GCC Energy Drinks Market Size (2025 – 2030)

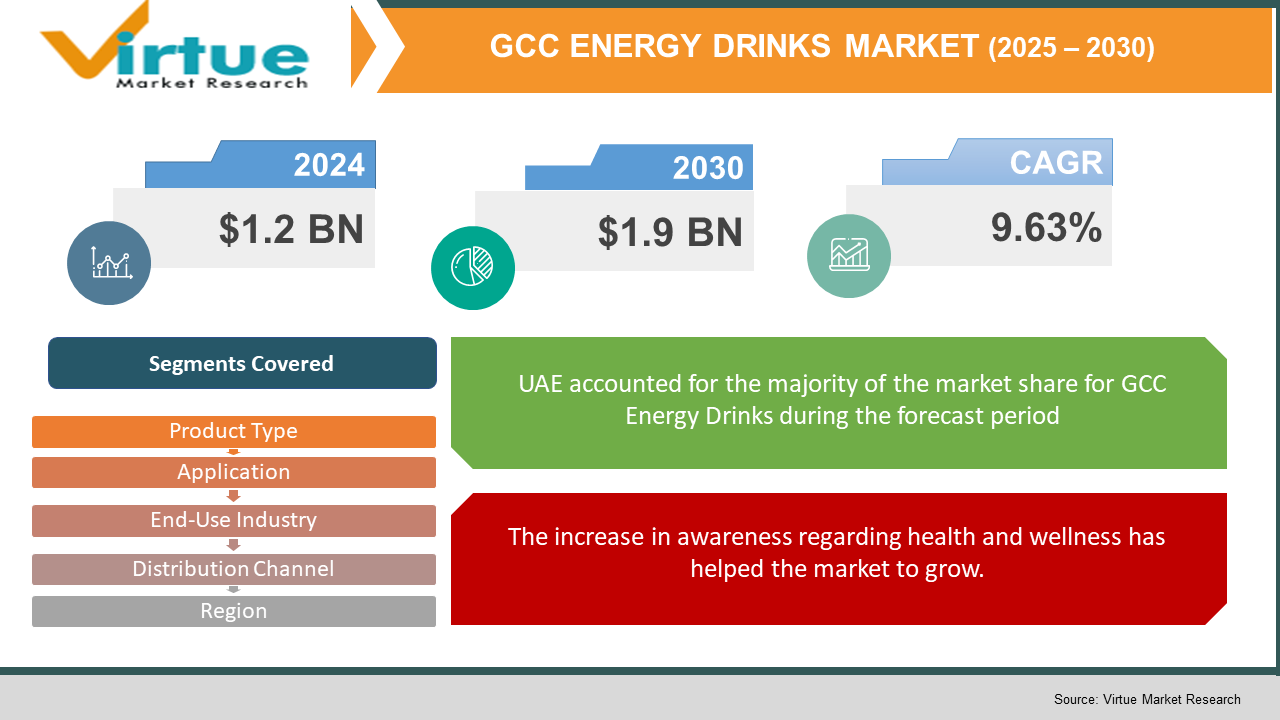

The GCC Energy Drinks Market was valued at USD 1.2 billion and is projected to reach a market size of USD 1.9 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.63%.

By growing consumption of functional and top-notch hydration solutions in the Gulf Cooperation Council (GCC) area, the Global GCC Energy Drinks Market is quickly changing. Rising disposable income, growing customer health awareness, and a cultural change in the younger generation toward active lifestyles define this market. In the GCC, energy drinks are growing beyond traditional caffeine-based recipes to include sugar‑free and functional versions meeting different consumer demands. Furthermore, supporting steady growth are the strong retail network of the area, the emergence of e-commerce, and encouraging government policies promoting market liberalization and innovation. To grab a big market share in a growing tough terrain, manufacturers are using sophisticated composition, branding, and distribution techniques.

Key Market Insights:

Growing demand for energy drinks offering practical advantages like increased focus, better endurance, and low sugar content is driving a radical change toward health and active living. Recent GCC regional polls show that nearly 70% of young urban customers now give beverages that not only increase energy but also promote overall health top priority, hence driving top companies to create new, more nutritious compositions.

In the GCC, digital transformation is changing the retail scene as online sales channels are growing fast. Research shows that in the last years, digital and direct-to-consumer (DTC) channels have grown more than 40%, therefore opening doors for companies to connect with technology-knowledgeable customers.

GCC customers are progressively eager to pay extra for top-notch, practical energy drinks that provide great taste and performance advantages. Market research demonstrates that premium energy drinks can achieve margins up to 35% higher than conventional varieties.

