General Line Metal Packaging Coatings Market Size (2024 – 2030)

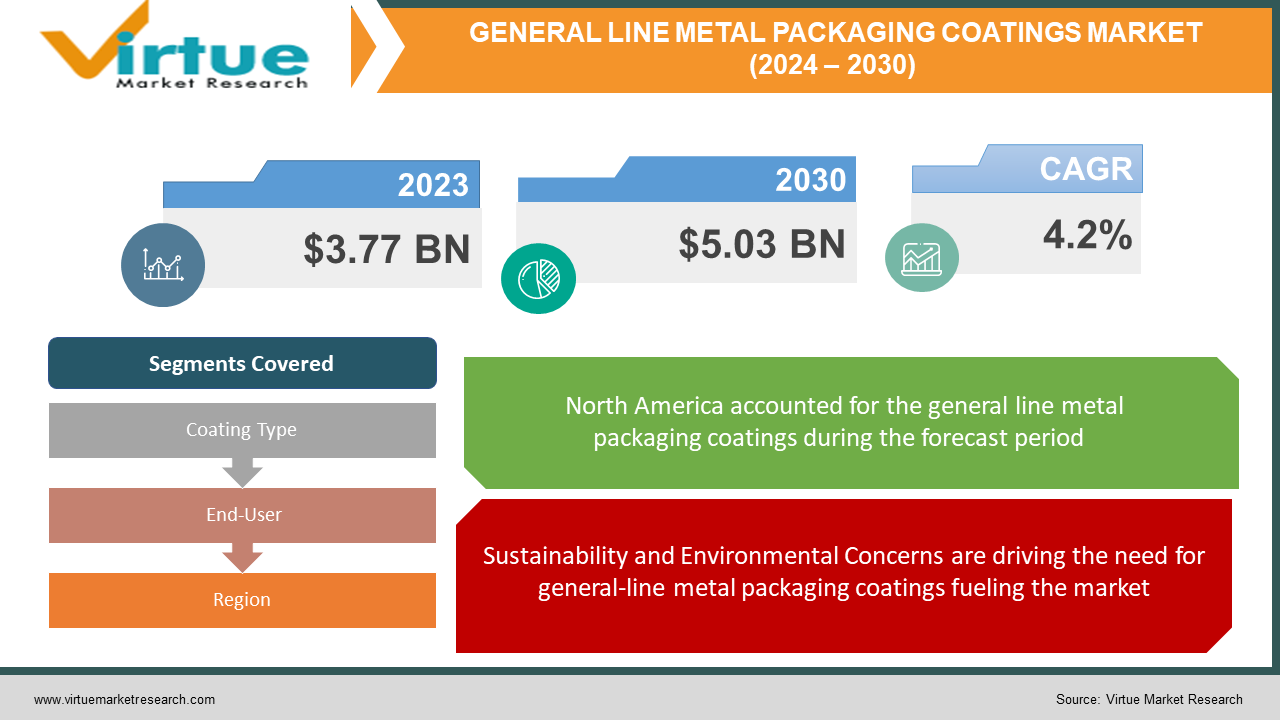

The General line metal packaging coatings Market was valued at $ 3.77 Billion, and is projected to reach a market size of $ 5.03 Billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 4.2%.

General line metal packaging coatings are specialized coatings applied to metal containers and packaging materials to protect them from corrosion, enhance their visual appeal, and provide barrier properties to protect the contents from external factors like moisture and oxygen. These coatings are commonly used in the packaging of food and beverages, aerosol cans, paint cans, and various consumer products. The global market for general line metal packaging coatings is driven by the growing demand for sustainable and recyclable packaging solutions, stringent regulations on food safety, and the need for extended shelf life of products.

Key Market Insights:

According to data from Metal Packaging Europe, the EU achieved a record recycling rate of 76.1% for aluminum cans and an all-time high of 85% for steel cans in 2019.

Over recent years, the industry has faced the challenge of developing alternative technologies that exclude Bisphenol A (BPA), a fundamental monomer used in conventional epoxy coating methods.

As of 2022, the estimated value of the metal packaging industry stands at $127.3 billion, and it is anticipated to experience a CAGR of 2.9% during the period from 2022 to 2027. The market is projected to reach a value of $147.0 billion by 2027.

