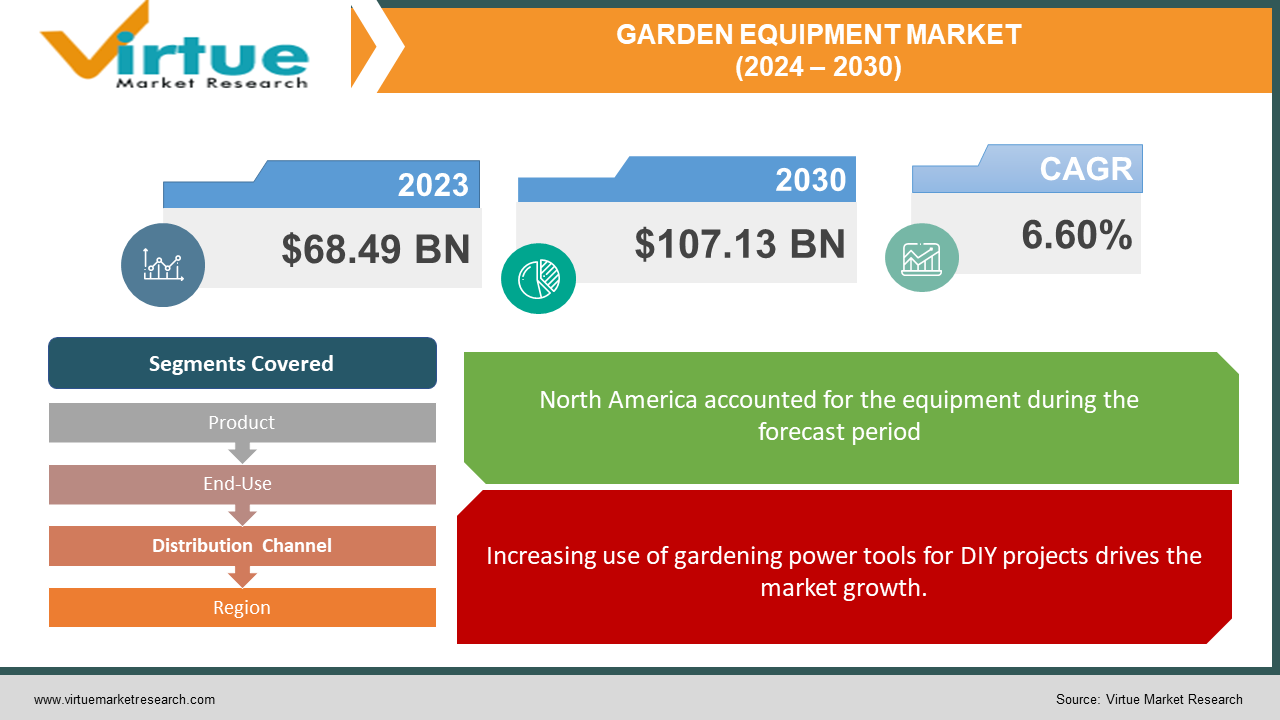

Garden Equipment Market Size (2024 – 2030)

The Garden Equipment Market was valued at USD 68.49 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 107.13 billion by 2030, growing at a CAGR of 6.60%.

Gardening apparatus encompasses an array of implements tailored for gardening and horticultural endeavors. Typically categorized into hand tools and power tools, they serve purposes like cutting, trimming, and mowing grass. Available in diverse sizes and configurations, these tools are purposefully crafted for functions such as drainage, gardening, and roofing, among others.

Key Market Insights:

The lineage of contemporary garden tools can be traced back to the earliest agricultural implements. Hand tools like the axe, sickle, scythe, pitchfork, and shovel have long been staples in gardening practices, particularly in home gardening contexts. Meanwhile, power tools are gaining significant traction in both commercial and residential settings due to their heightened efficiency and effectiveness, a trend poised to drive market growth.

Garden Equipment Market Drivers:

Increasing use of gardening power tools for DIY projects drives the market growth.

The surge in DIY projects is gaining traction, particularly among consumers in developed regions such as North America and Europe, where high living standards and evolving habits prevail. Moreover, the increasing discretionary income and burgeoning population in developing nations are propelling the DIY market, thereby boosting sales of landscaping power tools.

Comparatively, opting for DIY projects over hiring costly personnel for gardening endeavors enables consumers to achieve long-term cost savings. Consequently, there is a growing demand for gardening power equipment among DIY enthusiasts. The advent of e-commerce has further facilitated easy access to products and discounts for customers. Additionally, the cost-effectiveness of utilizing DIY gardening tools as opposed to engaging expensive personnel for garden maintenance tasks serves as another significant factor driving the adoption of DIY gardening tools.

Garden Equipment Market Restraints and Challenges:

High Maintenance Costs Restrain Market growth.