Particularly among millennials and Generation Z, the strong urbanization and economic diversification of the GCC region keep fueling energy drink use. Lifestyle-driven purchases in cities like Dubai, Riyadh, and Doha result in higher per capita consumption rates.

GCC Energy Drinks Market Drivers:

The increase in awareness regarding health and wellness has helped the market to grow.

Health and general well-being are becoming more and more important among modern GCC consumers. Particularly among young professionals and city residents, there is a clear trend away from traditional sugary drinks toward more healthy options as lifestyles get more demanding. People believe energy drinks, including natural caffeine sources, vitamins, minerals, and herbal extracts, provide extra nutritional advantages such as better focus, increased detoxification, and more hydration. Almost 70% of health-conscious consumers in the GCC now favor drinks with "clean" and natural ingredients, according to market research by regional consumer research companies providing support for this trend. Strong social media influence and approval from local celebrities have also quickened consumer acceptance of health-focused energy drinks, motivating businesses to invent compounds that match changing tastes and support the trajectory of market expansion.

Rapid urbanization and changes in the lifestyle of people are considered the major market growth drivers.

Characterized by the development of smart cities and rising infrastructure expenditures in major cities like Dubai, Riyadh, and Doha, the GCC area keeps going through fast urbanization. Increasing disposable incomes and the rise of a mostly young, tech-savvy urban population have fueled demand for simple, on‑the‑go drink alternatives. Consumers with hectic lives, those juggling busy social lives with demanding work, are especially drawn to energy drinks. Consumers in these busy cities value items that provide fast energy boosts and improved cognitive performance, which may help to meet the demands of contemporary urban life. Market analyses show that lifestyle-driven consumption trends have led to a noticeable change in favor of premium, practical energy drinks that serve only to meet city demands, so positioning such goods for robust, continuous development.

The latest innovations regarding product development have led to immense growth in the market.

Innovation inside the GCC energy drinks industry is based on improvements in beverage formulation and production techniques. To improve product quality and set their goods apart, companies are making state‑of‑the‑art research and development investments. This encompasses the application of natural sweeteners, adaptogenic extracts, nootropics, and other functional components meeting the ever more health-conscious consumer. Modern processing techniques, including microencapsulation, guarantee effective delivery and improved longevity for these actives. These technical improvements have produced energy drinks that supply a more even energy surge free of the downsides of artificial substances or too much sugar. By meeting current performance and health criteria, brands that first introduce these technologies can grab the premium section of the market, control higher margins, and so foster more customer loyalty.

The recent growth in the digital and omnichannel distribution systems is considered a great market driver.

For energy drinks, the digital transition in the GCC area is changing the retail scene dramatically. Consumers are purchasing their drinks online more and more, thanks in part to widespread internet usage and high smartphone penetration, and this is fueling the quick expansion of e-commerce platforms. Using direct-to-consumer sales techniques and omnichannel plans, energy drink companies are reaching out to a diverse and geographically spread audience. Brands can precisely target certain consumer groups using sophisticated digital marketing technologies such as AI-powered analytics, personalized online promotions, and influencer partnerships. This integrated retail approach not only lowers distribution costs but also improves customer engagement and support. The development of online retail and creative DTC campaigns is forecast to keep being a major driver in increasing market reach and hastening sales in the GCC as digital channels keep changing.

GCC Energy Drinks Market Restraints and Challenges:

The high levels of operational costs associated with this market act as a major challenge for many businesses.

Manufacturers spend on sophisticated equipment for extracting natural caffeine sources, mixing advanced functional ingredients, and using thorough quality control systems to guarantee consistent product quality. Additionally, the increasing demand for environmentally friendly packaging, such as biodegradable plastics or sustainable aluminum cans, necessitates more investment in new production lines and technology upgrades. The manufacture of premium energy drinks in the GCC includes significant capital outlays for first-class ingredients, state‑of‑the‑art formulation techniques, and creative packaging solutions. Taken together, these factors raise operating expenses and make it difficult for smaller players to scale production effectively. In a price-sensitive market, increased production costs can result in premium pricing that not all consumers can afford, hence restricting general market penetration and competitive position.

The existence of intense competition and price sensitivity poses a great challenge for the market to stay competitive.

