Gastrointestinal Drugs Market Size (2025-2030)

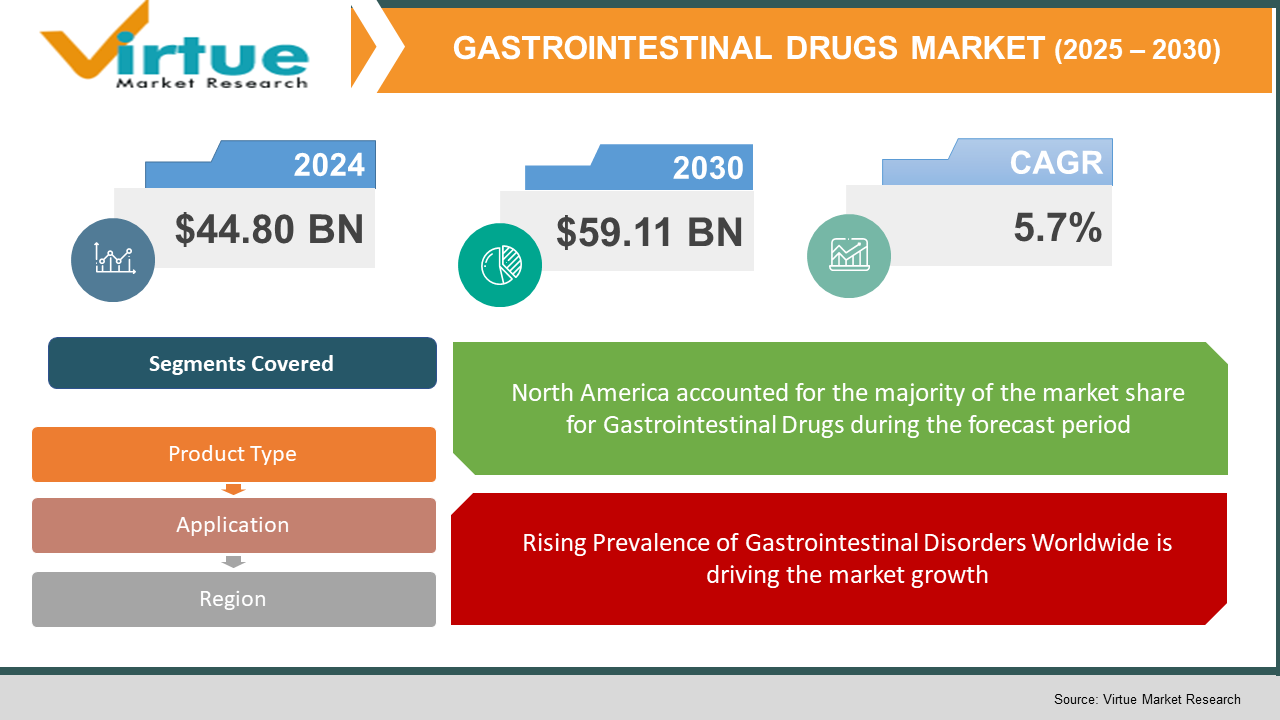

The Global Gastrointestinal Drugs Market was valued at USD 44.80 billion in 2024 and will grow at a CAGR of 5.7% from 2025 to 2030. The market is expected to reach USD 59.11 billion by 2030.

The Gastrointestinal Drugs Market includes medications used for the prevention and treatment of gastrointestinal (GI) disorders such as acid reflux, ulcers, constipation, diarrhea, inflammatory bowel disease (IBD), and irritable bowel syndrome (IBS). These drugs range from over-the-counter antacids to advanced biologics used in chronic conditions like Crohn’s disease. The market's growth is attributed to rising gastrointestinal disease prevalence, changing dietary habits, increasing geriatric population, and advancements in drug delivery technologies. Moreover, strong demand for biologics and targeted therapies, especially for IBD and colorectal conditions, is reshaping the treatment landscape. With the increasing global burden of lifestyle-related digestive disorders, the gastrointestinal drugs segment is expected to witness continuous innovation and robust growth.

