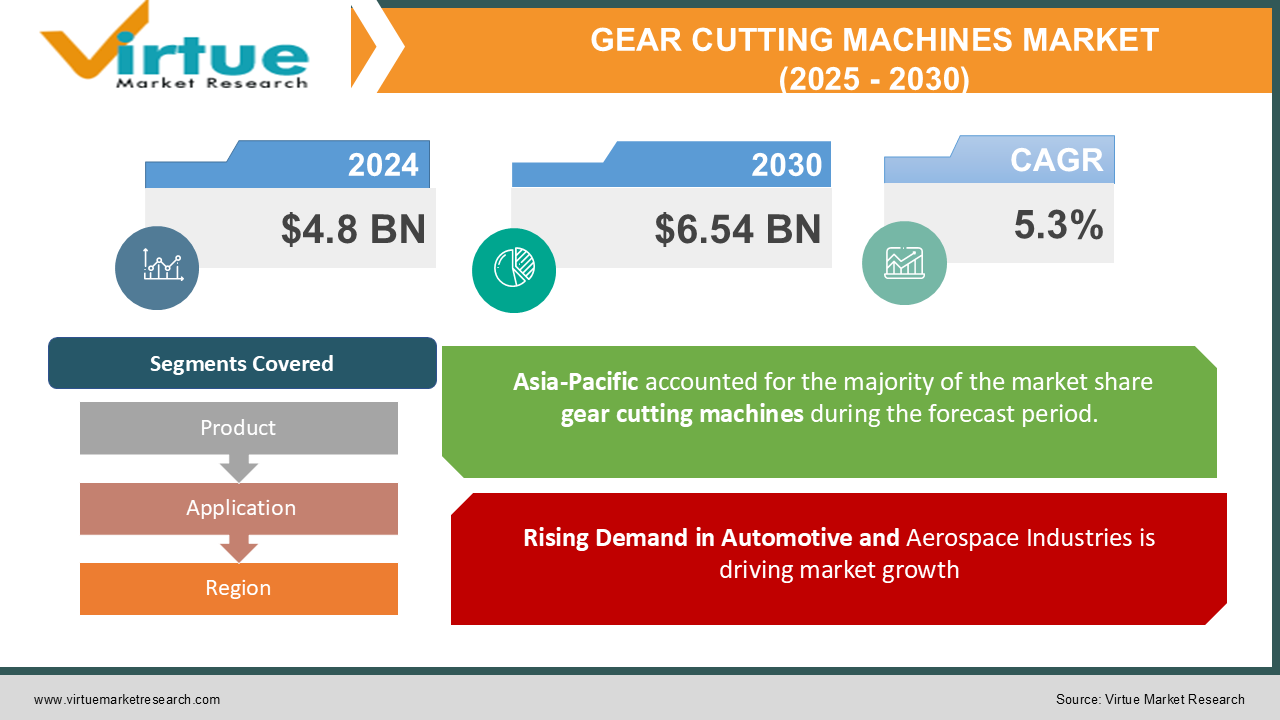

Gear Cutting Machines Market Size (2025 – 2030)

The Global Gear Cutting Machines Market was valued at USD 4.8 billion in 2024 and is projected to grow at a CAGR of 5.3% from 2025 to 2030. The market is expected to reach USD 6.54 billion by 2030.

Gear cutting machines are specialized tools designed to produce gears of various sizes and configurations used in diverse industries, including automotive, aerospace, energy, and heavy machinery. These machines play a critical role in ensuring precision and quality in gear production. The market growth is driven by increasing industrial automation, rising demand for high-performance gears, and advancements in gear manufacturing technologies.

Key Market Insights

-

The automotive sector, which accounts for over 40% of the gear cutting machines market demand, continues to drive growth due to the rising production of electric and hybrid vehicles.

-

Asia-Pacific leads the market in terms of demand, with China and India experiencing significant growth due to expanding industrial activities and infrastructure development.

-

Industry 4.0 integration, including real-time monitoring and predictive maintenance, is gaining traction in gear cutting machine operations.

-

Rising energy sector investments, particularly in wind power projects, are driving demand for large-scale gear cutting machines. The trend towards automation and robotics in manufacturing is accelerating the adoption of high-speed and precise gear cutting technologies.

Global Gear Cutting Machines Market Drivers

Rising Demand in Automotive and Aerospace Industries is driving market growth:

Sectors primarily consuming gears include the automotive and aerospace, and growth of these sectors increases demand in gear cutting machines. In the automotive sector, rising trends to electric and hybrid vehicles require more precise, lightweight gear cutting machines for perfect optimizing the performance. Electric vehicles have special gear configurations, which also contribute toward increased demand for novel gear-cutting solutions. The aerospace industry similarly relies on high-precision gears for mission-critical applications such as propulsion systems and flight control mechanisms. Both industries are bound to grow, including in emerging markets. Thus, the demands for high-end gear-cutting machines are likely to rise significantly.

