Fungi Based Meat Market Size (2025-2030)

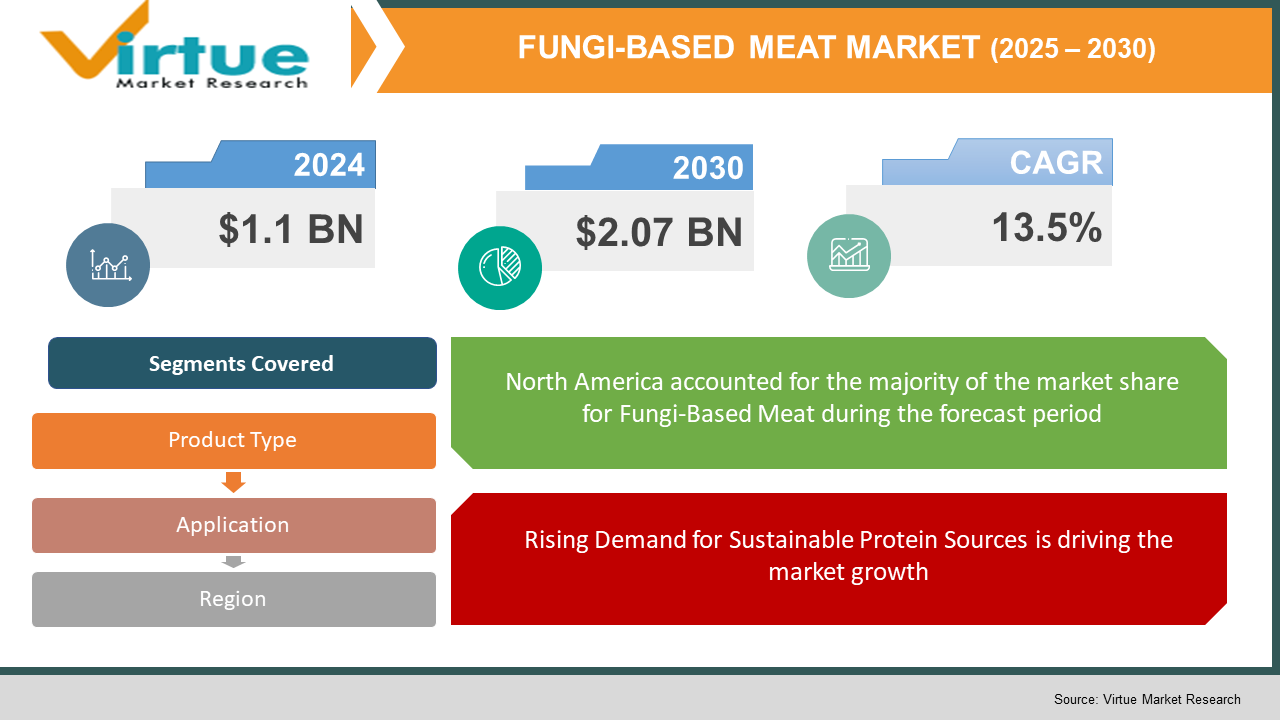

The Global Fungi-Based Meat Market was valued at USD 1.1 billion in 2024 and is projected to grow at a CAGR of 13.5% from 2025 to 2030. The market is expected to reach USD 2.07 billion by 2030.

The Fungi-Based Meat Market focuses on alternative protein sources derived from mycoprotein and other fungal ingredients, offering sustainable, high-protein substitutes for traditional meat. With rising concerns over environmental sustainability, health consciousness, and ethical food choices, fungi-based meat has gained significant traction. The industry is driven by technological advancements in fermentation processes, improved taste and texture of products, and increasing investment in alternative protein startups.

Key Market Insights

- North America and Europe collectively hold over 60% market share, with strong retail and foodservice adoption.

- The demand for fungi-based meat in vegan and flexitarian diets is growing, with over 40% of consumers seeking plant-based alternatives.

- Mycoprotein, a key ingredient, has high protein content (11-15%) and is free from cholesterol, boosting its appeal in health-conscious consumers.

- The segment for fungi-based burger patties holds the largest market share, accounting for 35% of total product sales.

Global Fungi-Based Meat Market Drivers

Rising Demand for Sustainable Protein Sources is driving the market growth

As global meat consumption continues to rise, concerns over the environmental impact of animal agriculture are fueling the demand for fungi-based meat alternatives. Traditional livestock farming is responsible for significant greenhouse gas emissions, deforestation, and excessive water use. Fungi-based meat offers a sustainable solution with 80-90% lower carbon footprint compared to conventional meat. Additionally, fungal protein production requires significantly less land and water while maintaining high nutritional value. With the global push toward carbon neutrality and eco-friendly food production, fungi-based meat is gaining strong momentum as a viable alternative.

