Pacific

10.4. Latin America

10.5. The Middle East

10.6. Africa

Chapter 11. Genome Sequencing Equipment/Systems Market – Key Companies

11.1 Illumina, Inc.

11.2 Thermo Fisher Scientific

11.3 ABBOTT LABORATORIES

11.4 QIAGEN N.V.

11.5 Agilent Technologies Inc.

11.6 Bio-Rad Laboratories

11.7 DANAHER CORPORATION

11.8 Oxford Nanopore Technologies Ltd.

11.9 Myriad Genetics Inc.

11.10 F. Hoffmann-La Roche Ltd.

11.11 Veritas Genetics

11.12 PACIFIC BIOSCIENCES OF CALIFORNIA INC.

11.13 BGI

Download Sample

Choose License Type

2500

4250

5250

6900