Gas Turbine Market Size (2024 – 2030)

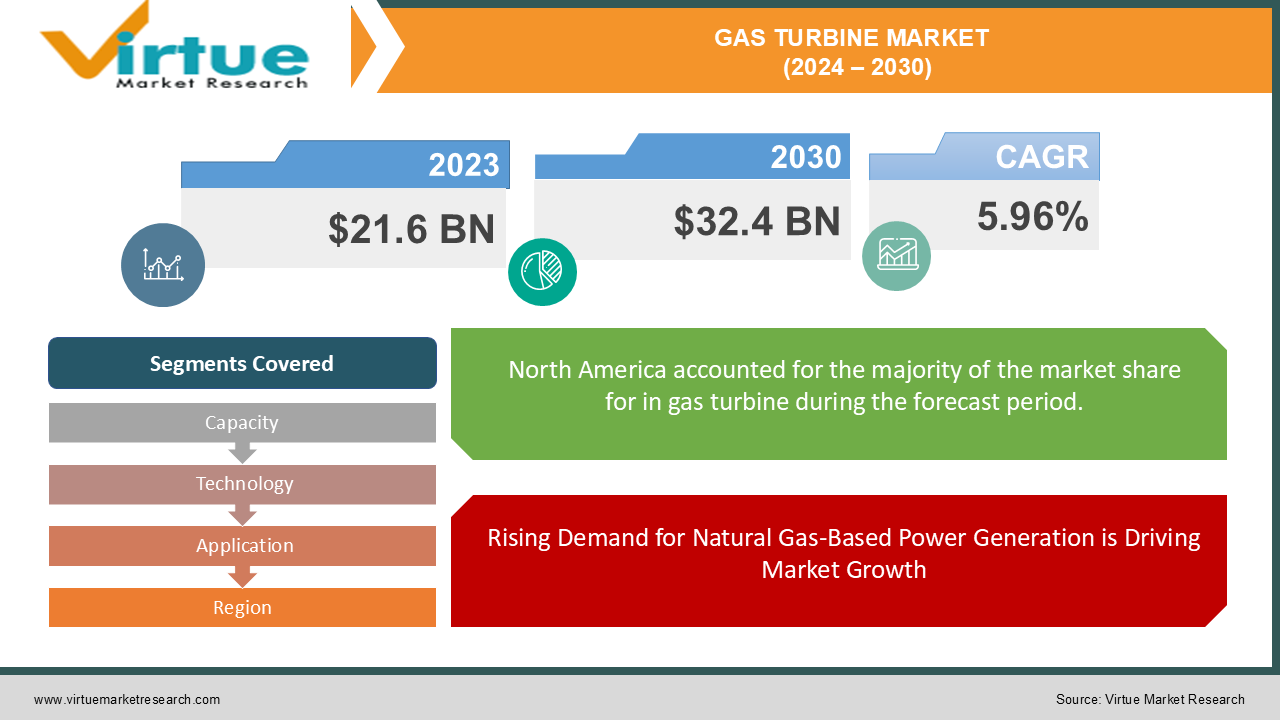

In 2023, the Global Gas Turbine Market was valued at USD 21.6 billion and is projected to reach USD 32.4 billion by 2030, expanding at a compound annual growth rate (CAGR) of 5.96% over the forecast period.

The Global Gas Turbine Market is witnessing robust growth due to the rising demand for power generation, technological advancements in turbine efficiency, and the global shift towards cleaner energy sources. Gas turbines, which use natural gas and other fuels to generate electricity, are widely used in power plants and industries, offering flexibility, higher efficiency, and lower emissions compared to traditional coal-based power generation. The growing need for efficient and environmentally friendly power generation systems, particularly in regions transitioning from coal to gas, is driving the market. In addition, advancements in combined cycle technologies, which allow gas turbines to achieve higher efficiency by utilizing waste heat, are further accelerating market growth. Gas turbines are also increasingly being used in industrial applications such as oil & gas and marine, where their reliability and scalability make them essential.

