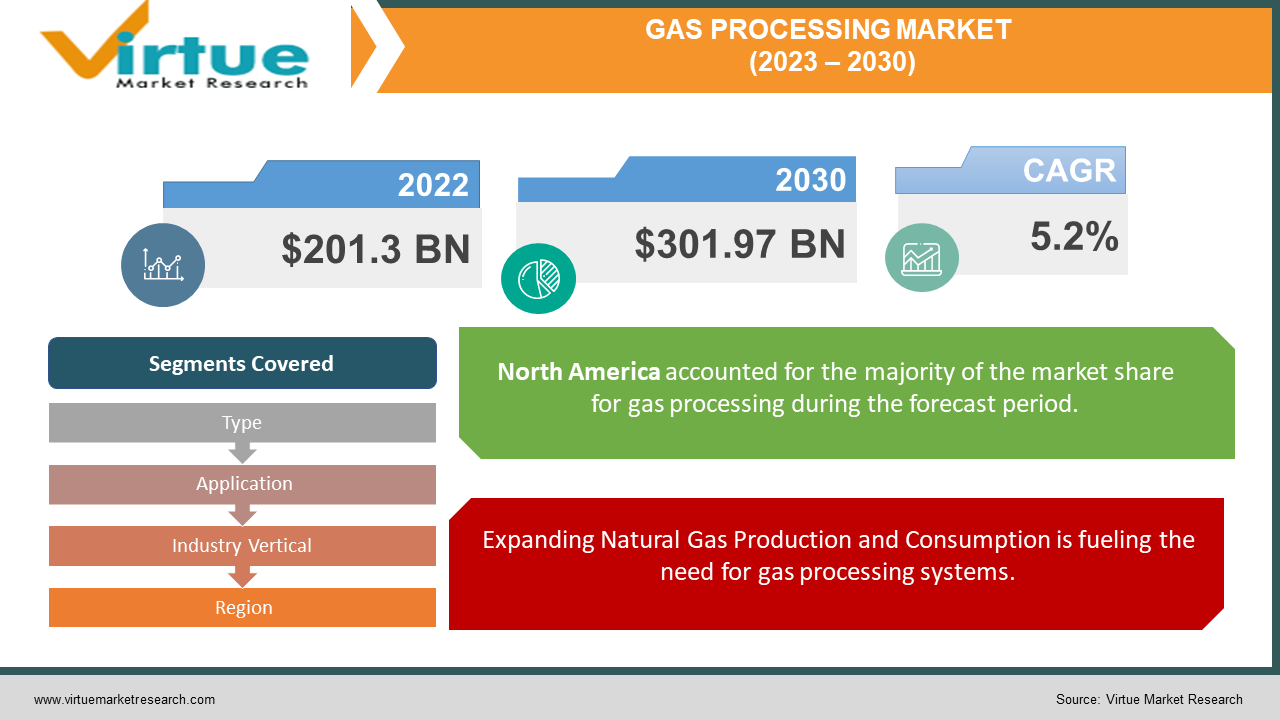

Gas Processing Market Size (2023 – 2030)

The Global Gas Processing Market was valued at USD 201.3 billion and is projected to reach a market size of USD 301.97 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.2%.

The processing of gas extracted from oil and gas wells involves separating the hydrocarbons and eliminating impurities to create products, like dry gas and NGL. The demand for gas is increasing, driving the growth of this industry. Natural gas is essential due to its abundance, versatility, and capacity, for purification. The demand, for gas has been on the rise in the transportation sector. Additionally, emerging nations are experiencing business growth due to the availability of gas for power generation. As a result, the global gas handling industry is expected to grow during the projected period.

To ensure that natural gas meets pipeline quality standards, various industrial processes collectively known as gas processing are employed. These processes remove pollutants, contaminants, and heavier hydrocarbons from gas. Gas processing begins at the wellhead. Is influenced by factors such as geology, depth of deposits, and their orientation. It's not uncommon to find both oil and gas, in the reservoir.

Key Market Insights:

According to the Ministry of Petroleum and Natural Gas Government of India, the production of gas, in 2018 19 (P) amounted to 90.1 Million Metric Standard Cubic Meters per Day (MMSCMD). ONGC and OIL account for 83.3% of this production through the nomination regime while the remaining 16.7% is produced by Private/JV companies through the PSC regime.

The International Energy Agency (IEA) estimates that the global capacity for gas processing will reach 12.2 billion meters per day (bumps) in 2022. It is projected to increase to 15.0 bumped by the year 2030 due to rising demand for gas in countries, like China, India, and the United States.

In 2022 the United States, Russia, Iran, Qatar, and Saudi Arabia stood out as the five countries, with gas processing capacity. Together they contributed to than 60% of the global gas processing capacity. This growth is primarily driven by the escalating demand for gas and the necessity to purify it effectively to meet industry standards.

The global gas processing capacity reached 12.2 billion meters, per day (bcmpd) in 2022.

Gas Processing Market Drivers:

Expanding Natural Gas Production and Consumption is fueling the need for gas processing systems.

