Global Generative Design Market Size (2024 – 2030)

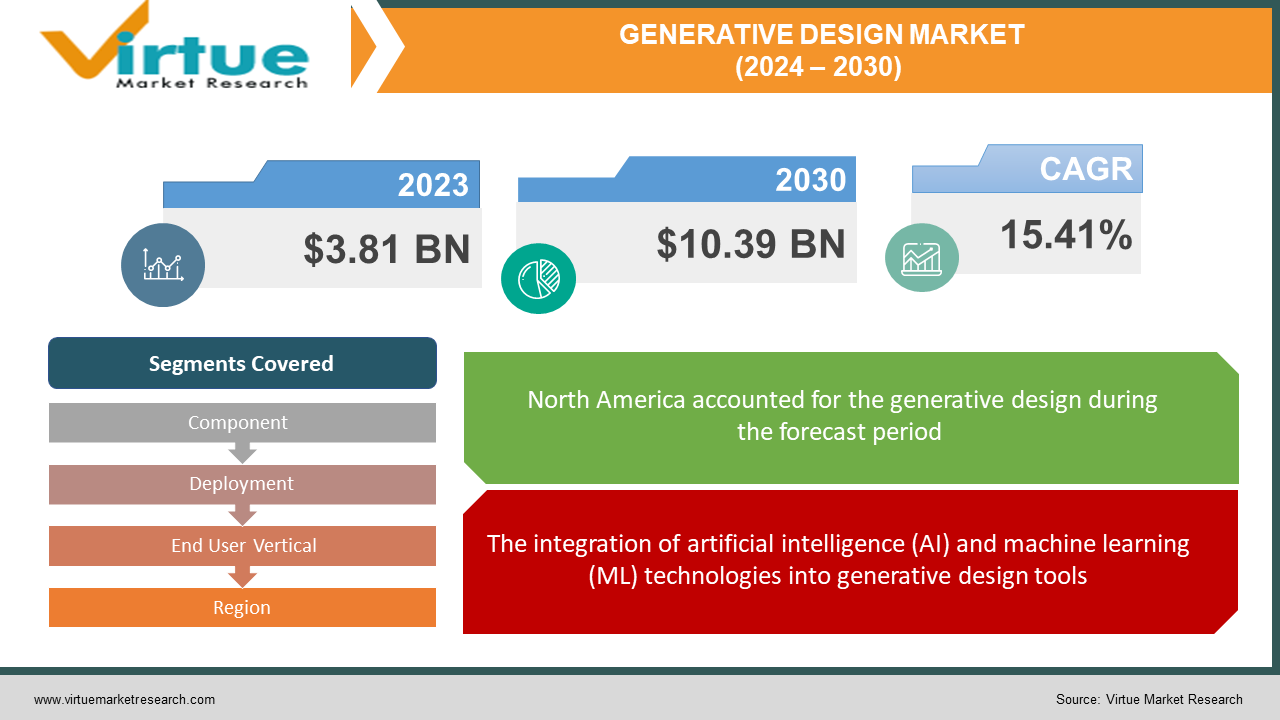

The global generative design market was valued at USD 3.81 billion in 2023 and is projected to reach a market size of USD 10.39 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 15.41%.

Generative design refers to a design approach that involves using algorithms and computational processes to explore multiple design possibilities and generate solutions based on specified parameters or constraints. This approach is particularly prominent in fields such as architecture, product design, and engineering. The generative design market has been growing as technology continues to advance and industries seek more efficient and innovative design solutions. Generative design is a design exploration process that uses artificial intelligence (AI) to automatically generate multiple design solutions based on a set of constraints and objectives. The software iteratively tests and refines these designs, eventually producing a design that is optimized for performance, weight, cost, or other factors. Generative design tools are often integrated with computer-aided design (CAD) software, allowing a seamless transition from generative design exploration to detailed design and engineering phases. Industries such as automotive, aerospace, architecture, and manufacturing have been early adopters of generative design. It helps in creating optimized and lightweight structures, improving performance, and reducing material usage. Generative design can lead to more efficient and cost-effective designs by optimizing for factors such as material usage, weight, and manufacturing processes. This is particularly crucial in industries where efficiency and resource optimization are key considerations. The generative design market is evolving with the integration of artificial intelligence (AI) and machine learning (ML) techniques. These technologies enhance the ability of generative design tools to learn from past designs and continuously improve the quality of generated solutions. Collaboration features and cloud-based solutions are becoming more common, enabling teams to work on generative design projects collaboratively and access computing resources on demand. Collaboration features and cloud-based solutions are becoming more common, enabling teams to work on generative design projects collaboratively and access computing resources on demand.