Key Market Insights:

Combined cycle technology dominates the market, accounting for over 60% of total revenue, due to its higher efficiency and reduced carbon emissions compared to open-cycle gas turbines.

The power generation sector is the largest application category, contributing over 65% of the market demand as governments worldwide focus on reducing greenhouse gas emissions and increasing the use of natural gas for power production.

Large-capacity gas turbines (above 300 MW) are projected to grow at the fastest rate, driven by increasing investments in large-scale power generation projects in Asia-Pacific and the Middle East.

North America and Asia-Pacific are the leading regions, together accounting for over 55% of global revenues, driven by government policies supporting the transition to cleaner energy sources and increasing investments in gas-based power infrastructure.

Hybrid gas turbines are emerging as a key trend, combining gas turbine technology with renewable energy sources like solar and wind, to provide a reliable and flexible power solution.

Global Gas Turbine Market Drivers:

Rising Demand for Natural Gas-Based Power Generation is Driving Market Growth The global shift towards cleaner energy sources, such as natural gas, is significantly driving the gas turbine market. As countries strive to reduce carbon emissions and phase out coal-based power plants, natural gas is being adopted as a bridge fuel due to its lower greenhouse gas emissions compared to coal and oil. Gas turbines are widely used in power plants for electricity generation because of their high efficiency and reliability. The flexibility of gas turbines to ramp up and down quickly in response to fluctuating electricity demand makes them ideal for integrating with intermittent renewable energy sources, such as solar and wind power. This is particularly important as many regions, including Europe, North America, and Asia-Pacific, focus on decarbonizing their energy systems. Additionally, as the global LNG market continues to expand, gas-based power generation is becoming more cost-competitive, further boosting the adoption of gas turbines in power plants.

Advancements in Combined Cycle Gas Turbine Technology is Driving Market Growth Technological advancements in combined cycle gas turbine (CCGT) systems are playing a pivotal role in driving the growth of the gas turbine market. Combined cycle gas turbines are highly efficient because they use the waste heat generated by the gas turbine to produce additional power through a steam turbine, thus significantly improving the overall efficiency of power plants. The efficiency of modern combined cycle gas turbines can exceed 60%, making them one of the most efficient power generation technologies available today. These systems are becoming increasingly popular in countries looking to reduce carbon emissions and optimize their power generation capacity. Moreover, CCGTs are favored for their ability to operate in both baseload and peaking power applications, offering flexibility to utilities. The rising demand for more efficient and flexible power generation solutions, combined with the push for decarbonization, is expected to drive further growth in the combined cycle segment.

Growth in Industrial Applications Such as Oil & Gas and Marine is Driving Market Growth Gas turbines are widely used in industrial applications, particularly in the oil & gas, marine, and aviation sectors. In the oil & gas industry, gas turbines are used for power generation in remote locations, such as offshore oil rigs, where reliable and continuous power supply is critical. Gas turbines are also used in the compression of natural gas for transportation through pipelines. As the global demand for oil and gas continues to grow, particularly in emerging markets, the demand for gas turbines in this sector is expected to rise. In the marine industry, gas turbines are used for propulsion in naval ships and commercial vessels due to their high power-to-weight ratio, reliability, and efficiency. Additionally, the aviation industry relies on gas turbines for jet engines, making them a critical component of the sector. The expanding industrial applications of gas turbines are expected to contribute significantly to market growth over the forecast period.

Global Gas Turbine Market Challenges and Restraints:

Fluctuations in Natural Gas Prices Restricting Market Growth One of the key challenges facing the global gas turbine market is the volatility of natural gas prices. Gas turbines primarily operate on natural gas, and fluctuations in the price of this fuel can impact the profitability of power generation companies and industrial users. In regions where natural gas is not readily available or where the infrastructure to transport gas is lacking, the cost of natural gas can be higher, limiting the adoption of gas turbines. Furthermore, geopolitical tensions, natural disasters, and changes in global energy policies can result in significant fluctuations in natural gas prices, creating uncertainties for market participants. While natural gas is considered a cleaner alternative to coal and oil, its price volatility remains a challenge for gas turbine operators, particularly in regions with less developed energy markets.