The gas processing market is experiencing growth due, to the increasing production and consumption of gas. As the global need for energy continues to rise more people are turning to gas because it has an environmental impact compared to other fossil fuels. This growing demand requires facilities that can purify and separate natural gas making it suitable for various uses like generating electricity, industrial processes, and heating. Additionally, the extraction of gas sources like shale gas has increased the availability of raw natural gas further driving the demand, for gas processing facilities.

Technological Advancements in Gas Processing are boosting the overall market growth.

Technological advancements have an impact, on the growth of the gas processing market. Ongoing innovation and research in gas processing technologies have resulted in improved efficiency, lower operational costs, and better environmental sustainability. Modern gas processing equipment, like high-efficiency separators, advanced desulfurization methods, and sophisticated control systems allow operators to extract higher-quality gas while minimizing emissions. Furthermore, digitalization and data-driven solutions are revolutionizing the industry by providing real-time monitoring and predictive maintenance services that ensure excellence. These technological developments encourage the adoption of gas processing solutions making them more competitive and appealing to industries and utilities.

Gas Processing Market Restraints and Challenges:

Challenge: Environmental Regulations and Sustainability are slowing down market growth opportunities.

A major hurdle, in the gas processing industry is the growing strictness of regulations and the need for sustainability. Governments and international organizations are imposing emissions standards, which means that gas processing facilities have to invest in advanced technologies and practices to reduce their environmental impact. Adhering to these regulations can be costly. This may create difficulties for some companies. Moreover maintaining sustainability throughout the gas processing value chain from extraction to distribution necessitates innovation and investment, in cleaner technologies. Neglecting these challenges can lead to noncompliance with regulations harm a company’s reputation and increase expenses.

Gas Processing Market Opportunity:

The gas processing market presents a prospect, with the shift towards environmentally friendly gases. As the world moves towards energy sources gas processing facilities have the opportunity to adjust and manufacture gases such, as hydrogen, biomethane, and synthetic natural gas. These gases can come from sources, like hydrogen produced through electrolysis or biomethane derived from organic waste. Shifting towards these gases not only supports sustainability objectives but also creates opportunities for new markets and revenue streams. Gas processing companies that invest in these emerging technologies and fuels can establish themselves as frontrunners in the journey, towards a friendly energy future.

GAS PROCESSING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Type, Application, Industry Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PetroChina Co. Ltd., China National Petroleum Corporation, PJSC Gazprom, ConocoPhillips, BP Plc, Royal Dutch Shell Plc,, TotalEnergies SE, Statoil, Exxon Mobil Corp., Saudi Arabian Oil Co., Chevron Corporation |

Gas Processing Market Segmentation: By Type

-

Dry Gas

-

Natural Gas Liquid (NGL)

-

Others

In 2022, based on the type, the Dry Gas segment accounted for the largest revenue share by almost 75% and has led the market. Dry gas refers to a gas that has undergone a purification process to eliminate impurities, including water, carbon dioxide, hydrogen sulfide, and nitrogen. It is the used type of natural gas, for various purposes like power generation, heating, and industrial processes. The market for processing natural gas liquids (NGLs) has shown growth potential with an annual growth rate (CAGR) of over 6% projected during the forecast period from 2023 to 2030. NGLs are a collection of hydrocarbon liquids obtained during the processing of gas. This group includes ethane, propane, butane, and pentane. NGLs play a role as materials in the petrochemical industry for producing an extensive array of products such, as plastics, fertilizers, and synthetic rubber.

Gas Processing Market Segmentation: By Application

-

Acid Gas Removal

-

Dehydration

-

Others

In 2022, based on the application, the Acid Gas Removal segment accounted for the largest revenue share by almost 60% and has led the market.

Acidic gases, like carbon dioxide and hydrogen sulfide, pose a risk to pipelines, equipment, human well-being, and the environment due to their nature. Hence it is crucial to remove these acid gases as part of the gas processing procedure. Among gas processing applications dehydration is experiencing growth with a compound annual growth rate (CAGR) of over 5% from 2023, to 2030. Dehydration primarily focuses on extracting water from gas. Ensuring hydration is crucial, for the effective transportation and storage of natural gas.

Gas Processing Market Segmentation: By Industry Vertical

-

Metallurgy

-

Healthcare

-

Chemical

-

Others

In 2022, based on the Industrial Vertical, the Chemical industry segment accounted for the largest revenue share by almost 50% and has led the market. The chemical industry heavily relies on gas as a material to manufacture a wide range of products, including plastics, fertilizers, and synthetic rubber. Consequently, gas processing plays a role, in ensuring the chemical industry produces top-notch goods.

Among industries, the metallurgy sector has shown growth in gas processing with an impressive compound annual growth rate (CAGR) of over 6% projected during the forecast period from 2023 to 2030. The metallurgy industry utilizes gas to produce steel and other metals. Therefore gas processing holds significance, for this industry by enhancing product quality and minimizing its impact.

