Gas Market Size (2025-2030)

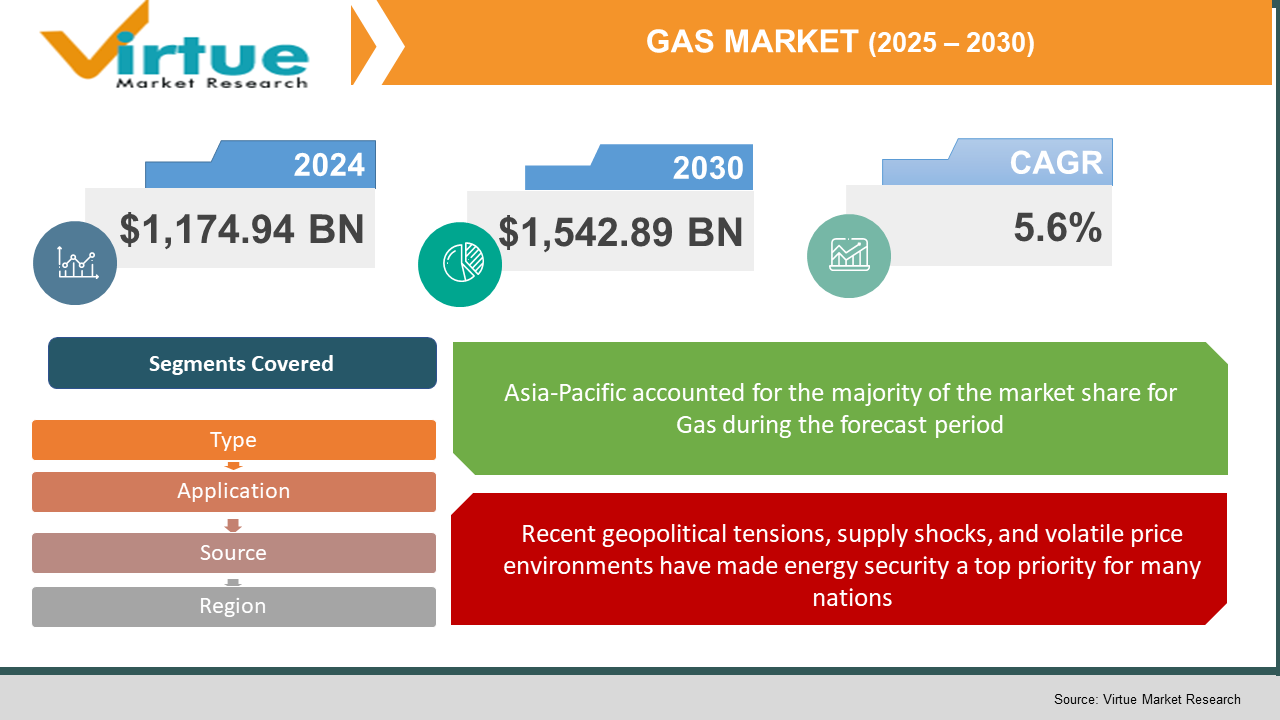

The Gas Market was valued at USD 1,174.94 billion in 2024 and is projected to reach a market size of USD 1,542.89 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.6%.

The global gas market is really the crux of the energy transition--satisfying the world's growing energy needs while still paving the way for decarbonization. Indeed, as countries look for cleaner and more reliable energy resources, natural gas has emerged as an essential bridge fuel-beyond the power to industries, households, and renewable energy integration. LNG is witnessing a rapid growth in exports, while Asia has a heightened demand with evolving supply dynamics to grant a much more vigorous custom-shaping world into something much more crucial than ever before.

Key Market Insights:

Asia contributes nearly 60% of the incremental gas demand growth. Countries like China, India, and emerging Southeast Asian nations are heavily investing in gas infrastructure to meet energy security needs. This trend underpins long-term import agreements and major LNG terminal expansions.

Over 50% of new power generation capacity globally uses natural gas. Gas-fired plants are favored for their quick ramp-up abilities and lower emissions compared to coal. This supports renewable integration by providing stable backup power.

Gas Market Drivers:

As the world faces increasing pressure to reduce greenhouse gas emissions, natural gas has emerged as a critical transition fuel in the global energy mix.