The gardening equipment market encounters a significant challenge related to the elevated maintenance costs associated with power tools. While these tools offer convenience and efficiency in completing gardening tasks, they necessitate regular maintenance to ensure optimal performance. The substantial maintenance expenses can impede market growth, as consumers might prefer sticking with traditional manual tools rather than investing in power tools that demand ongoing maintenance and upkeep. Moreover, maintenance costs can adversely impact the profitability of manufacturers and distributors, as they may be required to allocate substantial resources to repair and replace faulty products.

To tackle this challenge, manufacturers are channeling investments into research and development aimed at engineering power tools with enhanced durability and reliability, thereby diminishing the need for frequent repairs and maintenance. Furthermore, manufacturers are extending warranty periods and offering repair services, thereby affording customers peace of mind and alleviating the financial burden associated with maintenance costs.

Garden Equipment Market Opportunities:

Increasing interest in hydroponic gardening

Hydroponic gardening methods are experiencing heightened utilization within industrial farming settings. In comparison to traditional soil-based crop cultivation, hydroponics yields 3 to 10 times higher crop output within the same spatial constraints. Ensuring plants receive essential nutrients, hydroponic systems possess the capability to regulate pH levels and fertilizers. Moreover, these enclosed systems recycle unused water, promoting sustainability.

By cultivating plants indoors, farmers gain control over temperature and illumination patterns, thereby enhancing plant productivity. Systems can be designed to optimize vertical space utilization and increase crop density. Additionally, hydroponic farming facilitates cultivation in areas with unfavorable soil conditions. Consequently, the gardening equipment market is witnessing a significant upsurge in demand, driven by the expanding use of hydroponic systems in industrial agriculture.

GARDEN EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.60% |

|

Segments Covered |

By Product, End-Use, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

KUBOTA Corporation. (Japan), American Honda Motor Co., Inc. (U.S.), Husqvarna AB (Sweden), Robert Bosch GmbH (Germany), AriensCo (U.S.), The Toro Company. (U.S.), Falcon Garden Tools. (India), Fiskars Group (Finland), Castorama (France), BayWa AG (Germany) |

Garden Equipment Market Segmentation: By Product:

-

Hand Tools

-

Lawnmowers

-

Trimmers and Edgers

-

Water Management Equipment

-

Others

Over the forecast period, the lawnmower sector is projected to witness a Compound Annual Growth Rate (CAGR) of 6.8%. A key factor propelling market growth is the rapid adoption of technologically advanced equipment, offering customers enhanced ease and convenience. Handheld motor tools, encompassing chainsaws, edgers, trimmers, and leaf blowers, are gaining prominence. The demand for ergonomic and lightweight equipment, coupled with the anticipated decline in Li-ion battery costs following geopolitical events such as the conflict in the Russian Ukraine, is expected to further drive market expansion.

The hand tools and motorized implements segment comprises various categories including cutting and pruning tools, handled tools, short-hand tools, wheeled implements, and striking tools. Long-handled instruments such as rakes, hoes, spades, forks, and weeders are also included. Forecasts suggest that the market for hand tools and wheeled utensils will grow at a CAGR of 3.8% during the projection period. Moreover, the market is poised for growth as the usage of folding shovels becomes more prevalent for landscaping tasks.

Garden Equipment Market Segmentation: By End-Use

-

Residential

-

Commercial/Government

Throughout the forecast period, the commercial/government sector is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 5.9%. This segment encompasses gardening activities for commercial properties such as office buildings, motels, public buildings, sports fields, and other accommodation facilities. The sector's growth is expected to be propelled by the continuously increasing global tourism and leisure sectors, which are anticipated to contribute significantly to its expansion.

Garden Equipment Market Segmentation: By Distribution Channel

-

Online Sales

-

Retail Sales

-

Distributor Sales

Online sales serve as the predominant channel, expected to contribute 15.90 percent of market revenue. Throughout the forecast period, market growth is anticipated to be bolstered by manufacturers' growing inclination towards e-commerce platforms. This preference enables them to enhance their market presence and conduct commercial activities with ease, thereby facilitating market development.

Garden Equipment Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America asserts dominance in the gardening equipment market owing to its high living standards and a surge in new housing construction activities. Expectedly, North America is poised to maintain market leadership throughout the projection period, with the U.S. region projected to command over 72% of the global industry. The forecast period anticipates a heightened demand for battery-powered, lightweight, and portable yard landscaping tools, along with an increased preference for battery-operated instruments, further supporting market expansion. With a mature market boasting high adoption rates of power tools and advanced gardening equipment, North America remains a pivotal player in the industry.

