Global Gas Chromatography Food Testing Market Size (2024 - 2030)

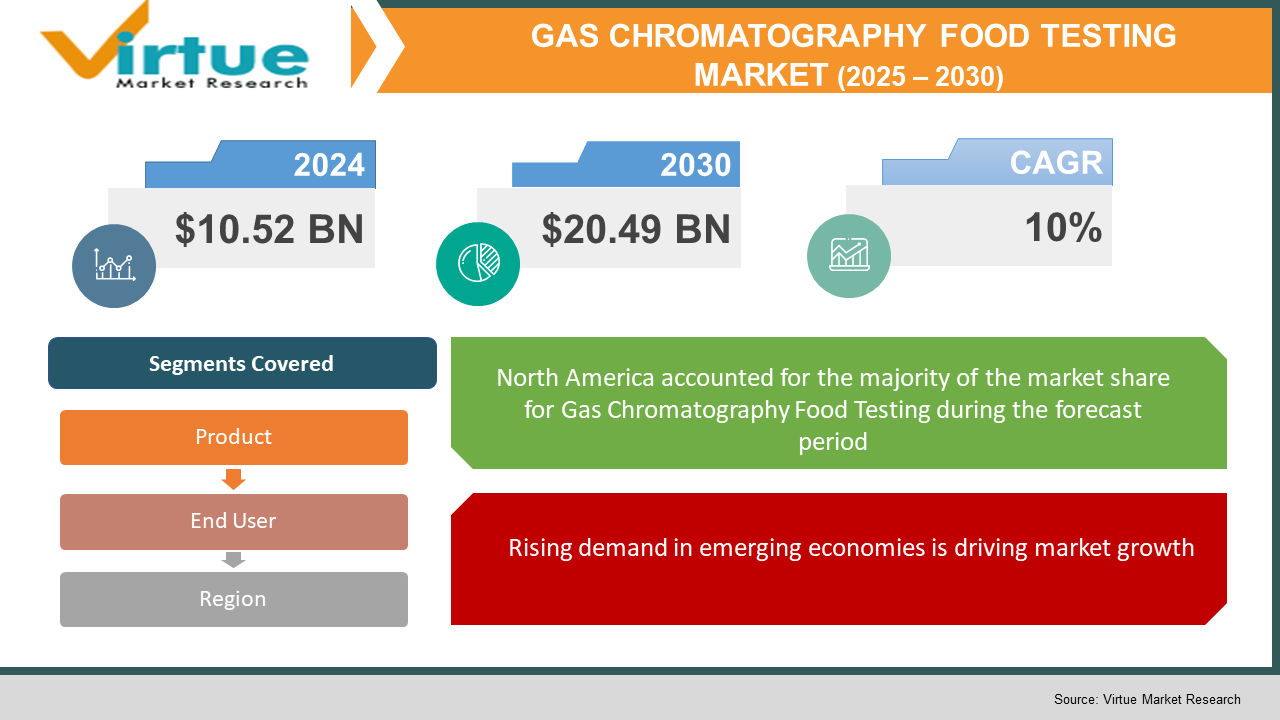

The global gas chromatography food testing devices market is estimated to reach a total market valuation of USD 10.52 Billion in 2023 to USD 20.49 billion by 2030. The market is projected to grow with a CAGR of 10% per annum during the period of analysis (2024 - 2030).

Industry Overview

Compounds that can vaporize without decomposing are typically analysed and separated using gas chromatography (GC). GC is used to identify compounds, prepare pure compounds from mixtures, and verify the purity of substances. It can also be used to separate the components in a mixture.

Some of the factors fuelling the growth of the gas chromatography market include the rise in the use of gas chromatography techniques in the drug discovery process as well as the expansion of its applications in a variety of industries, including forensic science, chemical and food industries, pharmaceutical industries, and environmental testing labs. Additionally, the market size for gas chromatography is expanding due to the introduction of hyphenated chromatography methods like GC-MS. On the other hand, advancements in gas chromatography methods for petrochemical applications are anticipated to create profitable prospects for the market's players.