With the increasing pressure on the world to reduce greenhouse gases, natural gas has become crucial in the transition stage in the global energy mix. Governments and industries have turned their backs on coal and oil, moving toward the less carbon-intensive gas, which emits about 50 percent less CO₂ than coal in power generation. Gas-fired power plants also have the flexibility to accommodate fluctuating renewable resources like wind and solar. They quickly ramp up their generation to stabilize grids. In Asia, countries like China and India are focusing on the development of gas infrastructure to respond not only to air pollution but also to climate commitments under the Paris Agreement. In Europe, it has also encouraged an increase in the uptake of natural gas, with a phase-out of coal and a shift away from the use of nuclear energy. The heating of gases has been supplemented by the industrial sectors making the shift to gas, including chemicals, steel, and manufacturing, in line with strict emission standards and improved operational efficiency. Consumer awareness and policy incentives to support clean-fuel use have also been other causes of the increasing demand by consumers for gaseous fuels. As these renewable capacities come on stream, gas would close in on them as a "bridging fuel" towards net-zero targets, and this will thus be reinforced by investment in LNG terminals, pipelines, and storage facilities worldwide. Altogether, gas would be strong in decarbonization demands and still headed toward full electrification and renewables.

Recent geopolitical tensions, supply shocks, and volatile price environments have made energy security a top priority for many nations.

In an increasingly contested geopolitical environment, marked by supply shocks and volatile prices, energy security has become a priority among an ever-growing number of nations. The recent Russia–Ukraine war has placed a glaring spotlight on the reliability of limited sources of gas supply, compelling European countries to diversify their imports with increasing urgency. Thus, Liquefied Natural Gas, or LNG, has become an attractive choice, giving nations the opportunity to access global markets independent of the constraints of pipeline supplies. Countries such as Japan and South Korea, which have small stocks of domestic energy resources, have relied on LNG imports for the reasonably assured availability of energy for decades. Similarly, Southeast Asian and South Asian countries are investing heavily in new LNG regasification terminals and floating storage units to shore up their defenses against potential supply risks. This diversification has also embraced the Middle East and Africa, where gas-rich countries are expanding export capacities to capture new markets. Meanwhile, the U.S. and Australia have consolidated their positions as leading LNG exporters to the benefit of global supply security.

Gas Market Restraints and Challenges:

Despite strong global demand, the expansion of the gas market faces significant hurdles due to infrastructure limitations and high upfront investment requirements.

Factors limiting growth in gas markets, mainly because of infrastructure bottlenecks and heavy investment at the outset are proving crippling in the global market. Constructing LNG terminals, regasification plants, pipelines, and storage facilities can run into billions of dollars and typically experience lengthy lead times, qualified by tortuous regulatory processes and local public opposition. Especially in developing countries, obtaining capital for large gas projects is a major challenge without solid government support or backing from international investments. In the case of mature markets, existing pipeline networks often need costly upgrading to ensure safety and reliability, stretching budgets further. On top of this, delays in getting a project executed arising from disruptions in the supply chain, shortages of labor, or environmental permitting could postpone gas availability and raise the risk profile of the complete project. This capital-intensive nature of gas infrastructure gives comfort to investors about other energy projects, whose competition is stiffening by the minute with the declining cost of renewable energy and the rising focus on green hydrogen. In summation, these effects prohibit several regions from ramping up gas supply in time enough to meet energy security challenges, greatly restricting market growth.

Gas Market Opportunities:

The gas market is highly opportunistic and buoyed by technological innovations and ever-smaller demand on a global scale, especially in emerging economies. These technologies assist in pitching open markets that are inaccessible or remote, thereby reducing the burden on countries with limited pipeline networks to accept natural gas. On the other hand, fast urbanization and industrialization in Asia and Africa create huge opportunities for new gas applications in power generation, transport, and manufacturing. The introduction of these digital tools and advanced monitoring systems thus helps improve operational efficiency, safety, and environmental performance along the value chain. The production of blue and green hydrogen by natural gas also lays out a very viable option for the future, as this way, gas producers will be able to embrace the low-carbon energy transition while generating other revenue streams. Last but not least, partnerships between exporters and importers in securing long-term LNG supply agreements create new momentum for investment and with it market stability.

