Furikake Market Size (2024 – 2030)

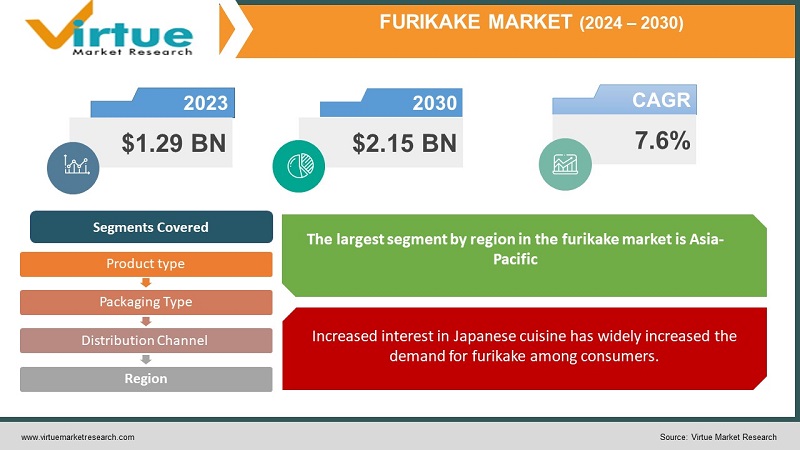

The Global Furikake Market was valued at USD 1.29 billion and is projected to reach a market size of USD 2.15 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.6%.

Download Free Sample Report Now

Furikake is a traditional Japanese seasoning typically sprinkled over rice, and it has gained popularity not only in Japan but also in various international markets. The furikake market is a niche but growing segment within the global condiment and seasoning industry. This savory mixture often includes ingredients such as dried seaweed, sesame seeds, bonito flakes, and seasonings, offering a flavorful and textured enhancement to plain rice or other dishes.

In recent years, the furikake market has expanded as consumers seek convenient, healthy, and flavorful meal options. Manufacturers are innovating with new flavors and packaging to cater to changing consumer preferences, including vegan and organic options. With the increasing popularity of Japanese cuisine worldwide and the demand for ready-to-eat and convenient meal solutions, the furikake market is poised for continued growth and diversification in the coming years.

Key Market Insights:

The popularity of Japanese cuisine has been on the rise globally, with the United States being a notable hotspot for this trend. As people become more adventurous in their culinary explorations, there is a growing demand for Japanese flavors and ingredients that is expected to continue to increase. The most rapidly growing consumer interest in furikake is for using it as a snack. Furikake is predominantly part of a vegan diet.

Major food manufacturers produce more than 1,000 different types of furikake, and when locally sold regional specialty furikake are included, the total variety available in the market extends to approximately 1,500 types. Condiment manufacturers are diversifying their product lines by regularly introducing new dry topping flavors of furikake, retort pouch sauces, and instant seasonings inspired by trending dishes.

Furikake Market Drivers:

Increased interest in Japanese cuisine has widely increased the demand for furikake among consumers.

The growing global interest in Japanese cuisine, including sushi, ramen, and bento boxes, has led to a higher demand for Japanese seasonings like furikake. As people become more adventurous with their culinary preferences, they seek out authentic Japanese flavors and ingredients to recreate these dishes at home. This trend has boosted the sales of furikake, as it is an essential condiment to enhance the flavor of Japanese-style rice dishes and more.

Changing consumer preferences for convenience and health is a notable driver in increasing the growth of furikake as it provides numerous health benefits.

Modern consumers are increasingly looking for convenient and healthy meal options. Furikake offers a quick and simple way to add flavor and nutritional value to meals, making it an attractive option for busy individuals or families. As manufacturers respond to health-conscious consumers, they are introducing furikake varieties with low sodium, no MSG, and even vegan or organic options. This alignment with health and convenience trends has driven the expansion of the furikake market as it caters to the evolving preferences of consumers seeking both flavor and nutrition in their meals.

Unlock Market Insights: Get A FREE Sample Report Today!

Furikake Market Restraints and Challenges:

Challenges with cultural acceptance and awareness about furikake in other regions could limit the growth of the Furikake market.

One challenge facing the furikake market is the need for increased cultural acceptance and awareness in regions where Japanese cuisine is not as prevalent. While furikake has gained popularity in many countries, there are still markets where consumers may not be familiar with its use or may be hesitant to try a new and foreign condiment. Manufacturers and marketers may need to invest in educational campaigns to introduce furikake to new audiences and explain its versatile uses beyond just rice seasoning.

Ingredient sourcing and cost fluctuations associated with furikake might be challenging for manufacturers and businesses in this market.

Many traditional furikake ingredients, such as bonito flakes and seaweed, are sourced from specific regions and can be subject to supply fluctuations and price variations. Changes in environmental conditions, regulations, or disruptions in the supply chain can impact the availability and cost of these key ingredients. Manufacturers in the furikake market need to manage these sourcing challenges and, in some cases, consider alternative ingredients or sustainable sourcing practices to mitigate potential supply chain disruptions and price fluctuations.

