Gas Generator Market Size (2024 – 2030)

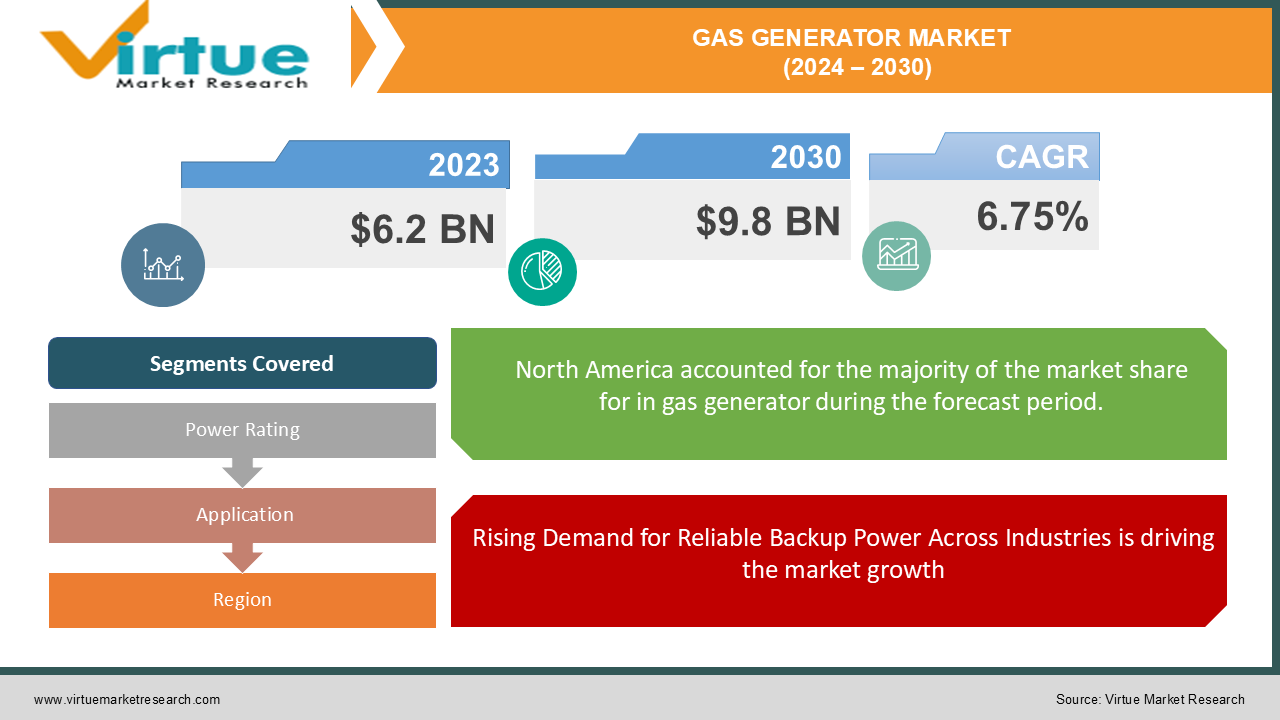

In 2023, the global gas generator market was valued at USD 6.2 billion and is expected to reach USD 9.8 billion by 2030, growing at a CAGR of 6.75% during the forecast period.

The market is largely driven by factors such as increasing power outages in several regions, rapid urbanization, industrialization, and the rising focus on reducing carbon emissions. Moreover, advancements in gas generator technology, including improvements in fuel efficiency and integration with renewable energy systems, are expected to drive market growth. The demand for gas generators is increasing in both developing and developed countries. In developing regions, the need for reliable power supply in areas with unstable electricity grids is fueling demand, while in developed economies, gas generators are being adopted as part of integrated energy management systems, including renewable energy storage solutions.

Key Market Insights:

Industrial applications hold the largest share of the global gas generator market, driven by the increasing need for backup power in sectors such as manufacturing, oil and gas, and mining.

The 100–350 kW power rating segment is expected to grow significantly, supported by its use in both commercial and industrial sectors for medium-scale power requirements.

North America dominates the gas generator market, thanks to its developed infrastructure, frequent power outages due to natural disasters, and strong demand from commercial and industrial users. However, Asia-Pacific is expected to witness the fastest growth due to rapid industrialization and urbanization in countries like China and India.

Stringent regulations aimed at reducing emissions are encouraging the adoption of natural gas generators, which offer lower emissions compared to diesel generators, thereby contributing to their growing market share.

Innovations in hybrid energy systems, where gas generators are used in conjunction with renewable energy sources like solar and wind, are providing new growth avenues in the market.