GAS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Type, Application, source, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Royal Dutch Shell, ExxonMobil, BP, Chevron, TotalEnergies, Equinor, Gazprom, QatarEnergy, PetroChina, and Saudi Aramco |

Gas Market Segmentation:

Gas Market Segmentation: By Type

- Natural Gas

- Liquefied Natural Gas

- Compressed Natural Gas

Natural gas is the backbone of global supplies, owing to its versatility in power generation and industrial heating on account of its high calorific value and lower emissions compared with coal and oil. Gas provides the foundation of supply globally, as on-demand measured demand continues to increase, and even public acceptance is gradually swinging towards more gas use. LNG has proven to be a game changer because gas can now be transported over long distances to markets that have few or no pipeline infrastructure, for example, Japan, South Korea, and parts of Europe. Improvements in liquefaction and regasification technologies have made LNG far cheaper, resulting in an increase in the number of new export and import terminals around the world as of now. Meanwhile, CNG is getting more recognition as a cleaner fuel for vehicles, particularly in urban public transport systems and fleet operations, in emerging economies like India and Brazil. CNG is expected to grow with the continuing move by countries towards lower emissions in transport. The regulatory, pricing, and infrastructure barriers that each gas type has add to the development of regional and national strategies as a whole. Together, these types provide multi-directional flexibility to fulfill various energy requirements, while supporting energy security and advancing decarbonization goals. With the combined growth that such types reflect, these show the global movement towards balancing accessibility, affordability, and environmental impacts in energy systems.

Gas Market Segmentation: By Application

- Power Generation

- Industrial

- Residential & Commercial

- Transportation

The gas market, owing to its economy-wide use, is segmented into Power Generation, Industrial, Residential & Commercial, and Transportation. Currently, the largest segment is Power Generation, where gas-fired plants stabilize electric grids by balancing intermittent sources of renewable energy owing to their fast-starting capability and lower emissions. In the industrial sector, gas is consumed as both a feedstock and a fuel; feedstocks are critical for chemical processing, fertilizer production, glass manufacture, and metal reduction, thus enabling industries to operate efficiently within strict emission norms. In the residential and commercial sectors, gas is used for space and water heating and cooking, which is often the more economical and reliable alternative to electric or oil-based systems. In colder climate regions, this segment represents a huge portion of seasonal peaks and demand. Transportation, hence gaining traction on its use in buses, trucks, and fleet vehicles, is natural gas to reduce urban air pollution and comply with growing emission laws; governments further support these investments with subsidies, incentives, and better refueling infrastructure. The diversity in applications showcases gas's versatility, establishing it as an important part of both classical and emerging energy systems. This segmentation emphasizes market resilience and significantly assists in economic growth and the transition to a clean energy system.

Gas Market Segmentation: By Source

- Conventional Gas

- Unconventional Gas

The gas market segmentation by source divides supply into Conventional Gas and Unconventional Gas, reflecting advances in extraction technologies and changing resource strategies. Conventional gas, which is produced from traditional reservoirs with standard drilling techniques, remains dominant in the world market, especially in the Middle East and Russia. Such resources are often less difficult and less expensive to develop and continue to provide a steady supply to established markets. On the other hand, unconventional gas, namely, shale gas, tight gas, and coalbed methane, has altered the production dynamics primarily in North America. The U.S. shale boom greatly enhanced domestic supply, moving the U.S. to a major LNG exporter and away from import dependence. However, the unconventional gas development raises certain environmental and regulatory concerns relating to hydraulic fracturing, horizontal drilling, water use, seismic activity, and emissions of methane. Nonetheless, the unconventional gas resource base is immense and very much an opportunity in terms of energy security and price stability. A number of states assess their resources in order to enhance supply diversification and diminish their import dependence. This segmentation illustrates broader industry changes, which now depend on gas's critical role in any future global energy strategy, on new technologies to unlock reserves that have hitherto been regarded as uneconomical.

Gas Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The global gas market is spearheaded by the Asia-Pacific region in part due to fast industrialization and subsequent energy demand from nations such as China, India, and other parts of Southeast Asia. North America comes next, fueled by its capacity in shale gas production and high liquefied natural gas (LNG) exports from the US. The European market boasts a strong recovery as countries diversify from conventional pipeline supplies to reliance on LNG for energy security and achieve climate-related goals. The Middle East and Africa are the main gas exporting regions, with prominent figures such as Qatar and Algeria, and rising domestic consumption in the MENA region. South America shows a mere but progressive growth, led by Brazil and Argentina, markets that are receiving new investments in gas-related infrastructure and gas-fired generation. Overall, each region is characterized by a different mix of strengths in production, import strategies, and demand shifts driven by policy, illustrating the global and interconnected nature of the gas industry.