Key Market Insights:

In 2024, proton pump inhibitors (PPIs) held a market share of over 25%, making them the most used drug class for GERD and peptic ulcers.

Biologics are the fastest-growing drug segment, expected to register a CAGR of over 7.5% between 2025 and 2030.

North America accounted for 41% of global revenue in 2024, driven by advanced healthcare infrastructure and high IBD prevalence.

Ulcerative colitis and Crohn’s disease collectively contributed to over 35% of total therapy market share in 2024.

Asia-Pacific is anticipated to grow at the fastest rate, with a projected CAGR of 6.8% from 2025 to 2030.

Global Gastrointestinal Drugs Market Drivers

Rising Prevalence of Gastrointestinal Disorders Worldwide is driving the market growth

One of the major drivers of the gastrointestinal drugs market is the increasing incidence and prevalence of GI disorders globally. Diseases such as gastroesophageal reflux disease (GERD), irritable bowel syndrome (IBS), peptic ulcers, ulcerative colitis, and Crohn’s disease are becoming more common due to sedentary lifestyles, poor dietary habits, alcohol consumption, stress, and rising obesity rates. GERD affects nearly 20% of the adult population in the United States alone, while inflammatory bowel diseases are increasingly diagnosed in younger age groups across developed and emerging nations. The elderly population, which is particularly susceptible to GI complications, is also expanding rapidly, contributing to the need for both chronic and acute GI treatments. This rising disease burden has led to an increase in both over-the-counter and prescription drug sales. The availability of a broad spectrum of treatment options from simple antacids to complex biologics further enhances market penetration. Moreover, the growing acceptance of digestive health as an integral aspect of overall well-being is encouraging earlier diagnosis and treatment initiation. As GI conditions affect a large cross-section of society and are often recurrent, the demand for effective gastrointestinal medications remains high, creating sustained growth opportunities for pharmaceutical companies globally.

Biologics and Targeted Therapies Changing Treatment Landscape is driving the market growth

The emergence of biologics and other targeted therapies is transforming the gastrointestinal drugs market, especially for inflammatory bowel diseases like Crohn’s disease and ulcerative colitis. Traditional therapies such as corticosteroids and aminosalicylates, while still used, have limitations in long-term disease control and come with side effects. Biologics, particularly TNF-alpha inhibitors and interleukin inhibitors, offer a more targeted mechanism of action, better efficacy in disease remission, and lower relapse rates. The introduction of biosimilars has also increased patient accessibility by reducing treatment costs. With a growing pipeline of innovative molecules, including JAK inhibitors and integrin antagonists, pharmaceutical companies are focusing heavily on the immunology segment of GI therapy. These drugs are being used increasingly as first-line treatments and in patients unresponsive to conventional drugs. In addition, increased research funding and regulatory support for fast-track approvals in gastrointestinal oncology, such as colorectal cancer therapies, are expanding the market scope. The success of biologics has also led to new drug delivery platforms, including subcutaneous and oral formulations, improving patient compliance. Overall, biologics are reshaping the treatment paradigm, providing personalized and long-term disease management options that align with the shift toward precision medicine.

Growth of Self-Medication and OTC Gastrointestinal Products is driving the market growth

