Gaming Console Market Size (2024 – 2030)

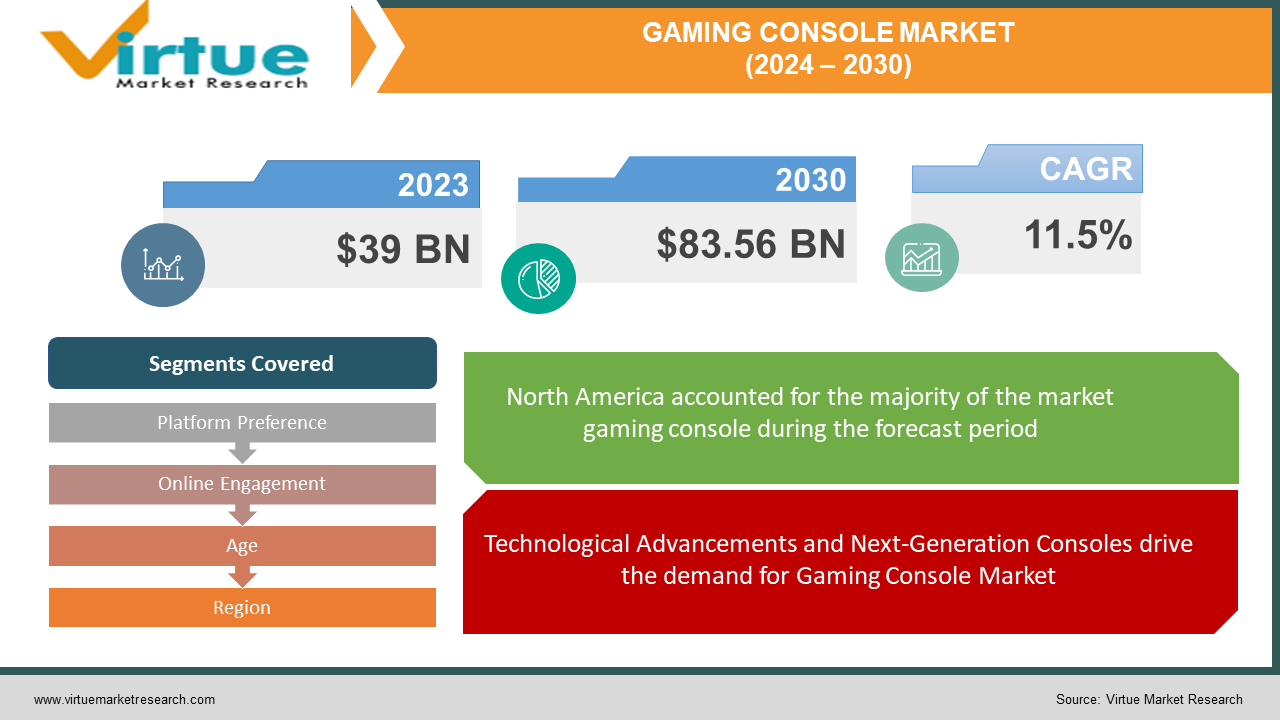

The Global Gaming Console Market was valued at USD 39 billion and is projected to reach a market size of USD 83.56 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.5%.

The gaming console industry is involved in the design, manufacturing, and distribution of dedicated video game consoles. These consoles are specialized electronic devices designed primarily for playing video games. The Gaming Console Market is expected to grow significantly in the coming years due to technological advancements and exclusive game titles that influence consumer preferences. The major well-established key players in the Gaming Console Market are Sony (PlayStation), Microsoft (Xbox), Nintendo, Nvidia, and Valve Corporation (Steam Deck).

Key Market Insights:

Technological advancements, exclusive game titles, online multiplayer experiences, hardware innovations, global consumer demand, virtual reality integration, subscription services, cross-platform compatibility, brand loyalty, and effective marketing strategies are propelling the Gaming Console Market

Sony's PlayStation series, the PlayStation 4 (PS4) and PlayStation 5 (PS5) is dominating the market. The PS5, released in late 2020, faced high demand. Microsoft's Xbox Series X and Series S are competitors to Sony's PlayStation. The Xbox Game Pass subscription service offers a vast library of games. This is a key strategy for Microsoft. Nintendo's Switch console continues to be popular. They offer a unique hybrid design that could be used both as a home console and a portable device. Nintendo's exclusive game titles, such as those from the Mario and Zelda franchises, are contributing to the Switch's success. Sony and Microsoft are investing in cloud gaming services. Microsoft's xCloud and Sony's PlayStation Now aim to provide streaming access to a library of games. Virtual Reality (VR)is also gaining attention, with Sony having its PlayStation VR headset, and other companies exploring VR options. The restraints on the Gaming Console Market include high cost, global supply chain disruptions, and shortages of critical components. North America occupies the highest share of the Gaming Console Market. Asia-Pacific is the fastest-growing segment during the forecast period.

