Gas Separation Membrane Market Size (2024 – 2030)

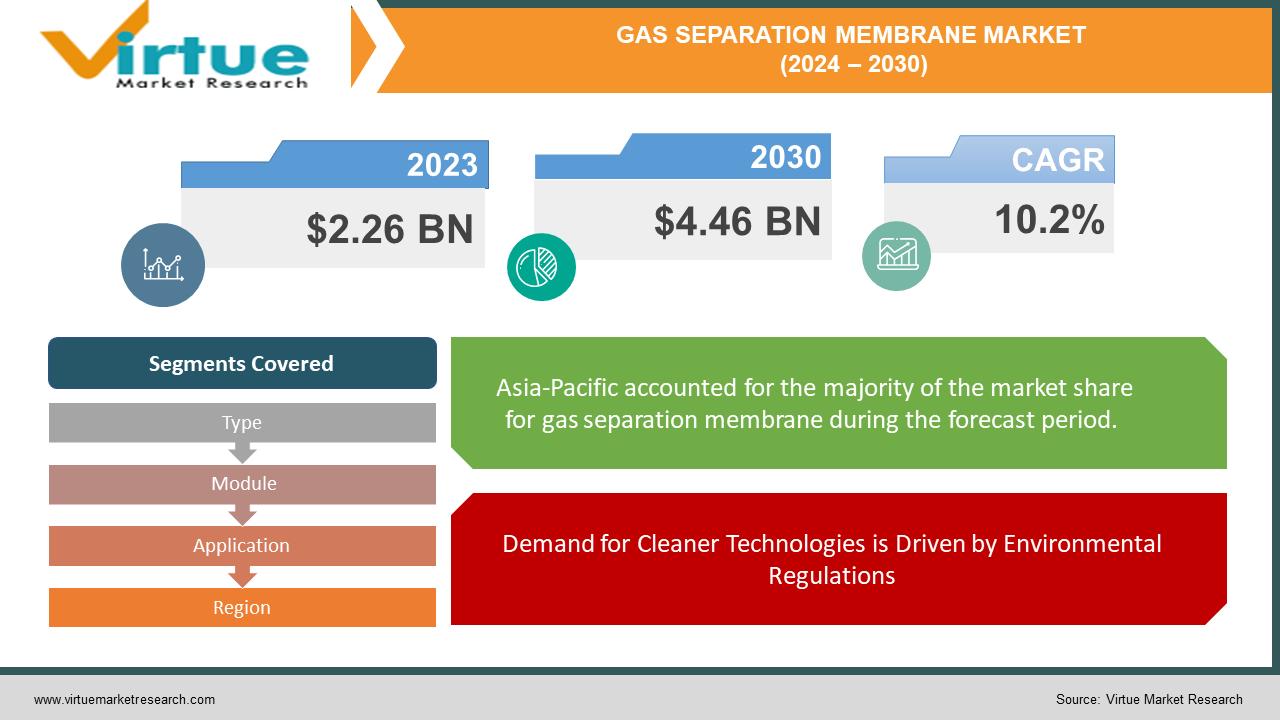

The Global Gas Separation Membrane Market was valued at $2.26 billion in 2023 and is projected to reach a market size of $4.46 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.2%.

Gas separation membranes function similarly to selective filters, facilitating the easier passage of certain gases through. Industries employ these thin layers extensively to extract desired gases from combinations. They do this by using a concept known as selective permeation. Certain gases can dissolve and pass through the membrane material at varying speeds. The pace at which a gas penetrates depends on its solubility in the membrane and its diffusion rate. There are two primary types: inorganic, which is built from stronger ceramic or metal components, and polymeric, which is manufactured from less expensive synthetic polymers. Because they are less expensive and work well with a wider range of gases, polymeric membranes are more widely employed than inorganic ones, which are reserved for harsher situations where polymers would not hold up.