The primary factor accelerating market growth is increased partnerships between chromatography instrument manufacturers, academic institutions, and research labs. Other factors driving the gas chromatography food market include an increase in GC-MS adoption, an increase in environmental pollution reduction policies and initiatives, an increase in food safety concerns, and an increase in the significance of chromatography tests in the drug approval process. Additionally, in the forecast period of 2022–2030, the growth of the proteomics market and the development of enhanced gas chromatography columns for the petroleum industry will open up new business prospects for the suppliers of this technology.

Impact of Covid-19 on the industry

The COVID-19 epidemic has severely disrupted global healthcare workflows. The sickness has caused several enterprises, as well as various areas of health care, to temporarily close their doors. The gas chromatography industry is also anticipated to then go through a brief period of negative growth in 2020, which can be attributed to things like a decline in product demand from the main end, limited operations in the majority of industries, inadequate funding for academic and research institutions, the temporary closure of top research institutes, disrupted supply chains, and difficulties in providing necessary/post-sales services.

Market Drivers

An increase in the usage of gas chromatography in the Food and Beverage industry will drive the market growth

Food additive analysis, taste, and fragrance component analysis, as well as the detection and analysis of contaminants such as environmental pollutants, fumigants, pesticides, and naturally occurring toxins, are just a few of the applications for gas chromatography in the food business. In addition, the expansion of the food business as a result of population growth is raising the possibility of food adulteration and necessitating the use of gas chromatography technology.

Rising demand in emerging economies is driving market growth

The global gas chromatography sector has higher development potential in emerging economies due to their rising GDP and increased healthcare spending as a result of their large population bases. Significant market development is a rise in the popularity of micro gas chromatographs. Most companies emphasize using small tools, condensing their spaces, and making large investments. Micro gas chromatographs also offer benefits such as speedier results acquisition times, lower energy consumption, fewer sample gas volumes required, process precision and accuracy, and improved operational reliability.

Market Restraints

The huge cost of gas chromatography instruments will challenge the market growth

Chromatography equipment is expensive since it has a wide range of intricate features and performance. However, the cost of this equipment varies according toits use. Since these devices use capillary columns to separate molecules like hydrogen, oxygen, and methane, they are also utilized in the pharmaceutical sector. More small and medium-sized firms and research and academic institutions are requesting these solutions for their processes in sectors including food and beverage, oil and gas, biotech, and pharmaceuticals. The amount of money spent on these systems has consequently increased dramatically.

GAS CHROMATOGRAPHY FOOD TESTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Product, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Agilent Technologies, Thermo Fisher Scientific Inc., Restek Corporation, Shimadzu Corporation, Bruker Corporation, Danaher Corporation (Phenomenex), Leco Corporation, Merck KGaA., SRI Instrument |

This research report on the global gas chromatography food testing market has been segmented and sub-segmented based on Product, End-User, and Geography & region.

Global Gas Chromatography Food Testing Market- By Product

- Instruments

- Consumables & Accessories

The system, detectors, autosamplers, and fraction collectors make up the instrument segment's further sub-segments. Also divided into columns and accessories, fittings and tubing, auto-sampler accessories, flow management, and pressure regulator accessories, and others such as pressure regulators, gas generators, and gas purifiers in the consumable & accessories category. In 2021, the consumable & accessories category had the majority of the global market share for gas chromatography, and it is predicted that this trend will hold during the forecast period. This is due to both their short lifespan and the increasing use of consumables and accessories in the pharmaceutical sector to separate, identify, and test diverse substances such as vitamins, preservatives, additives, proteins, and amino acids.

