Functional Water Market Size (2025 –2030)

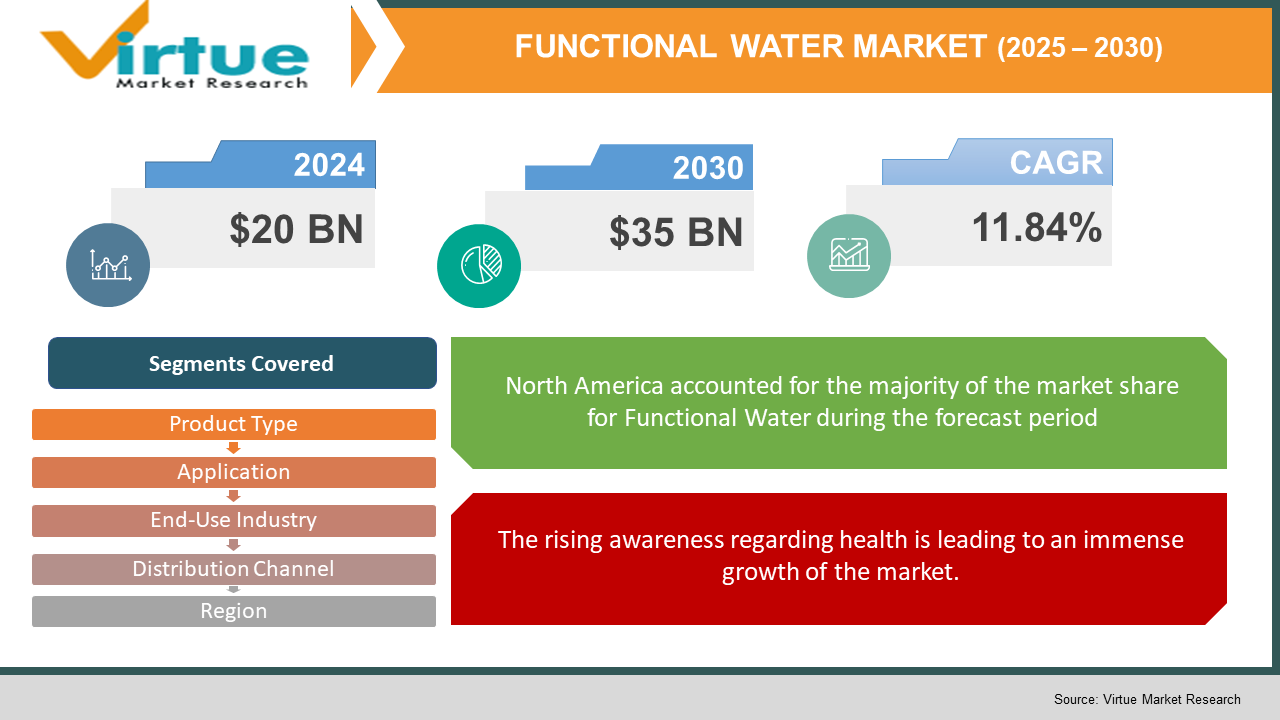

The Global Functional Water Market was valued at USD 20 billion and is projected to reach a market size of USD 35 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 11.84%.

As people more and more look for drinks that, in addition to hydration, provide extra health advantages, the worldwide functional water market is quickly expanding. Rising consumer preferences for wellness and preventative health are driving functional water rich in vitamins, minerals, electrolytes, and other bioactive ingredients forward in the food and drink sector. Rising health consciousness, creative product ingredients, and more digital distribution via digital platforms are driving market growth. Strong financial commitments in product research and intense marketing activities will help the market to expand considerably by 2030, therefore creating a wide spectrum of possibilities for companies all over.

Key Market Insights:

- Driven by consumer interest in health and wellness, functional water consumption has grown by over 40% in developed markets.

- Please reflect the focus of the industry on value-added goods by means of which nearly 30% of new drink releases now include functional water formulations.

- The 30% rise in Asia-Pacific market share shows strong support from businesses and governments for functional drinks.

- Emphasizing the influence of e‑commerce and social media in driving market development, brands with thorough digital strategies find a 35% greater engagement rate.