Health Benefits and Nutritional Superiority is driving the market growth

Fungi-based meat is gaining popularity among health-conscious consumers due to its high protein, fiber, and essential amino acid content. Unlike conventional meat, mycoprotein-based products are cholesterol-free, low in saturated fats, and rich in fiber, making them ideal for individuals seeking heart-healthy and weight management-friendly diets. Additionally, fungi-based meat contains beta-glucans, which have been linked to immune system support and improved gut health. With increasing cases of lifestyle-related diseases such as obesity, diabetes, and cardiovascular disorders, consumers are shifting toward functional and nutritious food options, driving the adoption of fungi-based meat products.

Growth in the Vegan and Flexitarian Population is driving the market growth

The global shift toward plant-based and flexitarian diets has significantly contributed to the rise of fungi-based meat. Consumers are actively seeking meat substitutes that offer the same texture, taste, and protein content without the ethical and environmental drawbacks of conventional meat. As over 25% of global consumers identify as flexitarians, the demand for high-quality meat alternatives has surged. The fungi-based meat industry benefits from this trend as it provides a meaty texture and umami flavor that closely resembles animal-based meat, making it an appealing option for both vegetarians and meat reducers.

Global Fungi-Based Meat Market Challenges and Restraints

High Production Costs and Scaling Challenges is restricting the market growth

Despite its environmental and nutritional benefits, fungi-based meat production remains cost-intensive. The fermentation and biomass cultivation processes require specialized bioreactors and controlled environmental conditions, leading to higher operational expenses. Additionally, scaling up production while maintaining product consistency and affordability is a major hurdle for manufacturers. Without advancements in cost reduction strategies, fungi-based meat may struggle to compete with traditional meat and other plant-based alternatives in price-sensitive markets.

Consumer Perception and Limited Awareness is restricting the market growth

While plant-based meat alternatives are widely recognized, fungi-based meat is still relatively new to mainstream consumers. Many consumers are unfamiliar with mycoprotein-based products, and misconceptions about the taste, texture, and processing methods can hinder market adoption. Additionally, regulatory challenges in certain regions slow down product approvals and labeling standards, further delaying market penetration. Companies must invest in marketing, education campaigns, and transparent labeling to build consumer trust and drive product acceptance.

Market Opportunities

The fungi-based meat market presents substantial growth opportunities, particularly in Asia-Pacific and Latin America, where plant-based diets are rapidly gaining popularity. The rise of fermentation technology startups is also accelerating product innovation, leading to improved taste, texture, and affordability. Additionally, collaborations between fungi-based meat manufacturers and foodservice giants are creating widespread availability of mycoprotein-based products in mainstream fast-food chains. Governments and investors are also supporting alternative protein development, further propelling market expansion. As consumer awareness increases and technology advances, fungi-based meat is positioned to become a key player in the alternative protein industry.

FUNGI-BASED MEAT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

13.5% |

|

Segments Covered |

By Product Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Quorn Foods, Meati Foods, Nature’s Fynd, MyForest Foods, The Better Meat Co |

Fungi Based Meat Market Segmentation

Fungi Based Meat Market Segmentation By Product Type:

- Burger Patties

- Sausages

- Nuggets

- Meatballs

- Others

Burger patties are the leading product type in the fungi-based meat market, holding 35% of total sales. The segment’s dominance is attributed to high consumer demand for meat substitutes that closely mimic traditional beef patties in texture and taste. Major food brands and quick-service restaurants (QSRs) have incorporated fungi-based burger patties into their menus, increasing their mainstream appeal. Additionally, the rising popularity of plant-based fast food options has further boosted the demand for fungi-based patties. With continuous product innovation and growing consumer preference for plant-based burgers, this segment is expected to maintain its leading position in the market.

Fungi Based Meat Market Segmentation By Application:

- Retail

- Foodservice

- Household

The foodservice sector is the dominant application for fungi-based meat products, accounting for a significant market share. Quick-service restaurants (QSRs) and fine-dining establishments are actively incorporating fungi-based meat options into their menus due to increasing consumer demand for sustainable and plant-based alternatives. Major chains have partnered with alternative protein manufacturers to offer fungi-based burgers, sausages, and nuggets, driving mass adoption. The convenience of pre-cooked fungi-based meat products makes them ideal for foodservice applications, ensuring easy preparation and consistent quality. With growing investments in plant-based menu innovations, the foodservice sector will continue to be a key driver of fungi-based meat market growth.

Fungi Based Meat Market Segmentation Regional Segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America leads the global fungi-based meat market, holding over 35% market share due to high consumer awareness and strong retail penetration. The region's dominance is driven by the increasing shift toward plant-based diets, environmental concerns, and health-conscious consumer trends. The United States and Canada are at the forefront, with major alternative protein companies investing in fermentation technology and large-scale production facilities. Additionally, regulatory approvals for mycoprotein-based products have facilitated easier market entry and consumer acceptance. The presence of leading food brands and QSR chains incorporating fungi-based meat into their offerings has further accelerated growth. With ongoing product innovations and sustainability-focused dietary habits, North America is expected to maintain its leadership in the fungi-based meat industry.