Gaming Console Market Drivers:

Technological Advancements and Next-Generation Consoles drive the demand for Gaming Console Market

Continuous technological advancements drive the gaming console market. The release of next-generation consoles, such as the PlayStation 5 and Xbox Series X/S, improved hardware capabilities, faster loading times, enhanced graphics, and innovative features. Technological progress attracts existing gamers looking for upgraded experiences and also helps expand the market by capturing the interest of new and casual gamers.

Content and Exclusive Game Titles are propelling the Gaming Console Market

Exclusive game titles and compelling content are critical drivers for the gaming console market. Major console manufacturers, including Sony (PlayStation), Microsoft (Xbox), and Nintendo, invest heavily in developing and securing exclusive games. Exclusive titles create brand loyalty and serve as a key differentiator. This influences consumers' choice of gaming platforms. The availability of unique and high-quality games also contributes significantly to console sales.

Gaming Console Market Restraints and Challenges

The major challenge faced by the Gaming Console Market is the global supply chain disruptions, including semiconductor shortages, production delays, and logistics issues. This leads to disruptions in the manufacturing and distribution of gaming consoles. Another challenge is the shortage of critical components, such as semiconductors and other hardware components. This impacts the production capacity of gaming consoles, resulting in occasional supply shortages. The production of high-end gaming consoles involves significant costs. Manufacturers often face challenges in managing production expenses while offering competitive pricing to consumers.

Gaming Console Market Opportunities:

The Gaming Console Market has various opportunities in the market. Embracing digital transformation and investing in cloud gaming services can open up opportunities for gaming console companies to reach a broader audience. This offers innovative gaming experiences without the need for high-end hardware. Opportunities lie in enhancing cross-platform play and progression features. This allows gamers to seamlessly transition between gaming consoles, PCs, and mobile devices, fostering a more inclusive and interconnected gaming community. Capitalizing on the growing popularity of esports and competitive gaming by supporting esports tournaments, developing esports-friendly features, and collaborating with esports organizations can create new revenue streams.

GAMING CONSOLE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.5% |

|

Segments Covered |

By Platform Preference, Online Engagement, Age, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sony (PlayStation), Microsoft (Xbox), Nintendo., Nvidia, Valve Corporation (Steam Deck), Atari, Sega, SNK Corporation, Google (Stadia), Amazon (Luna) |

Gaming Console Market Segmentation: By Platform Preference

-

PlayStation Users

-

Xbox Users

-

Nintendo Users

-

PC Gamers

In 2023, based on market segmentation by Platform Preference, PlayStation users and Xbox users occupy the highest share of the Gaming Console Market. This is due to a global user base and established market presence. These platforms are investing in subscription services to provide a wide range of games, contributing to user retention.

However, PC gamers are the fastest-growing segment during the forecast period and are projected to grow at a CAGR of 15%. This is due to the increasing popularity of PC gaming, especially in esports and streaming communities.

Gaming Console Market Segmentation: By Online Engagement

-

Online Multiplayer Gamers

-

Single-Player Campaign Gamers

-

Streaming and Cloud Gaming Users

In 2023, based on market segmentation by Online Engagement, the Online multiplayer gamers segment occupies the highest share of the Gaming Console Market. This is mainly due to the growth of esports, competitive gaming, and social connectivity.

However, Streaming and cloud gaming users are the fastest-growing during the forecast period. This is mainly due to the new technologies, accessibility over hardware specifications, and on-demand gaming. There is access to a wide library of games without the need for high-end hardware.

Gaming Console Market Segmentation: By Age

-

Children

-

Teens

-

Adults

In 2023, based on market segmentation by Age, the Teens segment occupies the highest share of the Gaming Console Market. This is mainly due to diverse interests, competitive gaming, and social interactions. They often have access to more disposable income and influence household purchasing decisions.

However, Adults are the fastest-growing segment during the forecast period. Adults reflect a broad range of interests, from immersive narrative-driven experiences to competitive gaming. Adults contribute to the overall growth of the gaming industry.

With the rise of educational and family-friendly content, the children's gaming segment could also see increased growth. This is driven by parents seeking interactive and entertaining experiences for their children.

Gaming Console Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, North America occupies the highest share of the Gaming Console Market. It has a market share of 45%. This growth is due to the high consumer spending on gaming. North America is a developed region with a strong emphasis on high-end technology, online gaming, and exclusive titles. The major presence of gaming industry events, such as E3 (Electronic Entertainment Expo) contributes to the growth in this region.

However, Asia-Pacific is the fastest-growing segment during the forecast period. This is mainly due to the growing middle-class population, increasing internet connectivity, and the popularity of esports. This growth is driven by high interest in PC gaming, mobile gaming, and consoles.

Countries like Japan and South Korea have a significant market share due to the dominance of mobile gaming.

Europe has a large and diverse market with a strong gaming culture. Cultural diversity influences game preferences, high disposable income in some regions, and interest in both single-player and multiplayer experiences. South America is a growing gaming market with increasing access to consoles. Middle East and Africa are developing gaming markets with varying levels of adoption.