Functional Water Market Drivers:

The rising awareness regarding health is leading to an immense growth of the market.

The prevalence of chronic lifestyle conditions, including obesity, diabetes, and heart problems, is increasing, so worldwide customers are turning more and more toward more nutritious food and drink options. Functional water, which provides hydration along with extra advantages like energy boosts, immunity support, and mental clarity, meshes beautifully with this trend. With people paying more focus on immunity-boosting components and overall health, the epidemic only hastened this trend. More than 70% of consumers worldwide said in a survey that they are actively trying to drink more practical drinks. The increasing emphasis on self-care and preventative health has driven product diversification as well as consumer demand in the marketplace.

The recent innovations in the field of product formulation are a major market growth driver.

Rising research and development spending meant to enhance flavor profiles, nutrient bioavailability, and shelf stability is becoming apparent in the market. Functional waters now contain mixtures of adaptogens (like ashwagandha), nootropics (for cognitive support), and probiotics (for gut health). For example, brands such as Hint, Smartwater+, and Vitaminwater have developed to include clean labels—natural sweeteners, zero artificial ingredients, and specific health claims. Nanoencapsulation and emulsification have made it possible to infuse water with previously unstable ingredients like fat-soluble vitamins and essential oils, making them bioavailable and stable in a clear beverage. A primary growth driver is this capacity to stuff a simple beverage with added benefits.

The growing expansion of various distribution channels is helping the market to grow its reach.

The global move to digital shopping is now being exploited by functional water brands. Key sales channels have become online grocery platforms, wellness marketplaces, and subscription-based delivery services. This is especially relevant in areas like Asia-Pacific and Latin America, where mobile commerce is flourishing but brick-and-mortar development could be sparse. Further assisting companies to reach specific markets like beauty-focused consumers, vegans, or fitness enthusiasts are the increasing influence, health-focused applications, and personalized marketing campaigns. Furthermore, vending machines in airports, coworking spaces, and fitness centers have increased instant accessibility and impulse purchasing, so improving practical water visibility and accessibility.

The rules and regulations are considered to be in favor of the market, leading to its growth.

To fight public health problems, world regulators are now more and more advocating healthier options in food and beverages. Functional statements such as "supports immune health" or "aids hydration" are currently better defined in markets like the U.S. and EU, therefore permitting clearer marketing communications. Many governments have imposed sugar taxes on soda and sugary drinks, therefore indirectly encouraging both consumers and producers toward better alternatives like functional water. Furthermore, projects supporting honest labeling and sustainable packaging, especially in Europe, have made functional water a preferred area for innovation and investment. Regulatory tailwinds are increasing market momentum with extra help through startup grants and food innovation centers in places like India, Singapore, and Canada.

Functional Water Market Restraints and Challenges:

The high cost of production of such water is a big challenge being faced by the market.

Sophisticated processing and stability measures such as microencapsulation or pH regulation are needed to maintain performance over shelf life for components' sourcing and integration. These technologies greatly raise expenses for operational and capital. Limited access to high-quality raw inputs and deficient manufacturing infrastructure in areas like Southeast Asia and parts of Africa compound the cost obstacle. Additionally, packaging functional water in environmentally sustainable, shelf-stable materials raises unit cost, therefore stressing margins for small and medium businesses.

The lack of standardization across the globe is a big problem for the market, affecting its operation.

The "functional water" still lacks a universally accepted definition. While some items marketed as functional are clinically developed, others have minimal active components. Though enforcement varies dramatically among nations, official organizations like the U.S. FDA or European EFSA have strict standards for health-related claims. This discrepancy causes consumer uncertainty and erodes brand trust. Brands may take advantage of imprecise definitions in unregulated markets, so damaging company-wide credibility. Global market expansion is hampered by the lack of unified standards and making it more challenging for top-notch manufacturers to set themselves apart.

A high percentage of consumers are skeptical about the product, which affects the growth of the market.