Key Market Insights:

As the industry grows at the fastest rate, carbon dioxide removal is expected to generate USD 1.68 billion in revenue by 2036. This emphasizes how important it is to capture and reduce greenhouse gas emissions. Because of its expanding emphasis on environmental sustainability and increasing industrial sector, the Asia-Pacific region is expected to grow at the quickest rate in the market. In this area, China and India are anticipated to be key players.

Global Gas Separation Membrane Market Drivers:

Demand for Cleaner Technologies is Driven by Environmental Regulations

Numerous strong factors are driving the global market for gas separation membranes. The increasing urgency of addressing environmental issues is one of the main motivators. Cleaner technology adoption is being pushed by government rules that are becoming more stringent on air and greenhouse gas emissions. This shift is made possible by gas separation membranes, which are essential for uses like carbon capture and storage (CCS). By effectively removing CO2 from industrial operations and limiting its emission into the atmosphere, CCS membranes help to mitigate climate change. Furthermore, by generating pure oxygen with less emissions, membranes employed in air separation help to cleaner combustion processes.

Better Performance Is the Result of Technological Advancements

The market is expanding thanks to ongoing developments in gas separation membrane technology. Researchers are always working to create membranes that function better. This comprises membranes with improved selectivity, which guarantees that only the intended gases pass through, and greater permeability, which enables the quicker passage of desirable gases. Furthermore, the variety of applications for gas separation membranes is growing due to the development of new materials with enhanced durability and resilience to severe chemicals. These developments are resulting in more adaptable, economical, and efficient gas separation procedures for a range of sectors.

Global Gas Separation Membrane Market Restraints and Challenges:

Gas separation membranes hold great promise, but a few obstacles prevent the worldwide industry from realizing its full potential. Technical restrictions prevent present membranes from effectively handling very large-volume gas streams, which restricts their use to sectors. Furthermore, there is still difficulty in achieving the optimal balance between flux (the rate of gas flow) and selectivity (the required gas separation) for both large and low-volume streams, making membrane performance optimization for both scenarios challenging. A further consideration is cost. Equipment for gas separation membranes might need a large initial investment, which can be prohibitive for some companies, particularly smaller-scale businesses. Furthermore, in some applications, well-established separation methods like cryogenic distillation or absorption pose a threat to gas separation membranes. The gas combination being treated, and the necessary purity levels are two important considerations when choosing between these approaches. Finally, a region's capacity to produce membranes may be hampered by a lack of high-quality raw materials, which may impede the expansion of that industry. To overcome these limitations, membrane performance must be increased, prices must be decreased, and their range of applications must be expanded via ongoing research and development.

Global Gas Separation Membrane Market Opportunities:

There is a tonne of intriguing potential in the worldwide gas separation membrane market. There is great potential due to the growing need for sustainable energy sources such as hydrogen fuel cells. The large-scale manufacture of clean-burning hydrogen fuel will be made possible by membranes made expressly for the purification of hydrogen. The increasing stringency of environmental rules, especially about CO2 capture, presents a substantial development opportunity for membranes utilized in carbon capture and storage (CCS). These membranes work incredibly well at absorbing CO2 from industrial operations, stopping it from escaping into space and halting global warming. Developments in membrane technology provide yet another attractive option. Researchers are developing membranes with improved selectivity, which allows just required gases to flow through, and greater permeability, which enables quicker gas passage. These developments will result in more effective and economical gas separation methods. This will pave the way for broader membrane applications across a range of sectors. Ultimately, the Asia-Pacific area is anticipated to assume a central role due to its rapidly expanding industrial sector and growing dedication to sustainability. It is projected that China and India will spend heavily on gas separation membrane technology, opening a wide range of prospects for market growth. Through leveraging these prospects and resolving current obstacles, the worldwide gas separation membrane industry is poised for significant expansion in the upcoming years.