Global Gas Generator Market Drivers:

Rising Demand for Reliable Backup Power Across Industries is driving the market growth The industrial sector’s reliance on continuous and stable power supply is a major factor driving the demand for gas generators. Manufacturing industries, oil and gas facilities, mining operations, and data centers require uninterrupted power to avoid costly downtimes and operational disruptions. Gas generators provide a reliable backup power solution, ensuring operational continuity during power outages or grid instability. This is particularly relevant in developing countries where power infrastructure may not be as reliable. In regions like Africa and parts of Asia, industries are increasingly adopting gas generators to mitigate the impact of frequent power cuts, boosting the global market.

Increasing Adoption of Cleaner and Greener Energy Solutions is driving the market growth As environmental regulations tighten across the globe, industries and businesses are looking for cleaner alternatives to traditional diesel generators. Gas generators offer a more environmentally friendly option, producing lower carbon emissions, nitrogen oxides (NOx), and particulate matter compared to their diesel counterparts. Natural gas, in particular, is being increasingly favored due to its lower greenhouse gas emissions. The shift towards gas-powered generators is being further driven by government incentives and subsidies for cleaner energy adoption, which is contributing to the growth of the gas generator market.

Urbanization and Infrastructure Development in Emerging Markets is driving the market growth Rapid urbanization, especially in developing countries, is creating an increasing demand for reliable and efficient power generation solutions. Urban areas require a consistent power supply to support infrastructure development, residential complexes, commercial establishments, and public services. In regions with unreliable grid power, gas generators are playing a crucial role in providing backup power for construction projects, hospitals, hotels, and other essential services. Countries in the Asia-Pacific region, such as China and India, are seeing significant growth in gas generator adoption, driven by large-scale infrastructure development and industrialization.

Global Gas Generator Market Challenges and Restraints:

Volatility in Natural Gas Prices is restricting the market growth One of the key challenges facing the gas generator market is the volatility in natural gas prices. Since gas generators rely on natural gas or other gas fuels like LPG and biogas, fluctuations in fuel prices can impact operational costs for end-users. Factors such as geopolitical tensions, supply disruptions, and market dynamics can cause significant variations in natural gas prices, affecting the cost competitiveness of gas generators compared to other power generation alternatives like diesel generators. While natural gas prices have been relatively stable in recent years, any future spikes in price could slow down the adoption of gas generators, particularly in price-sensitive markets.

High Initial Costs and Maintenance Requirements is restricting the market growth The high initial cost of gas generators, particularly larger units used for industrial applications, is another challenge for market growth. Gas generators typically require a higher upfront investment compared to diesel generators, which can be a barrier for small and medium-sized businesses with limited budgets. Additionally, gas generators have specific maintenance needs, including regular inspection of gas lines, filters, and exhaust systems to ensure safe and efficient operation. The need for skilled technicians to handle maintenance and the potential for higher maintenance costs can deter some businesses from adopting gas generators.

Competition from Alternative Power Solutions is restricting the market growth The growing adoption of renewable energy solutions, particularly solar and wind power, is posing competition to the gas generator market. Many industries and businesses are investing in renewable energy systems to reduce their dependence on traditional power generation methods. While gas generators are increasingly being used in hybrid systems with renewable energy sources, the standalone adoption of renewable energy is gaining traction due to its long-term cost benefits and environmental advantages. The declining costs of solar panels, battery storage systems, and other renewable energy technologies could pose a challenge to the growth of the gas generator market, especially in regions with favorable climates for solar or wind power generation.

Market Opportunities:

The Global Gas Generator Market presents several growth opportunities, especially in areas such as distributed energy generation, off-grid power solutions, and technological advancements in hybrid systems. As the global energy landscape shifts towards decentralized power generation, there is growing interest in distributed energy solutions. Gas generators are well-suited for distributed generation, particularly in remote areas and off-grid locations where grid infrastructure is limited or unreliable. They can be integrated into microgrid systems, providing a stable and consistent source of power. The increasing adoption of distributed energy generation, particularly in emerging economies, presents a significant growth opportunity for gas generator manufacturers. The demand for off-grid power solutions is rising in regions with limited access to grid electricity, such as rural areas in Africa, Southeast Asia, and parts of Latin America. Gas generators provide a viable solution for off-grid power generation, particularly in areas where renewable energy sources like solar or wind are not feasible due to climatic conditions or lack of infrastructure. Off-grid gas generator installations for residential, agricultural, and industrial applications represent a key growth area in the market. The growing trend towards hybrid energy systems, where gas generators are used in conjunction with renewable energy sources like solar and wind, offers a new avenue for market growth. Hybrid systems provide a reliable backup power solution during periods of low renewable energy production, such as cloudy days or low wind conditions. The integration of gas generators with energy storage systems is also gaining traction, offering businesses and industries greater flexibility in managing their energy needs. Technological advancements in energy storage and control systems are expected to drive the adoption of gas generators in hybrid energy solutions.