The increasing trend of self-care and self-medication, especially in developed and urban regions, has significantly contributed to the growth of the gastrointestinal drugs market. Many GI conditions, such as acid reflux, occasional constipation, and indigestion, can be effectively managed with over-the-counter (OTC) medications, which are readily available in pharmacies and online platforms. Rising health awareness, time constraints for doctor visits, and the convenience of home care are encouraging consumers to opt for self-treatment for mild symptoms. OTC drugs such as antacids, laxatives, proton pump inhibitors, and antidiarrheals are among the top-selling categories in the retail pharmaceutical sector. Regulatory authorities in many countries have expanded OTC listings, thereby boosting the commercial potential of gastrointestinal drugs. In addition, direct-to-consumer advertising and online health platforms are educating users about proper drug use, symptom recognition, and when to seek medical advice. The pandemic has further accelerated this behavior, with consumers preferring remote solutions for digestive health. Pharmaceutical companies are responding by offering new OTC formulations with improved taste, dosing, and packaging. This shift toward self-managed GI care has created a parallel revenue stream to prescription medications, further expanding the total addressable market for gastrointestinal drugs.

Global Gastrointestinal Drugs Market Challenges and Restraints

Side Effects and Long-Term Safety Concerns is restricting the market growth

Despite their effectiveness, gastrointestinal drugs are associated with a range of side effects that can influence patient compliance and market adoption. Long-term use of proton pump inhibitors (PPIs), for instance, has been linked to nutrient malabsorption, kidney disease, and increased risk of infections such as Clostridium difficile. Similarly, biologics, while potent, carry the risk of immunosuppression, opportunistic infections, and infusion reactions. Laxatives can cause dependency with prolonged use, and certain antidiarrheals may lead to constipation or abdominal discomfort. These safety concerns have led healthcare providers to exercise caution in prescribing long-term GI treatments, particularly in vulnerable populations such as the elderly or those with comorbidities. Additionally, lawsuits and negative media coverage about adverse drug reactions can damage brand reputation and reduce consumer trust. Regulatory bodies like the FDA and EMA have issued safety alerts and black box warnings for several gastrointestinal drugs, necessitating regular safety reviews and post-marketing surveillance. Such developments may delay product approvals, increase compliance costs, and hinder market penetration. Addressing these safety challenges through robust clinical trials, transparent labeling, and patient education is essential for maintaining therapeutic trust and market sustainability.

High Cost of Biologics and Specialty Drugs is restricting the market growth

While biologics offer significant therapeutic advantages, their high cost remains a major restraint in the gastrointestinal drugs market. Biologics for IBD treatment can cost thousands of dollars annually, making them inaccessible for uninsured patients and financially burdensome even for insured individuals with high deductibles. Although biosimilars have introduced some price competition, the reduction in cost is still modest, and uptake varies significantly across regions due to regulatory differences and physician hesitancy. In emerging economies, public healthcare systems often lack the funding to include biologics in their formularies, leading to heavy reliance on older, less effective drugs. Additionally, pricing pressures from government policies, such as price capping and reference pricing, reduce profitability for manufacturers. This financial barrier limits the widespread adoption of advanced treatments, especially in markets with limited insurance coverage or fragmented healthcare access. The complexity and cost of biologics production also restrict the entry of new players, keeping the market concentrated among a few multinational firms. Addressing this challenge will require broader policy reforms, increased biosimilar penetration, and innovative pricing strategies like patient assistance programs and value-based pricing models.

Market Opportunities

The gastrointestinal drugs market presents substantial opportunities for growth, innovation, and strategic expansion, particularly as the global burden of GI disorders continues to rise. One of the foremost opportunities lies in the increasing incidence of inflammatory bowel diseases and colorectal cancers, especially in Asia-Pacific and Latin America, where urbanization, western diets, and improved diagnostic access are fueling disease identification. Pharmaceutical companies can capitalize on these trends by expanding their therapeutic portfolios and geographic reach. Another significant opportunity is the development of microbiome-based therapies and probiotics that offer novel approaches to modulate gut health and immune responses. These biologically driven products are gaining traction for conditions like IBS, Crohn’s disease, and antibiotic-associated diarrhea. Additionally, advances in drug delivery technologies—such as extended-release oral formulations, pH-sensitive capsules, and transdermal patches—can improve medication adherence and therapeutic outcomes. The integration of digital health tools, including symptom tracking apps and AI-powered diagnostic platforms, also presents a futuristic opportunity to personalize treatment regimens and enhance patient engagement. Moreover, rising investment in pediatric and geriatric gastrointestinal care opens new niche segments for age-specific drug formulations. Collaborations between biotech firms, academic institutions, and global health organizations are further accelerating clinical trials and product innovation. On the commercial front, online pharmacies and direct-to-consumer models are expanding distribution channels, especially for OTC drugs. With healthcare systems increasingly emphasizing early detection, preventive care, and patient-centric models, the gastrointestinal drugs market is well-positioned for diversified and sustainable growth.