Key Market Insights:

The significant growth signifies the increasing adoption of generative design technology across sectors. Companies are increasingly seeking new ways to optimize products and processes, and generative design offers a powerful tool for exploring a broader range of design possibilities. Continuous progress in AI algorithms and techniques enables generative design software to create increasingly complex and efficient designs. Generative design can help optimize material usage and reduce production costs, leading to significant savings for manufacturers. The generative design market is expected to experience continued strong growth in the coming years, driven by evolving AI technology, increasing awareness, and expanding applications. Interoperability between different software platforms and seamless integration with existing workflows will be crucial for wider adoption. Advancements in AI and machine learning will lead to more sophisticated and autonomous design processes. The adoption of generative design aligns with the broader trend of Industry 4.0, where companies are embracing advanced technologies, automation, and data exchange to enhance manufacturing processes. Generative design plays a crucial role in creating designs optimized for digital manufacturing. Generative design is finding applications across diverse industries beyond traditional manufacturing. This includes fields like healthcare, consumer goods, and even fashion, showcasing the versatility of the approach. Collaborative features and cloud-based solutions are gaining importance, allowing multiple team members to work on generative design projects simultaneously. This fosters efficient collaboration and improves the overall project workflow. The market for generative design software is becoming increasingly competitive, with both established software giants and emerging startups entering the space. This competition is driving innovation and the development of more user-friendly and powerful generative design tools.

Generative Design Market Drivers:

The integration of artificial intelligence (AI) and machine learning (ML) technologies into generative design tools.

The integration of artificial intelligence (AI) and machine learning (ML) technologies into generative design tools has been a significant driver. These technologies enhance the capabilities of generative design by enabling the software to learn from past designs, understand user preferences, and continuously improve the quality of generated solutions ML algorithms can analyze vast amounts of design data, learn from successful designs, and identify patterns. This learning process enables generative design tools to offer more intelligent and context-aware design suggestions. Machine learning algorithms can assist designers by predicting design preferences, offering real-time feedback, and even automating certain aspects of the design process. This helps bridge the gap between complex algorithms and the human designer, making generative design more accessible. The iterative nature of generative design is well-suited for machine learning. As designers interact with the tool and make selections, the system can learn from these interactions, improving its recommendations over time. The integration of AI and ML technologies is making generative design tools more powerful and user-friendly. This has broadened the appeal of generative design beyond experts, attracting a wider range of users across various industries who can benefit from AI-driven design optimization. Advanced deep learning algorithms, particularly convolutional neural networks (CNNs), play a crucial role in analyzing complex shapes, understanding design constraints, and predicting performance outcomes. This opens doors to exploring previously unimaginable design possibilities. These innovative AI models pit two neural networks against each other, one generating design and the other critiquing them. This adversarial process fosters rapid design evolution, leading to highly refined and aesthetically pleasing outcomes. The availability of cloud-based high-performance computing (HPC) resources allows massive computational tasks to be distributed across numerous servers. This significantly accelerates the design iteration process, enabling more rapid exploration and optimization of design possibilities. Generative design is being used to develop sustainable and energy-efficient buildings. AI algorithms can optimize building shapes for thermal insulation, natural light utilization, and even earthquake resistance.

The pressure to innovate pushes companies to explore new frontiers in design and functionality.