COVID-19 Impact Analysis on the Gas Market:

The pandemic of COVID-19 had an enormous and immediate effect on the world gas market through the disruption of demand, supply chains, and investment plans in all regions. Lockdowns and widespread economic slowdowns led to an unprecedented slide in industrial activity and power consumption, with gas demand falling globally by some 3% in 2020; this was one of the largest declines in history. LNG shipments were delayed or redirected as major importing countries, especially in Asia and Europe, reduced purchases in response to weakening consumption and storage constraints. On the supply side, the cutbacks in output due to low prices, together with the delay of exploration projects and reduction in capital spending, impacted gas developments on both the conventional side and in the unconventional sector. Yet the concurrent price volatility saw spot LNG prices tumble to record lows and reflected the weakness of markets that were highly dependent on the short-term contract basis. Thus, overall, while COVID-19 did bring temporary disruption to market momentum, it also set future strategies upon changing the agility and adaptive nature of the gas sector toward global shocks.

Latest Trends/ Developments:

Through the modification of the trade patterns, the technology aspect is changing continuously, and policy priorities change, leaving a new global gas market in a robust change. Liquefied natural gas not only is rapidly growing, but new LNG exporters like Mexico and floating LNGs offer clean energy to pipeline-less areas. Diversifying contracts in the direction given by new important players are Chinese and Indian investments in regasification capacity to secure long-term supply, reflecting major market developments within import countries. Signs of war and supply disruptions further heightened focus on energy security, increased flexibility in storage rules, and diversification of contractual strategies of Europe and Asia. On the technology front, digitalization through AI, IoT, and blockchain goes beyond streamlining trading to enhancing transparency and unlocking new carbon-neutral trading models. Elements such as hydrogen blending, CCUS, and e-methane point at future-proofing gas infrastructure from a decarbonization perspective. Overall, the market opens out into a mass of diversification, strengthened along the way to become dynamic and resilient, while stronger opportunities for innovation and strategic growth exist worldwide.

Key Players:

- Royal Dutch Shell plc

- ExxonMobil Corporation

- BP plc

- Chevron Corporation

- TotalEnergies SE

- Equinor ASA

- Gazprom

- QatarEnergy

- PetroChina Company Limited

- Saudi Aramco

- ConocoPhillips

- Petronas

- Eni S.p.A.

- Cheniere Energy, Inc.

- Woodside Energy

Chapter 1. Gas Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Gas Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Gas Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging TYPE Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Gas Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Gas Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Gas Market – By Type

6.1 Introduction/Key Findings

6.2 Natural Gas

6.3 Liquefied Natural Gas

6.4 Compressed Natural Gas

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. Gas Market – By Source

7.1 Introduction/Key Findings

7.2 Conventional Gas

7.3 Unconventional Gas

7.4 Y-O-Y Growth trend Analysis By Source

7.5 Absolute $ Opportunity Analysis By Source , 2025-2030

Chapter 8. Gas Market – By Application

8.1 Introduction/Key Findings

8.2 Power Generation

8.3 Industrial

8.4 Residential & Commercial

8.5 Transportation

8.6 Y-O-Y Growth trend Analysis Application

8.7 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 9. Gas Market , BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Type

9.1.3. By Application

9.1.4. By Source

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Type

9.2.3. By Application

9.2.4. By Source

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Type

9.3.3. By Application

9.3.4. By Source

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Application

9.4.3. By Source

9.4.4. By Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Application

9.5.3. By Type

9.5.4. By Source

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Gas Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Royal Dutch Shell plc

10.2 ExxonMobil Corporation

10.3 BP plc

10.4 Chevron Corporation

10.5 TotalEnergies SE

10.6 Equinor ASA

10.7 Gazprom

10.8 QatarEnergy

10.9 PetroChina Company Limited

10.10 Saudi Aramco

10.11 ConocoPhillips

10.12 Petronas

10.13 Eni S.p.A.

10.14 Cheniere Energy, Inc.

10.15 Woodside Energy

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Gas Market was valued at USD 1,174.94 billion in 2024 and is projected to reach a market size of USD 1,542.89 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.6%.

Key drivers of the gas market include rising global demand for cleaner energy and increasing focus on energy security through diversified supply.

The gas market by type is segmented into Natural Gas, Liquefied Natural Gas (LNG), and Compressed Natural Gas (CNG). Each type serves different needs across power generation, industrial use, and transportation.

Asia-Pacific is the most dominant region for the Gas Market.

Royal Dutch Shell, ExxonMobil, BP, Chevron, TotalEnergies, Equinor, Gazprom, QatarEnergy, PetroChina, and Saudi Aramco are the key players in the Gas Market.