GASTROINTESTINAL DRUGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.7% |

|

Segments Covered |

By Product Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Takeda, AbbVie, Pfizer, J&J, Sanofi, Bayer, AstraZeneca, GSK, Bausch Health, Eisai. |

Gastrointestinal Drugs Market Segmentation

Gastrointestinal Drugs Market By Product Type:

• Antacids

• Laxatives

• Antidiarrheals

• Anti-inflammatory Drugs

• Biologics

• Others

Biologics are the dominant product type due to their superior efficacy in treating chronic gastrointestinal conditions such as ulcerative colitis and Crohn’s disease. These therapies offer targeted action with better long-term outcomes compared to conventional treatments. Their role in achieving sustained remission and managing severe cases has driven their rapid adoption globally, especially in developed markets.

Gastrointestinal Drugs Market By Application:

• Ulcerative Colitis

• Crohn’s Disease

• Gastroesophageal Reflux Disease (GERD)

• Irritable Bowel Syndrome (IBS)

• Others

Ulcerative colitis remains the leading application segment within the gastrointestinal drugs market due to the increasing incidence of autoimmune bowel conditions and greater clinical focus on achieving remission. The availability of both biologic and conventional treatment options supports high prescription rates and continuous innovation in this therapeutic area.

Gastrointestinal Drugs Market Regional Segmentation

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

North America is the dominant region in the gastrointestinal drugs market, holding a 41% market share in 2024. The region’s leadership is driven by its well-established healthcare infrastructure, high awareness about gastrointestinal health, and broad access to advanced therapies including biologics. The United States, in particular, has a high prevalence of IBD and GERD, with approximately 3 million people affected by inflammatory bowel diseases. Additionally, favorable reimbursement policies and strong investment in R&D fuel innovation and early adoption of new drug therapies. The presence of major pharmaceutical companies and academic research centers facilitates continuous clinical trials and drug development. Over-the-counter sales are also high due to widespread acceptance of self-medication for mild GI symptoms. Canada contributes significantly through its publicly funded healthcare system that ensures access to essential medications. Regulatory support for biosimilars and expanding telehealth services further reinforce the market’s growth. With lifestyle-related digestive issues rising among the aging and obese population, North America is expected to maintain its market dominance through the forecast period.

COVID-19 Impact Analysis on the Gastrointestinal Drugs Market

The COVID-19 pandemic had a multifaceted impact on the gastrointestinal drugs market. In the early months of the pandemic, disruptions in the pharmaceutical supply chain and reduced hospital visits led to a temporary decline in elective GI procedures and new diagnoses, affecting prescription volumes. Many patients delayed endoscopic examinations, colonoscopies, and specialist consultations, which led to a decrease in new treatment initiations, particularly for chronic GI disorders like ulcerative colitis and Crohn’s disease. However, demand for over-the-counter antacids, laxatives, and digestive aids surged due to heightened health anxiety, dietary disruptions, and increased remote work-related stress. Self-medication and online pharmacy use spiked during lockdowns, creating a shift in buying behavior. Biologics and immunosuppressive GI treatments faced temporary scrutiny due to concerns over immunocompromised states, but ongoing studies clarified that appropriate treatment should continue even during infection risk. Pharmaceutical companies quickly adapted by promoting telemedicine consultations and home delivery of medications. The pandemic also catalyzed innovation in virtual clinical trials and remote patient monitoring for GI conditions. As the healthcare system normalizes and patients return to routine care, delayed diagnoses are expected to convert into increased treatment uptake. Moreover, long COVID-related GI symptoms such as nausea, bloating, and diarrhea have generated new interest in digestive health products. While initial setbacks were observed, the gastrointestinal drugs market has demonstrated resilience and is projected to recover strongly, with renewed emphasis on accessible therapies, digital engagement, and chronic condition management.

