Gear Reducer Market Size (2025 – 2030)

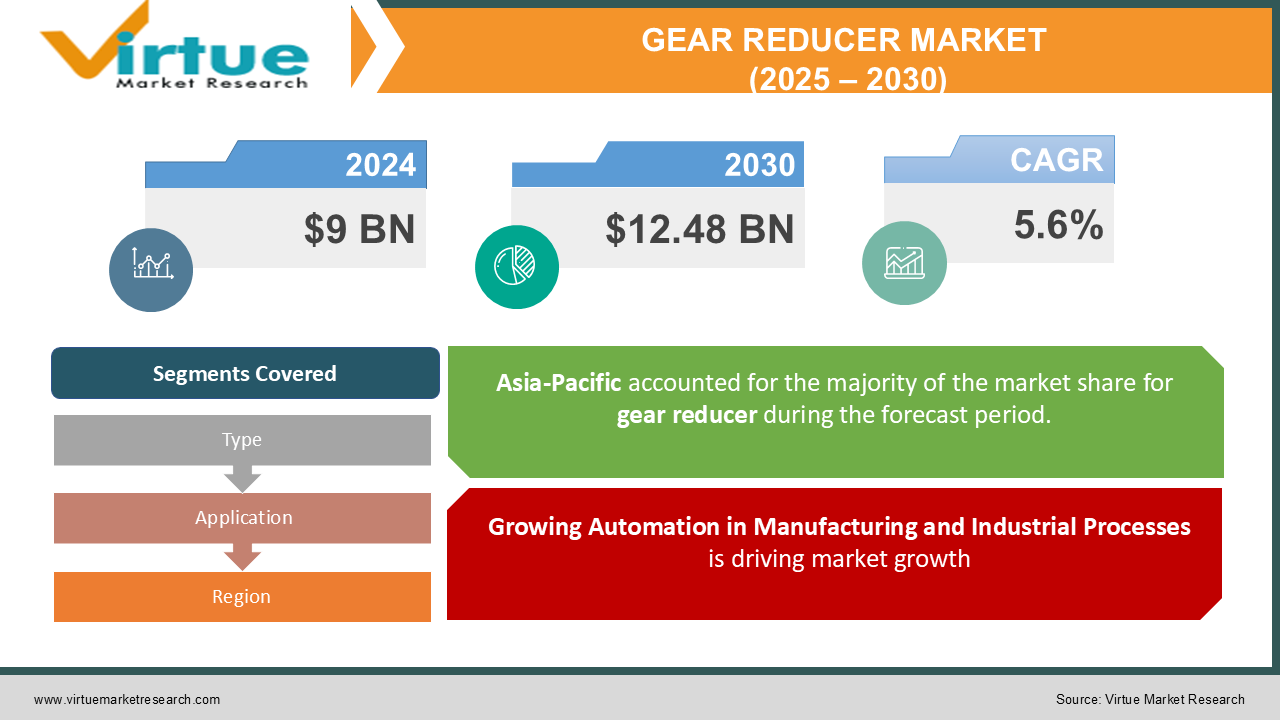

The Global Gear Reducer Market was valued at USD 9 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2030, reaching an estimated market value of USD 12.48 billion by 2030.

Gear reducers, also known as gearboxes, are mechanical devices used to reduce the speed of an input power source while increasing torque output. These devices play a crucial role in various industries, including manufacturing, automotive, power generation, and robotics.

The growth of the gear reducer market is fueled by the rising demand for efficient power transmission systems in industrial applications, increasing automation in manufacturing processes, and the growing adoption of electric vehicles (EVs) that require gear reduction systems in drivetrains. Additionally, advancements in gear technology, such as the development of lightweight, compact, and high-performance gear reducers, are enhancing their application across industries.

Key Market Insights

-

The industrial segment dominates the gear reducer market, accounting for over 40% of revenue in 2024, driven by high demand in manufacturing, mining, and material handling applications.

-

Worm gear reducers remain a popular choice due to their cost-effectiveness and efficiency in handling high torque at low speeds, particularly in conveyor systems and heavy machinery.

-

The renewable energy sector, especially wind turbines, is emerging as a key growth driver for gear reducers, with increasing investments in green energy projects globally.

-

Technological advancements, such as the integration of Internet of Things (IoT) in gear reducers for real-time monitoring and predictive maintenance, are transforming the industry.

Global Gear Reducer Market Drivers

Growing Automation in Manufacturing and Industrial Processes is driving market growth:

The shift toward automation in manufacturing and industrial processes is a significant driver of the gear reducer market. Automated machinery and equipment require precise power transmission systems, which gear reducers provide by delivering controlled torque and speed. Industries such as automotive, food and beverage, pharmaceuticals, and textiles are heavily investing in automated systems to enhance productivity and efficiency. Gear reducers play a vital role in these systems, enabling seamless and reliable operations. For example, in automated conveyor systems, gear reducers ensure smooth speed control and torque delivery to handle varying load conditions. As industries continue to embrace automation, the demand for advanced gear reducers with features like compact designs, low noise, and energy efficiency will increase.