COVID-19 Impact Analysis on the Global Gaming Console Market:

The COVID-19 pandemic had a significant impact on the Gaming Console Market. There were lockdowns, safety measures, and travel restrictions. The gaming console industry faced challenges due to supply chain disruptions. This included manufacturing delays and shortages of key components. Due to lockdowns and stay-at-home measures, there was a surge in demand for gaming consoles as people sought home entertainment options. The pandemic accelerated the adoption of digital gaming, with an increased emphasis on digital game downloads and online multiplayer experiences. Cloud gaming services gained attention as consumers looked for alternatives to physical hardware. This enabled them to play games on various devices without the need for high-end consoles. Esports and live streaming of gaming content saw a boost in popularity. Lockdowns influenced gaming behavior, with an increase in online multiplayer gaming, virtual events, and in-game socialization.

Latest Trends/ Developments:

Continuous growth of cloud gaming services like Xbox Cloud Gaming (formerly Project xCloud) and Google Stadia, allow players to stream games without high-end hardware. The release of next-generation gaming consoles, including the PlayStation 5 and Xbox Series X/S, with upgraded hardware, faster load times, and enhanced graphics capabilities is another latest development. There is an ongoing exploration of VR and AR technologies in gaming, with the potential for immersive experiences and enhanced gameplay. There is an incorporation of AI and machine learning technologies in gaming for improved NPC behavior, dynamic storytelling, and enhanced gaming experiences.

Key Players:

-

Sony (PlayStation)

-

Microsoft (Xbox)

-

Nintendo

-

Nvidia

-

Valve Corporation (Steam Deck)

-

Atari

-

Sega

-

SNK Corporation

-

Google (Stadia)

-

Amazon (Luna)

Market News:

-

May 2022: Ubisoft Expanding Ubisoft+ to PlayStation Platform Ubisoft has announced its plans to introduce Ubisoft+ to PlayStation, offering an additional avenue for PlayStation users to enjoy Ubisoft games on their consoles initially. With Ubisoft+ Classics, bundled within the PlayStation Plus Extra and PlayStation Plus Premium subscription tiers, players can access standard editions of well-loved Ubisoft games.

-

March 2022: NVIDIA Unveils Omniverse for Developers NVIDIA has introduced Omniverse, a robust and collaborative game creation environment designed to simplify asset sharing, organize asset libraries, facilitate collaboration, and deploy AI for animating characters' facial expressions in a new game development pipeline.

Chapter 1. Gaming Console Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Gaming Console Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Gaming Console Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Gaming Console Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Gaming Console Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Gaming Console Market – By Platform Preference

6.1 Introduction/Key Findings

6.2 PlayStation Users

6.3 Xbox Users

6.4 Nintendo Users

6.5 PC Gamers

6.6 Y-O-Y Growth trend Analysis By Platform Preference

6.7 Absolute $ Opportunity Analysis By Platform Preference, 2024-2030

Chapter 7. Gaming Console Market – By Online Engagement

7.1 Introduction/Key Findings

7.2 Online Multiplayer Gamers

7.3 Single-Player Campaign Gamers

7.4 Streaming and Cloud Gaming Users

7.5 Y-O-Y Growth trend Analysis By Online Engagement

7.6 Absolute $ Opportunity Analysis By Online Engagement, 2024-2030

Chapter 8. Gaming Console Market – By Age

8.1 Introduction/Key Findings

8.2 Children

8.3 Teens

8.4 Adults

8.5 Y-O-Y Growth trend Analysis By Age

8.6 Absolute $ Opportunity Analysis By Age, 2024-2030

Chapter 9. Gaming Console Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Platform Preference

9.1.3 By Online Engagement

9.1.4 By By Age

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Platform Preference

9.2.3 By Online Engagement

9.2.4 By Age

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Platform Preference

9.3.3 By Online Engagement

9.3.4 By Age

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Platform Preference

9.4.3 By Online Engagement

9.4.4 By Age

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Platform Preference

9.5.3 By Online Engagement

9.5.4 By Age

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Gaming Console Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Sony (PlayStation)

10.2 Microsoft (Xbox)

10.3 Nintendo

10.4 Nvidia

10.5 Valve Corporation (Steam Deck)

10.6 Atari

10.7 Sega

10.8 SNK Corporation

10.9 Google (Stadia)

10.10 Amazon (Luna)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Gaming Console Market was valued at USD 39 billion and is projected to reach a market size of USD 83.56 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.5 %.

Technological advancements, Next-Generation Consoles, Content, and exclusive game titles are the main market drivers of the Global Gaming Console Market.

Ans.Online Multiplayer Gamers, Single-Player Campaign Gamers, and Streaming and Cloud Gaming Users are the segments of the Global Gaming Console Market by Online Engagement.

North America is the most dominant region for the Global Gaming Console Market.

Sony (PlayStation), Microsoft (Xbox), Nintendo, Nvidia, and Valve Corporation (Steam Deck) are the key players in the Global Gaming Console Market.