Meanwhile, Asia-Pacific (APAC) is forecasted to witness substantial growth during the period, propelled by factors such as rising disposable income and the availability of cost-effective labor in the region. APAC is projected to experience a Compound Annual Growth Rate (CAGR) of 6.9% over the projection timeframe, owing to the rapid development of infrastructure across Asia. Despite the adverse impact of COVID-19 on key economies like China, India, and Japan, the region's stable economic conditions, characterized by a high GDP, stimulate increased household investments, favoring the gardening equipment market. Additionally, the growth in APAC is attributed to factors such as population growth, rising disposable income levels, and a growing interest in gardening and landscaping. The presence of numerous gardening equipment manufacturers in the region further drives market growth.

In Europe, the demand for gardening equipment is primarily fueled by factors such as urbanization, the burgeoning popularity of gardening as a recreational activity, and the increasing demand for landscaping services.

COVID-19 Pandemic: Impact Analysis

The onset of the COVID-19 pandemic in early 2020 resulted in a minor downturn in the gardening equipment market. This deceleration in market growth can be attributed to two primary factors: a reduction in consumer demand for garden and tool tools, coupled with the temporary closure of storefronts. However, mitigating the impact of the pandemic were favorable environmental conditions, an extended growing season, and an increasing preference among gardeners for online purchasing channels. Additionally, public health guidelines advising individuals to spend more time at home to mitigate the spread of COVID-19 prompted heightened interest in gardening activities, consequently driving up the demand for gardening tools.

Latest Trends/ Developments:

ZAMA Corporation, a subsidiary of STIHL, and the Elrad International Group announced a high-end collaboration to establish a joint venture dedicated solely to the production of electronic assemblies. The agreement for this joint venture was signed by both companies and subsequently approved by relevant antitrust authorities forming an alliance between the parties augmenting the global market. The newly formed entity will operate under the name ZE Electronic Manufacturing Service Ltd, with ZAMA owning a majority stake of 51 percent and Elrad holding the remaining 49 percent.

Key Players:

These are top 10 players in the Garden Equipment Market: -

- KUBOTA Corporation. (Japan)

- American Honda Motor Co., Inc. (U.S.)

- Husqvarna AB (Sweden)

- Robert Bosch GmbH (Germany)

- AriensCo (U.S.)

- The Toro Company. (U.S.)

- Falcon Garden Tools. (India)

- Fiskars Group (Finland)

- Castorama (France)

- BayWa AG (Germany)

Chapter 1. Garden Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Garden Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Garden Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Garden Equipment Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Garden Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Garden Equipment Market – By Product

6.1 Introduction/Key Findings

6.2 Hand Tools

6.3 Lawnmowers

6.4 Trimmers and Edgers

6.5 Water Management Equipment

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Garden Equipment Market – By End-Use

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial/Government

7.4 Y-O-Y Growth trend Analysis By End-Use

7.5 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 8. Garden Equipment Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Online Sales

8.3 Retail Sales

8.4 Distributor Sales

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Garden Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By End-Use

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By End-Use

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By End-Use

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By End-Use

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By End-Use

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Garden Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 KUBOTA Corporation. (Japan)

10.2 American Honda Motor Co., Inc. (U.S.)

10.3 Husqvarna AB (Sweden)

10.4 Robert Bosch GmbH (Germany)

10.5 AriensCo (U.S.)

10.6 The Toro Company. (U.S.)

10.7 Falcon Garden Tools. (India)

10.8 Fiskars Group (Finland)

10.9 Castorama (France)

10.10 BayWa AG (Germany)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The surge in DIY projects is gaining traction particularly among consumers in developed regions such as North America and Europe, where high living standards and evolving habits prevail. Moreover, the increasing discretionary income and burgeoning population in developing nations are propelling the DIY market, thereby boosting sales of landscaping power tools

The top players operating in the Garden Equipment Market are - KUBOTA Corporation. (Japan), American Honda Motor Co., Inc. (U.S.), Husqvarna AB (Sweden), Robert Bosch GmbH (Germany), AriensCo (U.S.), The Toro Company. (U.S.), Falcon Garden Tools. (India), Fiskars Group (Finland), Castorama (France), BayWa AG (Germany).

The onset of the COVID-19 pandemic in early 2020 resulted in a minor downturn in the gardening equipment market. This deceleration in market growth can be attributed to two primary factors: a reduction in consumer demand for garden and tool tools, coupled with the temporary closure of storefronts.

By cultivating plants indoors, farmers gain control over temperature and illumination patterns, thereby enhancing plant productivity. Systems can be designed to optimize vertical space utilization and increase crop density. Additionally, hydroponic farming facilitates cultivation in areas with unfavorable soil conditions.

Asia-Pacific (APAC) is forecasted to witness substantial growth during the period, 2024-2030, propelled by driving factors such as rising disposable income and the availability of cost-effective labor in the region.