For improved customer experience and product safety, the adoption of smart packaging solutions is being adopted by businesses which involves integrating technology into metal packaging to provide consumers with enhanced functionality and information. Smart packaging may include features such as QR codes for product information, freshness indicators, temperature-sensitive labels, and even near-field communication tags for interactive experiences.

General Line Metal Packaging Coatings Market Drivers:

Sustainability and Environmental Concerns are driving the need for general-line metal packaging coatings fueling the market.

Increasing awareness of environmental issues and a growing emphasis on sustainable packaging solutions are driving the demand for metal packaging coatings. Metal containers are highly recyclable, and these coatings help extend the lifespan of the metal, making them even more environmentally friendly. Coatings that reduce the need for preservatives or additives in packaged products, such as food, can align with consumer preferences for eco-friendly and health-conscious choices. Manufacturers are responding by developing coatings that are low in volatile organic compounds, heavy metal-free, and compliant with stringent environmental regulations.

The general metal packaging coatings market is poised to grow with the rise in food safety regulations.

Stringent food safety regulations imposed by governments and international bodies are a significant driver for the metal packaging coatings market, particularly in the food and beverage industry. Coatings play a crucial role in preventing contamination, maintaining product integrity, and ensuring that the packaging materials do not react with the contents. As regulations become more rigorous and consumer demand for safe food products increases, manufacturers are compelled to invest in high-quality coatings that meet or exceed these standards. This drive for compliance and consumer trust fuels the growth of the market as companies seek to maintain a competitive edge while adhering to strict food safety guidelines.

General Line Metal Packaging Coatings Market Restraints and Challenges:

Cost and Price Volatility associated with metal packaging coatings could prove a hindrance in this market.

The cost of raw materials used in metal packaging coatings, such as specialty chemicals and metals like aluminum and steel, can be subject to significant fluctuations. These fluctuations can affect the overall cost of producing coated metal packaging materials. Additionally, price volatility can make it challenging for manufacturers to set stable pricing for their products. Companies must carefully manage these cost variations to maintain profitability while ensuring their products remain competitive in the market. This challenge is increased when raw material prices spike, potentially leading to increased production costs and reduced profit margins.

A major limiting factor in the General Line Metal Packaging Coatings Market is environmental concerns and regulatory compliance.

While sustainability is a driver of the market, it also presents a challenge in terms of environmental concerns and regulatory compliance. Meeting stringent environmental standards and regulations, such as those related to emissions, waste disposal, and the reduction of hazardous substances in coatings, can be complex and costly. Manufacturers must invest in research and development to formulate coatings that meet these standards while maintaining performance characteristics. Additionally, keeping up with evolving environmental regulations across different regions can be a challenge, as compliance requirements may vary. Failing to meet these regulations can lead to fines, reputation damage, and market exclusion, making it essential for companies to stay informed and adaptable in this ever-changing landscape.

General Line Metal Packaging Coatings Market Opportunities:

Opportunities in the general line metal packaging coatings market include the growing demand for eco-friendly and sustainable packaging solutions, driven by heightened environmental awareness and regulatory pressures. The adoption of advanced technologies, such as nanotechnology and smart coatings, presents avenues for enhancing the functionality and performance of coatings, such as improved barrier properties and anti-counterfeiting features. Furthermore, the expansion of the e-commerce sector and increased consumer preference for packaged goods offer opportunities for innovative coatings that can protect during transportation and storage. As the global packaging industry evolves, companies investing in research and development to create coatings that align with these trends are poised to capitalize on emerging opportunities in this dynamic market.

GENERAL LINE METAL PACKAGING COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.2% |

|

Segments Covered |

By Coating Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PPG Industries, Inc., AkzoNobel N.V., The Sherwin-Williams Company, Valspar Corporation (now part of Sherwin-Williams), Axalta Coating Systems Ltd., RPM International Inc., TIGER Coatings GmbH & Co. KG, Toyochem Co., Ltd., Kansai Paint Co., Ltd., The Chemours Company |

General Line Metal Packaging Coatings Market Segmentation: By Coating Type

-

Water-Based Coating

-

Powder Coating

-

Solvent-Based Coating

-

Others

The largest segment based on the type of coating is the water-based coatings segment which has a market share of 41%. This is primarily because water-based coatings align closely with the growing global emphasis on environmental sustainability and regulatory restrictions on volatile organic compounds. Water-based coatings are renowned for their low VOC emissions, reduced environmental impact, and compliance with stringent environmental regulations. As consumer and industry preferences increasingly favor eco-friendly and health-conscious packaging solutions, the demand for water-based coatings has surged, making it the dominant segment in the market.