Rising Adoption of Electric Vehicles (EVs) is driving market growth:

The global shift toward electric vehicles (EVs) is creating significant opportunities for the gear reducer market. EVs utilize gear reduction systems to optimize motor performance and improve energy efficiency. Unlike traditional internal combustion engine vehicles, which rely on complex transmission systems, EVs use simplified gear reducers to achieve desired speed and torque levels. As governments worldwide implement policies to promote EV adoption and reduce carbon emissions, the demand for gear reducers tailored for EV applications is expected to grow. Manufacturers are focusing on developing lightweight, compact, and durable gear reducers that enhance the overall efficiency and performance of EV drivetrains. This trend aligns with the automotive industry’s push toward sustainability and innovation.

Expansion of Renewable Energy Projects is driving market growth:

The renewable energy sector, particularly wind power, is driving demand for gear reducers. In wind turbines, gearboxes are used to increase the rotational speed of the turbine shaft to match the generator's operational speed, enabling efficient energy production. With increasing investments in renewable energy projects globally, particularly in regions like Europe, North America, and Asia-Pacific, the demand for high-performance and durable gear reducers is rising. Governments and organizations are prioritizing green energy solutions to meet sustainability goals and reduce dependence on fossil fuels. As a result, gear reducer manufacturers are focusing on producing specialized gearboxes capable of withstanding harsh environmental conditions and ensuring reliable performance in wind turbines.

Global Gear Reducer Market Challenges and Restraints

High Initial Costs and Maintenance Requirements is restricting market growth:

One of the primary challenges facing the gear reducer market is the high initial cost of advanced gear reducer systems. Industries seeking precision and durability often require custom-designed gear reducers made from high-quality materials, which increases manufacturing costs. Additionally, the integration of advanced features like IoT-enabled monitoring systems adds to the expense. Maintenance requirements also pose a challenge, particularly in heavy-duty applications where gear reducers are subject to significant wear and tear. Regular maintenance, including lubrication and part replacements, is essential to ensure optimal performance and longevity. These factors can deter small and medium-sized enterprises (SMEs) from investing in high-end gear reducers, limiting market penetration in certain segments.

Emergence of Alternative Power Transmission Technologies is restricting market growth:

The rise of alternative power transmission technologies, such as direct drive systems and variable frequency drives (VFDs), poses a potential restraint to the gear reducer market. Direct drive systems eliminate the need for gearboxes by connecting the motor directly to the driven equipment, reducing mechanical losses and simplifying maintenance. Similarly, VFDs allow precise speed control without relying on mechanical gear reduction. These alternatives are gaining traction in applications where high efficiency and reduced mechanical complexity are prioritized. While gear reducers remain indispensable in many industries, manufacturers must innovate to stay competitive and address the growing preference for alternative technologies.

Market Opportunities

The increasing focus on energy efficiency and sustainability presents significant opportunities for the gear reducer market. Industries are seeking solutions that minimize energy consumption while maintaining high performance, driving demand for gear reducers with advanced designs and materials.

One notable opportunity lies in the integration of IoT and smart technologies in gear reducers. IoT-enabled gear reducers offer real-time monitoring, predictive maintenance, and improved operational control, helping industries reduce downtime and optimize performance. This trend aligns with the broader adoption of Industry 4.0 practices in manufacturing.

The expansion of emerging markets, particularly in Asia-Pacific and Latin America, is another area of growth. Rapid industrialization, urbanization, and infrastructure development in these regions are creating a robust demand for gear reducers across various sectors, including construction, mining, and energy. Manufacturers can capitalize on these opportunities by offering cost-effective and reliable solutions tailored to regional requirements.

GEAR REDUCER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SEW-Eurodrive, Bonfiglioli, Sumitomo Heavy Industries, Siemens AG, Nidec Corporation, Rexnord Corporation, Watt Drive (WEG Group), Brevini Power Transmission, Renold PLC, Boston Gear |

Gear Reducer Market Segmentation - By Type

-

Worm Gear Reducers

-

Planetary Gear Reducers

-

Helical Gear Reducers

-

Bevel Gear Reducers

-

Others

Helical gear reducers dominate the market due to their high efficiency, smooth operation, and versatility in handling various torque and speed requirements across industries.

Gear Reducer Market Segmentation - By Application

-

Automotive

-

Industrial Machinery

-

Energy and Power Generation

-

Food and Beverage Processing

-

Construction Equipment

-

Others

The industrial machinery segment leads the market, driven by the widespread use of gear reducers in manufacturing, material handling, and heavy equipment applications.