The pressure to innovate and stay ahead of the curve is fiercer than ever, pushing companies to explore new frontiers in design and functionality. This is where generative design steps in, acting as a catalyst for breakthrough products that redefine industries. By optimizing wing structures using generative design, Airbus achieved a 1% reduction in weight, translating to significant fuel savings and emission reductions. This breakthrough paved the way for lighter, more sustainable aircraft designs.GE Aviation employed generative design to optimize the complex internal components of the GE9X engine, resulting in improved fuel efficiency and thrust-to-weight ratio. This innovation redefined engine performance and set a new standard for fuel efficiency in large turbofan engines. The lightweight and aerodynamically efficient components of the BMW i8, created using generative design, contribute to its impressive fuel efficiency and performance. This pioneering approach to car design demonstrates the potential for lightweightness and optimization in the automotive industry. Algorithms can analyze vast datasets of molecules to identify potential drug candidates, accelerating the search for new treatments. Generative design can aid in the development of new materials with tailored properties for specific applications, leading to innovative and sustainable material solutions. Generative design can optimize building designs for energy efficiency, resource utilization, and occupant comfort, paving the way for greener and more sustainable living spaces.

Integration with additive manufacturing is a significant driver for the market.

The synergy between generative design and additive manufacturing processes has emerged as a significant driver for the market. Additive manufacturing, including 3D printing, allows for the efficient production of complex geometries, and generative design is well-suited to create such intricate designs. Additive manufacturing processes excel at creating complex, geometrically intricate designs. Generative design complements this by generating designs that maximize the benefits of additive manufacturing, including reduced material waste and the ability to produce structures that were previously challenging or impossible to manufacture. The combination of generative design and additive manufacturing enables the creation of highly customized and optimized components. This is particularly valuable in industries such as healthcare (e.g., patient-specific implants) and aerospace, where bespoke solutions are increasingly sought after. Generative design facilitates rapid prototyping by generating numerous design iterations quickly. This aligns with the iterative nature of additive manufacturing, allowing for faster product development cycles and reducing time-to-market. The growing adoption of additive manufacturing processes and the need for customized, complex components are propelling the demand for generative design tools. Industries leveraging additive manufacturing, including healthcare, aerospace, and automotive, are particularly inclined towards incorporating generative design into their workflows.

Generative Design Market Restraints and Challenges:

High Cost and Limited Accessibility Relating to the Generative Design Market.

Generative design software can be expensive, posing a barrier to entry for smaller companies and individuals. This limited accessibility hinders the broader adoption of the technology and its democratization. Running complex generative design algorithms often requires powerful computing resources, leading to additional hardware costs. This further accentuates the accessibility issue for smaller players. Utilizing generative design effectively requires specialized knowledge and training in both design principles and the software itself. This skill gap creates another hurdle for wider adoption.

Integration and Workflow Disruption in the Generative Design Market.

Generative design software needs to seamlessly integrate with existing design workflows and software used by engineers and designers. A lack of smooth integration can create compatibility issues and disrupt established workflows, causing resistance to adoption. The resistance to change and the difficulty of integrating generative design into established workflows can slow down adoption. Companies may be hesitant to disrupt their existing processes, even if generative design offers significant advantages. Overcoming this challenge requires careful planning, training, and a phased approach to integration. Generative design software often operates in isolation, lacking seamless integration with established CAD tools, simulation software, and project management platforms used by design teams. This incompatibility creates data silos, hinders information flow, and disrupts efficient workflows. Transitioning from traditional design methods to AI-driven approaches can be a steep learning curve for designers and engineers. This, coupled with potential anxieties about automation replacing human creativity, can lead to resistance and reluctance to adopt new tools. Integrating a new technology like generative design requires robust change management strategies. Lack of clear communication, training, and support can breed confusion and resistance, stalling the adoption process. Implementing generative design in a phased manner, starting with smaller projects and pilot programs, can ease the transition and provide opportunities for learning and feedback. This incremental approach builds confidence and paves the way for wider adoption.

Data quality and quantity concerns regarding the adaptation of the generative design market.

The quality and quantity of data fed into the algorithms profoundly impact the outcome. Inaccurate or incomplete data can lead to flawed or suboptimal designs, raising reliability concerns. Collecting, cleaning, and managing diverse data sets from various sources like material properties, manufacturing constraints, and performance requirements can be complex and resource-intensive. Algorithmic bias introduced through biased data sets can lead to discriminatory design outcomes. Ensuring data fairness and mitigating bias is crucial for responsible AI development in generative design. The complex algorithms behind generative design can be opaque, making it difficult to understand the rationale behind specific design suggestions. This lack of transparency can raise concerns about trust and control for designers. Developing methods to explain how AI algorithms arrive at specific design solutions is crucial for building trust and enabling human-AI collaboration. Proving the safety and reliability of AI-generated designs, particularly for critical applications like medical devices or aerospace components, requires rigorous verification and testing processes.