The energy drinks industry in the GCC is cutthroat and rich with local and foreign brands vying for customer interest. This intense rivalry results in great price pressure, especially in mature sectors where candidate products are widely accessible and brand loyalty is divided. Companies will often spend their dollars on marketing, product creativity, and high-end branding so as to set themselves apart. But this continual need for investment in creativity and marketing initiatives can lead to a race to the bottom in pricing, causing price wars that erode profit margins. Keeping distinction is crucial for premium or niche sectors where consumers might be ready to pay more for extra advantages. Still, too much rivalry may cause some businesses to mostly compete on price instead of quality, which would slow down general market development and dissuade fresh entrants.

The complexity that exists in the rules and regulations makes it difficult for the market to navigate through them.

Notwithstanding changing GCC legislation, particularly those with high levels of caffeine and sugar, energy drinks are under great examination in view of public health issues. To guarantee consumer safety, regulatory agencies carefully watch over product formulations, labeling, and marketing claims. Strict health and safety standards, together with occasional general public health initiatives, frequently lead to ingredient levels and dosage suggestions being limited. Varying across different GCC nations, manufacturers have to negotiate these rules by means of thorough compliance and quality assurance programs. Rising expenses and potential postponements of product releases result from the necessity of constant monitoring and adjustment of shifting legal standards. Furthermore, driven public health problems from research associating high caffeine intake with harmful health outcomes add more pressure on companies to change goods or modify marketing techniques, thus affecting creativity and market growth.

The fluctuations in the supply chain and prices of the raw material are a great challenge being faced by the market.

The supply chain for energy drink production depends mostly on the constant availability of essential components such as vitamins, natural caffeine sources, flavorings, and other functional elements. Global market fluctuations, political challenges, and environmental elements, including climate change and severe weather conditions in major sourcing areas, greatly affect this supply chain. Such uncertainty can cause swings in prices of raw materials and sometimes scarcity, which would have an impact on the steady of production and total operational expenditures. Production delays or erratic product quality caused by supply chain disturbances erode brand name and consumer faith. Companies must make investments in risk minimization techniques like supplier base diversification or long-term contracts, therefore further adding costs and complexity to the operational structure.

GCC Energy Drinks Market Opportunities:

The market has an opportunity to tap into underserved markets and hence, grow its reach.

Particularly in nations beyond the well-established markets of the UAE and Saudi Arabia, emerging markets in the GCC area present untapped possibilities. Driven by urbanization and increasing disposable incomes, faster economic growth in less-developed Gulf nations and surrounding areas is increasing the need for luxury lifestyle goods. By creating regional flavours or functional advantages that suit local tastes, businesses customizing their energy drink ingredients according to local consumer expectations can appeal to smaller markets. Moreover, the better distribution network, including the growth of contemporary retail outlets and greater e-commerce penetration, offers many avenues to access a wide range of consumers from high-end city dwellers to value-seeking consumers living in developing urban centres. By targeting both well-developed and underrepresented GCC sectors, this strategic approach not only broadens market contact but also drives incremental revenue growth.

The recent innovations in the health-focused formulations have helped the market to grow.

Demand for energy drinks that provide more than just an energy boost is strong in the GCC because of increasing consumer health awareness. To improve performance as well as general well-being, brands are currently creating formulas enriched with functional components including vitamins, antioxidants, adaptogens, and natural sweeteners. Leading companies are making significant R&D investments to create scientifically proven goods that provide noticeable health advantages such as better focus, increased hydration, and stress reduction, hence justifying premium price points and particularly appealing to millennials and Gen Z customers who are increasingly cautious of high sugar and artificial additives. The trend toward health-centric formulations not only attracts a well-defined consumer segment but also opens up premium product lines that command higher margins and strengthen brand differentiation in a competitive marketplace.

The expansion of digital marketing and E-Commerce in recent times is seen as an opportunity for the market to extend its coverage.

The digital revolution throughout the GCC area is greatly affecting much of the marketing and distribution of energy drinks. E-commerce and direct-to-customer (DTC) outlets have become vital means for accessing a bigger audience, given rising mobile phone usage and increasing internet access. To produce focused campaigns that appeal to health-conscious and tech-savvy buyers, energy drink brands are using digital marketing software, including AI-powered analytics, social media advertising, and influencer partnerships. In addition to allowing companies to quickly scale their distribution in reaction to market trends, this change improves consumer engagement via custom shopping experiences. Particularly among younger consumers who value the ease of digital shopping, the integration of omnichannel approaches seamlessly linking online and offline retail has resulted in better logistical performance and a greater geographical coverage.

The strategic collaboration among industries and product diversification offers a chance for the market to grow further.