Gear Reducer Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the most dominant region, accounting for over 45% of the market share. This dominance is attributed to rapid industrialization, significant infrastructure development, and the presence of major automotive and manufacturing hubs in countries like China, India, and Japan. The region's growing renewable energy sector, particularly in wind power, further contributes to its leadership in the gear reducer market.

COVID-19 Impact Analysis on the Gear Reducer Market

The COVID-19 pandemic had a mixed impact on the gear reducer market. Initially, disruptions in supply chains, labor shortages, and temporary shutdowns of manufacturing facilities caused a significant decline in production and sales. Key industries such as automotive and construction, which are major consumers of gear reducers, experienced slowdowns as demand reduced and projects were delayed. However, the pandemic also acted as a catalyst for the adoption of automation and digitalization in manufacturing and industrial processes. As businesses sought to enhance efficiency and reduce dependence on manual labor, the demand for advanced gear reducers, particularly those with IoT-enabled features, surged. These smart gear reducers offered improved performance, remote monitoring, and predictive maintenance capabilities, helping companies navigate the challenges posed by the pandemic and adapt to evolving market needs. Additionally, the post-pandemic recovery in the renewable energy sector played a significant role in boosting the gear reducer market. With increased investments in green energy projects, such as wind and solar power, the demand for gear reducers used in these technologies grew. As the world focuses on transitioning to sustainable energy sources, gear reducers are integral components in the efficient operation of renewable energy systems. This combination of technological innovation and green energy investment provided a much-needed boost to the market, helping it recover and thrive in the post-pandemic landscape.

Latest Trends/Developments

The gear reducer market is undergoing several key advancements and trends that are shaping its future. A major development is the integration of smart technologies, including the Internet of Things (IoT) and artificial intelligence (AI), into gear reducer systems. These innovations enable real-time monitoring, predictive maintenance, and remote diagnostics, significantly enhancing operational efficiency while minimizing downtime. This shift towards smarter systems is helping industries optimize their processes and improve productivity. Another notable trend is the move toward lightweight and compact designs. Manufacturers are increasingly focusing on developing gear reducers that use advanced materials and innovative designs to meet the growing demand for space-saving, energy-efficient solutions. These compact gear reducers are particularly in demand in industries where space and energy efficiency are crucial, such as robotics, automotive, and industrial automation. Sustainability is also playing a key role in driving market changes. With heightened awareness of environmental impact, there is a growing emphasis on eco-friendly lubricants, recyclable materials, and energy-efficient designs in gear reducers. These efforts align with global sustainability initiatives and the broader push toward reducing industrial carbon footprints. As industries adopt greener practices, the demand for more sustainable gear reducer solutions is expected to rise, reflecting the market's commitment to supporting eco-friendly industrial practices. These trends highlight the dynamic evolution of the gear reducer market, driven by technological innovation, design advancements, and an increasing focus on sustainability.

Key Players

-

SEW-Eurodrive

-

Bonfiglioli

-

Sumitomo Heavy Industries

-

Siemens AG

-

Nidec Corporation

-

Rexnord Corporation

-

Watt Drive (WEG Group)

-

Brevini Power Transmission

-

Renold PLC

-

Boston Gear

Chapter 1. Gear Reducer Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Gear Reducer Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Gear Reducer Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Gear Reducer Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Gear Reducer Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Gear Reducer Market – By Type

6.1 Introduction/Key Findings

6.2 Worm Gear Reducers

6.3 Planetary Gear Reducers

6.4 Helical Gear Reducers

6.5 Bevel Gear Reducers

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Gear Reducer Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Industrial Machinery

7.4 Energy and Power Generation

7.5 Food and Beverage Processing

7.6 Construction Equipment

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Gear Reducer Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Gear Reducer Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 SEW-Eurodrive

9.2 Bonfiglioli

9.3 Sumitomo Heavy Industries

9.4 Siemens AG

9.5 Nidec Corporation

9.6 Rexnord Corporation

9.7 Watt Drive (WEG Group)

9.8 Brevini Power Transmission

9.9 Renold PLC

9.10 Boston Gear

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Gear Reducer Market was valued at USD 9 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2030, reaching an estimated market value of USD 12.48 billion by 2030.

Key drivers include the growing adoption of automation, rising demand for gear reducers in electric vehicles, and expansion of renewable energy projects.

The market is segmented by type (worm, helical, planetary, etc.) and application (automotive, industrial machinery, energy, etc.).

Asia-Pacific is the dominant region, driven by rapid industrialization, infrastructure development, and renewable energy growth

Leading players include SEW-Eurodrive, Bonfiglioli, Sumitomo Heavy Industries, Siemens AG, and Nidec Corporation.