Global Generative Design Market Opportunities:

Generative design empowers personalized design like never before, catering to individual preferences and maximizing functionality. Optimizing material usage, minimizing waste, and reducing manufacturing energy are fundamental benefits of generative design. This translates to eco-friendly products, sustainable buildings, and a more resource-efficient future. AI-powered design tools are becoming more user-friendly and accessible, allowing smaller companies and individuals to tap into the power of generative design. This democratization fosters wider innovation and empowers diverse voices to contribute to the design landscape. Generative design can assist in discovering new materials with tailored properties, pushing the boundaries of material science. This opens doors to lighter, stronger, and more sustainable materials for diverse applications. Generative design can handle complex constraints and optimize designs for extreme environments, paving the way for groundbreaking advancements. Generative design enables unprecedented levels of innovation in product development. By exploring a multitude of design possibilities, companies can create more efficient, lightweight, and optimized products. This is particularly relevant in industries such as automotive, aerospace, and consumer goods. Companies that leverage generative design to drive innovation can gain a competitive edge by delivering products with enhanced performance, reduced material usage, and improved sustainability. Generative design facilitates the creation of highly customized and personalized products. It allows designers to optimize designs based on individual preferences, requirements, and constraints. In industries like fashion, consumer electronics, and healthcare, the ability to offer personalized products can be a significant market differentiator. Generative design opens opportunities for creating unique and tailor-made solutions for customers. Generative design is finding applications in industries beyond its traditional domains, such as healthcare, architecture, and urban planning. Identifying and exploring new use cases presents opportunities for market expansion. The diversification of generative design applications broadens their market reach, creating new revenue streams and partnerships across various sectors.

GLOBAL GENERATIVE DESIGN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15.41% |

|

Segments Covered |

By Component, Deployment, End User Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Altair Engineering Inc, Bentley Systems Inc, Caracol AM, Autodesk Inc, MSC Software Corporation (Hexagon AB), Diabatix, ANSYS Inc, Parameters, Desktop Metal Inc, nTopology, OmniFlow |

Global Generative Design Market Segmentation: By Component

-

Software

-

Services

The software segment currently holds the largest share of the generative design market, accounting for approximately 70% as of 2023. This dominance is driven by the essential role software plays in powering the entire generative design process, from algorithm execution to design optimization and visualization. General-purpose generative design software currently reigns supreme within the software segment. These platforms offer a broad range of functionalities, catering to various applications and industries. Prominent examples include Fusion 360, NX Generative Design Module, and SolidWorks Generative Design. Industry-specific generative design software is experiencing the most rapid growth within the software segment. These solutions cater to the unique needs and challenges of specific sectors, such as aerospace, automotive, or architecture. This targeted approach offers deeper functionality and tailored optimization capabilities, leading to increased adoption and market share growth. While holding a smaller share compared to software, the services segment is still significant, accounting for approximately 30% of the generative design market. This segment provides crucial support for companies navigating the adoption and integration of generative design into their workflows. Consulting services currently dominate the services segment. These services offer expertise in choosing the right software, integrating it with existing workflows, and training teams to effectively utilize generative design tools. This guidance is particularly valuable for companies with limited experience in this technology. Data management and AI training services are experiencing the fastest growth within the services segment. As the reliance on data and AI algorithms increases in generative design, the need for expert assistance in data curation, cleaning, and training becomes crucial. These services ensure the quality and accuracy of data, leading to optimized designs and increased trust in technology.

Global Generative Design Market Segmentation: By Deployment

-

On-Premises

-

Cloud-Based

While steadily declining, on-premises deployment currently holds approximately 60% of the generative design market share. This dominance is primarily driven by established enterprises with dedicated design teams and resources that value control, security, and customization of their software environment. Large, custom-built generative design solutions are still prevalent within the on-premises segment. These tailor-made systems cater to the specific needs and workflows of large companies, offering high levels of control and integration with existing infrastructure. Hybrid deployments are emerging as the fastest-growing type within the on-premises segment. These solutions combine on-premises software with cloud-based features, allowing companies to retain certain aspects of control while benefiting from the scalability and accessibility of the cloud.