Competition from Renewable Energy and Energy Storage Solutions is Restricting Market Growth The global shift towards renewable energy sources, such as wind, solar, and hydropower, poses a challenge to the gas turbine market. As governments around the world implement policies to reduce carbon emissions and increase the share of renewable energy in their power generation mix, gas turbines face competition from these cleaner energy sources. In addition, the rapid development of energy storage technologies, particularly lithium-ion batteries, is enabling renewable energy to become a more reliable and consistent power source. Energy storage systems can store excess energy generated from renewable sources and dispatch it when needed, reducing the reliance on gas turbines for peaking power. While gas turbines offer flexibility and the ability to complement renewable energy, the growing focus on zero-carbon energy solutions may limit the growth potential of the gas turbine market in the long term.

Market Opportunities:

The Global Gas Turbine Market presents several key opportunities, particularly in the areas of large-capacity turbines, hybrid gas turbine systems, and decarbonization strategies. The increasing demand for large-scale power generation projects, particularly in developing regions like Asia-Pacific and the Middle East, offers significant growth potential for large-capacity gas turbines (above 300 MW). These turbines are essential for meeting the power needs of expanding industrial sectors and urbanization in these regions. Additionally, there is a growing opportunity for hybrid gas turbine systems that integrate renewable energy sources, such as solar and wind, with gas turbines to create a reliable and flexible power solution. Hybrid systems are particularly beneficial in regions with abundant renewable resources but limited grid stability. These systems can optimize the use of renewable energy while providing backup power during periods of low renewable energy generation. The increasing focus on decarbonization strategies and the development of hydrogen-fueled gas turbines also present an opportunity for market growth. Hydrogen, as a clean fuel, has the potential to significantly reduce the carbon footprint of gas turbines. Several gas turbine manufacturers are investing in research and development to create turbines capable of running on hydrogen or other low-carbon fuels, offering a pathway to a more sustainable energy future.

GAS TURBINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.96% |

|

Segments Covered |

By Capacity, Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

General Electric Company, Siemens Energy AG, Mitsubishi Power, Ltd., Ansaldo Energia, Kawasaki Heavy Industries, Ltd., Capstone Green Energy Corporation, Rolls-Royce Holdings PLC, MAN Energy Solutions SE, Solar Turbines Incorporated, Harbin Electric Company Limited |

Gas Turbine Market Segmentation: By Capacity

-

1-40 MW

-

40-120 MW

-

120-300 MW

-

Above 300 MW

The above 300 MW segment is expected to witness the fastest growth, driven by increasing investments in large-scale power generation projects in regions such as Asia-Pacific and the Middle East.

Gas Turbine Market Segmentation: By Technology

-

Open Cycle

-

Combined Cycle

Combined cycle technology dominates the market due to its higher efficiency and ability to generate more power using the same amount of fuel compared to open cycle systems.

Gas Turbine Market Segmentation: By Application

-

Power Generation

-

Oil & Gas

-

Marine

-

Aviation

Power generation is the largest application segment, accounting for over 65% of the market demand, driven by the global push for cleaner energy and the increasing use of gas turbines in electricity generation.

Gas Turbine Market Segmentation: Regional Segmentation

-

North America

-

Europe

-

Asia-Pacific

-

Middle East & Africa

-

Latin America

North America is one of the largest markets for gas turbines, driven by government initiatives to reduce carbon emissions and the transition from coal to gas-based power generation. Experiencing growth due to the increasing adoption of combined cycle gas turbines in power plants and the growing emphasis on renewable energy integration. The fastest-growing market, with significant investments in power generation infrastructure in countries such as China, India, and Japan. The region is expected to account for a substantial share of global gas turbine installations over the forecast period. Gaining traction as countries in the region invest in natural gas infrastructure to diversify their energy portfolios