Furikake Market Opportunities:

One significant opportunity in the furikake market lies in product diversification and innovation to cater to evolving consumer preferences. With a growing demand for healthier and plant-based options, manufacturers can develop new furikake varieties that are vegan-friendly, gluten-free, and free from additives or preservatives. Exploring unique flavor profiles inspired by global cuisines can help expand the appeal of furikake to a broader audience, making it not only a staple in Japanese cuisine but also a versatile seasoning for various dishes. Capitalizing on the convenience and flavor-enhancing aspects of furikake, while aligning with health and dietary trends, can drive growth and wider adoption in both traditional and emerging markets.

GLOBAL FURIKAKE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.6% |

|

Segments Covered |

By Product type, Packaging Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mishima, JFC International, Katsuo Fumi Furikake, Kikkoman Corporation, Marumiya, Nishimoto Trading Co., Ltd., Shimaya, TAKANASHI GROUP, Totole, House Foods |

CUSTOMIZE THIS FULL REPORT AS PER YOUR NEEDS

SEGMENTATION ANALYSIS

Furikake Market Segmentation: By Product Type

-

Traditional Furikake

-

Flavored Furikake

-

Vegan Furikake

-

Organic Furikake

The largest segment in the furikake market by product type is Traditional Furikake which has a market share of over 40%. Traditional furikake, with its classic Japanese flavors like seaweed (nori), bonito (katsuobushi), and shiso, holds the dominant position due to its established popularity and recognition among consumers. These timeless flavors have a strong cultural presence, and they are often preferred for their authentic taste. While newer flavor varieties and specialty options are emerging, the traditional furikake segment continues to maintain its prominence.

The fastest-growing segment is Vegan Furikake growing at a CAGR of 19.6%. This growth is primarily driven by the increasing global trend toward plant-based and vegan diets. As more consumers seek healthier and environmentally sustainable food options, the demand for vegan furikake, which excludes animal-derived ingredients, has surged. Manufacturers have responded with innovative plant-based ingredients like seaweed, vegetables, and various seasonings, attracting health-conscious consumers while also aligning with their ethical and environmental concerns.

Furikake Market Segmentation: By Packaging Type

-

Bottles and Jars

-

Sachets and Single-Serve Packets

-

Shakers and Dispensers

The largest segment by packaging type is Bottles and Jars having a market share of 48%. This dominance is primarily due to the convenience and reusability offered by these packaging options. Bottles and jars provide easy access to the furikake, enabling consumers to sprinkle or scoop the desired amount easily. They are also often resealable, maintaining freshness and preventing moisture from affecting the product. This convenience and functionality have made bottles and jars the preferred choice for households, as they are well-suited for both occasional and regular furikake users, contributing to their prominence in the market.

The fastest-growing segment by packaging type is Sachets and Single-Serve Packets growing at a CAGR of 22%. This growth is driven by the increasing demand for convenience and portion control. Sachets and single-serve packets offer consumers a convenient way to portion out and use furikake, making them ideal for on-the-go and ready-to-eat meals. In addition, these packaging options reduce food waste and maintain the freshness of the product, aligning with consumer preferences for practical and sustainable choices.

Furikake Market Segmentation: By Distribution Channel

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online Retail

-

Specialty Stores

The largest segment in the furikake market by distribution channel is Supermarkets and Hypermarkets having a market share of 38.7%. This is primarily due to the wide availability of furikake products in these traditional retail outlets, where consumers can find an extensive range of choices and brands in one place. Supermarkets and hypermarkets offer a convenient shopping experience and the opportunity for customers to browse, compare, and select furikake products easily. These retail channels benefit from strong supply chains, ensuring consistent product availability, making them the preferred choice for many consumers when purchasing furikake.

The fastest-growing segment in the furikake market by distribution channel is Online Retail growing a CAGR of 24%. This surge can be attributed to the increasing preference for e-commerce and the convenience it offers. Online retail allows consumers to access a wide variety of furikake products from the comfort of their homes, with options for doorstep delivery. Moreover, the COVID-19 pandemic accelerated the adoption of online shopping, including for food products, as consumers sought safer and contactless purchasing methods. This shift towards online distribution aligns with the evolving consumer shopping habits and is expected to continue as a dominant distribution channel in the post-pandemic world.

What's Next for Your Market? Get a Snapshot with Sample Report

Furikake Market Segmentation: Regional Analysis

-

North America

-

Asia- Pacific

-

Europe

-

South America

-

Middle East and Africa

The largest segment by region in the furikake market is Asia-Pacific which has a large share of 43%. This can be attributed to the strong cultural and historical ties of furikake to Japanese cuisine, its widespread consumption in Japan, and the region's proximity to other Asian countries where furikake is also a popular seasoning. The prevalence of traditional Japanese flavors in this region, along with the increasing adoption of furikake in various dishes, solidifies the Asia-Pacific region as the largest market for furikake.