Rising at a rapid pace, cloud-based deployments now hold approximately 40% of the generative design market share. This growth is fueled by increased affordability, scalability, and accessibility for smaller companies and individual users. Cloud platforms also facilitate collaboration and real-time data sharing, making them attractive for dynamic design teams. Subscription-based Generative Design as a Service (GDaaS) platforms currently dominate the cloud segment. These platforms offer readily available software on a pay-as-you-go basis, removing upfront investment and making generative design accessible to a wider range of users. Industry-specific cloud-based solutions are experiencing the fastest growth within the cloud segment. These platforms cater to the unique needs and challenges of specific sectors, offering pre-trained algorithms and optimization tools tailored to their applications. This targeted approach simplifies adoption and leads to more efficient design results.

Global Generative Design Market Segmentation: By End User Vertical

-

Aerospace and Defense

-

Automotive

-

Architecture and Construction

-

Consumer Goods

-

Industrial Manufacturing, Healthcare, Oil & Gas

Aerospace & Defense holds a 25% share, driven by its focus on light-weighting, fuel efficiency, and performance optimization of aircraft and spacecraft components. Aerospace and defense hold the dominant position due to their established adoption of generative design and the high value placed on performance optimization in critical applications. The significant research and development investments in this sector further contribute to its leadership in generative design adoption. Architecture & Construction holds a 15% share, driven by the pursuit of sustainable energy-efficient buildings with optimized material usage and structural integrity. Industrial manufacturing, healthcare, and oil and gas combined share 30%, with the potential for significant growth in specific applications within each sector. Architecture and construction are witnessing the most rapid growth due to the convergence of sustainability concerns, rising material costs, and the increasing availability of user-friendly generative design software tailored for architects and engineers. This opens possibilities for optimized buildings with minimized environmental impact and improved energy efficiency.

Global Generative Design Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds the largest share of the generative design market, accounting for approximately 45%. This dominant position is driven by several factors, such as the strong presence of established technology companies and software vendors. High adoption in the aerospace, automotive, and consumer goods sectors; growing awareness of generative design's benefits; and investments in research and development.

Europe claims approximately 30% of the market share. Key factors contributing to this significant presence include a focus on sustainability and energy efficiency in architecture and construction, a strong manufacturing sector with increasing adoption of generative design for optimization and cost reduction, government initiatives, and funding programs supporting innovation in generative design.

Asia-Pacific demonstrated the fastest growth, currently holding 20% of the market share. Asia-Pacific is experiencing the most rapid growth due to a combination of factors, including its dynamic manufacturing sector, rising investments in infrastructure development, and a growing pool of tech-savvy individuals and startups. This region is expected to witness continued strong growth in the coming years, potentially challenging North America's dominant position in the long run.

COVID-19 Impact Analysis on the Global Generative Design Market.

The COVID-19 pandemic has had a complex and multifaceted impact on the global 5G services market, resulting in both challenges and opportunities. Global lockdowns and trade restrictions disrupted supply chains, hindering access to critical materials and hardware needed for generative design implementations. This led to project delays and increased costs. The pandemic caused an economic downturn, leading to reduced investment in R&D and technology adoption, including generative design. This affected demand, particularly for expensive on-premises software solutions. Companies focused on immediate survival needs and adjusted their budgets, often postponing non-essential investments like generative design projects. This caused a temporary slowdown in market growth. The pandemic highlighted the need for cost-cutting and production optimization across industries. This prompted some companies to explore generative design as a tool for material savings, performance improvement, and overall efficiency gains. The shift towards remote work and accessibility boosted the adoption of cloud-based generative design platforms. This provided easier access and flexible subscription models, attracting smaller companies and individual users. The pandemic heightened awareness of sustainability and resilience in design and manufacturing. Generative design emerged as a valuable tool for optimizing resource usage, designing eco-friendly products, and creating resilient supply chains, increasing its relevance in post-pandemic recovery plans. The initial phase of the pandemic saw a slowdown in the generative design market. However, this was mainly due to temporary disruptions and adjustments. The pandemic ultimately highlighted the long-term potential of generative design for addressing critical challenges like efficiency, sustainability, and resilience. This, coupled with the rise of cloud-based solutions and increasing awareness of their benefits, is expected to fuel the market's growth in the post-pandemic era.