Consumers are progressively skeptical of health claims without scientific evidence since past scandals surrounding other "health" beverages such as sugar-laced vitamin drinks or detox teas have set the stage for uncertainty. Many customers now seek clear labeling and evidence-based claims, and they are more likely to investigate components before buying. Functional water companies, therefore, have to spend on third-party testing, clinical studies, and honest marketing. These steps lengthen time-to-market and operating costs, therefore impacting especially new companies or those starting out lacking significant R&D budgets.

Strict rules and regulations act as a hurdle for the market, affecting its growth of the market.

Even if many administrations advocate for better beverage choices, the regulations surrounding functional water are difficult. For instance, depending on the nation, clinical verification and regulatory authorization might be needed for items marked with "supports cognitive function" or "boosts immunity". Strict food labeling laws introduced in countries like the EU and portions of Asia mean more thorough investigation of ingredients and marketing, hence product launches might be postponed or changes may be needed. Managing these regulations demands legal knowledge and adjustment to each target market's framework, which is resource-intensive.

Functional Water Market Opportunities:

The developing nations are considered the emerging markets, giving the market an opportunity to expand its reach.

Rising middle class, urbanization, and increased health awareness are driving explosive growth in health-focused consumer products in Asia-Pacific and Latin America. Functional drinks are progressively more available and appealing in nations such as India, China, Brazil, and Mexico. Market research shows that Asia-Pacific is poised to be the fastest-growing region in the functional water industry through 2030 with a CAGR exceeding 9%. These areas' governments are spending large sums on healthcare awareness initiatives and food labeling, therefore appealing to consumer selectivity. Moreover, infrastructural advancements in logistics and retail, particularly in urban and peri-urban zones, are helping larger product distribution to take place. India's Ayushman Bharat and China's Healthy China 2030 programs, for instance, advance preventive wellness, so in line with the advantages provided by functional water.

The increase in the development of products that are sustainable in nature is helping the market to grow.

Environmental sustainability is now a consumer demand as well as a legal mandate; it is not negotiable. According to a Mintel study, more than 60% of world consumers in the beverage business now choose items with environmentally friendly packaging or smaller environmental impact. Functional water companies are reacting with plant-based plastics, recycled PET bottles, and carbon-neutral operations. Nestlé Waters and Danone, for instance, have pledged to have 100% recyclable packaging during this decade, and big players are integrating sustainability KPIs into their product plans. Furthermore, new companies are trying zero-waste recipes, biodegradable bottles, and edible water pods.

The recent advancements in the field of digital marketing are seen as a great market opportunity to grow its presence.

The digital revolution is changing how people find and interact with medical goods. Functional water brands are using artificial intelligence-powered consumer insights, predictive analytics, and influencer marketing in ever-increasing degrees to customize their messaging and products. Platforms including Instagram, TikTok, and health-related mobile applications have become main channels for outreach to health and fitness-focused demographics. Brands such as Vitaminwater and Hint Water, for instance, have used interactive storytelling and micro-influencer campaigns to increase brand engagement and trust, especially among Generation Z and millennial buyers. AI solutions help these businesses grasp consumer behavior, customize offers, and even predict demand spikes during seasonal health patterns (e.g., immunity throughout winter or hydration throughout summer). Further strengthening customer retention are digital loyalty schemes and subscriptions. Direct-to-consumer platforms are quickly expanding, especially post-pandemic, and companies using omni-channel digital strategies may come to dominate market share and minimize reliance on conventional retail.

The recent innovations in the products and their diversification are allowing the market to increase its reach globally.

The functional water industry, like every other, runs on the pulse of innovation. From simple vitamin-infused goods to sophisticated formulae, the class is fast changing. Advances in ingredient encapsulation, flavor masking, and shelf-life optimization enable these breakthroughs, so letting functional chemicals remain effective while not sacrificing taste. Brands are also launching digital kiosks or app-based subscriptions for customized water blends, enabling consumers to customize their drinks based on daily health objectives. By addressing specific health needs and making science-supported, premium-priced SKUs, companies will draw in more knowledgeable, wellness-driven customers. By giving culturally appropriate formulas, diversification also helps to minimize market saturation dangers and support foreign growth.