The fastest growing segment in the furikake market is North America growing at a CAGR of 23.2%. This growth can be attributed to the increasing popularity of Japanese cuisine, including sushi and rice-based dishes, in the region. As consumers seek new and exciting flavors, furikake, with its versatile and umami-rich seasoning properties, has gained significant traction. The demand for convenient and flavorful meal solutions aligns with the fast-paced lifestyles in North America, making Furikake an attractive option.

COVID-19 Impact Analysis on the Global Furikake Market:

The global furikake market, like many food sectors, experienced both challenges and opportunities due to the COVID-19 pandemic. While the initial disruptions in the supply chain and restrictions on dining out affected sales, the market showed resilience as consumers turned to convenient and shelf-stable food options.

With more people cooking at home, the demand for furikake as a versatile and flavorful seasoning for homemade dishes increased. The market adapted by emphasizing online sales channels and offering innovative packaging options, such as individual sachets and portion-controlled containers, catering to the changing consumer preferences for safety and convenience. As the pandemic accelerated the shift towards at-home dining, the furikake market positioned itself to benefit from this new culinary landscape.

Latest Trends/ Developments:

A significant trend in the furikake market is the increasing emphasis on health and wellness. Consumers are seeking products that are not only flavorful but also align with their dietary preferences and nutritional goals. As a response to this trend, manufacturers are developing furikake options that are low in sodium, free from artificial additives, and catering to specific dietary needs, such as gluten-free or vegan. This trend reflects the broader consumer shift towards mindful eating and the desire for healthier condiments and seasoning choices.

Another notable trend is the diversification of furikake flavors to appeal to a wider, global audience. While traditional Japanese flavors remain popular, manufacturers are introducing new and exciting flavor profiles inspired by various international cuisines. This strategy helps expand the consumer base and encourages experimentation with furikake in a broader range of dishes, not limited to Japanese cuisine. These global flavor innovations include options like sriracha, curry, or Mediterranean-inspired furikake, reflecting the fusion of culinary traditions in today's multicultural food landscape.

Key Players:

-

Mishima

-

JFC International

-

Katsuo Fumi Furikake

-

Kikkoman Corporation

-

Marumiya

-

Nishimoto Trading Co., Ltd.

-

Shimaya

-

TAKANASHI GROUP

-

Totole

-

House Foods

- In December 2022, Wismettac Foods, Inc., which is a wholly owned subsidiary of Nishimoto Co., Ltd., created a new local subsidiary in the United Kingdom known as Wismettac EMEA Holdings Limited. This newly established holding company is part of their strategic initiative to extend their geographical footprint within the European market.

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Chapter 1. Furikake Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Furikake Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Furikake Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Furikake Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Furikake Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Furikake Market – By Product Type

6.1 Introduction/Key Findings

6.2 Traditional Furikake

6.3 Flavored Furikake

6.4 Vegan Furikake

6.5 Organic Furikake

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Furikake Market – By Packaging Type

7.1 Introduction/Key Findings

7.2 Bottles and Jars

7.3 Sachets and Single-Serve Packets

7.4 Shakers and Dispensers

7.5 Y-O-Y Growth trend Analysis By Packaging Type

7.6 Absolute $ Opportunity Analysis By Packaging Type, 2024-2030

Chapter 8. Furikake Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarkets and Hypermarkets

8.3 Convenience Stores

8.4 Online Retail

8.5 Specialty Stores

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Furikake Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Distribution Channel

9.1.4 By Packaging TypeFactor

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Distribution Channel

9.2.4 By Packaging TypeFactor

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Distribution Channel

9.3.4 By Packaging TypeFactor

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Distribution Channel

9.4.4 By Packaging TypeFactor

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Distribution Channel

9.5.4 By Packaging TypeFactor

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Furikake Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Mishima

10.2 JFC International

10.3 Katsuo Fumi Furikake

10.4 Kikkoman Corporation

10.5 Marumiya

10.6 Nishimoto Trading Co., Ltd.

10.7 Shimaya

10.8 TAKANASHI GROUP

10.9 Totole

10.10 House Foods

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Furikake Market was valued at USD 1.29 billion and is projected to reach a market size of USD 2.15 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.6%.

Increased interest in Japanese cuisine and changing consumer preferences for convenience and health are drivers of the Furikake market.

Based on product type, the Global Furikake Market is segmented into Traditional Furikake, Flavored Furikake, Vegan Furikake, and Organic Furikake.

Asia-Pacific is the most dominant region for the Global Furikake Market.

Mishima, JFC International, Katsuo Fumi Furikake, Kikkoman Corporation, Marumiya, and Nishimoto Trading Co., Ltd. are a few of the key players operating in the Global Furikake Market.