COVID-19 Impact Analysis on the Global Gas Turbine Market:

The COVID-19 pandemic had a mixed impact on the Global Gas Turbine Market. The temporary halt in construction and industrial activities during the early stages of the pandemic led to delays in gas turbine projects. However, the subsequent recovery, particularly in the power generation and oil & gas sectors, has driven demand for gas turbines as governments focus on energy security and reliable power generation. In addition, the pandemic accelerated the global shift towards cleaner energy, boosting the adoption of natural gas and gas turbine technologies. Post-pandemic, the market is expected to grow as countries invest in resilient and flexible energy systems.

Latest Trends/Developments:

The global gas turbine market is experiencing significant growth, driven by increasing energy demand, a shift towards cleaner energy sources, and technological advancements. Key trends include the development of more efficient and flexible gas turbines, the integration of gas turbines with renewable energy sources, and the growing popularity of combined cycle power plants. Advances in materials, coatings, and combustion technology are improving turbine efficiency and reducing emissions. Additionally, the rise of distributed power generation and the need for flexible power plants are driving demand for smaller, modular gas turbines. Overall, the gas turbine market is poised for continued expansion as it plays a crucial role in meeting the world's energy needs while addressing environmental concerns.

Key Players:

-

General Electric Company

-

Siemens Energy AG

-

Mitsubishi Power, Ltd.

-

Ansaldo Energia

-

Kawasaki Heavy Industries, Ltd.

-

Capstone Green Energy Corporation

-

Rolls-Royce Holdings PLC

-

MAN Energy Solutions SE

-

Solar Turbines Incorporated

-

Harbin Electric Company Limited

Chapter 1. Gas Turbine Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Gas Turbine Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Gas Turbine Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Gas Turbine Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Gas Turbine Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Gas Turbine Market – By Capacity

6.1 Introduction/Key Findings

6.2 1-40 MW

6.3 40-120 MW

6.4 120-300 MW

6.5 Above 300 MW

6.6 Y-O-Y Growth trend Analysis By Capacity

6.7 Absolute $ Opportunity Analysis By Capacity, 2024-2030

Chapter 7. Gas Turbine Market – By Technology

7.1 Introduction/Key Findings

7.2 Open Cycle

7.3 Combined Cycle

7.4 Y-O-Y Growth trend Analysis By Technology

7.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Gas Turbine Market – By Application

8.1 Introduction/Key Findings

8.2 Power Generation

8.3 Oil & Gas

8.4 Marine

8.5 Aviation

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Gas Turbine Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Capacity

9.1.3 By Technology

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Capacity

9.2.3 By Technology

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Capacity

9.3.3 By Technology

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Capacity

9.4.3 By Technology

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Capacity

9.5.3 By Technology

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Gas Turbine Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 General Electric Company

10.2 Siemens Energy AG

10.3 Mitsubishi Power, Ltd.

10.4 Ansaldo Energia

10.5 Kawasaki Heavy Industries, Ltd.

10.6 Capstone Green Energy Corporation

10.7 Rolls-Royce Holdings PLC

10.8 MAN Energy Solutions SE

10.9 Solar Turbines Incorporated

10.10 Harbin Electric Company Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Gas Turbine Market was valued at USD 21.6 billion in 2023 and is projected to reach USD 32.4 billion by 2030, growing at a CAGR of 5.96%.

Key drivers include the rising demand for natural gas-based power generation, advancements in combined cycle gas turbine technology, and the growing use of gas turbines in industrial applications.

The market is segmented by capacity (1-40 MW, 40-120 MW, 120-300 MW, above 300 MW), technology (open cycle, combined cycle), and application (power generation, oil & gas, marine, aviation).

Asia-Pacific is the fastest-growing region, driven by significant investments in power generation infrastructure, while North America remains one of the largest markets due to its focus on cleaner energy.

Leading players include General Electric Company, Siemens Energy AG, Mitsubishi Power, Ltd., and Ansaldo Energia.