FUNCTIONAL WATER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

11.84% |

|

Segments Covered |

By Product Type, application, end user industry, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestle Waters, Coca Cola Company, PepsiCo, Inc., Danone, Primo Water Corporation, Fiji Water, Voss of Norway, Essential Water, Smartwater, Gerolsteiner |

Functional Water Market Segmentation:

Functional Water Market Segmentation: By Product Type

- Enhanced Water

- Fortified Water

- Electrolyte Water

- Alkaline Water

- Functional Blends

The Enhanced Water segment is the dominant segment in the market, since it promotes general health and appeals generally to health-conscious customers for daily hydration. The Functional Blends segment is said to be the fastest-growing segment, driven by personalization trends and custom health advantages addressing particular consumer demands.

Products, including vital nutrients such as calcium, magnesium, and fiber, come under the Fortified Water segment. Electrolyte Water is created to replace electrolytes lost during exercise, they are used in the field of sports and fitness. Alkaline Water is water with an increased pH, which is used to balance acids in the body.

Functional Water Market Segmentation: By Application

- Sports & Fitness

- Health & Wellness

- Cognitive Enhancement

- Beauty & Skin Care

- Other

The Sports & Fitness segment holds dominance in the market, and the Cognitive Enhancement segment is the fastest-growing. The Sports & Fitness segment is dominant due to increased adoption by athletes. Cognitive Enhancement is the fastest‑growing segment because consumers now increasingly seek innovative solutions for brain health amid rising work stress and cognitive demands.

The Health and Wellness segment includes products aimed at general health, immunity, and energy. Functional waters including components to support skin moisture and integrity, come under the Beauty & Skin Care segment. The others segment includes specialized uses such as hydration aids for elderly consumers.

Functional Water Market Segmentation: By End-Use Industry

- Food & Beverages

- Healthcare

- Automotive

- Cosmetics & Personal Care

- Industrial

The Food & Beverages segment is the dominant one here. Food and Drink is the leading end-use industry, both because of strong customer demand and widespread retail coverage. The healthcare segment is the fastest-growing segment, driven by the growing focus on preventative health measures and customized wellness programs in hospitals and clinics.

In the Automotive segment, it is included as a premium choice in luxury cars together with driver-assistance systems. The cosmetics & personal care segment is used as elements of beauty routines at spas and specialty retail. Whereas in the industrial segment, it is used in industrial hydration systems and special cases like functional water devices.

Functional Water Market Segmentation: By Distribution Channels

- Direct Sales

- Distributors

- Online Retail

The direct sales segment is the dominant segment of the market, and the online retail segment is the fastest-growing. The reason behind the dominance of the direct sales segment is the high preference for personalized products. Driven by digital transformation, rising consumer acceptance of e-commerce, and the convenience of direct shopping in both developed and developing countries, online retail is the fastest-growing segment. The distributors are third-party distributors that help the market expand its regional and worldwide market reach.

Functional Water Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is leading the market due to various reasons like high brand penetration, well-established consumer market, and distribution channels. The Asia-Pacific region is said to be the fastest-growing region for the market. Asia‑Pacific is experiencing the highest growth due to expansive government support, rapid urbanization, and emerging consumer markets eager for innovative wellness solutions.

Europe is characterized as a region with strong regulations and sustainability projects that support constant demand. South America and the MEA regions are said to be the emerging markets, due to greater consumer emphasis on premium health drinks. Although Middle Eastern and Africa now have a smaller market share, they have great opportunities as health knowledge and digital infrastructure develop.

COVID-19 Impact Analysis on the Global Functional Water Market:

The functional water market was influenced dramatically by the coronavirus epidemic since it sped up consumer attention on health and well-being. Increased work-from-home agreements and lockdowns resulted in a spike in demand for drinks with extra health benefits. As consumers looked for goods that would support immunity, hydration, and stress relief, many functional water companies reported raised sales by up to 25% during the epidemic. The crisis also drove quick product launches and invention, as businesses spent on research and development to produce solutions for developing healthcare requirements. Furthermore, distribution channels quickly changed, with a significant movement toward internet retail, so that functional water items were still available even if conventional supply lines were disrupted. In general, the epidemic has permanently raised awareness of functional drinks, therefore opening the door for continued expansion in the post-COVID era.