GAS SEPARATION MEMBRANE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.2% |

|

Segments Covered |

By Type, Module, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Air Liquide (France), Air Products and Chemicals (US), Evonik (Germany), Generon (US), Honeywell UOP (US), Linde (Germany), Membrane Technology and Research (US), Parker Hannifin (US), UBE Corporation (Japan) |

Global Gas Separation Membrane Market Segmentation: By Type

-

Polymeric Membranes

-

Inorganic Membrane

When it comes to gas separation membranes, polymeric membranes dominate the market by type and account for the biggest portion. Their economic advantage is the main cause of their domination. The cost of producing polymeric membranes is far lower than that of their inorganic equivalents. They are excellent at separating a broad variety of gases, which makes them useful for a few applications. They also have remarkable adaptability. Polymeric membranes simplify the production process since they are simpler to make and may be shaped into a variety of shapes. In the upcoming years, the inorganic membrane market is expected to develop at the quickest rate. They are perfect for demanding applications because of their exceptional resilience, which allows them to endure harsh chemicals and high temperatures. Improvements in material science are also contributing to the creation of inorganic membranes that perform better overall by having increased permeability and selectivity.

Global Gas Separation Membrane Market Segmentation: By Module

-

Spiral Wound Membranes

-

Hollow Fiber Membranes

-

Plate & Frame Membranes

Spiral wound membranes are the biggest section and are in complete control. Their supremacy is a result of several important advantages. First of all, because of their small size, they take up little room and are perfect for retrofitting into already-existing industrial systems. They also provide the required outcomes with superior gas separation and penetration rate efficiency. In conclusion, spiral wound membranes are a reasonably priced alternative in comparison to some other module kinds. However, hollow fiber membranes are expected to increase at the highest rate. Because of their high surface area-to-volume ratio, these membranes can tolerate higher gas flow rates. Moreover, their design reduces pressure loss during gas flow, which uses less energy.

Global Gas Separation Membrane Market Segmentation: By Application

-

Nitrogen Generation & Oxygen Enrichment

-

Hydrogen Recovery

-

Carbon Dioxide Removal

-

Other Applications

The biggest market is led by nitrogen production and oxygen enrichment. The fact that these procedures are widely used in a variety of sectors, including food packaging, steel manufacturing, and wastewater treatment, contributes to their supremacy. This segment's substantial market share is driven by the steady demand for nitrogen and oxygen gas. However, carbon dioxide removal is taking the lead as the industry with the quickest rate of growth. Industry adoption of CO2 capture systems is being driven by strict environmental restrictions and rising concerns over greenhouse gas emissions. Gas separation membranes are used in CCS (carbon capture and storage) applications, and this increase in demand is driving the carbon dioxide removal market's explosive expansion.

Global Gas Separation Membrane Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

With the title of biggest and fastest-growing sector, the Asia-Pacific region is set to take the lead in the worldwide gas separation membrane market. This dominance has several important causes. First off, a large demand for gas separation technologies is being driven by the fast industrialization of nations like China and India, which is affecting a variety of sectors including food processing, steel manufacturing, and chemicals. Second, Asian countries are adopting cleaner technology because of increased environmental concerns. Because they make applications like carbon capture and storage (CCS) and air separation for better combustion processes possible, gas separation membranes are essential to environmental initiatives.

COVID-19 Impact Analysis on the Global Gas Separation Membrane Market:

The effects of the COVID-19 epidemic on the worldwide market for gas separation membranes were multifaceted. A brief drop in demand was brought on by lockdowns and disruptions in supply chains, especially in the oil and gas sector, which significantly depends on gas separation for purifying procedures. Furthermore, lower capital spending in these industries also restrained market expansion. Since gas separation membranes are used in air separation units to create medical-grade oxygen, the spike in demand for the substance during the pandemic's height most likely served as a counterbalancing positive force for the market. Despite the early negative effects, once economic activity returns to normal, the market is anticipated to have recovered and begun to expand again.