Gas Processing Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, the North American region dominated the Global Gas Processing Market with a revenue of 30%. Asia Pacific holds the market share, in gas processing accounting for over 25% of the regional market. This region is experiencing growth and urbanization resulting in an increased demand for natural gas and gas processing. Forecasts indicate that the Asia Pacific gas processing market will grow at a compound growth rate (CAGR) of more than 6%. Other regions, such, as Europe, South America the Middle East, and Africa are also expected to see growth in their gas processing markets during the forecast period.

COVID-19 Impact Analysis on the Global Gas Processing Market:

The COVID-19 pandemic is a health crisis, comparable, to the Spanish flu that has generated widespread concerns. China took the lead by implementing lockdown measures, which had far-reaching effects, on the economy, environment, and energy supply. One crucial aspect of the energy system that was impacted was the natural gas pipeline network.

The purpose of this infrastructure is to meet the long-term demands of the market. To assess the reliability of gas supply researchers utilized an evaluation index. It is important to note that both supply and demand strategies play a role, in determining this reliability. In response to disruptions in the supply chain, such as delays and reduced energy demand the gas processing industry has quickly adjusted by implementing operations and prioritizing sustainability and efficiency. These adaptations have been crucial, in overcoming the challenges posed by the pandemic.

Latest Trends/ Developments:

The gas processing industry is going through some changes that revolve around three trends. Firstly there is a focus, on exploring Carbon Capture and Storage (CCS) technologies as a way to reduce greenhouse gas emissions and align with sustainability goals. Secondly, there is an increasing interest in incorporating gases like hydrogen and biomethane into gas processing, which contributes to the shift towards energy sources. Lastly, digitalization is playing a role, in improving efficiency and decision-making within gas processing operations making processes more streamlined and boosting overall productivity. These trends collectively shape the future of the gas processing market by emphasizing responsibility, sustainability, and technological advancements.

BP is venturing into the wind sector following its acquisition of U.S. Assets. This move marks BP's step into the wind industry and is a vital part of their new strategy to expedite the shift away, from fossil fuels and accomplish their net zero emissions goals.

Key Players:

-

PetroChina Co. Ltd.

-

China National Petroleum Corporation

-

PJSC Gazprom

-

ConocoPhillips

-

BP Plc

-

Royal Dutch Shell Plc

-

TotalEnergies SE

-

Statoil

-

Exxon Mobil Corp.

-

Saudi Arabian Oil Co.

-

Chevron Corporation

-

On April 1 2020 Polskio Gornictwa Naftowe I Gazownictwo (PGNIG) acquired ownership of the ING roloading station located in Klaipeda, Lithuania. This move enabled the business to reach out to Baltic Sea markets and streamline the process of delivering LNG to customers in Poland.

-

ExxonMobil has completed the acquisition of InterOil Corporation. The transaction was authorized by the Supreme Court of Yukon, in Canada. As part of the agreement, ExxonMobil bought all the existing shares of InterOil. This arrangement is expected to generate benefits, for both ExxonMobil shareholders and the people of Papua New Guinea.

-

BASF SE has come up with an approach to extract natural gas components. This technique involves treating the gas for transportation through pipelines while simultaneously recovering helium, liquid hydrocarbons, and purified CO2 in one go.

Chapter 1. Gas Processing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Gas Processing Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Gas Processing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Gas Processing Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Gas Processing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Gas Processing Market – By Application

6.1 Introduction/Key Findings

6.2 Acid Gas Removal

6.3 Dehydration

6.4 Others

6.5 Y-O-Y Growth trend Analysis By Application

6.6 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 7. Gas Processing Market – By Type

7.1 Introduction/Key Findings

7.2 Dry Gas

7.3 Natural Gas Liquid (NGL)

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Type

7.6 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 8. Gas Processing Market – By Industry Vertical

8.1 Introduction/Key Findings

8.2 Metallurgy

8.3 Healthcare

8.4 Chemical

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Industry Vertical

8.7 Absolute $ Opportunity Analysis By Industry Vertical, 2023-2030

Chapter 9. Gas Processing Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Type

9.1.4 By Industry Vertical

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Type

9.2.4 By Industry Vertical

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Type

9.3.4 By Industry Vertical

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Type

9.4.4 By Industry Vertical

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Type

9.5.4 By Industry Vertical

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Gas Processing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 PetroChina Co. Ltd.,

10.2 China National Petroleum Corporation,

10.3 PJSC Gazprom,

10.4 ConocoPhillips,

10.5 BP Plc,

10.6 Royal Dutch Shell Plc,,

10.7 TotalEnergies SE,

10.8 Statoil,

10.9 Exxon Mobil Corp.,

10.10 Saudi Arabian Oil Co.,

10.11 Chevron Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Gas Processing Market was valued at USD 201.3 billion and is projected to reach a market size of USD 301.97 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.2%.

Technological Advancements in Gas Processing, Expanding Natural Gas Production, and Consumption are the Global Gas Processing Market drivers.

Based on type, the Global Gas Processing Market is segmented into Dry Gas, Natural Gas Liquid (NGL), and Others.

North America is the most dominant region for the Global Gas Processing Market.

PetroChina Co. Ltd., China National Petroleum Corporation, PJSC Gazprom, ConocoPhillips, and BP Plc are the key players operating in the Global Gas Processing Market.