GAS GENERATOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.75% |

|

Segments Covered |

By Power Rating, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cummins Inc., Caterpillar Inc., Generac Holdings Inc., Kohler Co., Mitsubishi Heavy Industries Ltd., General Electric, MTU Onsite Energy, Siemens AG, Doosan Corporation, Himoinsa |

Gas Generator Market Segmentation: By Power Rating

-

Below 100 kW

-

100–350 kW

-

Above 350 kW

The 100–350 kW segment is expected to witness the highest growth during the forecast period, driven by the increasing demand for medium-scale power generation solutions in commercial and industrial sectors. Generators below 100 kW are commonly used for residential and small commercial applications, while generators above 350 kW are primarily used for large-scale industrial applications and backup power for large commercial facilities.

Gas Generator Market Segmentation: By Application

-

Industrial

-

Residential

-

Commercial

The industrial segment dominates the market, accounting for the largest share due to the widespread use of gas generators in manufacturing, oil and gas, and mining industries. The commercial segment is also growing rapidly, with gas generators being used in hospitals, data centers, hotels, and retail establishments for backup power. The residential segment is seeing steady growth, particularly in regions prone to frequent power outages.

Gas Generator Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America is the largest market for gas generators, driven by frequent power outages caused by extreme weather events such as hurricanes, storms, and wildfires. Europe is a significant market for gas generators, particularly in industrial sectors such as manufacturing and oil and gas. The Asia-Pacific region is expected to witness the highest growth during the forecast period, driven by rapid urbanization, industrialization, and infrastructure development in countries like China, India, and Southeast Asian nations. Latin America is seeing steady growth in the gas generator market, particularly in industrial sectors such as mining, oil and gas, and agriculture.

COVID-19 Impact Analysis on the Global Gas Generator Market:

The COVID-19 pandemic had a mixed impact on the global gas generator market. While some sectors experienced a slowdown in demand due to economic uncertainties and project delays, others saw increased demand for backup power solutions. Hospitals, data centers, and essential service providers experienced higher demand for gas generators to ensure uninterrupted operations during the pandemic. As economies recover and industries resume normal operations, the market is expected to return to its growth trajectory, supported by the increasing demand for reliable and efficient power generation solutions.

Latest Trends/Developments:

The growing focus on reducing carbon emissions is driving the adoption of natural gas generators, which offer a cleaner alternative to diesel generators. Innovations in hybrid energy systems, where gas generators are integrated with renewable energy sources and energy storage systems, are gaining traction. Manufacturers are focusing on developing modular and scalable gas generator systems that can be easily customized and expanded based on the power requirements of end-users. The integration of IoT and remote monitoring technologies in gas generators is enabling real-time performance tracking, predictive maintenance, and remote troubleshooting, improving operational efficiency and reducing downtime.

Key Players:

-

Cummins Inc.

-

Caterpillar Inc.

-

Generac Holdings Inc.

-

Kohler Co.

-

Mitsubishi Heavy Industries Ltd.

-

General Electric

-

MTU Onsite Energy

-

Siemens AG

-

Doosan Corporation

-

Himoinsa

Chapter 1. Gas Generator Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Gas Generator Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Gas Generator Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Gas Generator Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Gas Generator Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Gas Generator Market – By Power Rating

6.1 Introduction/Key Findings

6.2 Below 100 kW

6.3 100–350 kW

6.4 Above 350 kW

6.5 Y-O-Y Growth trend Analysis By Power Rating

6.6 Absolute $ Opportunity Analysis By Power Rating, 2024-2030

Chapter 7. Gas Generator Market – By Application

7.1 Introduction/Key Findings

7.2 Industrial

7.3 Residential

7.4 Commercial

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Gas Generator Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Power Rating

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Power Rating

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Power Rating

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Power Rating

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Power Rating

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Gas Generator Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cummins Inc.

9.2 Caterpillar Inc.

9.3 Generac Holdings Inc.

9.4 Kohler Co.

9.5 Mitsubishi Heavy Industries Ltd.

9.6 General Electric

9.7 MTU Onsite Energy

9.8 Siemens AG

9.9 Doosan Corporation

9.10 Himoinsa

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 6.2 billion in 2023 and is projected to reach USD 9.8 billion by 2030, growing at a CAGR of 6.75%.

Key drivers include the rising demand for reliable backup power in industrial and commercial sectors, the growing adoption of cleaner energy solutions, and rapid urbanization in emerging markets.

North America holds the largest market share, driven by frequent power outages and the strong demand for backup power solutions.

Challenges include volatility in natural gas prices, high initial costs, and competition from alternative power solutions like renewable energy.

Leading players include Cummins Inc., Caterpillar Inc., Generac Holdings Inc., and Kohler Co.