Growing in the energy drinks market of GCC is the chance presented by forming strategic alliances. Sharing research expenses and technical knowledge, partnerships between beverage companies, technology suppliers, and research institutes can help to speed product innovation. Such partnerships help to speed time-to-market and improve product quality by means of cutting-edge manufacturing technologies and standardized compositions. Furthermore, product diversification, that is, introducing low-calorie, organic, or special functional energy drinks, lets brands focus on niche consumer sectors and reduce competitive pressures in a busy environment. Broadening their product ranges and using sector partnerships, businesses can generate special value propositions that entice premium customers and so grow their revenue. By improving operational effectiveness as well as encouraging creativity and consumer trust in developing product categories, this multifaceted strategy helps to propel long-term market growth.

GCC ENERGY DRINKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.63% |

|

Segments Covered |

By Product Type, application, end user industry, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Red Bull GmbH, Monster Beverage Corporation, PepsiCo., Inc., The Coca-Cola Company, Rockstar Energy (PepsiCo), Bang Energy, REIZE Energy, XS Energy (Amway), Guru Energy, Hydra Energy |

GCC Energy Drinks Market Segmentation:

GCC Energy Drinks Market Segmentation: By Product Type

- Regular Energy Drinks

- Sugar-Free Energy Drinks

- Functional Energy Drinks

- Organic Energy Drinks

The regular energy drinks segment dominates the market, since it is well known and has established consumer habits. This is a conventional recipe consisting of sugar and caffeine. The functional energy drinks segment is the fastest-growing segment, as there is a rise in the number of customers who are giving health advantages top priority. It also contains more functional components, including vitamins and adaptogens.

Sugar-free energy drinks are drinks for the calorie-conscious customer, formulated without sugar. Ingredients from organic sources and clean-label claims come under organic energy drinks.

GCC Energy Drinks Market Segmentation: By Application

- Sports & Fitness

- Work & Productivity

- Social & Leisure

- Others

The sports & fitness segment dominates the market because of powerful brand connections with performance and recovery. It is aimed at athletes and fitness fans requiring rapid energy boosts. The work & productivity segment is the fastest-growing segment of the market. Remote work and long hours are driving work and productivity, therefore expanding most rapidly. It is conceived to improve awareness and focus on workplace circumstances. Under the social & leisure segment, these drinks are consumed socially in leisure and pleasure contexts. The others segment covers particular uses, such as academic or travel.

GCC Energy Drinks Market Segmentation: By End-Use Industry

- Food & Beverages

- Hospitality

- Retail

- E-Commerce

The food & beverages segment dominates the market, these are energy drinks that are usually drunk through retail outlets, supporting mainstream retail and food business. The E-Commerce segment is the fastest-growing one, as direct online sales channels are attracting technology-savvy buyers. This is due to rising digital penetration and direct-to-consumer models. Hospitality includes hotels, cafes, and eateries serving high-quality energy drinks. Retail comprises chain stores, convenience stores, and specialty shops.

GCC Energy Drinks Market Segmentation: By Distribution Channel

- Direct Sales

- Distributors

- Online Retail

The direct sales segment is the dominant segment of the market, because of long-term, high-value agreements in developed markets, companies qualify directly from producers to major retailers and distributors. The online retail segment is said to be the fastest-growing segment, due to the ease of digital access and increasing consumer reliance on e-commerce. Digital channels that offer convenience and direct consumer engagement. Distributors are the middlemen who assist in extending market reach in established as well as developing markets.

GCC Energy Drinks Market Segmentation: By Region

The UAE emerges as the most significant market in the GCC given its great consumer buying power, sophisticated retail outlets, and quick acceptance of premium lifestyle drinks. Driven by revolutionary government policies, quick urbanization, and a young, changing consumer base, Saudi Arabia is starting to be the fastest‑growing market.

Although Kuwait is a smaller but very wealthy market with a great appetite for luxury and lifestyle-oriented items, well-established retail and digital channels facilitate effective market penetration. The Qatar economy is marked by rising disposable income, a developing tourism industry, and an ever more intense concentration on health and luxury experiences. Among local people and tourists could buying energy drinks is a popular activity. Aside from the size of the population, Bahrain is the smallest GCC market; it is quickly modernizing and experiencing increasing consumer demand for high-quality health and lifestyle products. An underdeveloped economy in the GCC, Oman has increasing consumer consciousness, modest disposable income, and rising commercial diversity. Still under construction, infrastructure enhancements and greater access to digital media channels are driving slow development.