The fastest-growing segment is also water-based coatings expanding at a CAGR of 19.2%. There is a rising emphasis on environmental sustainability, leading to increased demand for coatings with low volatile organic compound content. Water-based coatings are known for their eco-friendliness and reduced VOC emissions, aligning with stringent environmental regulations and consumer preferences. Additionally, as industries seek to reduce their carbon footprint, water-based coatings are seen as a more sustainable choice. Furthermore, advancements in water-based coating technology have improved their performance, making them increasingly competitive with solvent-based and powder coatings, thus driving their rapid adoption in the market.

General Line Metal Packaging Coatings Market Segmentation: By End-User

-

Food and Beverage

-

Pharmaceutical

-

Chemical and Industrial

-

Personal Care and Cosmetics

-

Others

The largest segment is typically the Food and Beverage industry having a revenue share of 39%. This dominance can be attributed to the sheer volume of metal packaging used for food and beverage products globally. Metal cans and containers remain a popular choice for packaging various food and drink items due to their durability, protection against external elements, and recyclability. Moreover, consumer preferences for convenient, shelf-stable, and eco-friendly packaging options continue to drive the demand for metal packaging coatings in this sector.

The fastest-growing segment in the general line metal packaging coatings market based on end-users is the food and beverage industry which has a CAGR of 23%. This growth is primarily driven by increasing consumer demand for packaged food and beverages, particularly due to changing lifestyles, convenience, and the impact of the COVID-19 pandemic, which accelerated the shift towards packaged products. The food and beverage industry's emphasis on food safety, shelf-life extension, and sustainable packaging solutions has further boosted the demand for advanced coatings that protect contents, enhance aesthetics, and meet regulatory standards. The expansion of e-commerce and the need for durable packaging for online deliveries have contributed to the growth of this segment as metal cans remain a preferred choice for preserving the quality and safety of food and beverages during transportation and storage.

General Line Metal Packaging Coatings Market Segmentation: Regional Analysis

-

North America

-

Asia- Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds the position of the largest segment with a market share of 36% in the General Line Metal Packaging Coatings market. This is primarily due to the significant demand for metal packaging coatings in the United States and Canada, driven by a well-established packaging industry and high consumption of food, beverages, and consumer products. North America's stringent food safety regulations and a growing emphasis on sustainable packaging solutions have further fuelled the demand for advanced metal packaging coatings. The region's mature manufacturing infrastructure and innovation in coating technologies contribute to its status as the largest segment in the market.

Asia-Pacific region is the fastest-growing with a CAGR of 24% in the general line metal packaging coatings market. The region's expanding population and rising disposable income levels have led to increased consumption of packaged goods, especially in the food and beverage sector, driving the demand for metal packaging coatings. Additionally, there has been a growing awareness of sustainability and environmental concerns in the region, prompting a shift toward metal packaging, which is highly recyclable. As manufacturers in the Asia-Pacific region invest in modernizing their packaging processes and adhering to global quality standards, the demand for advanced coatings to enhance product protection and aesthetics has surged.

COVID-19 Impact Analysis on the Global General Line Metal Packaging Coatings Market:

The COVID-19 pandemic has had a multifaceted impact on the global general-line metal packaging coatings market. While the initial disruptions in supply chains and manufacturing processes led to temporary setbacks, the market has shown resilience due to its association with essential industries like food and pharmaceuticals. The heightened focus on hygiene and food safety during the pandemic has underlined the importance of metal packaging coatings, driving demand. However, ongoing challenges such as supply chain disruptions, fluctuating raw material prices, and labor shortages continue to pose constraints. The pandemic has accelerated digital transformation, pushing companies to invest in technology and innovation, presenting opportunities for smart coatings and e-commerce packaging solutions. The long-term trajectory of the market will depend on the pace of economic recovery, evolving consumer preferences, and continued efforts to adapt to a post-pandemic world.