Technological Advancements in Gear Manufacturing is driving market growth:

With the introduction of high technology, such as CNC systems, the gear cutting machines market has changed. Geared products are manufactured accurately with the least amount of material waste using CNC. Advanced software is also integrated for the design and simulation of the gears, and thereby achieving complex geometries is easy. Additive manufacturing technologies, such as 3D printing, influence the market by providing the rapid prototyping of gear components. These developments are not only on the increase of productivity but also on the flexibility designs and production for manufacturers, making a modern day gear cutting machine such an industrial necessity.

Expansion of Industrial Automation and Industry 4.0 is driving market growth:

Indicators of industrial automation and Industry 4.0 principles are changing the manufacturing landscape. Gear cutting machines, where real-time monitoring, data analytics, and predictive maintenance are integrated, will dominate the market in the times to come. Their mode of operation mainly provides enhanced productivity while reducing the possibility of equipment breakdown, making it easier to handle changes in demand. Growing reliance of industries on smart manufacturing solutions is expected to increase demand for highly advanced gear cutting machines. Moreover, the increasing incorporation of robotics in manufacturing processes complements the adoption of high-precision gear cutting machines.

Global Gear Cutting Machines Market Challenges and Restraints

High Costs of Advanced Gear Cutting Machines is restricting market growth:

The cost of purchasing and maintaining high-tech gear cutting machines remains a great challenge for most manufacturers, more so for small and medium-sized enterprises. Indeed, such CNC gear-cutting machines and other state-of-the-art solutions require considerable upfront investment; as such, they might be too expensive for companies facing scarce budgets. Moreover, skilled labor to run and service the machines contributes to the overall cost burden. Despite the long-term advantages in productivity and waste reduction, the high up-front costs often discourage smaller producers from adopting these technologies. This challenge requires low-cost financing options and cost-effective machine designs to be implemented on a larger scale.

Shortage of Skilled Labor and Training is restricting market growth:

Operating advanced gear cutting machines requires specific skills and knowledge that usually are not present in the workforce. The increased complexity and automation of industry processes require high-skilled operators who can handle CNC systems, interpret advanced software tools, and acquire knowledge on how to perform a specific job. Unfortunately, the absence of such expertise deters the wide use of the newer gear cutting technologies. The manufacturers should invest in training programs and partnership with technical institutions to ensure such specific skills are developed. Besides that, some businesses fail to achieve the very potential in their gear cutting machines due to insufficient training equipment.

Market Opportunities

Gear cutting machines market is considered a big arena with optimum opportunities for growth, especially in emerging industries and regions. The growth in renewable energy projects, including wind and solar power, is one of the key growth areas because such industries require large, high-performance gears for turbines and other equipment. The demand for lightweight, strong gears in the automobile and aerospace industries opens opportunities for material science and machine technology innovations among manufacturers. Predictive maintenance, real-time monitoring, and increased customization are also possible using AI and IoT with gear cutting machines. These come in line with the uptrend of smart manufacturing, giving companies an upper hand. In addition, growth in manufacturing activity in the developing world is a large opportunity in the entry-level and mid-range gear cutting machines. Companies can achieve a strong footprint in high-potential markets by catering to the specialized needs of such regions.

GEAR CUTTING MACHINES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.3% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Gleason Corporation, Liebherr Group, Mitsubishi Heavy Industries Machine Tool Co., Ltd., KAPP NILES, Reishauer AG, EMAG Group, Mazak Corporation, Höfler Maschinenbau GmbH, Bourn & Koch, Inc., Felsomat GmbH & Co. KG |

Gear Cutting Machines Market Segmentation - By Product

-

Gear Hobbing Machines

-

Gear Shaping Machines

-

Gear Grinding Machines

-

Gear Milling Machines

-

Gear Chamfering Machines

Gear Hobbing Machines dominate the market due to their versatility and efficiency in producing gears for a wide range of applications. These machines are preferred for their ability to handle high-volume production while maintaining precision and consistency.

Gear Cutting Machines Market Segmentation - By Application

-

Automotive

-

Aerospace

-

Industrial Machinery

-

Energy and Power

-

Others

The Automotive sector is the leading application segment, driven by the increasing production of electric and hybrid vehicles. These vehicles demand precise and lightweight gears, boosting the need for advanced gear cutting machines in this industry.

Gear Cutting Machines Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific leads the global gear cutting machines market, driven by rapid industrialization and infrastructure development in countries such as China, India, and Japan. The region’s strong automotive and manufacturing sectors, coupled with government initiatives to promote industrial growth, contribute significantly to its dominance. Moreover, the availability of skilled labor and cost advantages in production make Asia-Pacific a hub for gear manufacturing. The increasing demand for energy-efficient machinery in the region further supports the growth of the gear cutting machines market.