COVID-19 Impact Analysis on the Fungi-Based Meat Market

The global upheaval caused by the COVID-19 pandemic acted as a powerful accelerant for the burgeoning alternative protein sector, with a notable surge in the popularity of fungi-based meat alternatives. The pandemic's disruption of conventional meat supply chains, characterized by processing plant closures and logistical challenges, coupled with heightened anxieties surrounding zoonotic diseases originating from animal agriculture, prompted a significant shift in consumer preferences towards safer and more sustainable food options. This confluence of factors led to a substantial increase in the demand for plant-based and fungi-based protein sources, as consumers sought to diversify their protein intake and reduce their reliance on traditional meat products. The retail sector experienced a remarkable surge in sales of these alternatives, registering consistent double-digit growth, indicating a significant and sustained shift in consumer behavior. This surge in demand was not merely a temporary response to pandemic-related anxieties but rather a reflection of a growing awareness of the interconnectedness between food choices, public health, and environmental sustainability. Consequently, the pandemic served to solidify fungi-based meat as a viable and long-term solution within the broader protein industry, highlighting its potential to address food security challenges and contribute to a more resilient and sustainable food system. The inherent characteristics of fungi-based proteins, such as their nutritional profile, versatility, and sustainable production methods, resonated strongly with consumers seeking healthy and environmentally responsible food choices. Furthermore, the pandemic underscored the vulnerability of centralized and resource-intensive animal agriculture, reinforcing the need for decentralized and sustainable protein production models. The agility and scalability of fungi-based protein production, coupled with its lower environmental footprint, positioned it as a compelling alternative to traditional meat, capable of meeting the growing global demand for protein while mitigating the environmental and health risks associated with conventional animal agriculture. This confluence of factors, driven by the pandemic's impact, has propelled fungi-based meat from a niche product to a mainstream contender in the evolving landscape of sustainable food solutions.

Latest Trends/Developments

The fungi-based meat sector is currently navigating a phase of intense innovation, characterized by significant strides in technological and product development. Precision fermentation techniques are being refined, allowing for the tailored production of specific mycoproteins with enhanced functionalities, thereby improving both the nutritional profile and sensory attributes of fungi-based meat alternatives. Simultaneously, considerable efforts are being invested in enhancing the texture and flavor profiles of these products, aiming to replicate the mouthfeel and taste of traditional meat more closely. This drive for realism is fueled by the desire to appeal to a wider consumer base, including those who are not yet fully convinced by existing plant-based or fungi-based options. Both emerging startups and established food companies are actively expanding their product portfolios, introducing a diverse range of fungi-based meat analogues that cater to various culinary applications. A notable trend is the development of hybrid formulations, combining plant-based proteins with mycoproteins to achieve a synergistic effect, resulting in enhanced nutritional value, improved texture, and a more well-rounded flavor. This strategic blending of ingredients is proving to be a highly effective approach to creating appealing and nutritious meat alternatives. Furthermore, the industry is experiencing significant growth through strategic partnerships with foodservice providers, enabling broader access to fungi-based meat products in restaurants, cafeterias, and other food service establishments. The expansion into emerging markets, where demand for sustainable and affordable protein sources is rapidly increasing, is also playing a crucial role in accelerating industry growth. These developments, driven by a combination of technological innovation, product diversification, strategic partnerships, and market expansion, are positioning the fungi-based meat industry for sustained and rapid growth, contributing to a more sustainable and diversified global protein landscape.

Key Players

- Quorn Foods

- Meati Foods

- Nature’s Fynd

- MyForest Foods

- The Better Meat Co.

- Prime Roots

- Enough

- Mush Foods

- Bosque Foods

- MycoTechnology

Chapter 1. FUNGI-BASED MEAT MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. FUNGI-BASED MEAT MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. FUNGI-BASED MEAT MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. FUNGI-BASED MEAT MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. FUNGI-BASED MEAT MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. FUNGI-BASED MEAT MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Burger Patties

6.3 Sausages

6.4 Nuggets

6.5 Meatballs

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. FUNGI-BASED MEAT MARKET – By Application

7.1 Introduction/Key Findings

7.2 Retail

7.3 Foodservice

7.4 Household

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. FUNGI-BASED MEAT MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. FUNGI-BASED MEAT MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 Quorn Foods

9.2 Meati Foods

9.3 Nature’s Fynd

9.4 MyForest Foods

9.5 The Better Meat Co.

9.6 Prime Roots

9.7 Enough

9.8 Mush Foods

9.9 Bosque Foods

9.10 MycoTechnology

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Fungi-Based Meat Market was valued at USD 1.1 billion in 2024 and is projected to grow at a CAGR of 13.5% from 2025 to 2030. The market is expected to reach USD 2.07 billion by 2030.

Sustainability, health benefits, and rising flexitarian diets.

Product types: burger patties, sausages, nuggets, meatballs, others. Applications: retail, foodservice, household.

North America, with a 35% market share due to high retail and foodservice adoption

Quorn Foods, Meati Foods, Nature’s Fynd, MyForest Foods, The Better Meat Co., and others.