Latest Trends/ Developments:

With growing environmental awareness and stringent regulations on VOC emissions and hazardous substances, there is a strong trend towards developing sustainable and eco-friendly coatings. Manufacturers are investing in research and development to formulate coatings that are low in VOCs, heavy metal-free, and compliant with eco-label certifications. These coatings not only meet environmental requirements but also align with consumer preferences for green and sustainable packaging solutions. Companies are often adopting recycling-friendly coatings to enhance the recyclability of metal packaging, contributing to circular economy principles.

The market is witnessing a shift towards advanced coating technologies to meet evolving customer demands. Nanotechnology is being employed to create nanocoatings that provide superior barrier properties, corrosion resistance, and improved aesthetics. Smart coatings with functionalities like anti-counterfeiting features, temperature monitoring, and freshness indicators are gaining traction, particularly in pharmaceutical and food packaging. Moreover, companies are exploring innovative ways to reduce the weight of coatings while maintaining performance, as lightweight is a key consideration for cost savings and sustainability. These advanced coating technologies help manufacturers differentiate their products and cater to specific industry needs.

Key Players:

-

PPG Industries, Inc.

-

AkzoNobel N.V.

-

The Sherwin-Williams Company

-

Valspar Corporation (now part of Sherwin-Williams)

-

Axalta Coating Systems Ltd.

-

RPM International Inc.

-

TIGER Coatings GmbH & Co. KG

-

Toyochem Co., Ltd.

-

Kansai Paint Co., Ltd.

-

The Chemours Company

-

In May 2023, AkzoNobel N.V. introduced an internal coating for beverage can ends that is free from bisphenol. Their strategy in the shift away from BPA and bisphenol centers on ensuring consumer safety and sustainability by responsibly substituting materials, all while minimizing disruptions in the value chain.

-

In June 2021, PPG increased its coatings manufacturing capacity in Europe, specifically at facilities in The Netherlands and Poland. These investments aimed at meeting the rising customer demand in the region for advanced coatings designed for use in general-line metal packaging applications.

Chapter 1. General Line Metal Packaging Coatings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. General Line Metal Packaging Coatings Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. General Line Metal Packaging Coatings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. General Line Metal Packaging Coatings Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. General Line Metal Packaging Coatings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. General Line Metal Packaging Coatings Market – By Coating Type

6.1 Introduction/Key Findings

6.2 Water-Based Coating

6.3 Powder Coating

6.4 Solvent-Based Coating

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Coating Type

6.7 Absolute $ Opportunity Analysis By Coating Type, 2023-2030

Chapter 7. General Line Metal Packaging Coatings Market – By End-Use

7.1 Introduction/Key Findings

7.2 Food and Beverage

7.3 Pharmaceutical

7.4 Chemical and Industrial

7.5 Personal Care and Cosmetics

7.6 Others

7.7 Y-O-Y Growth trend Analysis By End-Use

7.8 Absolute $ Opportunity Analysis By End-Use, 2023-2030

Chapter 8. General Line Metal Packaging Coatings Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.1.4 By Coating Type

8.1.2 By End-Use

8.1.3 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Coating Type

8.2.3 By End-Use

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Coating Type

8.3.3 By End-Use

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Coating Type

8.4.3 By End-Use

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Coating Type

8.5.3 By End-Use

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. General Line Metal Packaging Coatings Market – Company Profiles – (Overview, General Line Metal Packaging Coatings Market Portfolio, Financials, Strategies & Developments)

9.1 PPG Industries, Inc.

9.2 AkzoNobel N.V.

9.3 The Sherwin-Williams Company

9.4 Valspar Corporation (now part of Sherwin-Williams)

9.5 Axalta Coating Systems Ltd.

9.6 RPM International Inc.

9.7 TIGER Coatings GmbH & Co. KG

9.8 Toyochem Co., Ltd.

9.9 Kansai Paint Co., Ltd.

9.10 The Chemours Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global General Line Metal Packaging Coatings Market was valued at USD 3.47 Billion and is projected to reach a market size of USD 4.82 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 4.2%.

Sustainability and Environmental Concerns and the rise in food safety regulations are driving the demand for General Line Metal Packaging Coatings in the market.

Based on coating type, the Global General Line Metal Packaging Coatings Market is segmented into Water-Based Coating, Powder Coating, Solvent-Based Coating, and Others

North America is the most dominant region for the Global General Line Metal Packaging Coatings Market.

PPG Industries, Inc., AkzoNobel N.V., and the Sherwin-Williams Company are a few of the key players operating in the Global General Line Metal Packaging Coatings Market.