COVID-19 Impact Analysis on the Gear Cutting Machines Market

The COVID-19 pandemic had a mixed impact on the market for gear cutting machines. In the initial phase of the pandemic, closure and disruption to supply chains led to a considerable slump in manufacturing activities that subsequently resulted in low demand for gear cutting machines. Key industries such as automotive and aerospace were badly impacted, slowing down and, in some cases, halting investments in new machinery. This resulted in a mild decline in market growth during the early going of the crisis. However, the pandemic also catalyzed automation and digital solution adoption into manufacturing. In response to greater efficiency for the operations and cutting of manual dependency, companies found it more apparent to shift toward automation. This trend would positively influence the long-term growth of the gear cutting machines market as industries continue to adopt technologies that deliver output by employing predictive maintenance and real-time monitoring to optimize the process. The world has slowly begun to regain its footing from the pandemic; however, there is a marked increase in demand for high-tech, advanced machinery designed to enhance productivity and efficiency. Manufacturers are constantly investing in state-of-the-art gear cutting systems to meet the surging demand for precise gears. Increasingly, there is greater emphasis on renewable energy projects in the post-pandemic era; large-scale gear cutting machines for wind turbines, among other structures, would gain massive traction in the days ahead. While the pandemic had initially disrupted the gear cutting machines market, the recovery phase is optimistic, with increased investments in automation, digitalization, and sustainable energy projects contributing to the market's future growth and development.

Latest Trends/Developments

The gear cutting machines market experiences rapid innovations and technological advancements. The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into gear cutting systems is a major trend changing the industry. These technologies enable real-time monitoring, predictive maintenance, and data-driven decision-making to enhance operational efficiency and significantly reduce downtime. CNC technology also continues to evolve with increased precision and reduction of cycle times, especially when dealing with complex gear designs. This enables manufacturers to produce more complicated and precise gears more rapidly, answering the rapidly growing demand for quality. Because of rising ecological issues, lighter, eco-friendly materials along with green manufacturing processes are growing in use. Industries are focusing more on sustainability, which means that there is an emphasis on the cutting gear machine manufacturers to use green material and practice, minimizing waste and energy 3. Customize gears and prototyping through 3D printing is another metamorphosis happening in the market. This technology is changing the nature of the production process, with the ability to produce prototypes in record times, to test different designs, and to produce highly customized gears to meet particular customer needs. There is also a trend toward more modular and multi-functional gear cutting machines. Such multifunctional systems can perform several operations in one machine instead of in separate machines, reducing setup times and increasing overall production efficiency. This flexibility makes them highly appealing to companies looking to consolidate their operations and increase productivity. These trends characterise the gear cutting machines market, which continues to evolve in order to fulfill the needs of more accurate, efficient, sustainable, and customised gear production. It will be interesting to see just how far these technological developments can take the industry as it grows and develops further.

Key Players

-

Gleason Corporation

-

Liebherr Group

-

Mitsubishi Heavy Industries Machine Tool Co., Ltd.

-

KAPP NILES

-

Reishauer AG

-

EMAG Group

-

Mazak Corporation

-

Höfler Maschinenbau GmbH

-

Bourn & Koch, Inc.

-

Felsomat GmbH & Co. KG

Chapter 1. Gear Cutting Machines Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Gear Cutting Machines Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Gear Cutting Machines Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Gear Cutting Machines Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Gear Cutting Machines Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Gear Cutting Machines Market – By Product Type

6.1 Introduction/Key Findings

6.2 Gear Hobbing Machines

6.3 Gear Shaping Machines

6.4 Gear Grinding Machines

6.5 Gear Milling Machines

6.6 Gear Chamfering Machines

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Gear Cutting Machines Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Aerospace

7.4 Industrial Machinery

7.5 Energy and Power

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Gear Cutting Machines Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Gear Cutting Machines Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Gleason Corporation

9.2 Liebherr Group

9.3 Mitsubishi Heavy Industries Machine Tool Co., Ltd.

9.4 KAPP NILES

9.5 Reishauer AG

9.6 EMAG Group

9.7 Mazak Corporation

9.8 Höfler Maschinenbau GmbH

9.9 Bourn & Koch, Inc.

9.10 Felsomat GmbH & Co. KG

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Gear Cutting Machines Market was valued at USD 4.8 billion in 2024 and is projected to grow at a CAGR of 5.3% from 2025 to 2030. The market is expected to reach USD 6.54 billion by 2030.

Key drivers include rising demand in automotive and aerospace industries, technological advancements in gear manufacturing, and the expansion of industrial automation and Industry 4.0.

The market is segmented by product (gear hobbing, shaping, grinding, milling, and chamfering machines) and by application (automotive, aerospace, industrial machinery, energy, and others).

Asia-Pacific dominates the market due to rapid industrialization, strong automotive production, and government support for manufacturing activities.

Leading players include Gleason Corporation, Liebherr Group, Mitsubishi Heavy Industries Machine Tool Co., Ltd., KAPP NILES, and Reishauer AG.