COVID-19 Impact Analysis on the GCC Energy Drinks Market:

Lockdowns and remote work have changed daily habits, so the need for convenient and practical drinks has soared. This has altered consumer behavior and accelerated the digital transformation of retail outlets, thereby changing the Global GCC Energy Drinks Market. Many companies rapidly adjusted by improving their online presence and direct-to-consumer sales channels, therefore reducing supply chain interruptions and maintaining market growth under uncertain circumstances. Furthermore, better knowledge about health during the epidemic helped to permanently change the more healthy energy drinks, therefore supporting both product development and premiumization. The market sustains a hybrid model of online and conventional retail as constraints relax, therefore supporting a strong recovery and laying the foundation for ongoing growth till 2030.

Latest Trends/ Developments:

Leading GCC energy drink brands are investing in eco-friendly, recyclable, and biodegradable packaging solutions in reaction to worldwide environmental issues. This not only appeals to eco-conscious consumers but also helps companies satisfy progressively more rigorous legal criteria for sustainability.

One clear trend seems to be the addition of functional elements to conventional energy drinks. Because they offer specific health advantages in line with niche consumer segments seeking energy and health solutions, fresh product lines including organic adaptogens, nootropics, vitamins, and electrolytes are starting to gain momentum.

The GCC market's distribution channels have been transformed by the growth of e‑commerce and digital marketing. Brands are using online retail platforms, direct-to-customer models, and omnichannel approaches to reach a broader and more targeted audience, therefore significantly lowering time-to-market and distribution costs while enhancing customer engagement.

Through public campaigns and subsidies, GCC governments and regulatory agencies are progressively encouraging good dietary choices and active living. As people become more health-conscious and seek drinks that fit with their values, supporting continued market growth, these programs are indirectly influencing the energy drink sector.

Key Players:

- Red Bull GmbH

- Monster Beverage Corporation

- PepsiCo., Inc.

- The Coca-Cola Company

- Rockstar Energy (PepsiCo)

- Bang Energy

- REIZE Energy

- XS Energy (Amway)

- Guru Energy

- Hydra Energy

Chapter 1. GCC Energy Drinks Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. GCC Energy Drinks Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GCC Energy Drinks Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GCC Energy Drinks Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GCC Energy Drinks Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GCC Energy Drinks Market– By Investment Type

6.1 Introduction/Key Findings

6.2 Regular Energy Drinks

6.3 Sugar-Free Energy Drinks

6.4 Functional Energy Drinks

6.5 Organic Energy Drinks

6.6 Y-O-Y Growth trend Analysis By Investment Type

6.7 Absolute $ Opportunity Analysis By Investment Type , 2025-2030

Chapter 7. GCC Energy Drinks Market– By Application

7.1 Introduction/Key Findings

7.2 Sports & Fitness

7.3 Work & Productivity

7.4 Social & Leisure

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. GCC Energy Drinks Market– By End-Use Industry

8.1 Introduction/Key Findings

8.2 Food & Beverages

8.3 Hospitality

8.4 Retail

8.5 E-Commerce

8.6 Y-O-Y Growth trend Analysis End-Use Industry

8.7 Absolute $ Opportunity Analysis End-Use Industry , 2025-2030

Chapter 9. GCC Energy Drinks Market– By Distribution Channel

9.1 Introduction/Key Findings

9.2 Direct Sales

9.3 Distributors

9.4 Online Retail

9.5 Y-O-Y Growth trend Analysis Distribution Channel

9.6 Absolute $ Opportunity Analysis Distribution Channel , 2025-2030

Chapter 10. GCC Energy Drinks Market, By Geography – Market Size, Forecast, Trends & Insights

Chapter 11. GCC ENERGY DRINKS MARKET– Company Profiles – (Overview, Portfolio, Financials, Strategies & Developments)

11.1 Red Bull GmbH

11.2 Monster Beverage Corporation

11.3 PepsiCo., Inc.

11.4 The Coca-Cola Company

11.5 Rockstar Energy (PepsiCo)

11.6 Bang Energy

11.7 REIZE Energy

11.8 XS Energy (Amway)

11.9 Guru Energy

11.10 Hydra Energy

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The important growth drivers are consumer health consciousness, digital sales expansion, and urban lifestyle trends

Signifying raised market penetration, e-commerce and direct-to-consumer approaches have helped to propel the growth of this market

High manufacturing expenses, cutthroat competition, regulatory inspection, and variability of supply chains all impede the growth of the market.

Luxurious branding and sophisticated ingredients help premium goods have better margins in the market

Driven by digital consumer engagement and convenience, online retail is said to be the fastest-growing distribution channel of the market