Latest Trends/ Developments:

Generative design is being used to minimize material usage, reduce waste, and promote the use of sustainable materials. From buildings to vehicles, generative design is optimizing structures and components for reduced energy consumption and carbon footprint. Tools are being developed to integrate life cycle analysis into the design process, considering the environmental impact of materials and production throughout the product's life. More sophisticated AI algorithms are enabling more complex design tasks, handling multi-objective optimization, and generating truly innovative solutions. Generative AI models are expanding the possibilities of design by creating unexpected forms and functionalities, pushing the boundaries of human imagination. Companies from different industries are partnering to develop generative design solutions for shared challenges, like sustainable packaging or lightweight medical devices. Online communities and open-source platforms are fostering knowledge sharing and accelerating the development of new generative design tools and methodologies. Developers are creating pre-trained algorithms and optimization tools for specific industries, like aerospace, automotive, and architecture, delivering faster and better results. Generative design tools are seamlessly integrated with existing software used in different industries, reducing disruption and enabling smooth adoption. Industry-specific databases and real-world data are being leveraged to train algorithms and generate designs that are optimized for specific contexts and challenges.

Key Players:

-

Altair Engineering Inc

-

Bentley Systems Inc

-

Caracol AM

-

Autodesk Inc

-

MSC Software Corporation (Hexagon AB)

-

Diabatix

-

ANSYS Inc

-

Parameters

-

Desktop Metal Inc

-

nTopology

-

OmniFlow

Chapter 1. Generative Design Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Generative Design Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Generative Design Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Generative Design Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Generative Design Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Generative Design Market – By Component

6.1 Introduction/Key Findings

6.2 Software

6.3 Services

6.4 Y-O-Y Growth trend Analysis By Component

6.5 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Generative Design Market – By Deployment

7.1 Introduction/Key Findings

7.2 On-Premises

7.3 Cloud-Based

7.4 Y-O-Y Growth trend Analysis By Deployment

7.5 Absolute $ Opportunity Analysis By Deployment, 2024-2030

Chapter 8. Generative Design Market – By End User Vertical

8.1 Introduction/Key Findings

8.2 Aerospace and Defense

8.3 Automotive

8.4 Architecture and Construction

8.5 Consumer Goods

8.6 Industrial Manufacturing, Healthcare, Oil & Gas

8.7 Y-O-Y Growth trend Analysis By End User Vertical

8.8 Absolute $ Opportunity Analysis By End User Vertical, 2024-2030

Chapter 9. Generative Design Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Deployment

9.1.4 By End User Vertical

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Deployment

9.2.4 By End User Vertical

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Deployment

9.3.4 By End User Vertical

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Deployment

9.4.4 By End User Vertical

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Deployment

9.5.4 By End User Vertical

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Generative Design Market – Company Profiles – (Overview, By Component Portfolio, Financials, Strategies & Developments)

10.1 Altair Engineering Inc

10.2 Bentley Systems Inc

10.3 Caracol AM

10.4 Autodesk Inc

10.5 MSC Software Corporation (Hexagon AB)

10.6 Diabatix

10.7 ANSYS Inc

10.8 Parameters

10.9 Desktop Metal Inc

10.10 nTopology

10.11 OmniFlow

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global generative design market was valued at USD 3.81 billion in 2023 and is projected to reach a market size of USD 10.39 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 15.41%.

Technological Advancements, Artificial Intelligence and Machine Learning, Consumer Demand, Government Initiatives, Evolving Ecosystems, and Integration with Additive Manufacturing.

North America holds the largest share of the generative design market, accounting for approximately 45%.

Asia-Pacific demonstrates the fastest growth, currently holding 20% of the market share.

Artificial Intelligence and Machine Learning, Tech-Driven Advancements, Industry-Specific Solutions, Sustainability Focus, Advanced AI and Computing Power, Collaboration, and Partnerships.