Latest Trends/Developments

Several dynamic trends are currently shaping the trajectory of the gastrointestinal drugs market. One major development is the growing focus on gut microbiome research, which is unlocking novel treatment avenues for chronic GI disorders, obesity, and even neurological conditions through gut-brain axis modulation. Probiotics and prebiotics are being explored as complementary therapies alongside conventional drugs. Another trend is the expansion of pediatric and geriatric gastrointestinal drug formulations, as healthcare providers increasingly tailor treatments for vulnerable age groups. Personalized medicine is gaining ground, with genomic data and biomarker-based diagnostics influencing drug selection in inflammatory bowel disease and GI cancers. In the pharmaceutical pipeline, JAK inhibitors, S1P receptor modulators, and integrin blockers are demonstrating promising results in clinical trials. Drug developers are also investing in advanced oral delivery systems that improve bioavailability and reduce dosing frequency. On the commercial front, e-pharmacy platforms and remote diagnostic services are reshaping how gastrointestinal drugs are prescribed, delivered, and monitored. Companies are integrating AI tools for predictive analytics in disease management, enhancing both clinical outcomes and operational efficiency. Moreover, patient assistance programs and biosimilar approvals are making high-cost biologics more accessible in emerging economies. Together, these trends reflect a market that is rapidly embracing scientific innovation, technological integration, and patient-centric care to address a growing global need for effective gastrointestinal therapies.

Key Players:

- Takeda Pharmaceuticals

- AbbVie

- Pfizer

- Johnson & Johnson

- Sanofi

- Bayer

- AstraZeneca

- GlaxoSmithKline

- Bausch Health

- Eisai Co., Ltd.

Chapter 1. Gastrointestinal Drugs Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. GASTROINTESTINAL DRUGS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GASTROINTESTINAL DRUGS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GASTROINTESTINAL DRUGS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. GASTROINTESTINAL DRUGS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GASTROINTESTINAL DRUGS MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Antacids

6.3 Laxatives

6.4 Antidiarrheals

6.5 Anti-inflammatory Drugs

6.6 Biologics

6.7 OtherS

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. GASTROINTESTINAL DRUGS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Ulcerative Colitis

7.3 Crohn’s Disease

7.4 Gastroesophageal Reflux Disease (GERD)

7.5 Irritable Bowel Syndrome (IBS)

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. GASTROINTESTINAL DRUGS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GASTROINTESTINAL DRUGS MARKET – Company Profiles – (Overview, Product Type , Portfolio, Financials, Strategies & Developments)

9.1 Takeda Pharmaceuticals

9.2 AbbVie

9.3 Pfizer

9.4 Johnson & Johnson

9.5 Sanofi

9.6 Bayer

9.7 AstraZeneca

9.8 GlaxoSmithKline

9.9 Bausch Health

9.10 Eisai Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Gastrointestinal Drugs Market was valued at USD 44.80 billion in 2024 and will grow at a CAGR of 5.7% from 2025 to 2030. The market is expected to reach USD 59.11 billion by 2030.

Rising GI disease burden, biologics innovation, and self-medication trends are key drivers.

Product types include antacids, laxatives, biologics; applications include GERD, IBD, IBS.

North America dominates with 41% share due to high disease prevalence and drug access.

Takeda, AbbVie, Pfizer, J&J, Sanofi, Bayer, AstraZeneca, GSK, Bausch Health, Eisai.