Recent Trends and Developments in the Global Gas Separation Membrane Market:

Market activity for gas separation membranes worldwide is booming. Research on new membranes especially intended for hydrogen purification a necessary step for clean-burning hydrogen fuel in fuel cells is being fuelled by a major emphasis on clean energy sources like hydrogen. The tightening of environmental restrictions, especially those about CO2 emissions, presents a substantial development potential for carbon capture and storage (CCS) membranes. These membranes are quite good at trapping industrial CO2 and keeping it from escaping into space. Material progress is yet another important theme. Researchers are creating membranes with increased selectivity, which allows just desired gases to pass, and greater permeability, which allows gases to pass through more quickly, resulting in more effective and economical gas separation. Lastly, it is anticipated that the Asia-Pacific region will play a significant role in driving market growth in the next years due to its expanding industrial sectors and increased dedication to sustainability. It is projected that significant investments in gas separation membrane technology will come from China and India specifically. These patterns demonstrate how crucial gas separation membranes are becoming to accomplishing renewable energy targets, environmental sustainability, and industrial efficiency.

Key Players:

-

Air Liquide (France)

-

Air Products and Chemicals (US)

-

Evonik (Germany)

-

Generon (US)

-

Honeywell UOP (US)

-

Linde (Germany)

-

Membrane Technology and Research (US)

-

Parker Hannifin (US)

-

UBE Corporation (Japan)

Chapter 1. Gas Seperation Membrane Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Gas Seperation Membrane Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Gas Seperation Membrane Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Gas Seperation Membrane MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Gas Seperation Membrane Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Gas Seperation Membrane Market– By Type

6.1 Introduction/Key Findings

6.2 Polymeric Membranes

6.3 Inorganic Membrane

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Gas Seperation Membrane Market– By Module

7.1 Introduction/Key Findings

7.2 Spiral Wound Membranes

7.3 Hollow Fiber Membranes

7.4 Plate & Frame Membranes

7.5 Y-O-Y Growth trend Analysis By Module

7.6 Absolute $ Opportunity Analysis By Module, 2024-2030

Chapter 8. Gas Seperation Membrane Market– By Application

8.1 Introduction/Key Findings

8.2 Nitrogen Generation & Oxygen Enrichment

8.3 Hydrogen Recovery

8.4 Carbon Dioxide Removal

8.5 Other Applications

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Gas Seperation Membrane Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Module

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Module

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Module

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Module

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Module

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Gas Seperation Membrane Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Air Liquide (France)

10.2 Air Products and Chemicals (US)

10.3 Evonik (Germany)

10.4 Generon (US)

10.5 Honeywell UOP (US)

10.6 Linde (Germany)

10.7 Membrane Technology and Research (US)

10.8 Parker Hannifin (US)

10.9 UBE Corporation (Japan)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Gas Separation Membrane Market size is valued at USD 2.26 billion in 2023.

The worldwide Global Gas Separation Membrane Market growth is estimated to be 10.2% from 2024 to 2030.

The Global Gas Separation Membrane Market is segmented By Type (Polymeric Membranes, Inorganic Membranes); By Module (Spiral Wound Membranes, Hollow Fiber Membranes, Plate & Frame Membranes); By Application (Nitrogen Generation & Oxygen Enrichment, Hydrogen Recovery, Carbon Dioxide Removal, Other Applications) and by region.

The market for gas separation membranes is anticipated to gain from a few trends, including the increasing need for clean energy (such as hydrogen purification for fuel cells), tighter environmental laws (such as CO2 capture), and developments in membrane materials with higher selectivity and efficiency.

The gas separation membrane market was affected by the COVID-19 epidemic in a variety of ways. One way to look at the fall was through supply chain disruptions and decreased demand in some industries, such as oil and gas. However, the market was probably helped by a rise in the demand for medical oxygen. All things considered, the market should have bounced back and be expanding again.