Latest Trends/ Developments:

In response to rising consumer demand for evidence‑based wellness solutions, manufacturers are beginning to include natural adaptogens, vitamins, antioxidants, and herbs into water to maximize health advantages.

Brands are using advanced digital marketing techniques and e-commerce sites as consumer buying turns more and more online, therefore increasing engagement and expanding international presence.

Companies are increasingly turning to sustainable production and packaging by acquiring recyclable and biodegradable goods to comply with consumer demands and environmental standards.

As emerging technologies enable companies to offer custom water formulations tailored to particular health targets like sports performance, cognitive enhancement, or skin care, therefore draw niche consumer segments and drive premium positioning.

Key Players:

- Nestle Waters

- Coca Cola Company

- PepsiCo, Inc.

- Danone

- Primo Water Corporation

- Fiji Water

- Voss of Norway

- Essential Water

- Smartwater

- Gerolsteiner

Chapter 1. FUNCTIONAL WATER MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. FUNCTIONAL WATER MARKET– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. FUNCTIONAL WATER MARKET– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. FUNCTIONAL WATER MARKET- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. FUNCTIONAL WATER MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. FUNCTIONAL WATER MARKET– By Product Type

6.1 Introduction/Key Findings

6.2 Enhanced Water

6.3 Fortified Water

6.4 Electrolyte Water

6.5 Alkaline Water

6.6 Functional Blends

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. FUNCTIONAL WATER MARKET– By Application

7.1 Introduction/Key Findings

7.2 Sports & Fitness

7.3 Health & Wellness

7.4 Cognitive Enhancement

7.5 Beauty & Skin Care

7.6 Other

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. FUNCTIONAL WATER MARKET– By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distributors

8.4 Online Retail

8.5 Y-O-Y Growth trend Analysis Distribution Channel

8.6 Absolute $ Opportunity Analysis Distribution Channel , 2025-2030

Chapter 9. FUNCTIONAL WATER Market– By End-Use Industry

9.1 Introduction/Key Findings

9.2 Food & Beverages

9.3 Healthcare

9.4 Automotive

9.5 Cosmetics & Personal Care

9.6 Industrial

9.7 Y-O-Y Growth trend Analysis End-Use Industry

9.8 Absolute $ Opportunity Analysis End-Use Industry , 2025-2030

Chapter 10. FUNCTIONAL WATER MARKET, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Product Type

10.1.3. By Distribution Channel

10.1.4. By Application

10.1.5. End-Use Industry

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Product Type

10.2.3. By Distribution Channel

10.2.4. By Application

10.2.5. End-Use Industry

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Product Type

10.3.3. By End-Use Industry

10.3.4. By Application

10.3.5. Distribution Channel

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By End-Use Industry

10.4.3. By Application

10.4.4. By Product Product Type

10.4.5. Distribution Channel

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Distribution Channel

10.5.3. By End-Use Industry

10.5.4. By Application

10.5.5. Product Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. FUNCTIONAL WATER MARKET– Company Profiles – (Overview, Service End-Use Industry Product Product Type Portfolio, Financials, Strategies & Developments)

11.1 Nestle Waters

11.2 Coca Cola Company

11.3 PepsiCo, Inc.

11.4 Danone

11.5 Primo Water Corporation

11.6 Fiji Water

11.7 Voss of Norway

11.8 Essential Water

11.9 Smartwater

11.10 Gerolsteiner

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growth of the market is fueled by changing consumer tastes toward goods providing extra advantages, increased health awareness, and R&D innovation in drink formulations.

Raising consumer knowledge about health and wellness, the epidemic boosted demand and therefore led to a claimed sales rise of up to 25% during lockdown times.

Digital change has resulted in the fast growth of online retail, as many companies find increased accessibility and engagement on e-commerce platforms helpful.

The challenges faced by the market consist of high production and R&D costs, uniformity across formulations, and fierce competition calling for constant creativity and legal compliance.

Strong government support for digital and wellness initiatives, growing health awareness, and improving disposable incomes are some of the reasons why the Asia-Pacific region is the fastest-growing region in this market.