Global Gas Chromatography Food Testing Market- By End-User

- Pharmaceutical And Biotechnology Industries

- Academic Research Institutes

It is divided into pharmaceutical and biotechnology companies, academic and research institutions, food and beverage companies, and others, such as oil and gas companies and environmental agencies, according to end users. Due to an increase in the use of gas chromatography techniques by pharmaceutical and biotechnology companies for a variety of purposes, including the identification and analysis of samples for the presence of chemicals or trace elements, the preparation of enormous quantities of extremely pure materials, the separation of chiral compounds, and the detection of small molecules, the pharmaceutical and biotechnology company held the largest market share in 2021 and is anticipated to maintain its dominance throughout the forecast period.

Global Gas Chromatography Food Testing Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

By region, North America held the biggest market share for gas chromatography in 2021, and it is anticipated that it will continue to hold this position during the projected period. This was attributed to the large biotech and pharmaceutical companies that are present in nations like the U.S. Additionally, during the projected period, a rise in the adoption of gas chromatographic techniques for drug discovery and approval by biopharmaceutical and pharmaceutical companies would further propel market expansion in the area.

Global Gas Chromatography Food Testing Market- By Companies

- Agilent Technologies

- Thermo Fisher Scientific Inc.

- Restek Corporation

- Shimadzu Corporation

- Bruker Corporation

- Danaher Corporation (Phenomenex)

- Leco Corporation

- Merck KGaA.

- SRI Instrument

NOTABLE HAPPENINGS IN THE GLOBAL GAS CHROMATOGRAPHY FOOD TESTING MARKET IN THE RECENT PAST:

- Merger & Acquisition: - In 2021, PPD, Inc. (Nasdaq: PPD), a major international provider of clinical research services to the biopharmaceutical and biotech industries, has been acquired by Thermo Fisher Scientific Inc. (NYSE: TMO), the world leader in servicing science, for $17.4 billion.

- Merger & Acquisition: - In 2021, The purchase of MOLECUBES NV, a dynamic innovator in benchtop preclinical nuclear molecular imaging (NMI) systems, was announced by Bruker Corporation (Nasdaq: BRKR). With this acquisition, Bruker is better positioned to serve as a top supplier of NMI systems for preclinical and translational imaging research.

- Merger & Acquisition: - In 2019, Out of the current authorized capital, Meyer Burger issues 62,288,420 registered shares and purchases 18.4% of Oxford PV. Meyer Burger Technology Ltd. revealed today that it had successfully acquired a sizable equity investment in Oxford Photovoltaics Limited (SIX Swiss Exchange: MBTN) (Oxford PV).

Chapter 1. GLOBAL GAS CHROMATOGRAPHY FOOD TESTING MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL GAS CHROMATOGRAPHY FOOD TESTING MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024- 2030

2.3.2. Impact on Supply – Demand

Chapter 3. GLOBAL GAS CHROMATOGRAPHY FOOD TESTING MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. GLOBAL GAS CHROMATOGRAPHY FOOD TESTING MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL GAS CHROMATOGRAPHY FOOD TESTING MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL GAS CHROMATOGRAPHY FOOD TESTING MARKET – By Product

6.1. Instruments

6.2. Consumables & Accessories

Chapter 7. GLOBAL GAS CHROMATOGRAPHY FOOD TESTING MARKET – By End User

7.1. Pharmaceutical and Biotechnology Industries

7.2. Academic Research Industries

Chapter 8. GLOBAL GAS CHROMATOGRAPHY FOOD TESTING MARKET – By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

Chapter 9. GLOBAL GAS CHROMATOGRAPHY FOOD TESTING MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Agilent Technologies

9.2. Thermo Fisher Scientific Inc.

9.3. Restek Corporation

9.4. Shimadzu Corporation

9.5. Bruker Corporation

9.6. Danaher Corporation(Phenomenex)

9.7. Leco Corporation

9.8. Merck KGaA.

9.9. Sri Instrument

Download Sample

Choose License Type

2500

4250

5250

6900